This article provides an in-depth analysis of Sansom Asset, covering its background, regulation, account types, trading costs, and platform transparency, to objectively assess the platform’s risks and potential reliability.

1. Company Background: Establishment and Initial Information of Sansom Asset

1.1 Company Overview

Sansom Asset is a newly established online trading platform that claims to offer trading services for various financial products, including forex and Contracts for Difference (CFDs). Forex and CFD trading have gained popularity in global financial markets due to their high liquidity and flexible leverage options. As a platform claiming to provide diverse financial product trading, Sansom Asset asserts that it can deliver a professional and secure trading experience to users. However, unlike established platforms with a long operational history, Sansom Asset lacks a track record, and its transparency issues have raised concerns among potential users.

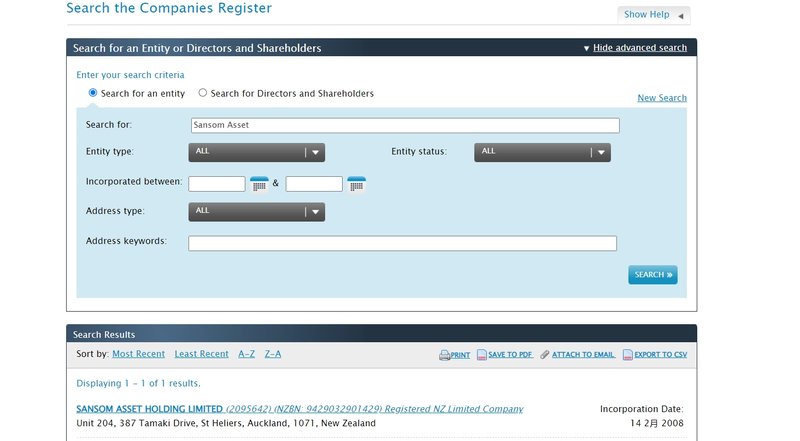

1.2 Claimed Address in New Zealand

According to its website, Sansom Asset’s operational address is based in New Zealand, a claim that is frequently emphasized to underscore the company’s formal physical operations. However, upon investigation, it was found that while there is a registered company named “SANSOM ASSET HOLDING LIMITED” in New Zealand, no evidence suggests any connection or collaboration between this company and the Sansom Asset platform. Although Sansom Asset claims to be located in New Zealand, this statement remains unverified. Many reputable platforms disclose registration information and corporate certificates to build user trust, but Sansom Asset’s lack of transparency in this area may cause users to question its background.

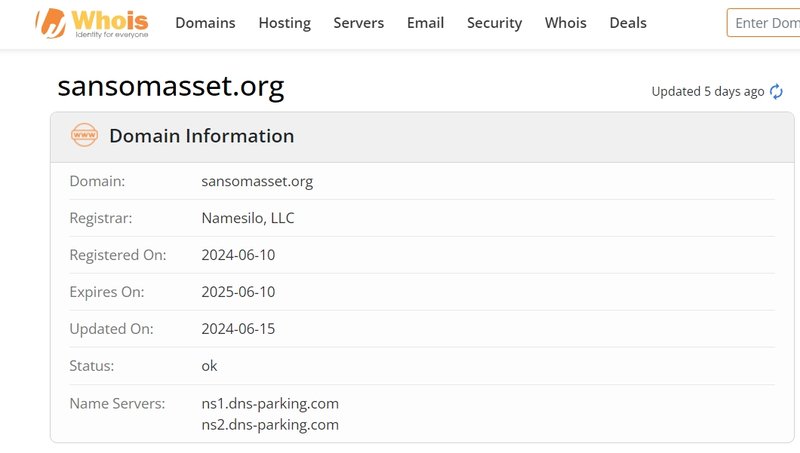

1.3 Domain and Company Registration Transparency

The domain of the Sansom Asset website was registered on June 10, 2024, which indicates the platform’s limited operational history and lack of established market reputation. Domain registration information is an important factor in assessing a platform’s reliability. Generally, a longer operational period and transparent registration information help build user trust. However, Sansom Asset has not publicly disclosed its registration or domain ownership details. This lack of transparency is uncommon in the financial services industry and may raise concerns among users. Additionally, the short registration period suggests that the platform has yet to undergo sufficient market validation.

