In recent years, Forex trading platforms have rapidly developed, attracting a large number of investors. However, with the increase in Forex brokers, many unscrupulous platforms have quietly entered the market, taking advantage of the opportunity to defraud investors of their funds. Multi Stock Trading is one such Forex broker that has attracted widespread attention. Although it offers a variety of trading options and attractive trading conditions, the platform’s underlying issues—such as a lack of proper regulation, insufficient user support, and infrastructure problems—pose significant investment risks. In this article, we will analyze the potential risks behind Multi Stock Trading and provide warnings for investors.

1. Introduction to Multi Stock Trading

1.1 Company Background and Operating Model

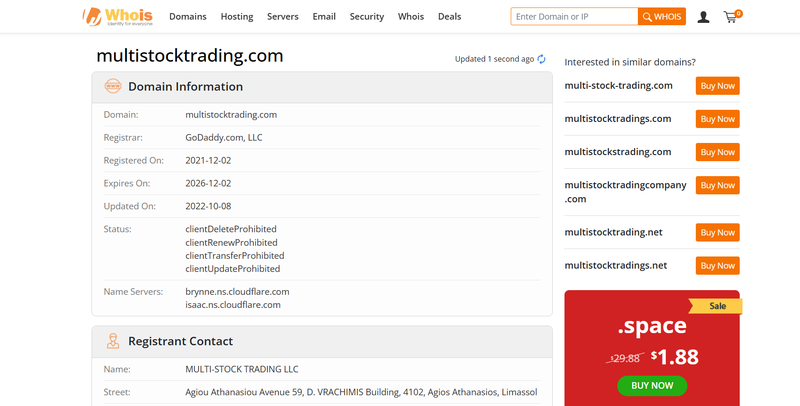

Multi Stock Trading is a new Forex broker operated by Multi-Stock Trading LLC. According to Whois data, its website domain was registered in December 2021 and was acquired and re-registered by the current team in October 2022. The platform offers various trading products, including Forex, metals, commodities, energy, cryptocurrencies, and stocks, aiming to provide investors with a diversified trading experience.

1.2 Platform Positioning and Objectives

As a Forex and CFD trading platform, Multi Stock Trading offers a wide range of financial instruments, allowing investors to switch between markets with flexibility. Its core slogan, “A POWERFUL PLATFORM FOR FOREX AND EXCHANGE MARKETS,” seeks to attract global investors. However, despite its powerful marketing, the risks hidden behind the platform are far from negligible.

2. Core Features and Trading Conditions of the Platform

2.1 Trading Platform: MetaTrader 5 (MT5)

Multi Stock Trading provides the widely supported MetaTrader 5 (MT5) trading platform, available on desktop, web, and mobile versions. MT5 is favored by many traders due to its robust analytical tools and flexible trading options. However, despite the platform’s advanced features, the download link provided on the website is not functional, causing significant inconvenience to users trying to access the platform.

2.2 Account Types and Trading Conditions

Multi Stock Trading offers three types of accounts: Standard Account, ECN Account, and PRO Account. Each account is designed to meet the different needs of investors:

- Standard Account: Minimum deposit of $10, spread from 0.2 pips, leverage up to 1:1000, ideal for beginner traders.

- ECN Account: Minimum deposit of $1,000, spread from 0.15 pips, leverage up to 1:1000, suitable for professional traders who seek low spreads and high liquidity.

- PRO Account: Minimum deposit of $3,000, spread from 0.1 pips, leverage up to 1:1000, ideal for experienced high-net-worth traders.

While these accounts offer flexible options, if investors are unaware of the platform’s regulatory issues, they could be exposing themselves to significant risks.

