Founded in 2023, MaxiFy offers diverse financial products but lacks regulation, clear funding channels, and faces technical issues, urging caution.

1. Background: Emerging but with Caveats

1.1 Founding Date and Registration

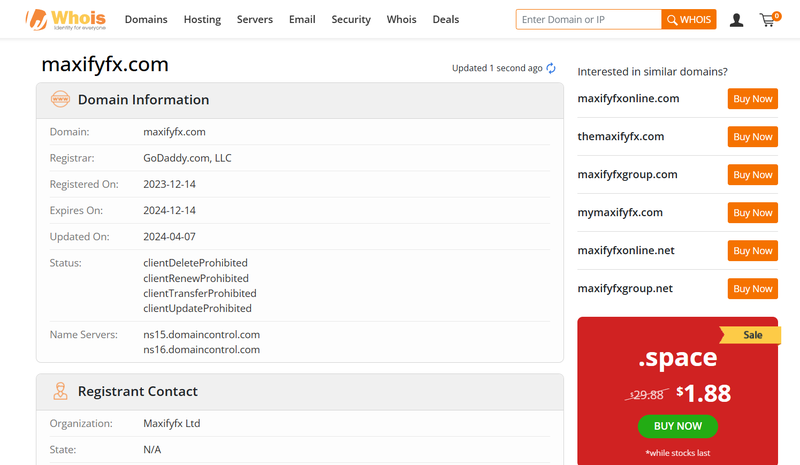

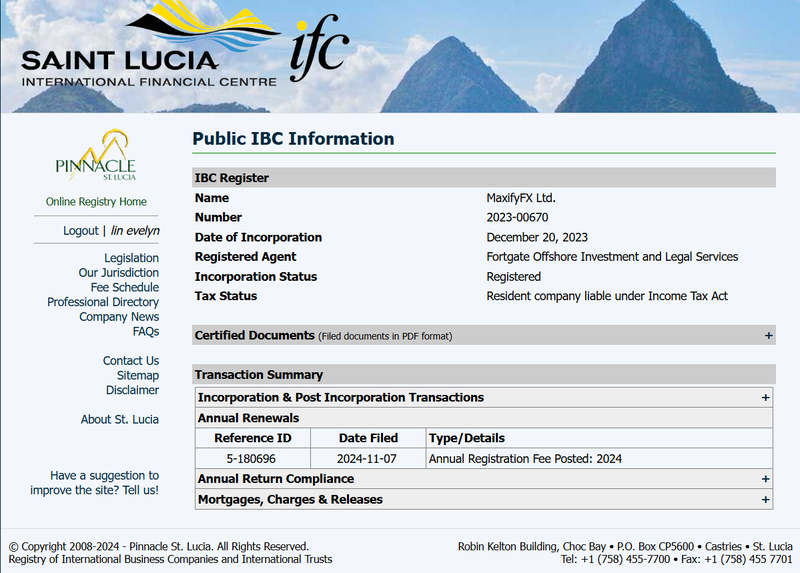

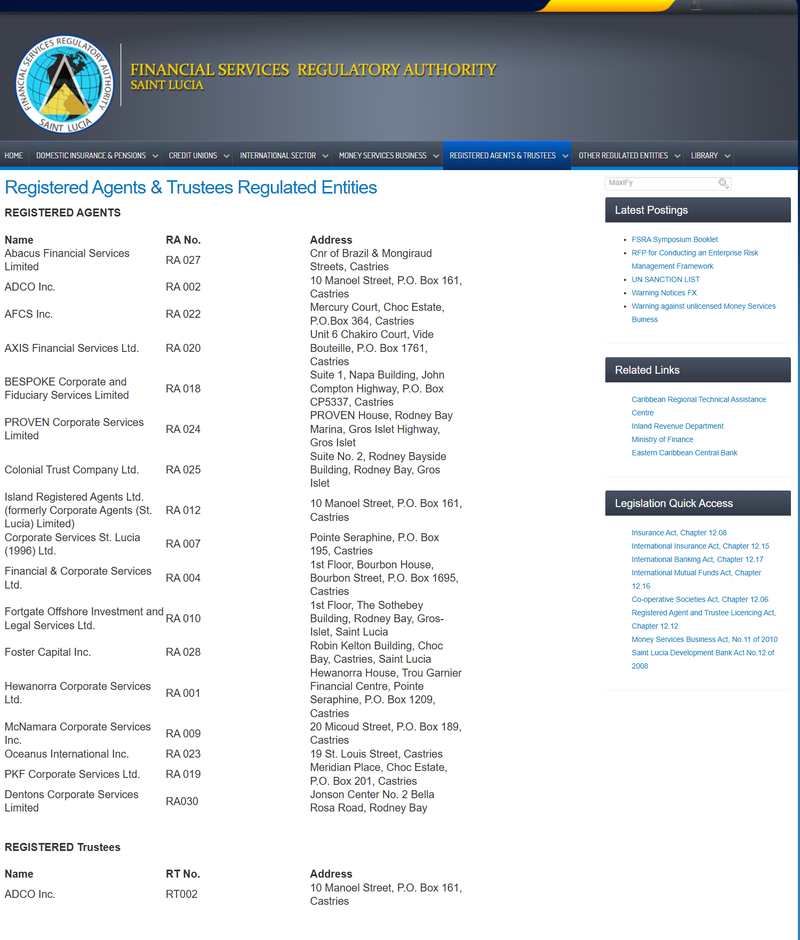

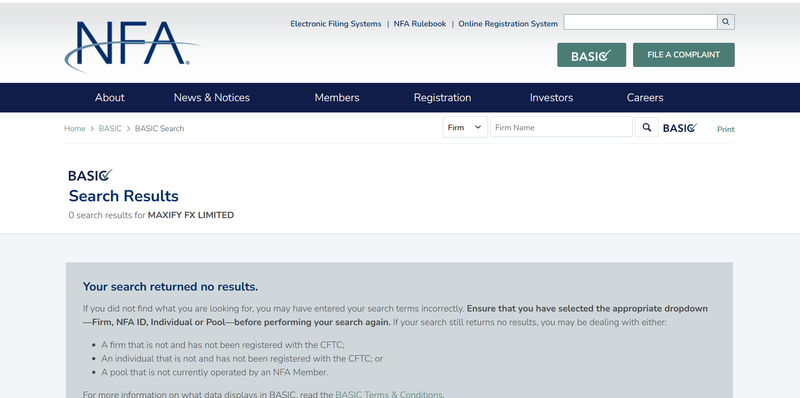

MaxiFy was established in December 2023, with its official domain being maxifyfx.com, registered in Saint Lucia (registration number: 2023-00670). Despite offering global services, the platform is not regulated by major financial authorities like the Financial Services Regulatory Authority (FSRA) of Saint Lucia or the National Futures Association (NFA) in the U.S.

Why does this matter?

The lack of regulation means investors’ funds are not protected, posing higher risks compared to regulated platforms.

2. Trading Platform: Advanced but Technically Challenged

2.1 Supported Trading Tools

MaxiFy currently offers MetaTrader 5 (MT5) as its main trading platform and plans to launch cTrader in the future. MT5 is widely recognized for its versatility and technological advantages, including:

- Security: Advanced data protection ensures the privacy of transaction information.

- Technical Analysis: Extensive charting and indicator tools aid in precise strategy formulation.

- Fast Execution: Instant order execution minimizes trade delays.

2.2 Platform Technical Issues

While MT5 is a powerful tool, MaxiFy has encountered technical issues with download links for both PC and mobile apps. Such problems may hinder users from trading efficiently.

