Aviana Capital is a newly established online trading platform offering various account types. However, its lack of regulation and transparency raises significant risks for investors.

Company Background: Questionable Information and Lack of Credibility

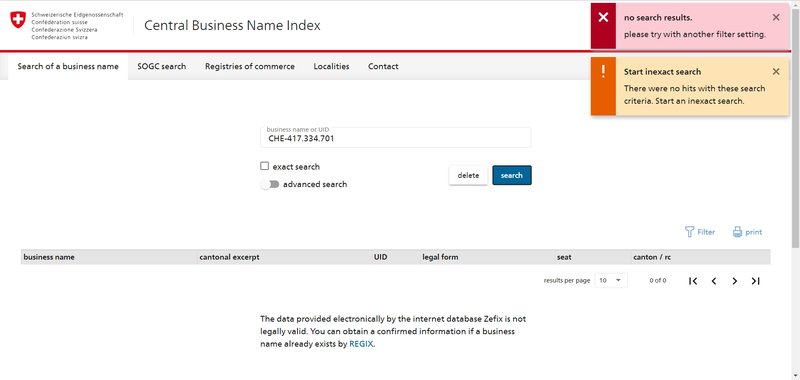

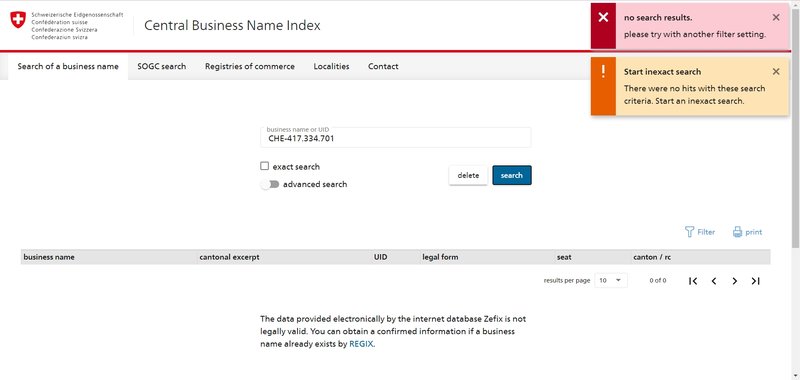

1.1 Recently Established with Suspicious Registration Information

Aviana Capital is a new online trading platform, with its domain registered on February 5, 2024. Although the platform displays a registration number, CHE-417.334.701, on its website, verification reveals that this registration number does not exist. Typically, legitimate financial platforms provide accurate registration details that investors can verify to build trust. However, Aviana Capital’s registration information is questionable, and the lack of clear corporate background makes it difficult for investors to place trust in the platform.

1.2 High Risk Due to Lack of Regulation

Aviana Capital has not provided evidence of regulation by any financial regulatory authority. This means the platform operates without oversight, putting user funds and personal data at risk. In a regulated financial market, agencies like the UK Financial Conduct Authority (FCA) and the U.S. Commodity Futures Trading Commission (CFTC) monitor platforms to protect investors’ interests. Without such regulation, Aviana Capital cannot offer users legal protections, and investors will likely find it difficult to resolve issues if they arise.

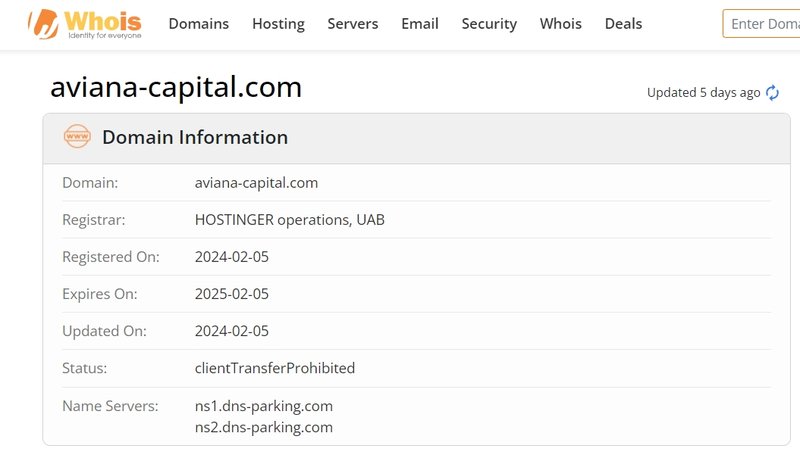

Domain Analysis: Newly Registered Domain Lacks Credibility

2.1 Risks of a Short-Term Registration

Aviana Capital’s domain was registered in February 2024, indicating it has been operational for only a short period. Investors typically look for platforms with established reputations and histories, as these factors directly influence stability and reliability. A platform with a short registration period, like Aviana Capital, lacks sufficient market experience, which raises concerns about stability and credibility.

2.2 Exit Risks with Short-Term Platforms

Many short-term platforms close quickly due to non-compliance or poor management, leaving investors unable to recover their funds. A newly registered domain is often a characteristic of temporary trading sites, which may shut down unexpectedly. Investors should remain cautious when choosing a platform with such a brief history, as these platforms carry higher risks.

