NKVO, a cryptocurrency broker established in 2024, appears to have great potential at first glance, with its broad range of services and “global” vision. However, upon closer inspection, numerous doubts arise about its background, regulatory licenses, and transparency. This article delves into NKVO’s actual situation, offering insights to help investors make more informed decisions.

1. Company Background—A Fancy “Shell” or Something More?

1.1 A Prestigious Address? Not Quite!

NKVO claims its headquarters is located at 555 17th Street in Denver, a well-known skyscraper. This address seems impressive, even making it appear as though NKVO is a large, reputable company. However, after a deeper investigation, we found that NKVO does not appear on the building’s tenant list, raising serious concerns about its transparency.

Why would a newly established cryptocurrency platform associate itself with such a prominent address? Is this an attempt to fabricate a “legitimate” image? This certainly casts a shadow of doubt over the platform’s credibility.

1.2 Why Hide the Real Address?

In today’s information age, transparency is key. NKVO clearly understands this, yet it chooses to mislead by associating itself with a prestigious address rather than being forthright about its actual operations. This lack of transparency raises a question: if a platform can’t disclose its real office address, what else is it hiding? Could there be deeper issues with its operations that it doesn’t want investors to know?

2. Regulatory Licenses—Gleaming Exteriors, but Suspect Interiors

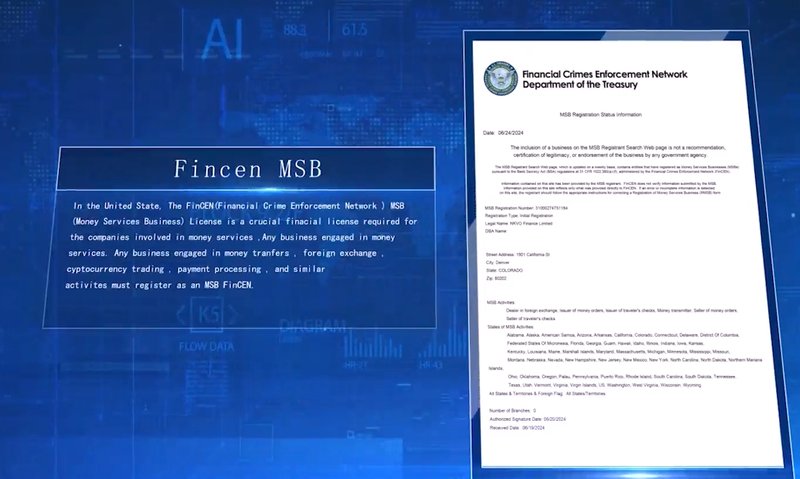

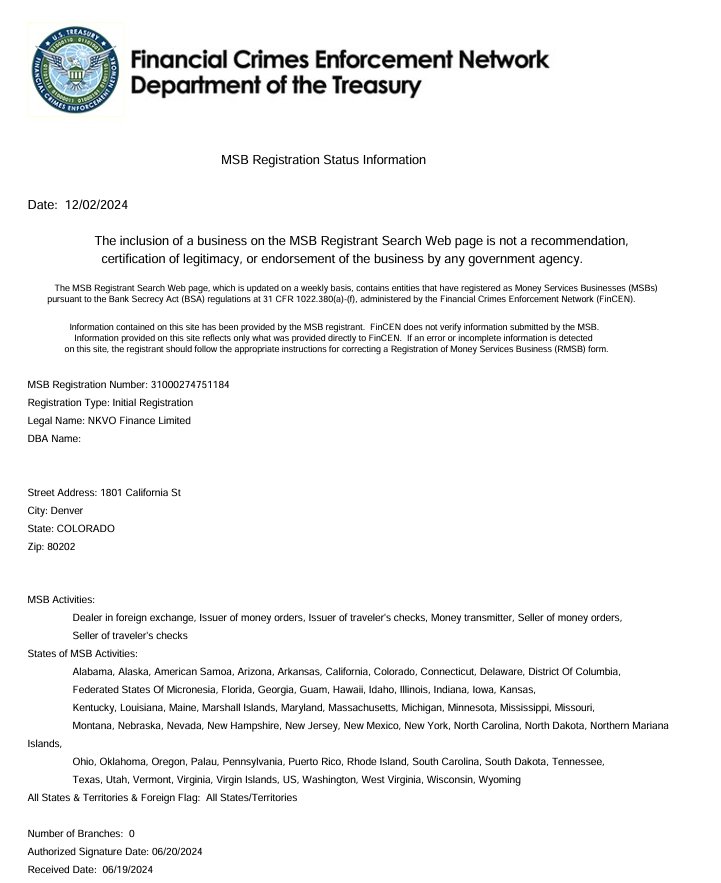

2.1 MSB License—Does It Really Apply to Crypto Trading?

NKVO prominently displays an MSB (Money Services Business) license issued by the U.S. Financial Crimes Enforcement Network (FinCEN). At first glance, this seems like a legitimate credential, adding an air of legality to the platform. However, upon closer examination, it becomes clear that the MSB license primarily applies to activities like currency exchange, foreign exchange trading, and money transmission—none of which directly relate to cryptocurrency trading. Is this license really as relevant to NKVO’s business model as it appears?

Moreover, the MSB license only allows certain activities in specific U.S. regions, such as Colorado and American Samoa. NKVO, however, markets itself as a “global” platform. Does this imply the broker is conducting unauthorized cross-border operations? This is a serious concern.

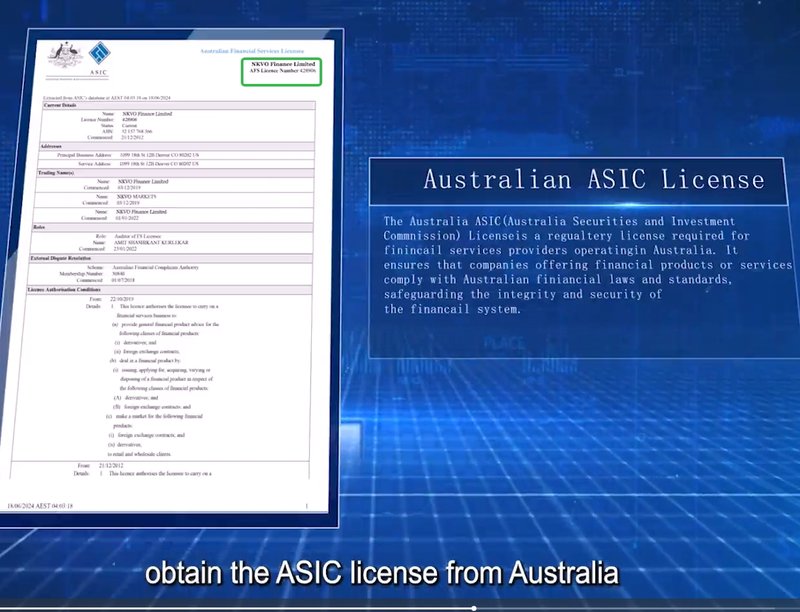

2.2 ASIC vs. AFS—Confusing the Public?

NKVO also claims to hold an ASIC license, purportedly from the Australian Securities and Investments Commission. However, further investigation reveals that the license displayed by NKVO is actually an AFS (Australian Financial Services) license, which is a distinct entity from the ASIC license. While the names might seem similar, they serve very different purposes.

