Altragate claims to provide CFD trading with ultra-high returns, but it lacks real regulatory oversight, features a fabricated corporate entity, and poses significant fraud risks for investors.

Altragate, founded in August 2024, is an online trading platform claiming to offer CFD trading in forex, stocks, indices, and cryptocurrencies. While it asserts regulatory oversight from various international agencies and lists registration and license numbers on its website, investigations reveal a starkly different reality. Altragate’s so-called “regulatory information” merely recycles details from other established brokers, and it lacks any actual company presence or operating address. This article provides an in-depth look at Altragate’s background, fabricated regulatory information, promises of high returns, and associated trading risks to help investors identify potential fraud risks.

I. Background: Basic Facts About Altragate

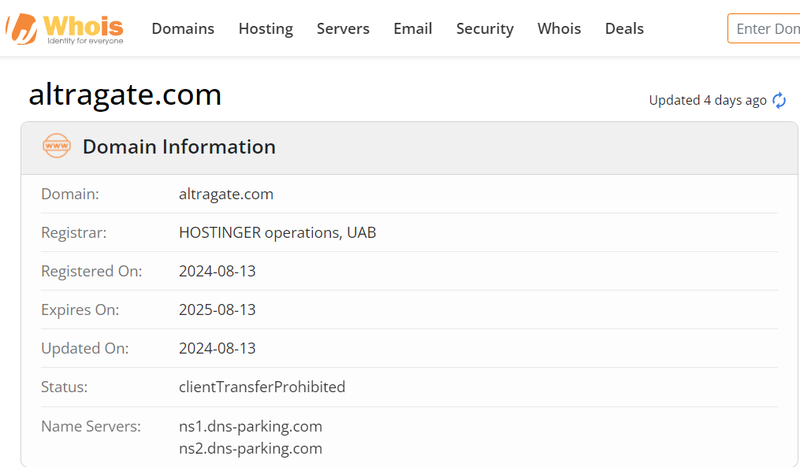

Altragate’s official website, altragate.com, was registered on August 13, 2024, claiming to offer CFD trading products globally, including forex, stocks, indices, and cryptocurrencies. To boost credibility, it lists numerous fictitious regulatory credentials on its website under “registrations and authorizations.” However, checks confirm that Altragate has no legitimate corporate presence, and its regulatory claims are entirely fabricated. Such tactics have been commonly used in financial fraud to mislead investors by creating a false impression of legitimacy.

From an investment perspective, Altragate’s numerous issues signal a high degree of irregularity, particularly given its opaque corporate background and lack of valid regulation, which raises doubts about its reliability. Choosing a secure, transparent, and regulated platform is essential for investors, and Altragate falls critically short on all these counts.

II. Domain Information and Potential Risks: Trust Issues with New Platforms

2.1 Domain Registration Information

Altragate’s domain, altragate.com, was registered in August 2024, marking it as a new platform. Typically, recently registered domains lack long-term operational track records and market reliability, making operational stability and continuity hard to guarantee. Scam platforms often use short-term domain registrations to quickly shut down their sites after exposing investors to financial risks.

2.2 Risks of a New Domain

For investors, a newly registered domain poses a high risk, lacking user reviews and historical performance to determine reliability. This lack of a proven track record is particularly risky in the financial investment sector, where platforms with short domain histories often carry high potential for rapid shutdowns. Altragate’s recent registration, absence of user feedback, and lack of operational history further compound the risk for investors.

III. Lack of Corporate Presence: No Verified Company Address or Operational Transparency

3.1 Risks of a False Company Address

Altragate claims to have multiple registered locations, including Cyprus, the UK, and Mauritius, but these addresses are unverifiable. Trustworthy financial platforms typically disclose their office locations to enable customer verification and increase transparency. However, Altragate not only lacks a clear company address but provides no verifiable information about any operational location. Without a legitimate business address, investors facing disputes or issues may find it difficult to seek recourse, increasing the suspicion of Altragate as a potential fraud.

