CCFX Market claims to be a globally regulated CFD trading platform, but its website information, regulatory claims, and operational background raise numerous concerns. Investors should approach with caution.

CCFX Market’s Corporate Background: Deceptive Information or Experienced Operation?

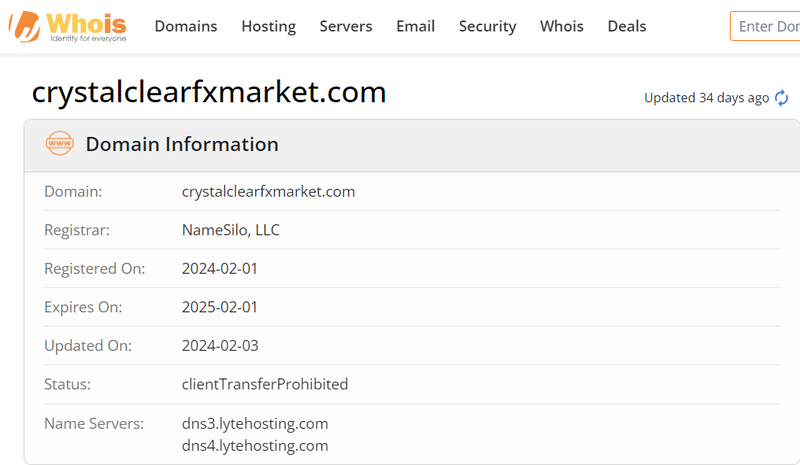

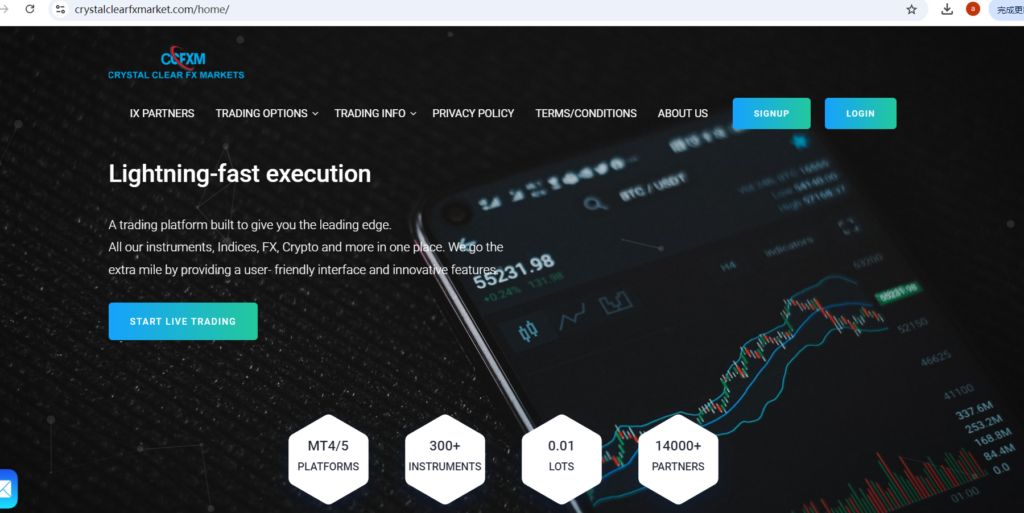

CCFX Market’s website, crystalclearfxmarket.com, was registered on February 1, 2024. The platform advertises a wide range of CFD trading services, including forex, precious metals, energy, commodities, indices, and cryptocurrencies. CCFX Market lists its full legal name as CRYSTAL CLEAR FX MARKETS. It claims to hold regulatory licenses in several jurisdictions. However, a closer look at its corporate background and regulatory claims reveals inconsistencies. Numerous questionable details cast doubt on the platform’s legitimacy and compliance.

Domain Information: Discrepancies Between Registration Date and Claimed History

A WHOIS lookup shows that CCFX Market’s domain, crystalclearfxmarket.com, was registered on February 1, 2024. This registration date is at odds with the company’s claim of having a long-standing history in the market. Reputable brokers typically have domain records that match their stated years of operation, especially those claiming extensive market experience. This discrepancy in timing is a clear warning sign, suggesting that CCFX Market may not have the market history it claims.

The inconsistency between the domain registration date and the company’s claimed establishment year suggests that the platform either began recently or operates as a scam, aiming to quickly attract investor funds before vanishing. Such behavior is unfortunately common in the forex and CFD industry, particularly among unregulated entities. This underscores the importance for investors to verify a company’s background and domain history to ensure the information is genuine.

