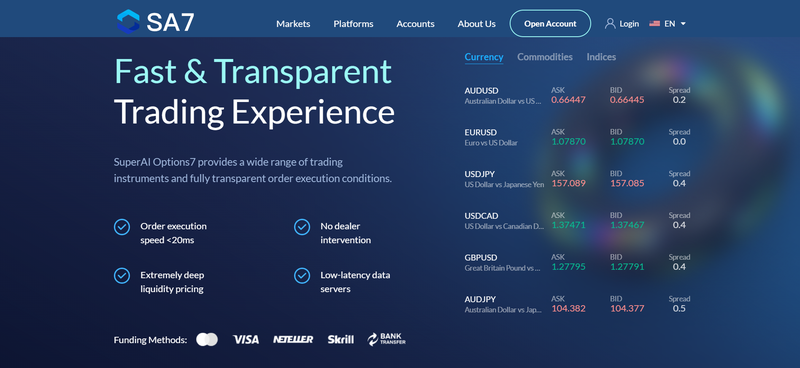

SuperAI Options7 is an online trading platform offering a range of CFD products. Despite its claims of holding multiple international regulatory licenses, there are inconsistencies in its regulatory information, and investors are advised to exercise caution when choosing this platform.

1. Company Background

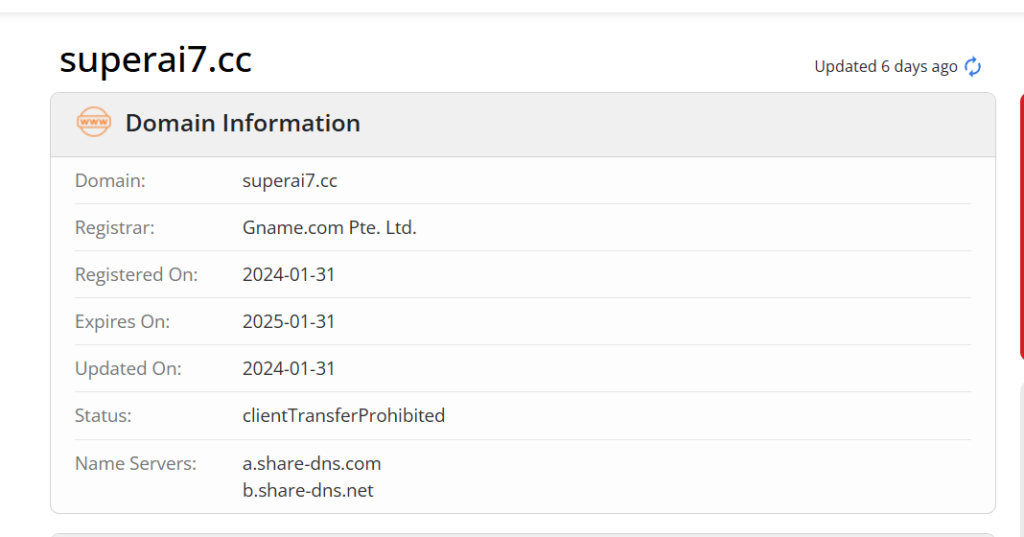

SuperAI Options7 is a newly established online CFD (Contract for Difference) trading platform launched in January 2024 and operated by SuperAI Options7 Limited. The platform offers a wide range of trading products, including forex, precious metals, commodities, and indices, providing users with diverse investment options.

1.1 Target Clients and Regional Restrictions

SuperAI Options7 primarily serves global investors, but it does not offer services in certain jurisdictions, including the United States, Iran, and North Korea, due to regulatory compliance. These restrictions help the platform avoid legal conflicts in regions where CFD trading is heavily regulated.

2. Domain and Entity Information

While SuperAI Options7’s website provides some background information about the company, details about its domain registration and actual corporate entity are limited. Although the platform claims regulatory oversight from multiple agencies, it lacks sufficient public information for users to verify the authenticity of these claims.