3.2 Issues from Lack of a Legal Entity

Platforms without legitimate business entities or physical addresses struggle to provide effective customer support and lack adequate financial protection for clients. Even if the platform promises high returns, investors have little legal recourse in reality, with no entity to hold accountable or complain to. Therefore, it’s crucial for investors to choose a regulated financial platform with a real company entity to ensure fund security.

IV. Fake Regulatory Claims: Misusing Other Brokers’ Credentials

4.1 Altragate’s False Regulatory Information

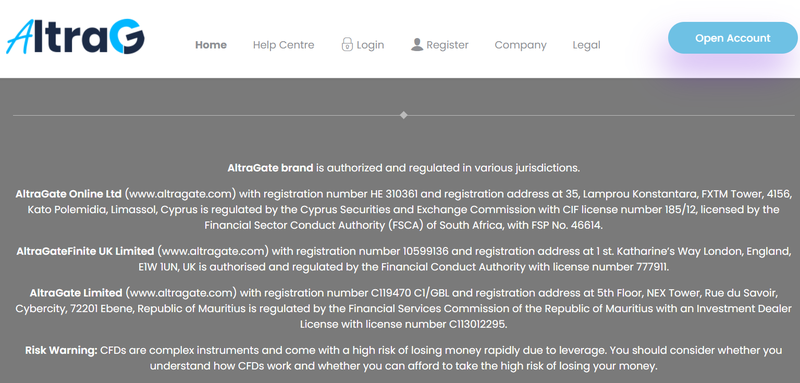

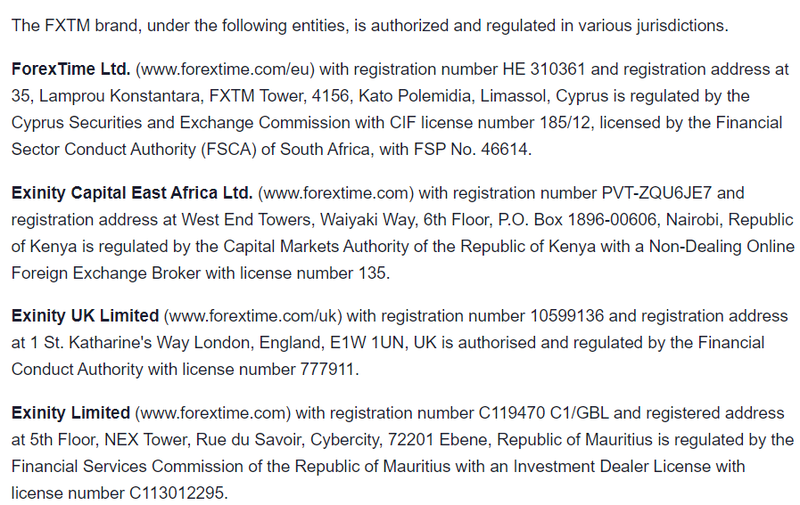

Altragate claims regulatory oversight by agencies in multiple countries, including the Cyprus Securities and Exchange Commission (CySEC), the UK’s Financial Conduct Authority (FCA), the South African Financial Sector Conduct Authority (FSCA), and the Mauritius Financial Services Commission (FSC). However, further checks reveal that Altragate’s license numbers are in fact stolen from the well-known broker FXTM and are entirely fabricated. This behavior not only infringes on legitimate brokers’ rights but also misleads potential investors.

4.2 Risks of Unregulated Status

Altragate’s fake regulatory claims highlight that it isn’t supervised by any legitimate financial authority. For investors, an unregulated trading platform generally lacks protections for financial security. If financial or legal issues arise, investors would struggle to seek compensation through legal channels. Regulatory bodies like FCA or CySEC conduct thorough inspections and supervision over companies they regulate, ensuring investor protection. Altragate’s misuse of regulatory credentials only serves to underline its unreliability.

V. Excessive Promotion of High Returns: Unrealistic Profit Promises

5.1 Altragate’s “Investment Plans” and High Return Promises

Altragate’s website lists 12 different investment plans, promising returns between 560% and 3000% within as little as 14 to 30 days. Below are examples of these accounts:

- Basic 14: 40% daily return, 14-day investment term, total return 560%.

