FxGlobalPrime is a trading platform that claims to offer various financial products such as forex, indices, cryptocurrencies, and precious metals. However, its operating background is opaque, lacking proper regulation, and the platform has already been warned by multiple regulatory authorities. It does not disclose crucial company information, trading conditions, or fee policies, and the self-developed trading platform lacks security guarantees. The high leverage and high-risk trading model put investors at significant financial risk. This article will delve into the platform’s numerous hidden dangers and urge investors to stay highly cautious.

1. Overview of FxGlobalPrime

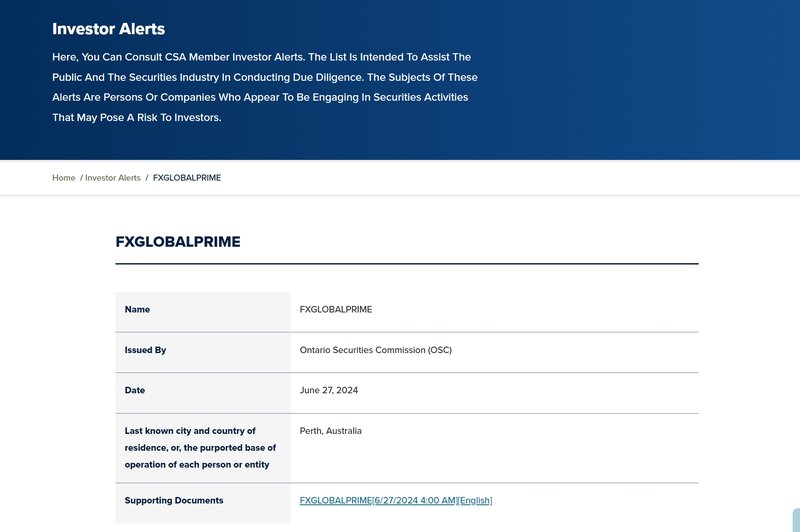

FxGlobalPrime is an online trading platform that claims to offer products across forex, cryptocurrencies, precious metals, and indices. However, despite claiming to be based in Australia, the platform has failed to provide any verified registration details, and lacks legitimate regulatory credentials. More alarmingly, FxGlobalPrime has been listed by the Canadian Securities Administrators (CSA) as a warning due to potentially offering financial services illegally. This is a serious red flag for investors.

2. Analysis of FxGlobalPrime’s Corporate Background

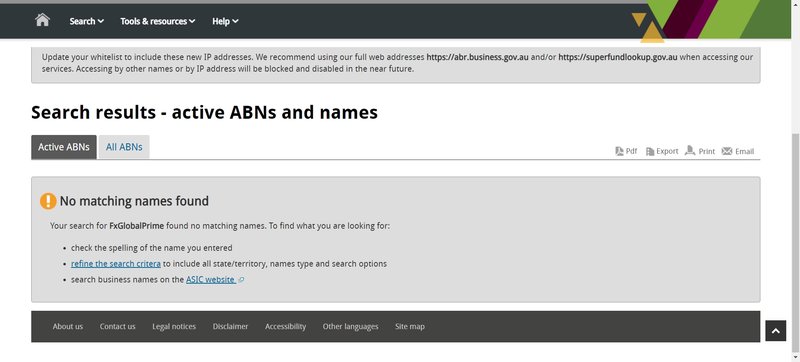

2.1 Opaque Background and Lack of Registration Information

FxGlobalPrime claims to be registered as FxGlobalPrime.com Inc., located in Australia. However, upon further investigation, no public registration details could be found. Legitimate platforms typically provide their company registration number, regulatory information, and physical address, which are essential for verifying the platform’s legality. FxGlobalPrime fails to provide these basic details, significantly diminishing the platform’s transparency and raising concerns about its credibility.

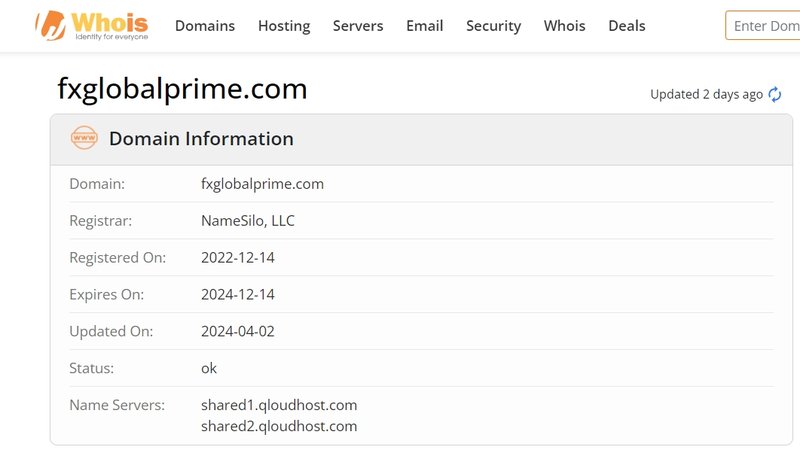

2.2 A Suspiciously Rapid Launch

FxGlobalPrime’s domain was registered in December 2022, indicating that the platform is very new. A platform that has been operating for such a short period without any historical track record can be quite risky. Well-established platforms typically have years of operations and customer feedback, which helps build trust. In contrast, FxGlobalPrime lacks such historical grounding, making it more susceptible to suspicion.