3. Regulatory Verification: Discrepancies Between Claims and Reality

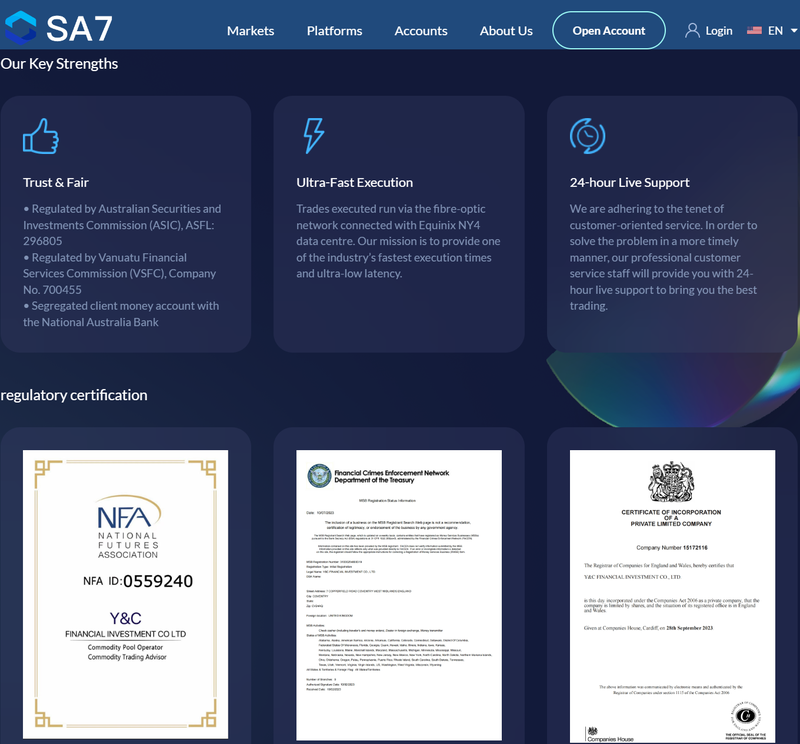

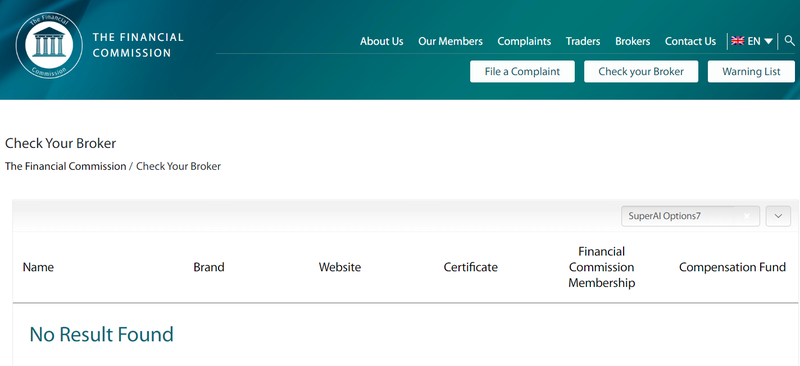

SuperAI Options7 claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investments Commission (ASIC) and mentions regulatory credentials through additional affiliated companies. However, further verification reveals discrepancies between these claims and official regulatory data.

