Propflys, a financial trading platform claiming to offer investment opportunities, has recently gained attention—but not for good reasons. Its mysterious operating model and lack of transparency have raised significant concerns about its reliability. Despite promising high returns, Propflys appears to be a risky trap for unwary investors. This article delves into Propflys’ background, warning signs, psychological tactics, potential risks, and strategies to safeguard your investments, helping you avoid such pitfalls.

1. Background of Propflys: A New Platform Full of Questions

1.1 Suspiciously New Website Registration

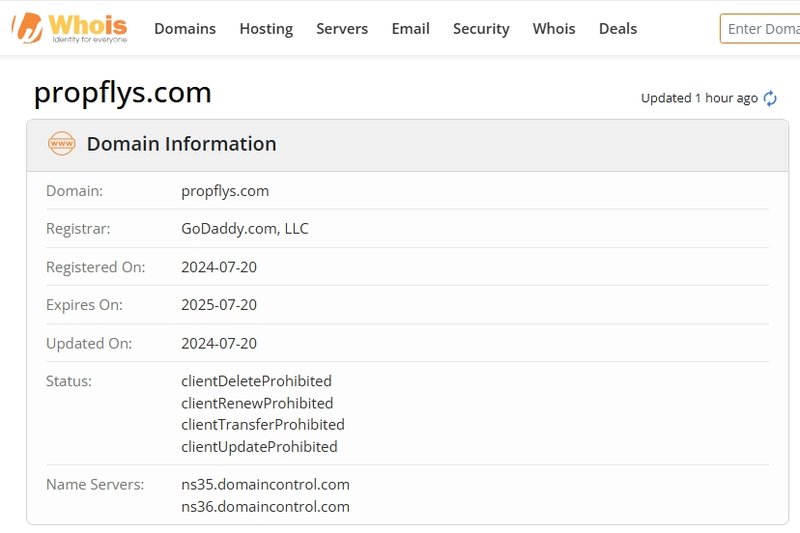

Propflys’ official website (propflys.com) was registered on July 20, 2024. For a platform claiming to offer serious investment services, this brief history makes it difficult to trust.

1.1.1 Concerns From Whois Information

According to a Whois lookup, Propflys’ registration details are hidden under privacy protection, and no operational address or corporate entity is disclosed. While privacy protection is common for websites, it is highly unusual for a financial trading platform.

1.2 A Vague Operational Model

Propflys claims to offer lucrative investment opportunities but provides little information on its business model, fund flows, or management team. Such vagueness is a significant red flag for potential investors.

2. Warning Signs of Propflys: Identifying the Red Flags

2.1 Lack of Transparency

Legitimate financial trading platforms usually provide clear details about their registration, operational background, and regulatory status. However, Propflys fails to disclose this basic information, leaving investors in the dark.

2.1.1 Ambiguous Trading Terms

Investors using Propflys report difficulty in finding clear trading terms and fee structures, making it hard to understand what they are agreeing to. This lack of transparency increases the risk of fund misuse.

2.2 Poor Website Design Reflects Unprofessionalism

Propflys’ website is poorly designed, with slow loading speeds and frequent technical issues. These shortcomings further question its ability to manage a financial trading platform professionally.

2.2.1 The Risk of Technical Failures

In financial trading, stable technology is crucial. Propflys’ lack of technical reliability can lead to transaction errors, delays, or even difficulty withdrawing funds.

3. The Risks of an Unregulated Platform

3.1 Dubious Regulatory Claims

Propflys claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, the authenticity of this claim is questionable. Legitimate platforms typically list regulatory information on their websites and allow investors to verify these credentials.

3.1.1 Concerns About Offshore Regulation

Even if Propflys is under VFSC regulation, offshore jurisdictions like Vanuatu are known for weak investor protection. Any issues investors face are difficult to resolve legally.

3.2 Real Risks Investors Face

- Inability to Withdraw Funds: Unregulated platforms often delay or refuse withdrawals.

- High Risk of Fraud: Operators can shut down the platform abruptly, taking all investor funds.

