LinxVista Global was established in 2024 and offers a variety of CFD trading services, including forex, stocks, cryptocurrencies, and more. The platform supports MetaTrader 4, 5, and cTrader, offering various account types. However, its regulatory information is questionable, with no records found in relevant regulatory bodies, and it appears to have misused information from other companies. Despite providing educational resources and flexible deposit options, the platform lacks effective customer support and a presence on social media. Investors should approach with caution.

Company Overview and Mission: An Ambitious Declaration

LinxVista Global, a newly established broker, was founded on August 5, 2024, with the goal of offering the best trading experience for both retail and institutional clients. The platform claims to help traders focus solely on their trades, providing high-quality services and products to help users stand out in the financial markets. LinxVista offers a wide range of trading instruments, including Forex, indices, commodities, cryptocurrencies, stocks, futures, and bonds, seemingly catering to the needs of different levels of investors. But is this as attractive as it sounds? Upon closer examination of its operations and transparency, one has to ask: Is this platform really trustworthy?

Diverse Trading Instruments: Real Variety or Overly Idealized Promises?

LinxVista Global claims to provide a variety of CFDs, including Forex, indices, commodities, cryptocurrencies, stocks, futures, and bonds. For many investors, the diversity of trading instruments is a key factor in attracting attention. Moreover, the platform offers high leverage (up to 1:1000) and low spreads, which seem to provide a strong competitive edge.

However, whether investors can actually benefit from these diverse offerings is still questionable. After all, the true trading experience and platform stability are crucial to delivering these promises.

Trading Platforms and Features: Versatile, But With Hidden Risks

LinxVista Global offers three main trading platforms: MetaTrader 4, MetaTrader 5, and cTrader. These platforms are widely used in the industry, offering extensive functionality and strong trading support. The platform claims the following features:

- Real-time Forex and CFD quotes, ensuring traders stay updated on market movements;

- Unlimited price order limits, allowing users to choose the most suitable trading points based on market conditions;

- Market-leading spreads and low commissions, keeping trading costs low;

- Various order types to cater to different strategies and needs;

- Servers in LD5 BX Equinix data center, ensuring fast trading speeds and stable data flow.

However, while the platform promises ideal trading conditions, the actual experience has not been flawless. One major issue is that, although the platform supports PC, iOS, and Android clients, the iOS and Android app download links don’t work, redirecting users to the LinxVista website instead of the app download pages. Does this technical barrier indicate potential instability of the platform?

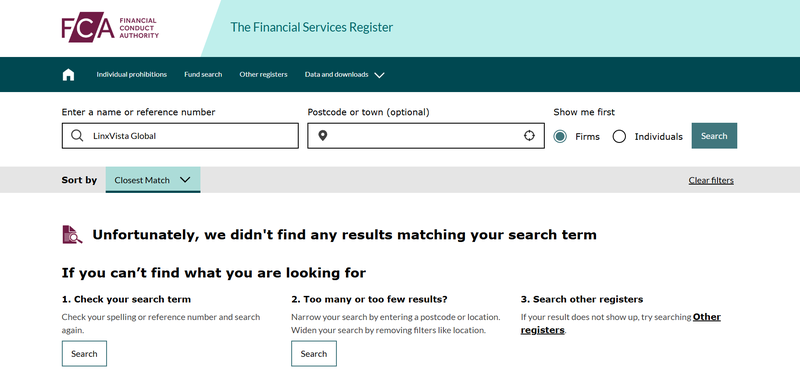

Regulatory Information: Claimed Regulation but No Evidence, Is There a Hidden Risk?