CCFX Market’s Regulatory Information: A Mix of False Claims and Copying

Claimed Regulatory Entities and Licenses

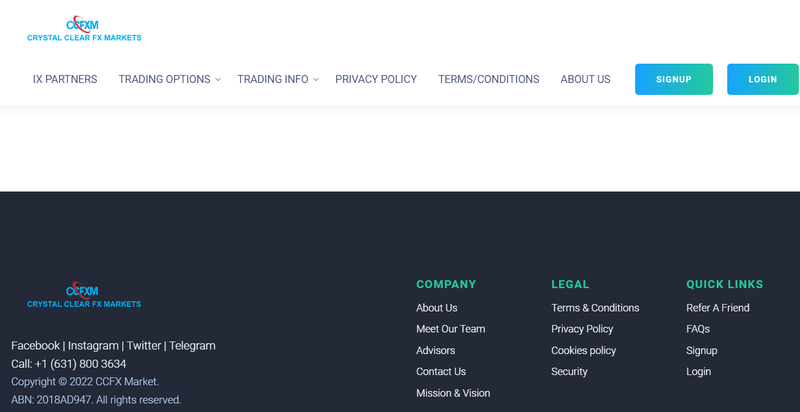

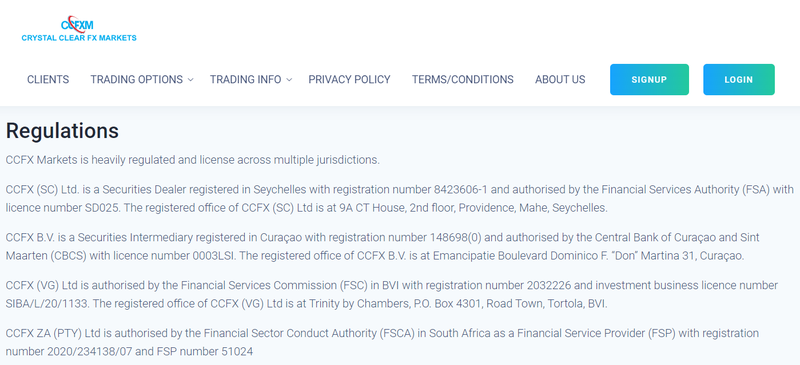

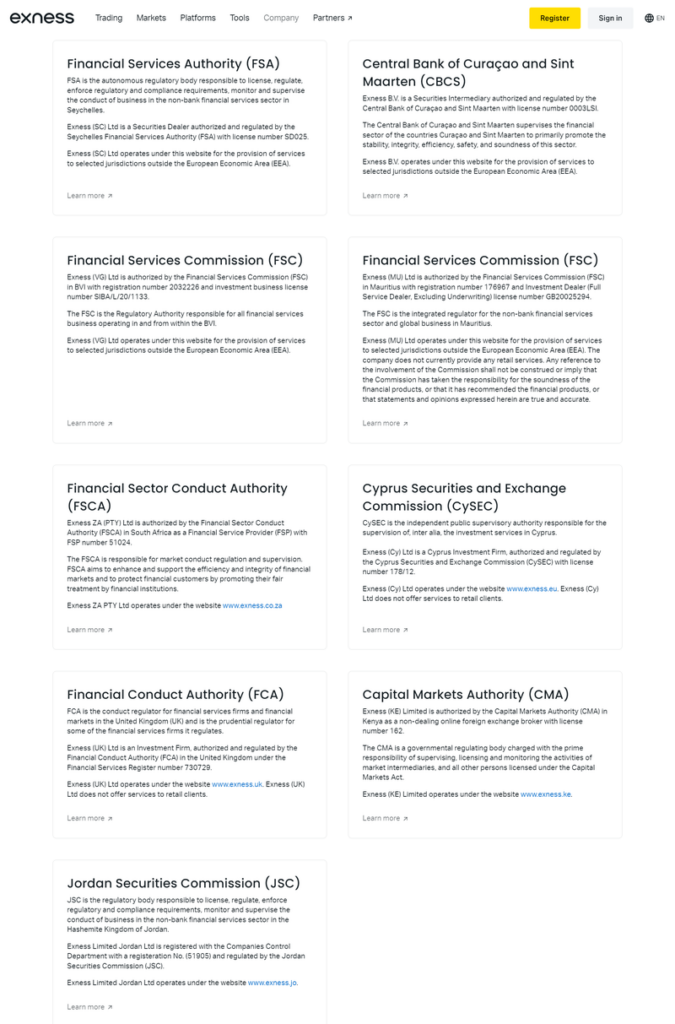

The CCFX Market website lists multiple entities and claims regulation by several international authorities, including:

- CCFX (SC) Ltd.: Registered in Seychelles with registration number 8423606-1, claiming a license from the Seychelles Financial Services Authority (FSA) under license number SD025.