- Legal Challenges: Investors face significant hurdles in recovering funds through legal means due to weak regulatory oversight.

4. Exploiting Investor Psychology: Propflys’ Strategies

4.1 The Illusion of Quick Wealth

Propflys lures investors with promises of “high returns.” Its website employs flashy language to create the impression of a once-in-a-lifetime opportunity.

4.1.1 Manipulating Greed and Fear

- Greed: High-return promises make investors overlook potential risks.

- Fear: Limited-time offers or urgent promotions push investors into hasty decisions.

4.2 The Trap of Continuous Investments

Many investors report receiving small initial returns, which Propflys uses to encourage further investments. Eventually, these investors find themselves stuck in a cycle of losses.

4.2.1 Withdrawal Barriers

When investors try to withdraw funds, they often encounter complicated withdrawal rules or outright denial, leaving them financially trapped.

5. Investment Risks and Case Studies

5.1 The Risks of High-Stakes Environments

Investing on Propflys exposes investors to significant financial risks, including:

- Hidden Fees: Unexpected charges that are only revealed after transactions.

- Account Freezing: Accounts suddenly frozen under vague claims of “violations.”

- Withdrawal Refusals: Investors unable to access their own money.

5.2 Lessons From Similar Platforms

Propflys is not the first platform to raise concerns. Many other unregulated platforms have collapsed, proving that lack of transparency and regulation often leads to fraud.

6. How to Spot and Avoid Platforms Like Propflys

6.1 Recognizing Common Warning Signs

- Lack of Transparency: Missing company addresses, management details, and registration information.

- Overpromised Returns: Claims of high profits in a short time frame are usually a trap.

- Technical Failures: Frequent glitches or delays indicate poor platform management.

6.2 Verifying a Platform’s Legitimacy

- Check Regulatory Status: Verify credentials through official financial regulatory websites.

- Research User Reviews: Learn from other investors’ experiences.

- Scrutinize Fee Structures: Ensure all transaction and withdrawal fees are clearly stated.

7. Protecting Your Investments

7.1 Conduct Due Diligence

Thoroughly research any platform before investing. Investigate its background, reviews, and regulatory compliance.

7.1.1 Steps for Due Diligence

- Search for news and reviews on the platform.

- Verify its regulatory information through official sources.

- Consult financial advisors for professional insights.

7.2 Prioritize Regulated Platforms

Regulated platforms offer these advantages:

- Legal Protection: Funds are protected under regulatory frameworks.

- Transparent Terms: Fees and conditions are clearly stated.

- Reliable Support: Professional customer service and technical support are available.

7.3 Avoiding the “Get Rich Quick” Trap

Be cautious of platforms that promise unrealistically high returns. Rational decision-making is critical to avoiding financial losses.

8. Conclusion: Why Propflys Is a Risky Choice

Propflys, with its mysterious and opaque operations, lacks the fundamental attributes of a legitimate investment platform. Investors must exercise extreme caution when considering platforms like this and prioritize regulated services to ensure the safety of their funds. By making informed decisions and staying vigilant, investors can avoid falling into similar traps and protect their financial well-being.

9. FAQ (Frequently Asked Questions)

1. What is Propflys?

Propflys is an online financial trading platform claiming to offer investment opportunities, but its operations and regulatory status are questionable.

2. How can I verify if a platform is regulated?

Legitimate platforms usually list their regulatory credentials on their websites, which can be verified through official regulatory websites.

3. Is Propflys safe?

Based on available information, Propflys lacks transparency and regulatory support, making it a high-risk platform.

4. Why is choosing a regulated platform important?

Regulated platforms provide transparency, legal protections, and clear rules to safeguard investors’ funds.

5. How can I avoid falling into traps like Propflys?

- Choose reputable, regulated platforms.

- Avoid being swayed by promises of high returns.

- Research the platform thoroughly before investing.

6. What should I do if I’ve already invested in Propflys?

Stop further investments immediately and consult a legal or financial expert to explore options for recovering your funds.