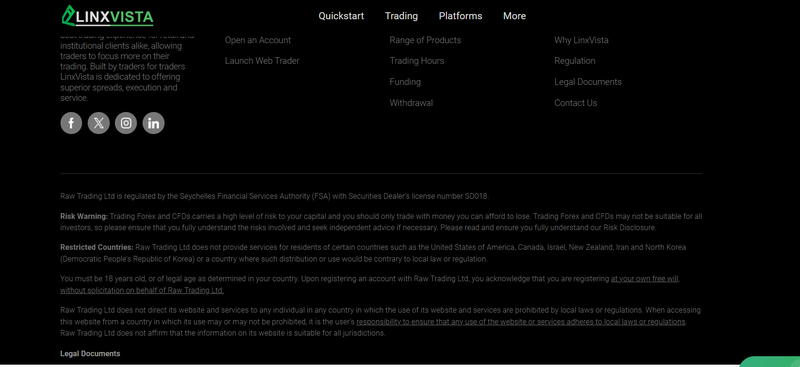

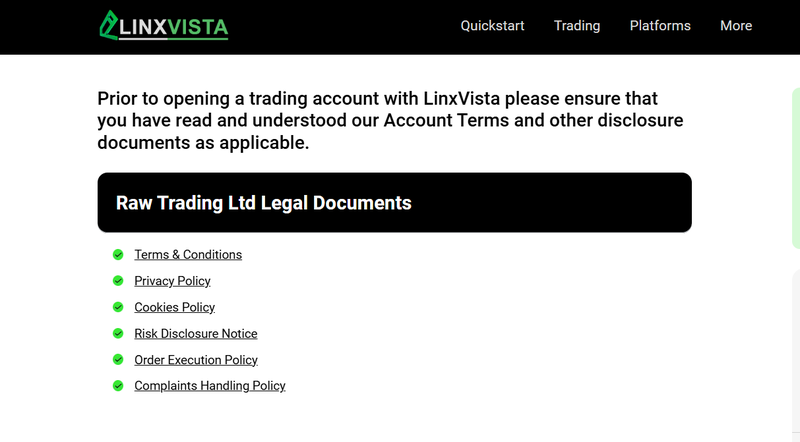

LinxVista Global claims to be regulated by the Seychelles Financial Services Authority (FSA). However, upon verification, no related records for LinxVista appear on the FSA website. More concerning, the legal documents and regulatory information published on LinxVista’s website belong to Raw Trading Ltd, with no mention of LinxVista. This raises the question: Could LinxVista be using another company’s information in an attempt to mislead consumers?

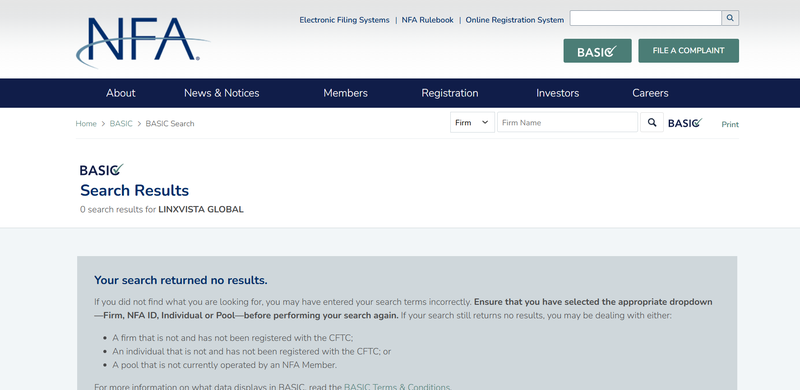

Moreover, no related records for LinxVista appear on the websites of the UK Financial Conduct Authority (FCA) or the National Futures Association (NFA) in the US, meaning the platform lacks effective regulatory oversight. Without regulatory support, can investors truly rely on this platform for secure trading?

Account Types and Trading Conditions: Flexible Yet Hard-to-Control Risks

LinxVista offers three main account types: cTrader Account, Raw Spread Account, and Standard Account, with a minimum deposit requirement of $200 for each. No matter which account type is chosen, the platform provides leverage of up to 1:1000, targeting high-risk, high-reward traders. For those looking for low-cost trading, the platform offers spreads starting from 0.0 pips, with commissions charged per lot.

However, while these conditions look appealing, the high leverage and low spreads can also conceal greater market volatility risks. Can the platform effectively support trading with such high leverage? This remains an unanswered question.