- CCFX B.V.: It registers in Curacao and claims regulation by the Central Bank of Curacao and Sint Maarten (CBCS), with registration number 148698(0) and license number 0003LSI.

- CCFX (VG) Ltd.: Registered in the British Virgin Islands, supposedly regulated by the British Virgin Islands Financial Services Commission (FSC) with registration number 2032226 and license number SIBA/L/20/1133.

- CCFX ZA (PTY) Ltd.: Claiming registration in South Africa as a financial service provider with FSP number 51024.

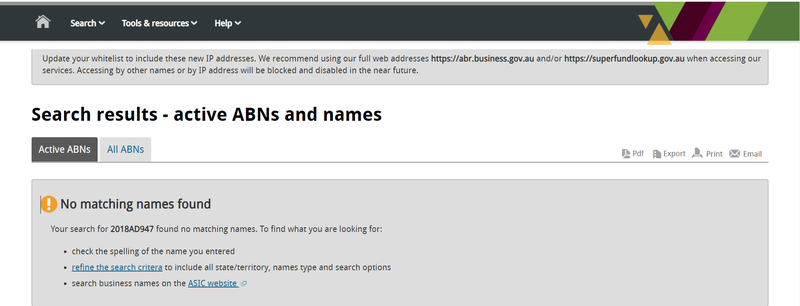

- Australian Entity: CCFX Market also claims to have a registered entity in Australia with registration number 2018AD947.

Verification Results: False Information and Copying

A search on the Australian Business Register (ABR) shows no record of a company with registration number 2018AD947, suggesting that CCFX Market’s claim of an Australian entity is entirely fabricated. Additionally, further investigation showed that all of the regulatory information listed on CCFX Market’s website actually belongs to the well-known broker Exness. CCFX Market does not provide any genuine corporate entities or legitimate regulatory oversight.

The practice of using another company’s regulatory details to create a false sense of credibility is a common tactic in fraudulent schemes. If a broker cannot provide real regulatory information and attempts to mislead investors by using another company’s regulatory credentials, this is a significant red flag. Investors should always verify a broker’s regulatory claims directly with the relevant regulatory bodies. Additionally, investors should check the company’s actual registration status, as falsified or copied regulatory information typically signals a lack of compliance.

Unrealistic Investment Returns: Leverage and Opaque Spreads

High-Yield Investment Plans: Unrealistic Promises

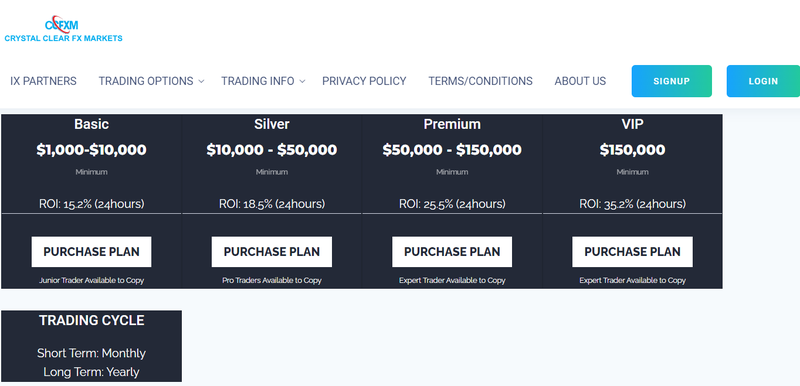

CCFX Market offers four investment plans: Basic, Silver, Premium, and VIP, all of which promise extremely high short-term returns:

- Basic: For investments between $1,000 and $10,000, it promises a 15.2% return within 24 hours and an option to copy beginner traders.

- Silver: For investments between $10,000 and $50,000, it offers an 18.5% return within 24 hours and an option to copy professional traders.

- Premium: For investments between $50,000 and $150,000, it promises a 25.5% return within 24 hours, with an option to copy expert traders.

- VIP: For investments above $150,000, it offers a 35.2% return within 24 hours, with an option to copy expert traders.