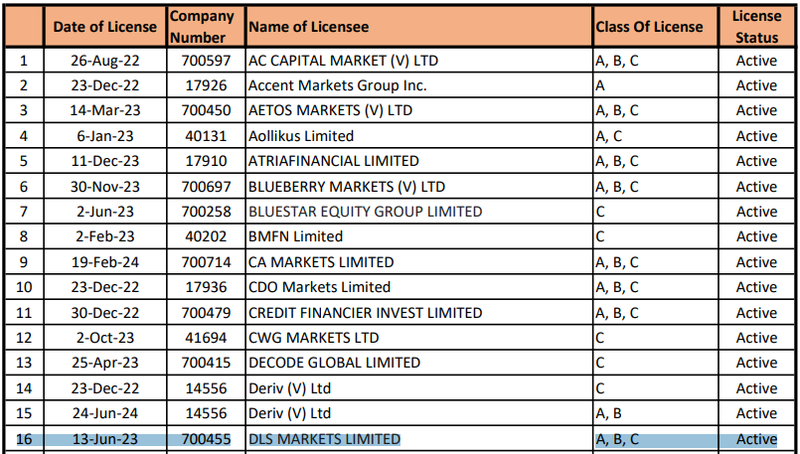

3.1 Vanuatu Financial Services Commission (VFSC)

SuperAI Options7 claims to be regulated by VFSC under license number 700455. However, upon checking the official VFSC website, it was found that license number 700455 actually belongs to DLS MARKETS LIMITED, not SuperAI Options7 Limited. This inconsistency suggests possible misrepresentation regarding the platform’s regulatory credentials.

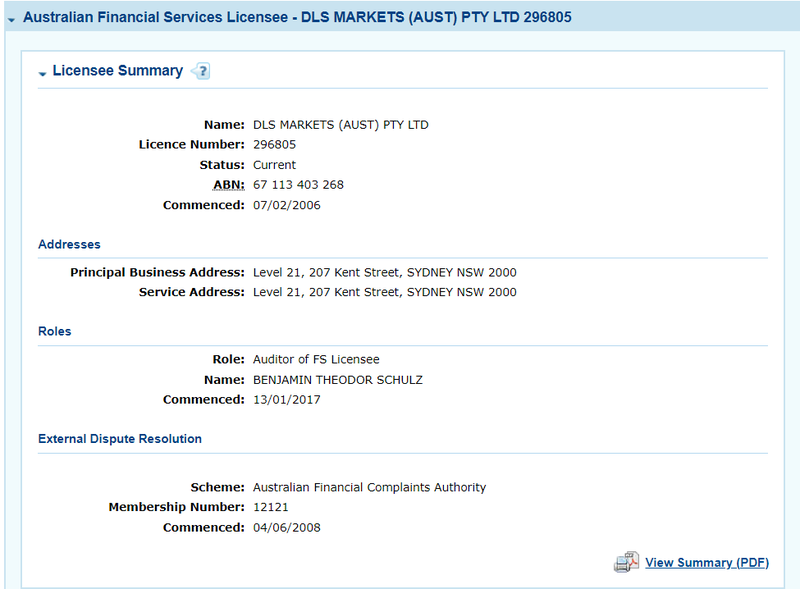

3.2 Australian Securities and Investments Commission (ASIC)

The platform also claims to hold ASIC license number 296805. However, official ASIC records show that license number 296805 is registered to DLS MARKETS (AUST) PTY LTD, not SuperAI Options7. This discrepancy further raises questions about the platform’s regulatory compliance.

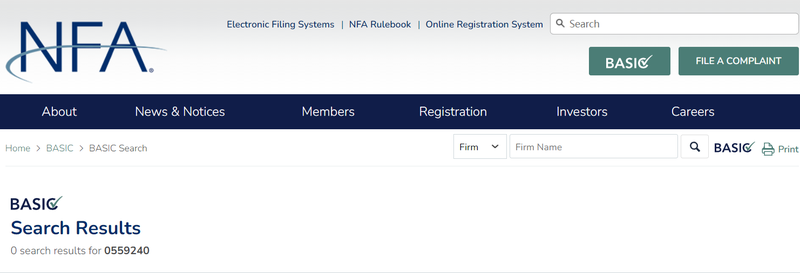

3.3 Other Affiliated Companies and Regulatory Claims

SuperAI Options7 also lists an affiliate, Y&C FINANCIAL INVESTMENT CO., LTD, which it claims is registered in the United Kingdom and regulated by both the U.S. Financial Crimes Enforcement Network (FinCEN) and the U.S. National Futures Association (NFA). However, NFA records show no registration for this company, raising further concerns about the platform’s accuracy in citing regulatory affiliations.

3.4 FinCEN’s Role

SuperAI Options7 mentions FinCEN as a regulatory body for its affiliate company, suggesting a form of compliance. However, FinCEN’s primary responsibilities include enforcing anti-money laundering (AML) and counter-terrorism financing (CTF) policies, and it does not directly oversee forex, precious metals, or cryptocurrency trading. Therefore, citing FinCEN does not substantively demonstrate regulatory oversight.