Key Concern:

Unstable technology can disrupt trading or cause delays in accessing essential market information, creating risks for investors.

3. Account Types and Fee Structures

3.1 Standard and Zero Accounts

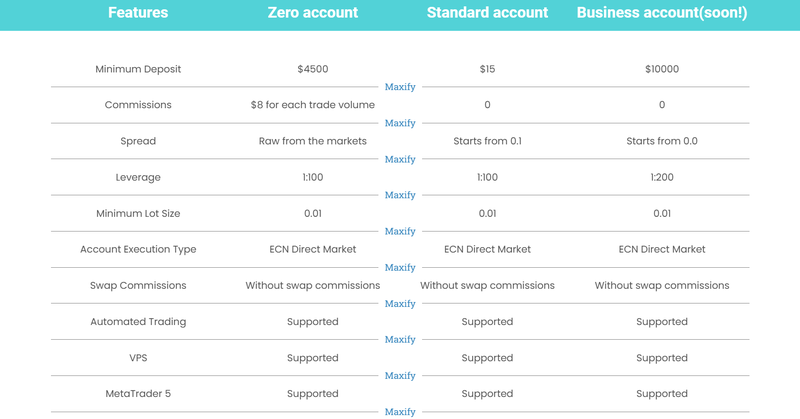

MaxiFy offers various account options to cater to different trading needs:

- Zero Account: Minimum deposit of $4,500, $8 commission per trade, raw market spreads, 1:100 leverage.

- Standard Account: Minimum deposit of $15, no commissions, spreads starting at 0.1, 1:100 leverage.

3.2 Upcoming Commercial Account

The Commercial Account promises higher leverage (1:200), tighter spreads (from 0.0), and exclusive features. However, its $10,000 minimum deposit requirement may deter average investors.

How to Choose?

While high-end accounts may offer better conditions, novice investors are better off starting with the Standard Account to minimize initial risks.

4. Funding Methods: Lack of Transparency

MaxiFy has not disclosed specific deposit and withdrawal methods. The absence of clear funding processes can make it difficult for investors to understand where their money goes or how to retrieve it.

Potential Issue:

Opaque financial operations raise concerns about fund security, especially for investors requiring fast and reliable withdrawals.

5. International Partnership Program

5.1 Partnership Model

MaxiFy offers an international partnership program targeting businesses, content creators, and professionals, promising commission rates of up to 50% for client referrals.