Deposits and Withdrawals: Convenient but Is It Smooth?

LinxVista supports various payment methods, including NETELLER, Skrill, VISA, and bank transfers. While these diverse payment options certainly provide convenience for transactions, do they ensure smooth and efficient fund transfers? The platform doesn’t provide detailed information on withdrawal processing times or any potential issues that might arise. Are users truly able to rely on these payment methods?

Educational Resources: Are They Sufficient to Help Traders Grow?

For novice traders, the educational resources offered by LinxVista are quite limited. The platform provides basic knowledge about Forex and CFDs, including:

- Advantages of Forex: A brief introduction to the features of the Forex market;

- Advantages of CFDs: Highlights the flexibility and popularity of CFD trading;

- Video Tutorials: Helps users familiarize themselves with the platform’s operation;

- Web TV: Offers short videos with market analysis and trading insights, in collaboration with Trading Central, covering global stock, currency, and commodity CFDs.

However, these resources may not be enough to help traders improve their strategies, especially when faced with complex market dynamics. Currently, LinxVista’s educational content seems quite basic and may not meet the needs of more experienced traders.

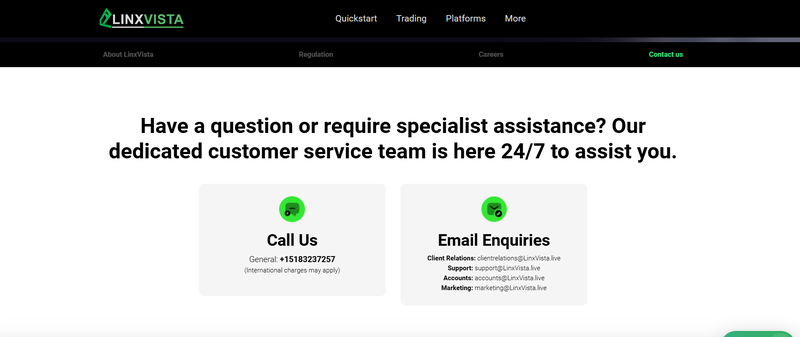

Customer Support: 24/7 Online Service, but Is It Truly Effective?

LinxVista offers 24/7 online customer support, allowing users to contact customer service via email ([email protected]). However, the platform does not provide a contact phone number, nor has it set up official accounts on social media platforms, despite displaying links to Facebook, Twitter, Instagram, and LinkedIn that all redirect to the company website. Does this mean that if traders encounter urgent issues, they won’t be able to get timely responses and effective solutions?

Summary: A Trustworthy Platform or Just a “Paper Tiger”?

LinxVista Global offers a diverse range of CFDs and supports three mainstream trading platforms. Its high leverage, low spreads, and flexible account types certainly attract attention. However, the platform’s questionable regulatory status, website flaws, and lack of social media presence severely undermine its transparency and credibility. For investors, despite the appealing conditions, the lack of effective regulation and potential platform reliability issues warrant caution.

Frequently Asked Questions (FAQ)

1. Is LinxVista Global regulated?

Although the platform claims to be regulated by the Seychelles Financial Services Authority (FSA), no related records can be found on the FSA website. Additionally, the legal documents published on the website appear to belong to another company, raising doubts about its regulatory status.

2. What account types does LinxVista offer?

LinxVista offers three account types: the cTrader Account, Raw Spread Account, and Standard Account, with a minimum deposit of $200 for each. All account types provide leverage of up to 1:1000.

3. Can I trade with low risk on LinxVista?

The platform offers high leverage and low spreads, making it suitable for high-risk traders. However, these conditions also increase the potential risk of trading.

4. Are deposits and withdrawals smooth?

LinxVista supports various payment methods, but it has not disclosed specific information regarding processing times for deposits and withdrawals, so users should remain cautious.

5. What educational resources does LinxVista offer?

The platform offers basic educational materials, including Forex and CFD advantages, video tutorials, and market insights. However, these resources may not be enough for experienced traders.