- Standard 30: 60% daily return, 30-day investment term, total return 1800%.

- VIP 30: 100% daily return, 30-day investment term, total return 3000%.

These extreme returns exceed market norms by a significant margin and are practically unattainable in real-world investment markets. In forex and CFD markets, profit potential is inherently volatile and uncertain, making such consistent high returns implausible. Altragate’s promises are alluring but appear to be designed more to attract investors than to deliver real returns.

5.2 Risks of Unrealistic High Returns

Promises of high returns are often a hallmark of scam platforms looking to lure investors. Legitimate investment institutions generally maintain conservative estimates and avoid promising excessive returns. Altragate’s high-return investment plans lack any basis in reality, and investors who trust these promises may face significant financial losses. It’s advisable to carefully assess the realism of any investment plan before choosing a platform and to avoid scams disguised by high-return promises.

VI. Spread and Leverage Risks: Enhanced Risk on Unregulated Platforms

6.1 Potential Risks of Leverage Settings

While Altragate hasn’t disclosed specific leverage settings, many fraudulent platforms attract investors by offering high leverage. High leverage in financial markets can magnify gains quickly but also significantly heightens loss risks. Particularly on unregulated platforms, leverage use lacks adequate risk control mechanisms, making it easy for investors to incur heavy losses in a short time.

6.2 Spread Issues on Unregulated Platforms

On a properly regulated platform, spread, fees, and related information are disclosed transparently. However, Altragate hasn’t provided any clarity on spreads and fees, indicating a lack of transparency in its trading environment. Investors may face additional hidden costs during transactions. With an unregulated platform, investors have no protection regarding spreads, leverage, or other fees, which amplifies the risk.

VII. Minimum Deposit Requirements: How Should Investors Decide?

7.1 Altragate’s Minimum Deposit Requirements

Altragate’s minimum deposit starts at $1,000, with some plans requiring as much as $100,000. This high threshold poses a risk for most investors, especially given the platform’s lack of transparency and regulatory protection. High deposit requirements heighten the financial risk for investors on this unregulated platform.

7.2 Choosing Reasonable Minimum Deposit Levels

New investors are advised to select platforms with lower minimum deposit requirements and regulatory protection to reduce investment risks. Regulated platforms offer flexible deposit options, helping investors adapt gradually to the market. High minimum deposit requirements on unregulated platforms are particularly dangerous, as investors may struggle to recover funds if the platform proves untrustworthy.

VIII. Conclusion: Is Altragate Worth Investing In?

In summary, Altragate attracts investors with fabricated regulatory information and excessively high return promises, but it operates without transparency or legal security. This lack of regulatory oversight often marks high-risk investments, and investors should approach Altragate with caution to avoid financial pitfalls from promises of high returns. Selecting a legitimate, regulated platform is essential to protect investments. Investors should remain rational and carefully deliberate in their investment choices.

IX. FAQ

- Is Altragate under legitimate financial regulation?

No, although Altragate claims regulation by CySEC, FCA, and others, investigations reveal all regulatory information is fake. - What is Altragate’s minimum deposit requirement?

Altragate’s minimum deposit starts at $1,000, with high-end accounts requiring up to $100,000. Given its risks, caution is advised. - Are Altragate’s high-return promises credible?

Altragate’s high-return promises far exceed standard market returns and are practically unachievable, so investors should question their legitimacy. - Is Altragate transparent about spreads and leverage settings?

Altragate hasn’t disclosed details about spreads and leverage, adding hidden risks to transactions. - Why are high-return promises a red flag?

Excessive return promises are often tactics of scam platforms. Legitimate financial platforms don’t easily guarantee such high returns, so investors should be wary of these claims. - How can one choose a safe trading platform?

Selecting a platform regulated by authorities like the FCA or CySEC, with a real corporate presence and transparent trading rules, is essential for investment security.