3. Regulatory Issues: Legitimacy and Transparency Concerns

3.1 Registration Information and Regulatory Gaps

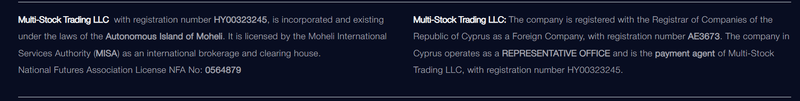

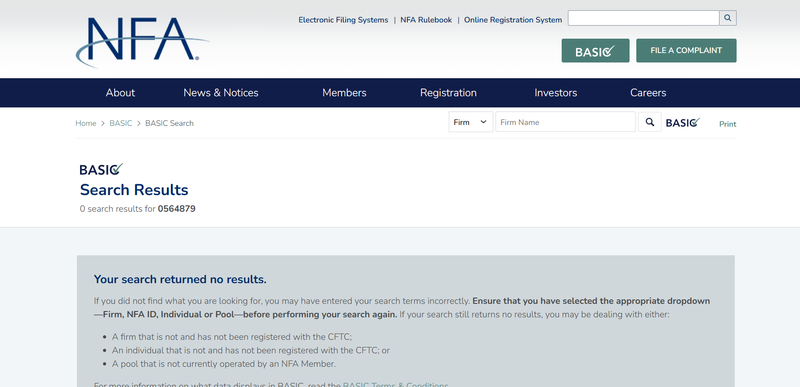

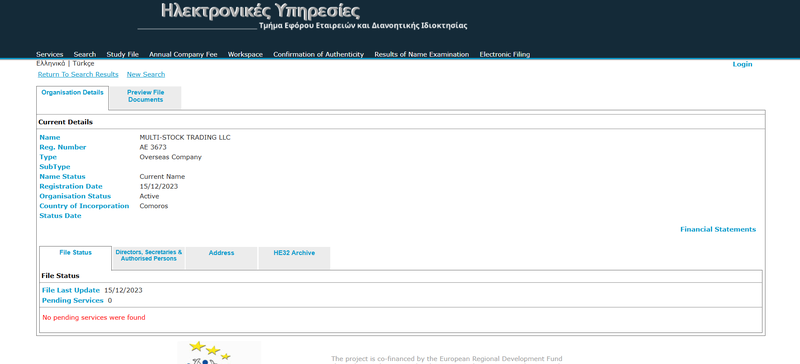

According to the platform’s official information, Multi Stock Trading is registered in the Republic of Cyprus with registration number AE3673. This registration indicates that the company has a legal identity in Cyprus. However, there is no record of this platform being regulated by any major financial regulatory bodies, such as the U.S. National Futures Association (NFA), raising serious concerns about its legitimacy.

3.2 Risk to Investors Due to Lack of Regulation

The lack of effective regulation is one of the most controversial aspects of Multi Stock Trading. Regulatory oversight is crucial for ensuring the safety of investor funds and the transparency of trading activities. Without proper regulation, investors have little protection in case of disputes or problems, and they may find it difficult to recover their funds through legitimate channels.

4. Fees and Commissions: Hidden Costs Behind Attractive Conditions

4.1 Deposit and Withdrawal Policies

Multi Stock Trading requires a minimum deposit of $10, and the platform does not charge deposit fees. However, credit card deposits are subject to a 5.5% fee, with a minimum fee of $10. This additional cost can be a burden for some investors. Regarding withdrawals, the platform does not specify any withdrawal fees, but the transparency of its trading conditions remains questionable.

4.2 Commission and Spread Structure

The platform charges a commission of $1.50 per lot for ECN accounts, with spreads as low as 0.0 pips. While these conditions may seem attractive, the commission and spreads may not be competitive for investors with lower deposits. Particularly for Standard Accounts, the higher spreads and lack of commissions mean that investors may end up paying more in trading fees.

4.3 Comparison with Other Platforms

In contrast, many well-established Forex brokers do not charge deposit fees on credit card payments and offer more competitive spreads and commission structures. Therefore, Multi Stock Trading’s fee structure may not be attractive to some users, especially those who are sensitive to transaction costs.

5. Customer Support: Slow Response and Poor Service Quality

5.1 Insufficient Customer Support

Although Multi Stock Trading provides 24/7 customer support, the quality of its service leaves much to be desired. Users have reported slow response times and low efficiency in resolving issues. Furthermore, the platform only offers email and phone contact options, lacking more direct and convenient channels like live chat.

5.2 Complaint Handling

The platform provides a dedicated email for feedback and complaints ([email protected]), but many users have reported slow complaint handling and low resolution efficiency. Investors facing issues cannot get timely feedback, which exacerbates their risk exposure.

