Aircrypt Trades offers trading in forex, CFDs, and cryptocurrencies but lacks transparency, regulation, and basic user protections, posing substantial risks for potential users.

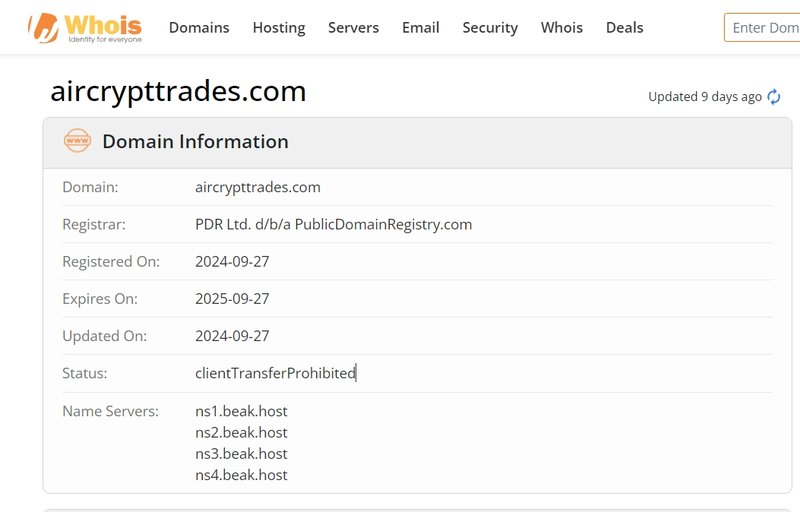

1. Domain Registration: Recently Established Platform

Aircrypt Trades operates under the domain aircrypttrades.com, registered on September 27, 2024. The recent registration date highlights that the platform is new to the financial industry, which raises concerns regarding its reliability and experience. Typically, established financial platforms have a long-standing online presence that adds credibility; Aircrypt Trades, however, does not have this established track record. For potential investors, the lack of an extended history and reputation is a factor to consider carefully.

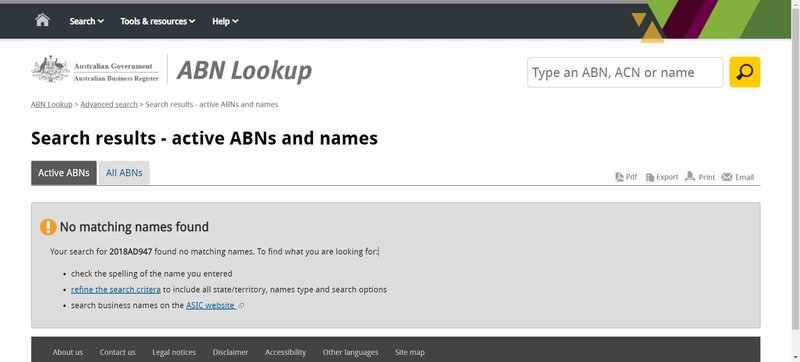

2. Lack of Registered Entity and Invalid ABN

Aircrypt Trades presents an Australian Business Number (ABN) (2018AD947) on its website. However, upon verification, this ABN number is not valid, and there are no records of a legally registered entity associated with this number. This absence of valid business registration raises concerns about the platform’s actual operations and its corporate legitimacy. Reliable trading platforms usually provide complete and verifiable registration details, allowing users to research their legitimacy and accountability. Aircrypt Trades’ lack of transparency makes it challenging for users to establish trust.

2.1 The Importance of Corporate Transparency

For users and investors, knowing a platform’s legal registration information is essential for security. When a platform’s registration is unverifiable, users face greater risks because there is no legal recourse in case of fraud or financial disputes. Transparency in a company’s background is often a marker of reliability, but Aircrypt Trades lacks this basic attribute.

3. Absence of Regulatory Oversight

Aircrypt Trades operates without any regulation or oversight from a recognized financial authority. Typically, platforms that offer trading in forex, CFDs, or cryptocurrencies are required to hold licenses issued by regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These licenses ensure that brokers comply with financial standards, protect user funds, and adhere to transparency requirements. The lack of any regulatory backing for Aircrypt Trades indicates that it is free from compliance with standard rules that regulated brokers follow.

3.1 Risks of an Unregulated Platform

Without regulatory oversight, Aircrypt Trades is not held to any legal requirements for fund protection, data security, or fair trading practices. This lack of accountability increases the risk of user data and funds being compromised, and users lack recourse in case of fraud or platform failure. Regulatory bodies provide a protective framework for investors, and platforms without regulation operate without these important safeguards.