2. Regulatory Status and Legal Compliance

2.1 Regulatory Status of Sansom Asset

Sansom Asset has not provided any documentation to confirm that it is regulated by a financial authority. Reputable trading platforms typically operate under the oversight of local or internationally recognized regulatory bodies, such as the UK’s Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). The oversight provided by these regulatory bodies offers a layer of protection for users and may assist them in seeking redress in case of disputes.

Unregulated online trading platforms often carry greater risks regarding fund management, transparency, and user protection. For example, if trading account funds are not segregated from company operational funds, users’ financial security may be at risk. Regulatory oversight also helps users understand a platform’s risk management and financial stability, thereby improving trading transparency and security. Sansom Asset’s lack of regulatory oversight is a critical risk factor for investors considering this platform.

2.2 Potential Risks of Operating Without Regulation

Regulation is essential in the operation of trading platforms, especially given the high-risk nature of online trading. Regulated platforms generally provide transparent disclosure, strict account segregation, and comprehensive user protection measures, while unregulated platforms may have lower transparency, higher trading risks, and limited legal recourse. For investors, selecting an unregulated platform means that, in the event of disputes or financial losses, legal support may be difficult to obtain.

3. Account Types and Investment Requirements

3.1 Overview of Sansom Asset Account Types

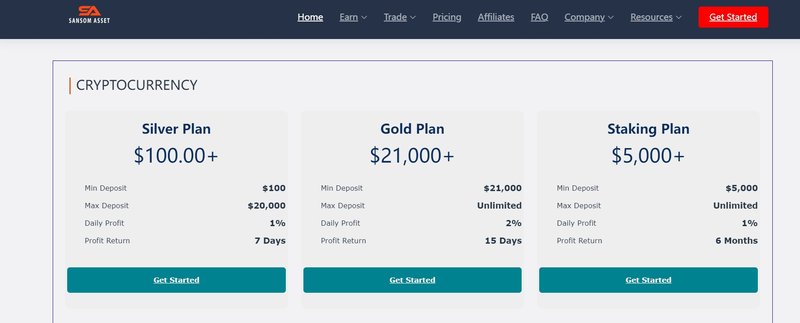

Sansom Asset currently offers three main account types: Silver Plan, Gold Plan, and Staking Plan, with minimum deposit requirements and maximum deposit limits varying across the three:

- Silver Plan: Minimum deposit of $100, maximum deposit limit of $20,000;

- Gold Plan: Minimum deposit of $21,000, no deposit limit;

- Staking Plan: Minimum deposit of $5,000, no deposit limit.

The tiered account structure provides a range of options for investors with varying capital levels, but the platform does not offer specific details on the services provided by each account, such as spreads, leverage, or commission rates. These details are critical for investors to evaluate trading platforms accurately, and the lack of transparency may prevent users from properly assessing the platform’s actual trading costs and service quality.

3.2 Impact of Lacking Detailed Account Services Information

Different account types typically come with varying fee structures, trading conditions, and service features, such as lower spreads, higher leverage, or access to a dedicated account manager. However, Sansom Asset has not published specific service details for its accounts, making it challenging for users to assess which account best suits their needs. Transparent account service information can help users evaluate a platform’s cost-effectiveness and reduce potential risks during trading. Thus, the absence of detailed account type information on Sansom Asset may impact users’ trading experience and risk management.

4. Trading Costs: Absence of Spread, Leverage, and Commission Information

4.1 Missing Information on Spreads and Commissions

Sansom Asset has not disclosed essential trading cost information on its website, including spreads and commission rates. In forex and CFD trading, the spread and commission fees significantly impact traders’ costs, so investors often carefully compare these differences when choosing a platform. Higher spreads or hidden commissions can notably impact profits, especially for short-term traders.

Spreads generally fall into two categories: fixed spreads and floating spreads. However, Sansom Asset has not clarified its spread model or indicated whether commissions are charged per trade or vary by account type. The absence of detailed cost information makes it challenging for investors to analyze trading expenses and could lead to unforeseen costs.

