Prime Market IQ exhibits severe issues regarding regulatory legitimacy and transparency, with unrealistic high-yield investment plans. Investors should proceed with caution and select only regulated, credible financial platforms.

1. Company Background

Prime Market IQ claims to operate under licenses across multiple jurisdictions, with its website stating that the company is regulated in Cyprus, South Africa, the UK, and Belize. However, deeper investigation shows that most of this regulatory information is not genuine, and the platform’s actual corporate background is highly questionable.

1.1 Claimed Multi-Jurisdiction Regulation

Prime Market IQ’s website lists various entities as holding regulatory licenses:

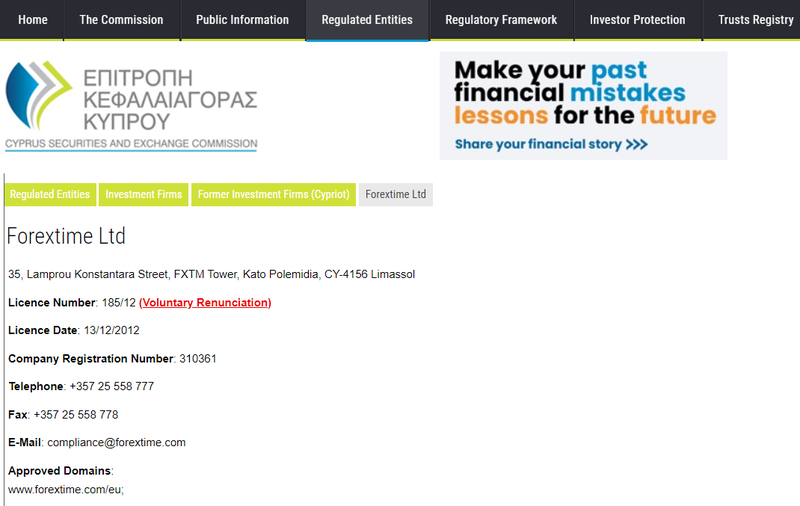

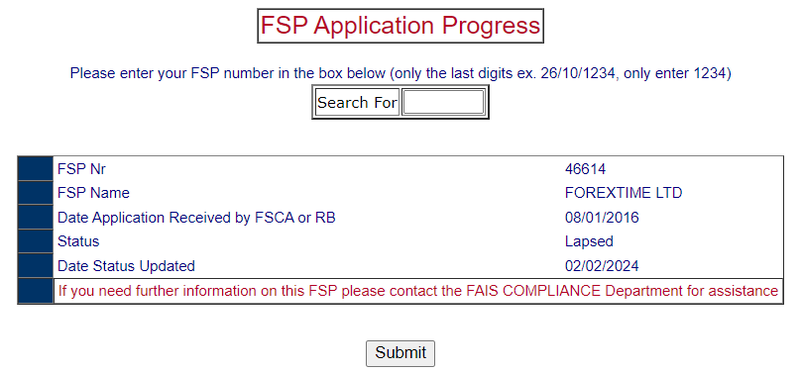

- Prime Market IQ Limited: Claims regulation under the Cyprus Securities and Exchange Commission (CySEC), CIF license number 185/12, and authorization from the Financial Sector Conduct Authority (FSCA) in South Africa, FSP number 46614.

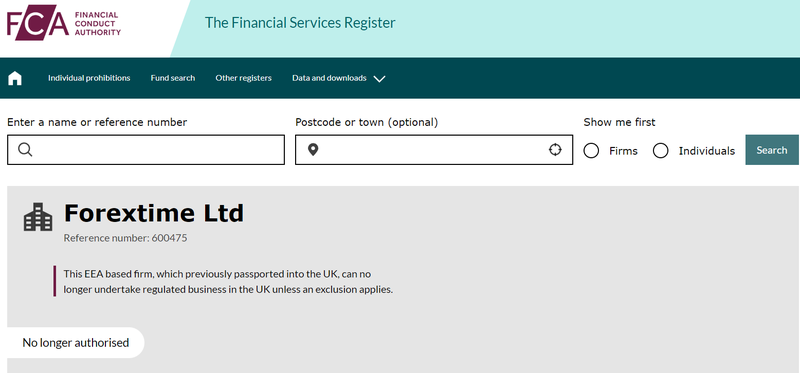

- Prime Market IQ UK Limited: Claims authorization by the UK Financial Conduct Authority (FCA), license number 777911.