3. Regulatory Status of FxGlobalPrime

3.1 Lack of Regulation and Existing Warnings

FxGlobalPrime has not provided any valid regulatory information. While the platform claims to adhere to certain financial regulations, it is not officially certified by any recognized regulatory authority. More concerning is the fact that the Canadian Securities Administrators (CSA) has added FxGlobalPrime to its warning list, highlighting that the platform may be providing financial services without proper authorization. This is a major warning signal for investors, indicating that the platform could pose a serious risk to their funds.

3.2 The High Risk of an Unregulated Platform

An unregulated platform means that investors cannot rely on the protections offered by official regulatory bodies. The platform could shut down at any moment, leaving investors unable to withdraw their funds, and with little legal recourse to recover their losses. For ensuring the safety of one’s funds, regulation is crucial, and FxGlobalPrime has clearly failed to provide this level of security, thus significantly increasing its risk profile.

4. FxGlobalPrime Account Registration and Trading Conditions

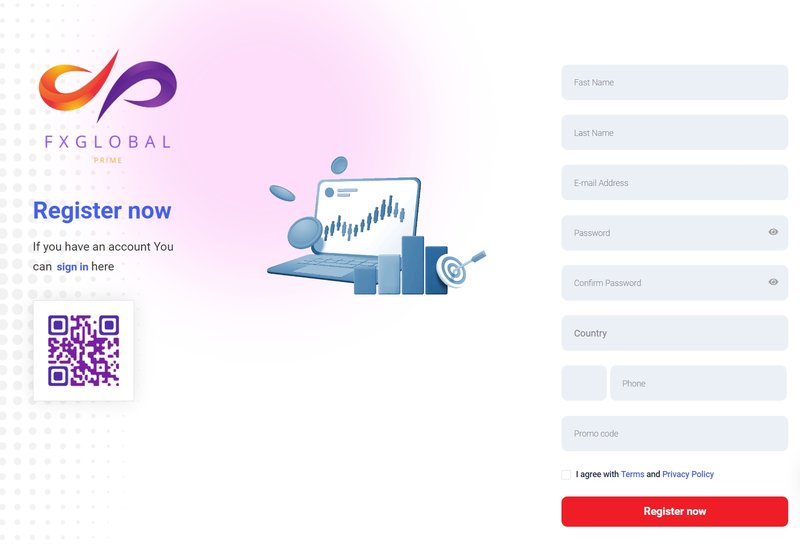

4.1 Simple Registration Process, But Risky

The registration process on FxGlobalPrime is relatively simple; users only need to provide personal information and submit identity verification documents. While this ease of access may attract new investors, the platform’s lack of transparency and regulatory legitimacy means investors should proceed with caution. Before committing personal information and funds, investors must be certain that the platform operates legally and complies with local financial regulations.

4.2 High Leverage Brings Significant Risks

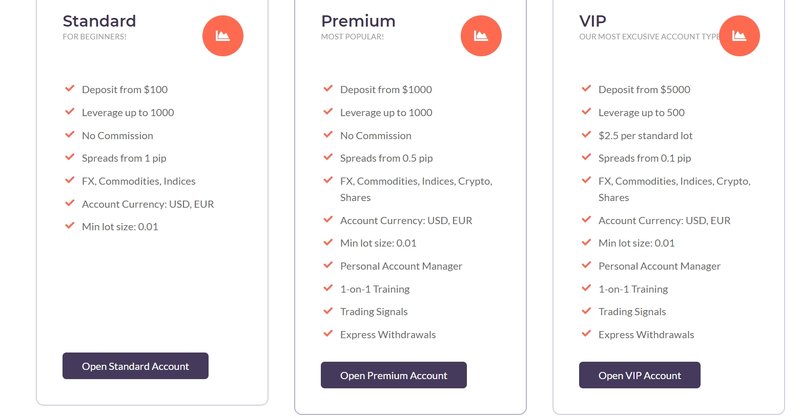

FxGlobalPrime offers different account types, including Standard, Premium, and VIP accounts, each with varying minimum deposits and leverage ratios. Particularly for Standard and Premium accounts, the platform offers leverage as high as 1:1000, meaning that while profits can be amplified, losses can also be greatly magnified. High leverage increases the potential for loss, especially for inexperienced traders. Without clear disclosure of the spread, commission, and trading conditions, investors may be blindsided by hidden fees, adding to their risks when using high leverage.