4.2 Lack of Leverage and Risk Management Information

Leverage is a key feature of forex and CFD trading, as it enables traders to increase their profit potential, though it also heightens risk. Most trading platforms offer different leverage options based on account types or user experience to help traders manage risk effectively. Sansom Asset has not specified the leverage ratios it provides, leaving investors unable to evaluate the platform’s risk management policies.

Additionally, Sansom Asset has not disclosed information regarding minimum/maximum trade volumes, maximum open positions, margin call levels, or stop-loss margins. These factors are critical in managing trading risks, and the absence of this information may result in higher uncertainty for investors using the platform.

5. Transparency Issues with Trading Software

5.1 Sansom Asset’s Platform Selection and Functionality

Sansom Asset has not specified which trading platform it uses, such as MetaTrader or other third-party trading software. Trading software is the core tool through which users perform trades, analyze markets, and manage risks. The functionality and stability of the platform directly impact users’ trading experience. Popular platforms like MT4 and MT5 are widely trusted due to their powerful charting tools and technical analysis capabilities, whereas an unknown trading software may raise concerns about its functionality and security.

5.2 Technical Support and Security of the Trading Platform

A professional trading platform typically provides multiple security measures, such as data encryption, two-factor authentication (2FA), and IP locking, to safeguard users’ data and funds. Sansom Asset has not disclosed the technical support and security features of its trading platform, leaving users without a basis for evaluating the platform’s reliability. Transparent information on trading software and security measures is essential for building user trust and serves as a fundamental guarantee for investors to mitigate potential trading risks.

6. Deposit and Withdrawal Methods and Process

6.1 Deposit and Withdrawal Options

Although Sansom Asset has not specified deposit and withdrawal methods on its website, legitimate trading platforms generally provide a variety of safe and convenient deposit and withdrawal options, such as bank transfers, credit/debit cards, and third-party payment tools. When selecting a trading platform, users usually prefer platforms that support fast withdrawal and convenient deposit options. For investors, the availability of quick and transparent deposit and withdrawal channels is a critical part of the trading experience.

6.2 Withdrawal Process and Fees

The speed and fee structure of withdrawals are among the primary factors users consider when choosing a trading platform. While Sansom Asset has not detailed its withdrawal process, some unregulated platforms in the industry may impose additional conditions on withdrawals or charge high fees, potentially leading to delays in withdrawal processing. Therefore, investors should confirm the transparency and reliability of Sansom Asset’s withdrawal process to ensure more control over their funds.

7. Summary of Sansom Asset’s Advantages and Potential Risks

7.1 Advantages of Sansom Asset

- Diverse Account Types: The platform offers three different account types, initially catering to investors with different levels of capital.

- Potential for New Platform Innovation: As a recently established platform, Sansom Asset may have some potential for innovation in products and services.

7.2 Potential Risks of Sansom Asset

- Lack of Regulation: No evidence of regulatory oversight, which may expose users to higher trading risks.

- Lack of Transparency: Missing information on critical factors, including spreads, commissions, leverage, and trading platform details, makes it difficult for users to assess the platform’s costs and risks.

- Unclear Technical Support: Lack of information about the trading platform’s technical specifications and security features may affect users’ trading experience and fund safety.

FAQ

1. Is Sansom Asset regulated?

Sansom Asset has not provided any evidence of regulation. Unregulated platforms generally present higher risks concerning fund safety and legal protections, so users should evaluate carefully.

2. What types of accounts does Sansom Asset offer?

The platform offers three account types: Silver Plan, Gold Plan, and Staking Plan, with minimum deposits ranging from $100 to $21,000, though specific service details are not provided.

3. What are the spreads and commissions at Sansom Asset?

Sansom Asset has not disclosed specific spreads or commission structures, making it difficult for investors to assess trading costs.

4. What leverage does Sansom Asset offer?

The platform has not disclosed leverage information, so users cannot understand the platform’s potential risks.

5. Which trading software does Sansom Asset use?

Sansom Asset has not specified the type of trading platform it uses. Users should inquire further about the platform’s technical support before trading.

6. What is the deposit and withdrawal process?

Sansom Asset has not provided detailed information about deposits and withdrawals. Users are advised to confirm the platform’s deposit and withdrawal process before trading.