- Prime Market IQ Global Limited: States regulation by the International Financial Services Commission (IFSC) in Belize, with license numbers IFSC/60/345/TS and IFSC/60/345/APM.

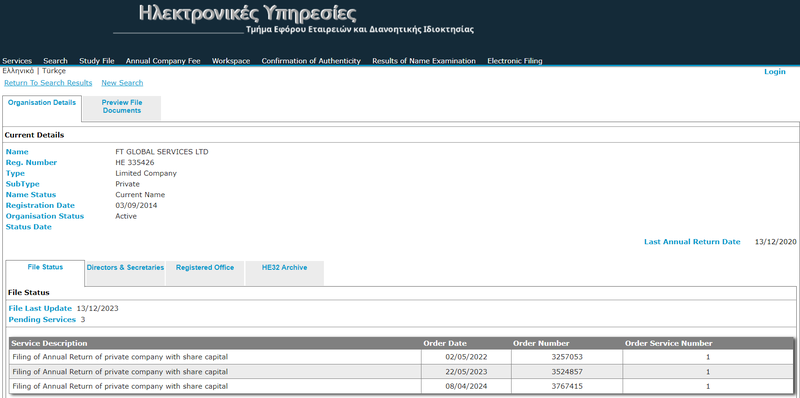

- Prime Market IQ Global Services: Claims to handle card transactions with registration number HE 335426 as a fully owned subsidiary.

1.2 Suspect Corporate Structure

Prime Market IQ also claims to have a global corporate presence registered in multiple countries. However, upon verification, most of this information appears to be false, with many regulatory claims copied from FXTM, a well-known broker, using expired or inactive content. For instance, CySEC license CIF number 185/12 is no longer valid. Moreover, the Cyprus Registrar of Companies lists HE 335426 as belonging to FT Global Services Ltd., not Prime Market IQ Global Services.

2. Domain Information and Transparency Issues

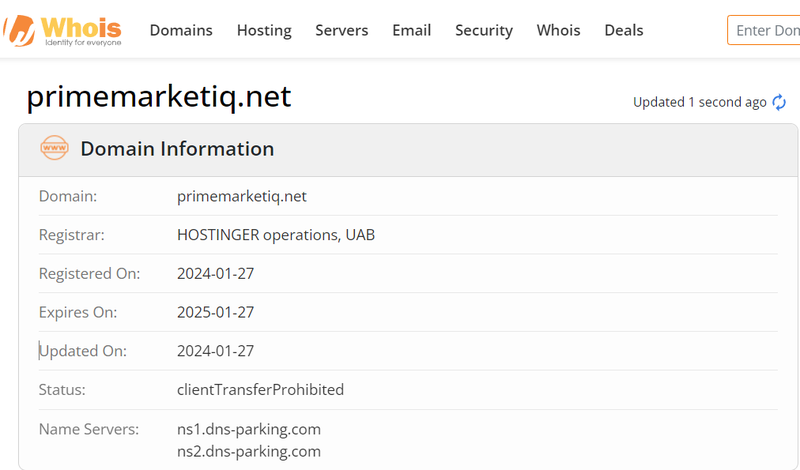

2.1 Short Domain Registration Period

Prime Market IQ’s domain (https://www.primemarketiq.net) was registered recently and lacks a long operational history, conflicting with its claims of multiple international regulatory approvals and years of experience. A legitimate global financial brand typically has a well-established domain and years of public records, which Prime Market IQ lacks.

2.2 Concealed Domain Ownership

Prime Market IQ’s domain registration details are hidden, with no information on company registration or ownership. Legitimate platforms generally disclose domain registration details so investors can verify corporate registration through official channels. This privacy setting raises further doubts about the platform’s authenticity, making it difficult for investors to verify its legitimacy.

3. Issues with Registration and Regulatory Compliance

3.1 Use of False Regulatory Information

Research shows that much of Prime Market IQ’s regulatory information is copied from FXTM, a well-known broker, using expired or invalid licenses. By copying these regulatory details, Prime Market IQ attempts to present itself as credible, but this is a deceptive practice and reveals the platform’s lack of legitimate oversight. Several stated regulatory numbers are invalid:

- CySEC CIF license 185/12: No longer active.