In particular, when the platform does not clearly disclose its costs, investors may unknowingly bear additional financial burdens. For traders using high leverage, the lack of transparency regarding fees can lead to unforeseen losses.

5. FxGlobalPrime’s Trading Software and Platform Features

5.1 In-House Developed Platform Lacks Market Validation

FxGlobalPrime provides its proprietary trading platform, FXGLOBALPRIME Platform, which supports WebTrader and mobile trading. However, the platform lacks third-party security validation and market feedback. Compared to industry-standard platforms like MetaTrader 4 or MetaTrader 5, FxGlobalPrime’s in-house platform has potential vulnerabilities in terms of functionality, stability, and security. The absence of market verification means investors cannot be certain of the platform’s technical reliability, which might lead to technical failures or security breaches.

5.2 Security Risks with the Platform

An unverified platform may lack proper encryption and security measures, leaving users’ accounts and funds exposed to theft. Legitimate platforms typically employ multi-factor authentication, SSL encryption, and other security protocols to protect users’ data and funds. However, FxGlobalPrime does not provide sufficient information on its security measures, raising concerns about the platform’s ability to protect investors’ assets.

6. FxGlobalPrime’s Financial Products and Conditions

6.1 Diverse Financial Products, But Lack of Transparency

FxGlobalPrime offers a wide range of financial products, including forex, indices, precious metals, and cryptocurrencies, aiming to attract various types of investors. However, the platform does not provide detailed information about the trading conditions for each asset, such as spreads, commissions, leverage, etc. The lack of clear fee structures means that investors are unable to accurately assess the cost of trading, which may lead to hidden costs during trading.

6.2 Hidden Fees and Trading Costs

While FxGlobalPrime claims that it does not charge commissions for its Standard and Premium accounts, it fails to clearly outline the spreads and trading fees for these accounts. The lack of transparent fee disclosure increases the likelihood that investors may encounter unexpected hidden charges. Moreover, traders using high leverage may incur large financial losses, especially when the platform fails to provide adequate risk warnings.

7. FxGlobalPrime’s Deposit and Withdrawal Methods

7.1 Opaque Deposit and Withdrawal Policies

FxGlobalPrime has not provided clear details on its accepted deposit and withdrawal methods, fees, or processing times. Investors may encounter various obstacles, such as long withdrawal times or delayed deposit processing. Reputable platforms typically provide transparent information on these matters, enabling users to plan their financial operations effectively.

7.2 Difficulty in Withdrawals and Potential Fund Freezing

Since FxGlobalPrime lacks clear deposit and withdrawal policies, investors may face difficulties or delays when attempting to withdraw funds. The absence of transparency on these processes raises concerns about the platform’s ability to handle withdrawals properly, leaving users vulnerable to potential issues like frozen funds.

8. FxGlobalPrime’s Customer Support Service

8.1 Poor Customer Support Response Time

FxGlobalPrime provides customer service contact options, including email ([email protected]) and phone (+971583098967). However, due to the lack of transparency regarding customer feedback and reviews, investors cannot accurately assess the efficiency and responsiveness of their support team. In case of issues, investors might face long wait times and even receive no effective solutions.

Conclusion

FxGlobalPrime’s high-leverage, high-risk trading approach, lack of regulation and transparency, hidden fees, and security concerns regarding its proprietary trading platform make it an unreliable choice for investors. Without legitimate financial regulation and clear operational processes, FxGlobalPrime poses significant risks to investor capital. When selecting a trading platform, it is crucial to prioritize those with clear regulatory backing and transparent operations to avoid substantial financial losses.

FAQ

Q1: Is FxGlobalPrime legally operating?

FxGlobalPrime does not provide valid regulatory information and has been listed by the Canadian Securities Administrators (CSA) as a warning. It is not recommended for investors to use this platform.

Q2: Is the account registration process on FxGlobalPrime secure?

Although the registration process is simple, investors should exercise caution due to the platform’s lack of transparency and regulatory legitimacy. Ensure the platform is operating legally before submitting personal information or funds.

Q3: What is the leverage offered by FxGlobalPrime?

FxGlobalPrime offers leverage of up to 1:1000 on Standard and Premium accounts, which increases both potential profits and risks. High leverage can lead to significant financial losses, particularly for inexperienced traders.

Q4: What financial products does FxGlobalPrime offer?

FxGlobalPrime offers forex, indices, precious metals, and cryptocurrencies, but lacks detailed disclosure on trading conditions and fees, making it difficult for investors to assess the true cost of trading.

Q5: Is FxGlobalPrime safe?

FxGlobalPrime’s platform is not adequately secured, and it lacks market validation. Investors’ funds and information may be at risk due to the absence of proper security measures.

Q6: Are deposits and withdrawals easy with FxGlobalPrime?

FxGlobalPrime does not provide clear information on deposit and withdrawal methods or related fees, which may lead to difficulties and delays in processing funds.