6. Website Traffic and Marketing: Lack of Transparency

6.1 Traffic Analysis and Market Coverage

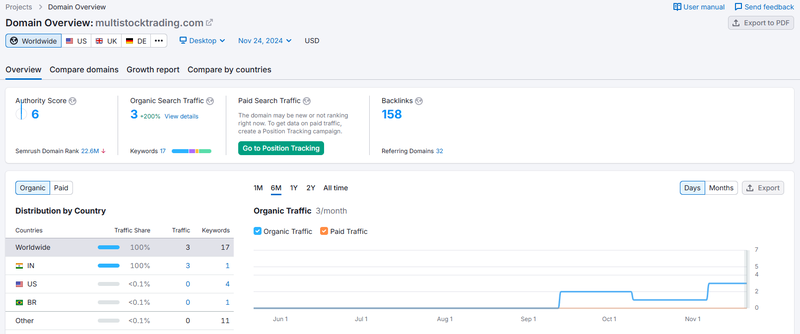

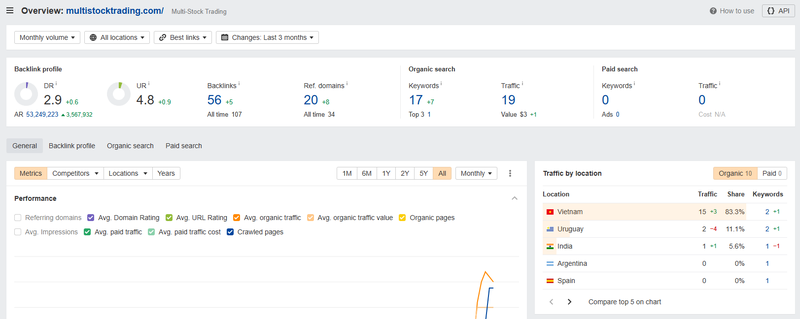

According to data from Semrush and Ahrefs, Multi Stock Trading’s website has very low organic traffic, with only 3 visits per month on average. The platform mainly attracts users from markets like India, Vietnam, and Uruguay, with little presence in mainstream Forex markets such as the U.S. and Europe. This indicates significant problems with the platform’s marketing efforts and brand influence.

6.2 Poor Quality of Backlinks

While Multi Stock Trading has increased its number of backlinks to 158, these links lack quality. The platform’s overall authority score is low, which suggests its trustworthiness and recognition in the financial industry are still limited.

7. Infrastructure Issues: Incomplete User Experience

7.1 Non-functional Download Links

While Multi Stock Trading promotes its MT5 platform across multiple devices, the download links on its official website are not working, preventing users from easily downloading and installing the trading platform. Such infrastructure issues not only hinder user experience but also further damage the platform’s credibility.

7.2 Security and Data Protection Concerns

In today’s financial landscape, platform security is of paramount importance. Multi Stock Trading has not provided sufficient information regarding data protection and cybersecurity measures. The lack of clear security protocols makes it difficult for investors to trust the platform with their sensitive financial information.

8. Conclusion: Investors Need to Exercise Caution

Although Multi Stock Trading offers a variety of trading products and attractive trading conditions, its lack of regulation, opaque fee structure, poor customer service, and infrastructure issues make it a risky platform for investors. Before engaging with this broker, investors should carefully evaluate the potential risks and weigh its advantages and disadvantages.

When choosing a trading platform, investors must ensure that the platform is regulated, transparent in its operations, and offers reliable customer support. For Multi Stock Trading, the current warning signs and instability are too significant to overlook.

Frequently Asked Questions (FAQ)

1. Is Multi Stock Trading a legitimate trading platform?

Multi Stock Trading is registered in Cyprus with registration number AE3673. However, the platform has not been authorized by other major financial regulators, such as the National Futures Association (NFA) in the United States. This lack of regulatory oversight means that the platform is not properly regulated. Due to the absence of transparency in its regulation, investors should exercise caution when choosing to trade on this platform.

2. What types of assets are offered on the platform?

Multi Stock Trading offers a wide variety of asset classes, including forex, metals, commodities, energy, cryptocurrencies, and stocks. The platform aims to provide global investors with a broad range of market options and flexible trading choices.

3. What is the minimum deposit requirement on Multi Stock Trading?

The minimum deposit requirement for Multi Stock Trading is $10, making it accessible for most beginner investors. This low entry barrier is appealing to new traders and those with smaller investment amounts.

4. What should I do if I encounter issues with downloading the MetaTrader 5 platform on Multi Stock Trading?

Currently, the download link provided on the Multi Stock Trading website is not working, and users may face difficulties installing the MT5 platform. If this happens, it is recommended to contact customer support (via email at [email protected]) for an alternative download link or further assistance.

5. Does Multi Stock Trading charge deposit fees?

Multi Stock Trading does not charge deposit fees, but if you deposit using a credit card, there is a 5.5% fee (minimum $10). Other payment methods do not incur additional fees for deposits.