- FSCA FSP number 46614: Its validity could not be confirmed.

- FCA license 777911: Unrelated to Prime Market IQ.

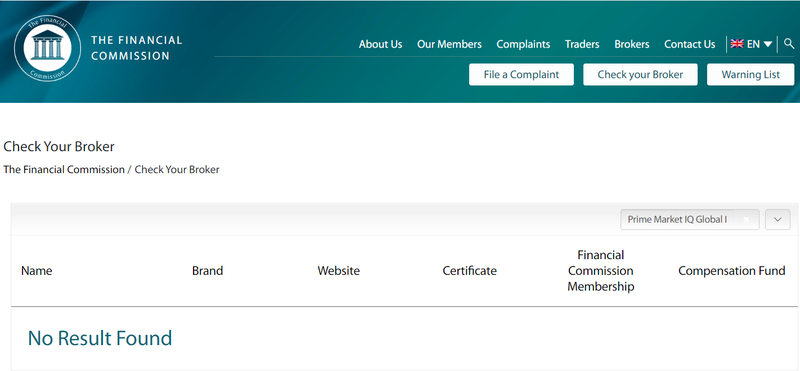

3.2 Not a Registered Member of the Financial Commission

Prime Market IQ claims membership in the Financial Commission, an organization for forex dispute resolution. However, searches show no record of Prime Market IQ in the Financial Commission’s member database, indicating that this claim is false and further raising compliance concerns.

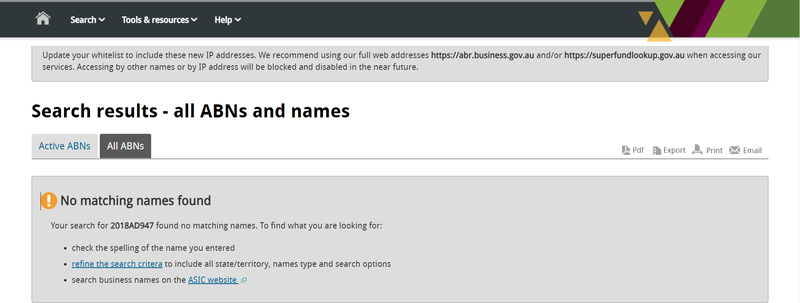

3.3 Invalid Australian Business Number

Prime Market IQ lists its Australian business number as ABN: 2018AD947 on its website to appear legitimate in Australia. However, a search of the Australian Business Register shows no company associated with this ABN. This false registration number is yet another sign of Prime Market IQ’s questionable operations.

4. Unrealistic Investment Plans and Returns

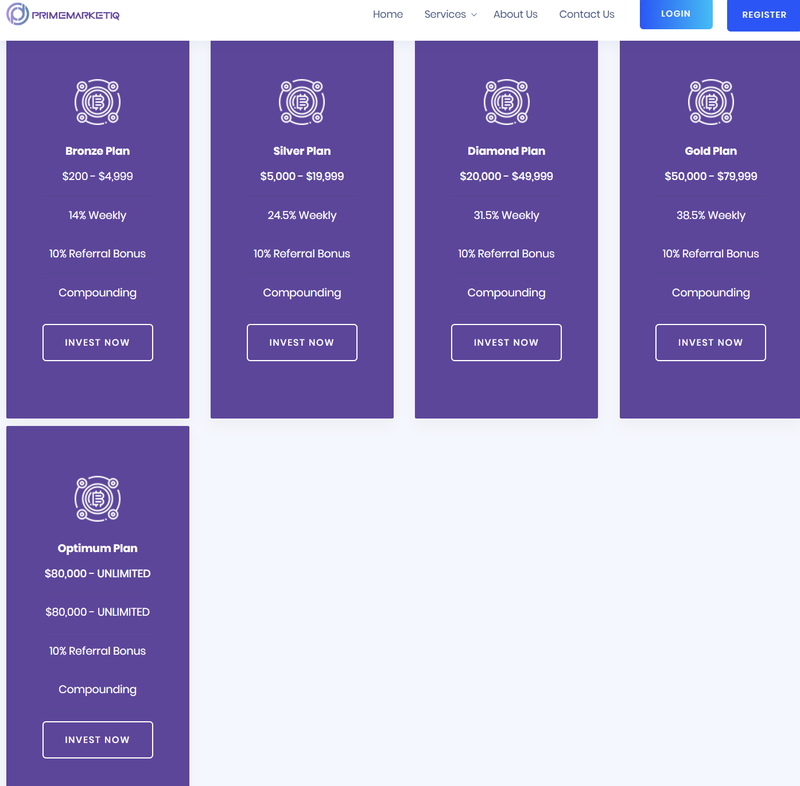

Prime Market IQ offers five investment plans—Bronze, Silver, Diamond, Gold, and Optimum— with investment amounts ranging from $200 to unlimited, each with high weekly returns that appear unrealistic.