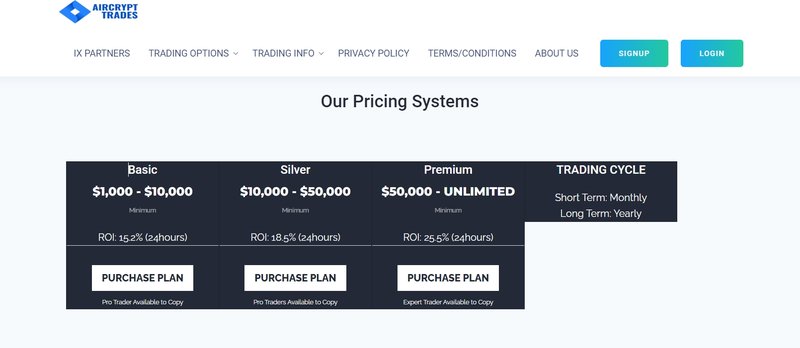

4. Lack of Clarity on Spreads and Leverage

Aircrypt Trades offers three account types—Basic, Silver, and Premium—with varying minimum deposits:

- Basic: Deposit range of $1,000 to $10,000

- Silver: Deposit range of $10,000 to $50,000

- Premium: Minimum deposit of $50,000, with no upper limit

However, the platform does not provide clear information on the specific benefits or differences among these account types. Furthermore, Aircrypt Trades does not disclose crucial details about trading conditions such as spreads, leverage, or transaction fees, which are essential for traders to make informed decisions.

4.1 Risks of Unclear Trading Terms

Traders need to understand spreads and leverage terms to evaluate potential risks and costs. Lack of transparency on these points can lead to unexpected expenses or losses. Platforms that do not provide this information could potentially charge hidden fees, eroding traders’ profits without them realizing it.

4.2 Potential Costs Associated with High Leverage

While leverage can be appealing for traders seeking high returns, it also amplifies risks, especially on unregulated platforms. If Aircrypt Trades provides high leverage but does not disclose the terms, it may expose traders to significant financial risks without their knowledge.

5. Unclear Deposit and Withdrawal Procedures

Aircrypt Trades does not provide any information regarding its deposit and withdrawal methods. Reputable platforms generally offer various funding methods such as bank transfers, credit cards, and e-wallets, and they disclose associated fees, processing times, and limitations.

5.1 Risks of Opaque Deposit and Withdrawal Policies

Clear policies on deposits and withdrawals are critical for users to assess how accessible their funds are. Without this transparency, users may encounter delays, high fees, or even limitations on withdrawals, making it difficult for them to manage their funds efficiently. Such uncertainties may also raise red flags about the platform’s financial integrity and operational stability.

5.2 Importance of Fund Accessibility

For traders, the ability to deposit and withdraw funds easily is crucial. When a platform is vague about these processes, it limits the user’s control over their finances and raises questions about potential hidden fees or processing delays that could adversely impact trading.

6. Limited Customer Support Options

Aircrypt Trades only provides a single point of contact—an email address ([email protected]). While this email contact may be sufficient for basic inquiries, it is insufficient for handling urgent or complex issues that may arise during trading. Established platforms often provide multiple support options, including phone, live chat, and detailed FAQs, to ensure that users can access timely assistance.

6.1 Risks of Limited Customer Support

Limited support options can leave users stranded when issues arise, especially in the fast-paced world of online trading where quick response times are often critical. For example, if users experience delays in withdrawals, they may have no immediate recourse to resolve the issue, leading to increased frustration and potential financial loss.

6.2 User Trust and Customer Support

A responsive customer service team is a sign of a reliable trading platform. By offering minimal support, Aircrypt Trades may unintentionally signal a lack of commitment to user satisfaction and risk management, which can undermine users’ trust in the platform.

7. Lack of Educational Resources

Aircrypt Trades does not offer any educational materials, resources, or training tools. For both beginners and advanced traders, access to educational resources can be instrumental in understanding market dynamics, building skills, and implementing strategies effectively. Many reputable platforms provide market analysis, webinars, tutorials, and other educational materials to help their users make informed trading decisions.

7.1 Why Educational Resources Matter

Without access to educational resources, beginner traders may lack the tools they need to understand market trends or develop effective trading strategies. Additionally, users are more likely to make uninformed decisions that could lead to losses. Educational resources demonstrate a platform’s commitment to user success, and their absence at Aircrypt Trades could be a disadvantage for novice traders.

Aircrypt Trades is a newly launched trading platform offering forex, CFD, and cryptocurrency trading. However, it lacks key regulatory oversight, fails to provide verifiable company registration, and does not disclose critical trading conditions. The platform’s unclear deposit and withdrawal processes, limited customer support, and absence of educational resources present further concerns. Users are advised to exercise caution when considering Aircrypt Trades as a trading platform, given its lack of transparency and potential risks to fund security and personal data.

FAQ

1. Is Aircrypt Trades regulated by any financial authority?

No, Aircrypt Trades operates without oversight or licensing from any financial regulatory authority, meaning user funds lack regulatory protection.

2. What are the minimum deposit requirements for Aircrypt Trades accounts?

The Basic account requires a minimum deposit of $1,000, the Silver account $10,000, and the Premium account $50,000. However, the platform does not clarify any additional benefits tied to these accounts.

3. Are there clear deposit and withdrawal methods?

Aircrypt Trades has not disclosed its deposit or withdrawal options, nor any associated fees or processing times, making it difficult for users to gauge fund accessibility.

4. How responsive is Aircrypt Trades’ customer support?

The platform only provides a single email address for customer support, which may be insufficient for urgent issues or technical difficulties.

5. Does Aircrypt Trades provide any educational resources for traders?

No, the platform does not offer any educational materials, such as market analysis or tutorials, which could be valuable for novice traders seeking to improve their trading skills.

6. How secure is Aircrypt Trades for users?

As an unregulated platform with unverifiable registration, Aircrypt Trades lacks the transparency and legal protections that users should look for when choosing a trading platform.