Account Types: High Deposit Thresholds and Lack of Transparency

3.1 High Minimum Deposits and Ambiguous Account Structure

Aviana Capital offers five account types, each with different deposit requirements:

- Basic Plan: Minimum deposit of $100, maximum deposit of $19,999

- Silver Plan: Minimum deposit of $20,000, maximum deposit of $39,999

- Top Plan: Minimum deposit of $40,000, maximum deposit of $59,999

- Standard Plan: Minimum deposit of $60,000, maximum deposit of $79,999

- Golden Plan: Minimum deposit of $80,000, with no maximum limit

Although Aviana Capital appears to offer options for various investor levels, the high deposit thresholds and lack of detailed information make it hard for users to make informed choices. Legitimate trading platforms typically provide a clear breakdown of the services and benefits associated with each account type, allowing investors to select the account that best meets their needs. However, Aviana Capital’s unclear account descriptions may pressure users into depositing larger amounts without a clear understanding of benefits.

3.2 Unclear Account Benefits

For investors, understanding account details such as spreads, transaction fees, and withdrawal policies is essential for effective trading and fund management. Although Aviana Capital offers a range of account tiers, the platform fails to clarify the benefits and features of each one, leaving investors unable to gauge the value of their choices. Without transparent information, users risk depositing significant amounts and not receiving the services they expected.

Missing Trading Information: Lack of Key Details on Spreads, Leverage, and Commissions

4.1 Omission of Critical Trading Conditions

Aviana Capital does not disclose information on key trading conditions such as spreads, leverage ratios, or commissions. Spreads, leverage, and commissions directly affect investors’ costs and risk levels. Most transparent platforms list these conditions to help users fully understand trading costs. Aviana Capital’s omission of this information leaves investors vulnerable to hidden fees and an unclear picture of their trading expenses.

Typically, reputable trading platforms display essential data on spreads, leverage, and commissions so users can assess costs accurately. Without these disclosures, Aviana Capital makes it challenging for users to gauge actual expenses, potentially hiding high spreads or additional fees.

4.2 Hidden Costs and Lack of Transparency

Without clear trading conditions, investors risk facing unexpected fees. Lack of transparency is common among unregulated platforms, which may rely on high spreads or undisclosed fees for profits. This practice often forces investors to bear unexpected costs, increasing financial risk.

Lack of Clear Deposit and Withdrawal Methods

5.1 Unspecified Deposit and Withdrawal Options

Aviana Capital’s website does not detail the available methods for deposits and withdrawals, leading to concerns over fund accessibility. Typically, compliant platforms clearly list the payment methods they support, such as bank transfers, credit cards, and e-wallets, and include information on fees and processing times. By omitting these details, Aviana Capital limits investors’ ability to assess liquidity and security.

5.2 Potential Barriers to Withdrawals

Without clear deposit and withdrawal processes, users may face challenges when attempting to access their funds. Many unregulated platforms create obstacles for withdrawals, locking funds within the platform. Investors who deposit large sums without transparent withdrawal information may later encounter difficulty accessing their funds, creating additional financial risk.

Lack of Educational Resources: Limited Support for New Traders

6.1 Lack of Resources for Investor Development

Aviana Capital offers no educational resources, such as market analysis, trading strategies, tutorials, or e-books. Educational resources help users learn about markets and develop their trading skills, especially for beginners. Regulated trading platforms often provide educational content to support user growth, but Aviana Capital’s lack of resources shows limited interest in investor development.

6.2 Negative Impact on New Traders

For new traders, educational resources are crucial to building foundational knowledge and improving risk management. Without these resources, users may lack the knowledge needed to make sound trading decisions, increasing their risk of losses. Aviana Capital’s lack of educational support suggests that the platform focuses on attracting deposits rather than offering long-term value to its clients.

Conclusion: Proceed with Caution on Aviana Capital

In summary, Aviana Capital is an unregulated, non-transparent trading platform that raises red flags due to unverified registration information, high deposit requirements, lack of essential trading details, unclear deposit and withdrawal policies, and a lack of educational resources. The absence of legal protections and transparency makes this platform risky for investors. Potential users are advised to approach Aviana Capital with caution, carefully evaluating its legitimacy and potential risks to avoid unexpected financial losses.

FAQ

- Is Aviana Capital regulated?

Answer: No, Aviana Capital is unregulated and lacks financial oversight, which raises concerns about fund security. - Is Aviana Capital’s registration information reliable?

Answer: Verification shows that the platform’s registration number does not exist, suggesting questionable registration information. - What are the differences between Aviana Capital’s account types?

Answer: Aviana Capital offers five account types, but fails to specify the benefits of each, leaving investors in the dark. - Are spreads, leverage, and commissions disclosed?

Answer: No, Aviana Capital does not disclose these key trading details, making it difficult to assess trading costs and risks. - Does Aviana Capital provide educational resources?

Answer: No, the platform lacks educational resources, potentially disadvantaging beginner traders. - Is trading on Aviana Capital safe?

Answer: Without regulation or transparency, Aviana Capital presents high risks for investors; caution is advised.