Mega Expert Tradefx claims to offer forex and contract-for-difference (CFD) trading services, covering stocks, precious metals, commodities, and cryptocurrencies. However, detailed investigations reveal numerous red flags, including falsified regulatory claims, opaque trading conditions, and minimal market presence. These issues cast serious doubt on the platform’s legitimacy and reliability. This article uncovers the risks and lesser-known truths about Mega Expert Tradefx.

1. Mega Expert Tradefx’s Services: Extensive Claims, Questionable Reality

1.1 Forex Trading

Mega Expert Tradefx promotes forex trading with access to major and minor currency pairs, offering leverage up to 500:1.

- Issue 1: High Leverage Risks

- High leverage is a double-edged sword. While it can amplify profits, it also exposes inexperienced traders to significant losses.

- Issue 2: Lack of Transparency in Spreads

- Despite advertising spreads as low as 0.0 pips, there’s no clarity on actual spread ranges under varying market conditions. Hidden costs may significantly affect profitability.

1.2 Stock Trading

The platform claims users can trade stocks of global giants like Tesla and Apple via CFDs.

- Problem: Lack of Market Connectivity

- Investigations suggest that Mega Expert Tradefx lacks real-time connectivity with global stock markets. The stock prices offered may simply be simulated data, raising doubts about transaction authenticity.

1.3 Index Trading

The platform offers investments in major global indices, such as the S&P 500 and Nasdaq 100.

- Problem: Undefined Spreads and Leverage

- The platform provides no clear explanation of spreads and leverage for index trading, potentially leaving traders exposed to unexpected costs.

- Problem: Absence of Real Market Support

- There’s no evidence that the platform provides genuine market liquidity, implying trades may rely solely on internal pricing.

1.4 Precious Metals Trading

Mega Expert Tradefx offers trading in gold and silver as safe-haven assets.

- Issue: Hidden Costs Could Erode Profits

- The lack of transparency in spreads and commissions raises concerns about undisclosed fees.

- Issue: Leverage Magnifies Losses

- While precious metals are considered stable investments, high leverage can lead to significant losses during volatile periods.

1.5 Commodity Trading

The platform claims to support energy commodities like oil and natural gas, as well as agricultural products such as coffee and wheat.

- Problem: Market Volatility Increases Risk

- Commodity prices are highly sensitive to global supply-demand dynamics, presenting unpredictable risks for traders.

- Problem: Lack of Detailed Trading Terms

- The absence of clear information on leverage, spreads, or overnight fees makes it difficult for traders to assess risks comprehensively.

1.6 Cryptocurrency Trading

Mega Expert Tradefx provides access to digital assets like Bitcoin and Ethereum, targeting traders seeking opportunities in emerging markets.

- Issue: Questionable Security Measures

- There’s no evidence the platform has robust cybersecurity to protect traders’ digital assets from theft or hacking.

- Issue: Non-transparent Pricing

- The platform might manipulate cryptocurrency market data, preventing traders from receiving accurate market quotes.

2. Account Types: A Gap Between Marketing and Reality

2.1 GO Plus+ Account

Key features:

- Leverage: Up to 500:1

- Spreads: Starting from 0.0 pips

- Commission: AU $3.00 per side

2.2 Standard Account

Key features:

- Leverage: Up to 500:1

- Spreads: Starting from 1.0 pips

- Commission: None

- Summary of Issues:

- The platform fails to validate its advertised spreads. Under different market conditions, traders may experience substantial slippage.

- The claimed commission-free trading in the Standard Account might be offset by higher spreads or hidden fees.

3. Trading Tools and Support: More Hype than Substance

3.1 Autochartist

The platform claims this tool provides real-time trading signals, but no user reviews or case studies back up its effectiveness.

3.2 Genesis Suite

This tool is marketed as enhancing traders’ market insights, but there’s no independent evaluation to support these claims.

3.3 Virtual Private Server (VPS)

VPS services promise stable connections for high-frequency traders, but Mega Expert Tradefx doesn’t clarify if this feature incurs additional charges.

4. Educational Resources: Richly Advertised, Questionably Useful

4.1 Forex Beginner Courses

These claim to teach basic forex trading concepts but lack verified content quality.

4.2 Advanced Technical Analysis Courses

The platform advertises in-depth technical analysis for experienced traders, but the practicality of this content remains unverified.