4.1 Analysis of Each Investment Plan

- Bronze Plan: Minimum investment of $200 with a weekly return of 14%, 10% referral bonus, and compounding.

- Silver Plan: Minimum investment of $5,000 with a weekly return of 24.5%, 10% referral bonus, and compounding.

- Diamond Plan: Minimum investment of $20,000 with a weekly return of 31.5%, 10% referral bonus, and compounding.

- Gold Plan: Minimum investment of $50,000 with a weekly return of 38.5%, 10% referral bonus, and compounding.

- Optimum Plan: Minimum investment of $80,000 with no return limit, 10% referral bonus, and compounding.

4.2 Unreasonably High Returns

Prime Market IQ’s promised weekly returns of 14% to 38.5% are extremely unrealistic. Given the volatility of the forex market, any fixed high-return promise is typically a red flag for potential fraud. Legitimate financial institutions do not guarantee such high fixed returns, especially not on a weekly basis, as doing so would be financially unsustainable. These overly optimistic returns should alert investors to proceed with caution.

4.3 Use of Compounding as a Lure

Prime Market IQ promotes compounding in all of its plans, suggesting that returns will multiply over time. Although compounding can be profitable, it is frequently used by deceptive platforms as a hook, creating unrealistic return projections to attract more deposits. A legitimate platform will provide transparent explanations of both the potential risks and benefits of compounding, rather than merely promoting high returns.

5. Uncertain Fund Security

5.1 Lack of Clarity on Client Fund Safety

Prime Market IQ does not specify any fund custody or management measures, nor does it mention whether client funds are separated from company funds. Regulated platforms are required to maintain separate accounts for client funds to protect against internal misuse. However, Prime Market IQ provides no information on this, meaning investors face high risk regarding the security of their funds.

5.2 Absence of Third-Party Custody

Legitimate financial platforms often use third-party custodians to safeguard client funds, ensuring that funds are accessible when clients need to make withdrawals. Prime Market IQ, however, makes no mention of third-party custody services on its website, indicating it may not follow external safeguarding practices. The lack of such third-party custody arrangements increases the risk of client funds being misused or lost if the platform faces internal issues.

6. Conclusion

Prime Market IQ displays numerous characteristics commonly associated with high-risk platforms. Its vague corporate background, short domain registration period, false regulatory information, unrealistic return promises, and lack of fund security measures all expose the platform’s potential issues. Compared to legitimate, regulated platforms, Prime Market IQ falls short in transparency and regulatory compliance. Investors should exercise extreme caution and opt for reputable, legally compliant platforms to avoid financial losses.

FAQ

Q1: Is Prime Market IQ a regulated company?

A: Prime Market IQ claims regulatory approval in multiple countries, but investigations reveal that much of this information is copied and false. It is not legitimately regulated.

Q2: Are the high returns promised by Prime Market IQ realistic?

A: No, the weekly returns of 14%-38.5% are highly unrealistic. Such fixed high returns are unsustainable and should raise red flags for investors.

Q3: Are client funds safe with Prime Market IQ?

A: Prime Market IQ does not clarify whether it separates client funds or offers any protection. Investors should choose platforms with clear fund protection policies.

Q4: Why is Prime Market IQ’s background information concerning?

A: Prime Market IQ has a short domain registration period and does not disclose details about its corporate headquarters or team, unlike legitimate, established platforms.

Q5: What risks do investors face when trading with Prime Market IQ?

A: Investors may face risks such as inability to recover funds, lack of regulatory oversight, and unrealistic return promises that could lead to financial loss.

Q6: How can I identify if Prime Market IQ is a scam?

A: Check for legitimate regulatory certificates, realistic return rates, corporate background, and customer reviews. Transparent platforms usually provide clear regulatory and fund management information.