4. Account Types: Is the Minimum Deposit Reasonable?

SuperAI Options7 offers two types of accounts for users: the Standard Account and the ECN Account. Both accounts require a minimum deposit of $200, which is relatively high for new investors, potentially increasing their financial commitment upfront.

4.1 Standard Account vs. ECN Account

- Standard Account: Supports over 250 currency pairs, indices, commodities, and stock CFDs, with leverage up to 1:500, spreads starting from 1 pip, and no commission.

- ECN Account: Also offers up to 1:500 leverage, with spreads starting from 0.0 pips, and a commission of $6 per round-trip trade.

4.2 Is the Minimum Deposit Too High?

Generally, beginner investors favor platforms with lower minimum deposits, allowing them to manage risks at an entry level. The $200 minimum deposit required by SuperAI Options7 may be high for new traders or those wishing to start small to get acquainted with the platform. Therefore, investors should carefully consider their risk tolerance and investment goals before choosing this platform.

5. Leverage Levels: Is There Excessive Risk?

SuperAI Options7 offers a maximum leverage of up to 1:500, available to both Standard Account and ECN Account users. While high leverage can increase potential profits, it also significantly magnifies risks, especially in the volatile forex and CFD markets.

5.1 Potential Risks of High Leverage

High leverage allows investors to control larger assets with less capital, theoretically increasing profitability, but it also amplifies potential losses, posing significant risks to beginners who may experience substantial losses within a short time frame. At a leverage level of up to 1:500, market volatility can rapidly erode principal capital. Investors should carefully consider their strategies and risk tolerance when choosing a high-leverage platform.

6. Security of Deposit and Withdrawal Methods: Are They Legitimate?

SuperAI Options7 provides various deposit and withdrawal methods, including Mastercard, VISA, NETELLER, Skrill, and bank transfers. While these options appear flexible, the security and transparency of the platform’s transaction processes remain uncertain.

6.1 Are Mainstream Payment Methods Secure?

The platform supports commonly used payment methods such as Mastercard and VISA, which are relatively secure for international transactions. However, for electronic payment methods like NETELLER and Skrill, which may involve cross-border payments, users should be aware of potential currency conversion fees, processing delays, and additional charges. Secure deposit and withdrawal options are essential for verifying a platform’s legitimacy, so users are advised to understand the specific fees and processing times associated with each payment method before committing funds.

6.2 Transparency and Liquidity of Funds

A transparent transaction process, including clear fees and processing times, is vital for user experience on financial platforms. Although SuperAI Options7 does not specify its fee structure, users are encouraged to consult customer support for details to ensure their funds can be moved freely and with minimal costs. Given the platform’s lack of transparency, users should exercise caution when dealing with such platforms.

7. Conclusion

In conclusion, while SuperAI Options7 offers a variety of trading products in forex, precious metals, and CFDs, there are concerns regarding its regulatory information, minimum deposit requirements, leverage risks, and transaction security. The platform’s multiple claimed regulatory licenses are not fully verifiable, and its regulatory information appears to be misleading. Potential investors are encouraged to conduct thorough risk assessments and to consider their personal investment goals and risk tolerance before selecting this platform.

Frequently Asked Questions (FAQ)

- Is SuperAI Options7 regulated by legitimate authorities?

- The platform claims regulation by VFSC and ASIC, but verification shows discrepancies. Investors should approach with caution.

- What is the minimum deposit required?

- The minimum deposit is $200, which may be high for new investors. It’s recommended to evaluate personal financial goals.

- Does the platform offer a high leverage level?

- SuperAI Options7 offers up to 1:500 leverage, which increases potential risks, especially for new investors.

- Are SuperAI Options7’s deposit and withdrawal methods secure?

- The platform offers multiple mainstream options, but users should be cautious about fees and processing times.

- How can I verify the platform’s regulatory information?

- Visit the official regulatory websites to verify license information and ensure the platform’s legitimacy.