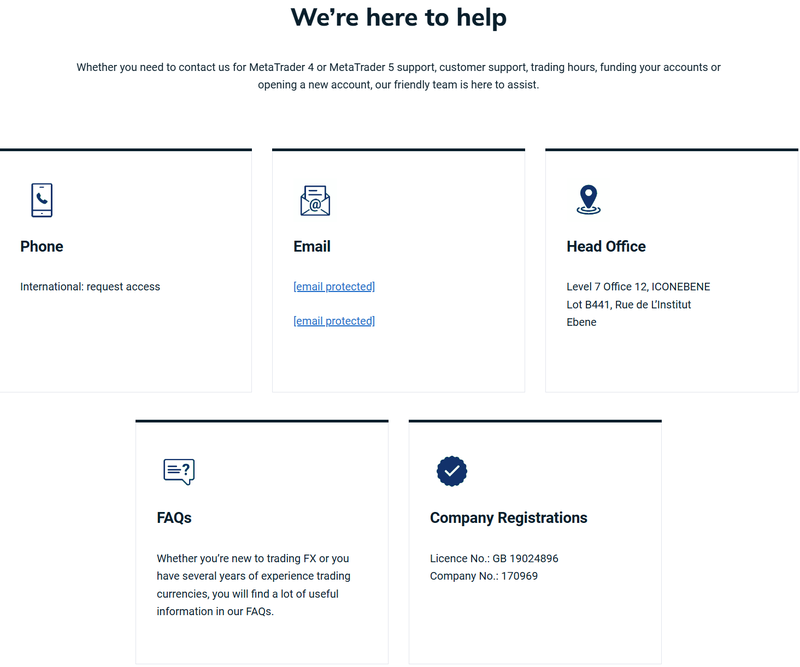

5. Regulatory Claims: Potentially Falsified

5.1 Platform’s Statements

Mega Expert Tradefx claims to be regulated by the Financial Services Commission (FSC) of Mauritius, providing specific registration and license numbers.

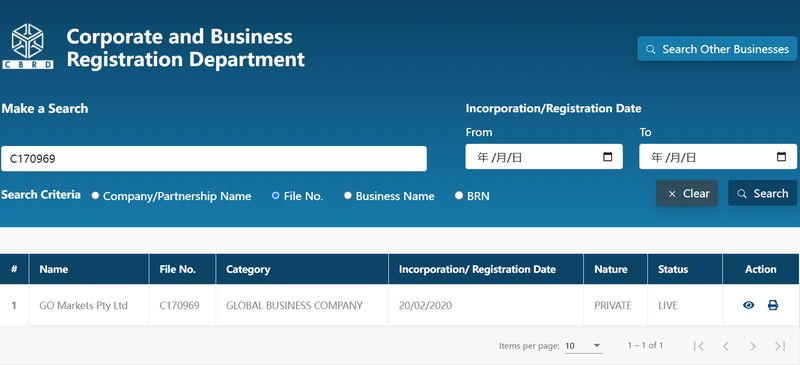

5.2 Investigation Results

- The provided regulatory information belongs to GO Markets, a legitimate brokerage, not Mega Expert Tradefx.

- This indicates that Mega Expert Tradefx is likely misrepresenting itself to gain investors’ trust.

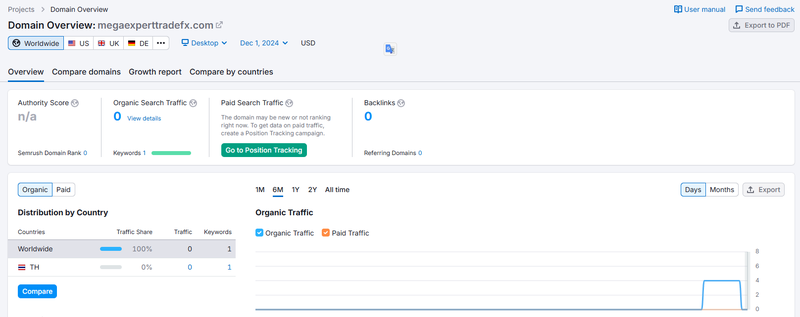

6. Brand Presence and Market Impact: Practically Nonexistent

6.1 Website Traffic

According to Semrush data, Mega Expert Tradefx’s official website receives zero monthly visits, indicating minimal market presence.

6.2 Social Media

The platform has no official social media accounts on mainstream platforms like Facebook or Instagram, further diminishing its credibility.

7. Financial Safety: A Major Concern

- Deposit and Withdrawal Issues:

- While multiple methods are supported, the platform fails to specify processing times and fees, raising concerns about accessibility.

- There’s no transparency regarding fund segregation or third-party oversight, increasing the risk of fund mismanagement.

- Account Security:

- The platform does not confirm whether client funds are stored securely in segregated accounts, leaving traders vulnerable to potential misuse.

8. Conclusion: The Risks Far Outweigh the Benefits

Mega Expert Tradefx faces significant credibility issues due to:

- Falsified Regulatory Claims: It misrepresents itself as a regulated entity.

- Opaque Trading Conditions: Hidden fees and unclear terms could harm profitability.

- Minimal Market Presence: Lack of reviews and a nonexistent online presence suggest the platform is not widely trusted.

- Financial Safety Risks: Poor transparency regarding deposits, withdrawals, and fund security exposes traders to potential losses.

Traders are strongly advised to avoid such platforms and choose regulated brokers with proven credibility and transparent operations.

FAQ

1. Is Mega Expert Tradefx regulated?

No, the platform’s regulatory claims are falsified, and it operates without proper oversight.

2. What assets can I trade?

It claims to offer forex, stocks, commodities, precious metals, and cryptocurrencies.

3. Are the trading tools reliable?

The effectiveness of tools like Autochartist and Genesis Suite remains unverified.

4. How can I spot a fraudulent trading platform?

Verify the platform’s regulatory credentials, user reviews, and ensure it has a credible market presence.

5. Are my funds safe with Mega Expert Tradefx?

The platform offers no evidence of segregated accounts or fund protection measures, leaving traders exposed to high risks.