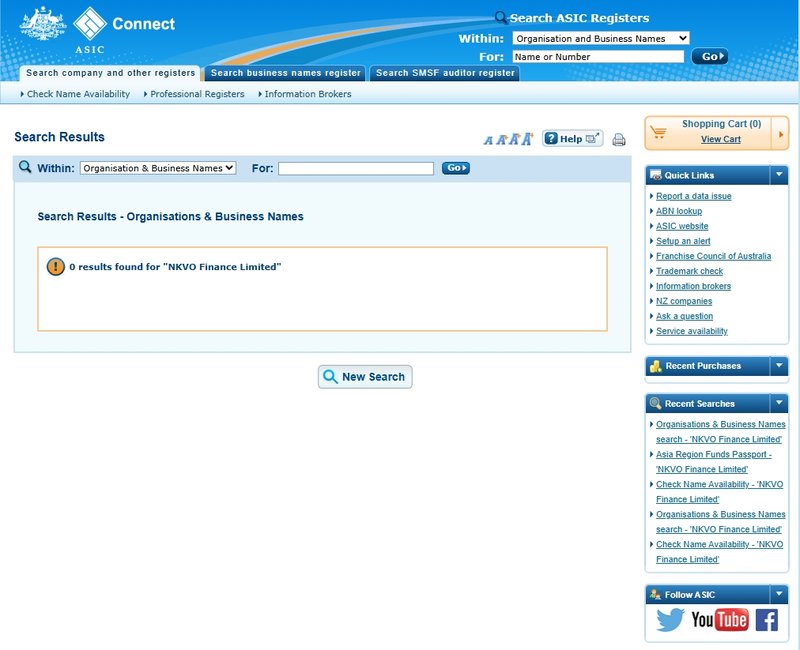

More troubling, there is no record of NKVO on the ASIC website, despite the broker’s claim of being ASIC-licensed. Does this mean the broker is misrepresenting its regulatory status, or is it engaged in a deliberate attempt to mislead potential investors?

2.3 MENA Multilateral Exchange—An Unverifiable Credential?

Lastly, NKVO claims to be a member of the MENA Multilateral Exchange, a Middle Eastern and North African exchange platform. While this may sound impressive, an extensive search yields little to no information about MENA Multilateral Exchange. If this organization is so important, why can’t we find any official online presence? Is NKVO using an unverifiable certificate to boost its image?

3. Transparency—How NKVO Packages Itself

3.1 A Series of “False Facades”

NKVO’s website and promotional materials are full of seemingly legitimate licenses and credentials, including the MSB, ASIC, and MENA Multilateral Exchange memberships. These licenses give the appearance of a trustworthy and well-regulated platform. But a closer look reveals significant problems: many of these certificates are either irrelevant to the platform’s business model or difficult to verify. NKVO seems to be relying on a series of misleading credentials to create the illusion of legitimacy. How long can such a facade hold up before investors begin to question its validity?

3.2 How Should Investors Make Their Choice?

If you were an investor, seeing these credentials might give you a sense of confidence in NKVO’s legitimacy. After all, who wouldn’t be swayed by a “prestigious” address and “official” licenses? But as we have shown, NKVO’s lack of transparency and questionable regulatory credentials should raise red flags. When choosing a cryptocurrency broker, transparency and regulatory legitimacy should be paramount. Any legitimate financial platform should be open about its operations and provide clear proof of its regulatory status.

4. Conclusion

NKVO tries to create an image of legitimacy by showcasing various “official” licenses and associating itself with a prestigious address. However, upon deeper investigation, it becomes clear that these certifications and claims are either irrelevant, misleading, or unverifiable. For investors, this highlights the importance of conducting thorough due diligence before investing in any platform. Transparency and regulatory legitimacy should be key factors when choosing a broker—anything less should raise serious concerns.

5. FAQ

Q1: Is NKVO’s MSB license legitimate?

A1: While the MSB license is legitimate in the U.S., it does not cover cryptocurrency trading. NKVO’s use of this license seems irrelevant to its core business and may mislead investors into thinking it is fully licensed for crypto transactions.

Q2: Is NKVO’s ASIC license real?

A2: No, NKVO does not appear to hold an ASIC license, despite claiming to. The license it shows is an AFS license, which is different and doesn’t provide the same regulatory status as an ASIC license.

Q3: Does NKVO’s MENA membership mean anything?

A3: The MENA Multilateral Exchange certificate presented by NKVO is unverifiable. There is no credible online information about this exchange, casting doubt on the validity of this membership.

Q4: What should investors look for when choosing a crypto broker?

A4: Investors should prioritize transparency, verified regulatory licenses, and a clear understanding of the platform’s operations. If a platform cannot provide verifiable information or seems to rely on misleading credentials, it’s best to be cautious.