5.2 Is It Worth It?

While the program provides marketing tools and support, such high-reward models often rely heavily on onboarding new clients rather than ensuring platform stability in the long run.

6. Website Traffic and Market Performance

6.1 Traffic Analysis

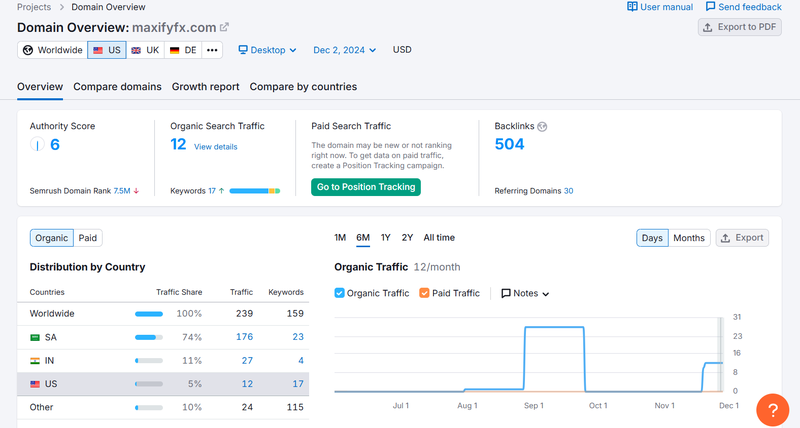

According to Semrush data, MaxiFy receives approximately 239 monthly organic searches, reflecting a 369% growth. The majority of its traffic comes from South Africa (74%), followed by India (11%) and the UK (3.8%).

6.2 Keywords and Backlinks

- Keyword Rankings: With 159 ranked keywords, the platform has made some SEO efforts, though its reach remains limited.

- Backlinks: It has 504 backlinks from 30 referring domains, indicating that its SEO strategy still has room for improvement.

Observations:

MaxiFy shows strong performance in the South African market but struggles with global expansion and paid advertising strategies.

7. Educational Resources and Customer Support

7.1 Lack of Educational Tools

MaxiFy’s website lacks dedicated educational content, such as market analysis, trading tutorials, or beginner guides. This absence could hinder new users from developing essential trading skills.

7.2 Customer Support Availability

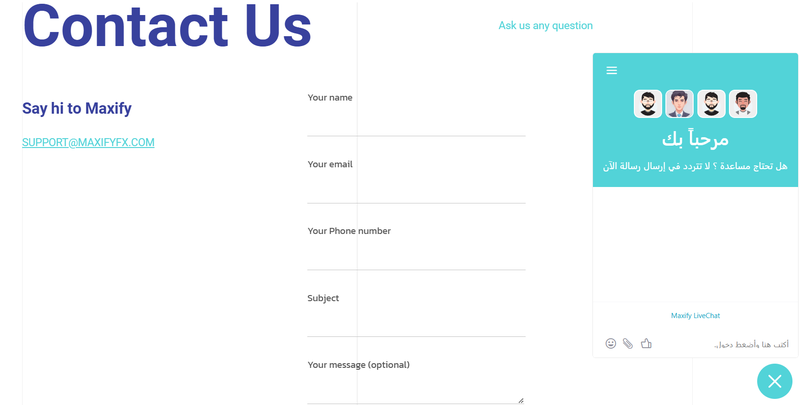

MaxiFy offers:

- Live chat for instant queries.

- Email support ([email protected]).

Drawback: The lack of phone support may limit timely resolution of urgent issues.

8. Risk Assessment: Key Concerns

- Lack of Regulation: Without oversight from reputable financial authorities, fund safety cannot be guaranteed.

- Unclear Payment Channels: Vague deposit and withdrawal processes create uncertainty about fund accessibility.

- Insufficient Educational Support: The absence of resources makes the platform less friendly for beginners.

- Technical Issues: Problems with platform stability may impact trading efficiency.

9. Conclusion: Is MaxiFy Worth Considering?

As a newly established broker, MaxiFy offers diverse trading products and reasonable account options that cater to various trading styles. However, its lack of regulation, unclear funding channels, and technical challenges pose significant risks. Investors should carefully evaluate these factors and prioritize regulated brokers with proven track records.

FAQ

1. Is MaxiFy regulated?

No, it is registered in Saint Lucia but not supervised by major financial regulators, leaving funds unprotected.

2. Is MaxiFy suitable for beginners?

The lack of educational resources may make it less ideal for beginners. Experienced traders may find it more appealing.

3. Are deposits and withdrawals straightforward?

The platform has not disclosed its payment methods, raising concerns about fund accessibility.

4. What are the benefits of a Commercial Account?

The Commercial Account offers higher leverage and tighter spreads but requires a minimum deposit of $10,000.

5. Why should I be cautious about technical issues?

Download link problems may prevent users from accessing the platform, disrupting trading activities.

6. Should I join MaxiFy’s partnership program?

The program’s high commissions are attractive, but its sustainability and platform stability should be carefully assessed.