These high promised returns are almost impossible to achieve in legitimate financial markets, especially over such a short period. Due to the inherent volatility in financial markets, no reputable company can guarantee such high returns within 24 hours. Such investment plans are likely a tactic to lure investors into depositing funds quickly, possibly with the intention of shutting down the platform and absconding with the funds.

Lack of Transparency in Leverage and Spread Information

CCFX Market claims to offer high leverage but does not specify exact leverage ratios or spread ranges on its website. Reputable forex brokers typically provide clear information on their major currency pair spreads and leverage rates for each asset class so that investors can transparently understand trading costs and associated risks. If a platform is vague about such key information, it could be hiding high fees or unfavorable trading terms.

High leverage presents significant risks, and a lack of transparency in spreads can lead investors to incur higher hidden costs, impacting their overall profitability. Investors should prioritize brokers that provide clear and transparent information regarding fees and trading conditions to ensure the security of their funds.

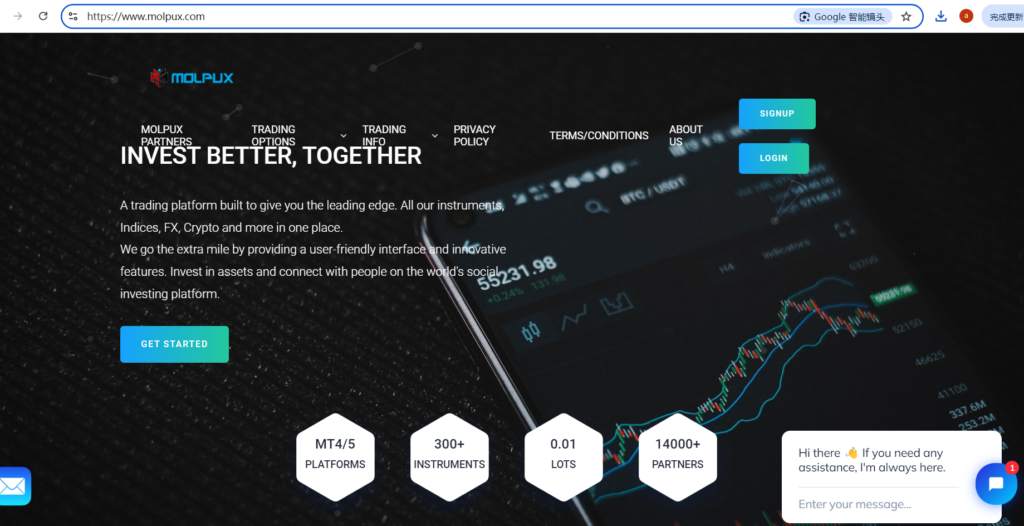

Similar Website Design: Signs of a Clone or Fraudulent Operation

Copying Design Elements: Suspiciously Identical Website Layouts

Our investigation showed that CCFX Market’s website design and content closely resemble those of other brokers, such as Golden Pawn Trades Market, Reflex Options, and 247TRADING TARGETS. The layout, text, and color schemes are nearly identical, suggesting that CCFX Market may be a cloned site.

Clone scams typically involve a single fraudulent entity controlling multiple websites that look distinct but are nearly identical in design and content. These sites imitate independent companies, yet they use the same trading terms, regulatory information, and user interfaces. This tactic creates the illusion of a credible financial institution to entice investors to deposit funds. After securing deposits, these platforms often disappear or shift to a new domain, allowing the fraud to continue.

The “FAQs” section of CCFX Market’s website mentions another name, Epitome Market, indicating connections to other fraudulent sites that use shared content to mislead potential investors.

Limited Payment Methods: High-Risk Cryptocurrency Transactions Only

CCFX Market only allows deposits and withdrawals via cryptocurrency, a practice rarely seen among reputable forex brokers. This approach carries two main risks:

- Difficult to Trace Funds: The anonymity of cryptocurrency transactions makes transferred funds nearly impossible to trace, creating an ideal setup for fraudulent platforms. If investors encounter issues with funds, the likelihood of recovering them is minimal.

- Increased Fraud Risk: Fraudulent platforms often exploit the irreversible nature and decentralized flow of cryptocurrency transactions to obscure fund movements. Legitimate brokers usually offer various deposit and withdrawal options, such as bank transfers, credit cards, and e-wallets, to ensure transparency and traceability of funds. CCFX Market’s restriction to cryptocurrency transactions suggests an attempt to reduce the traceability of investor funds.

Additionally, the limited payment options may restrict investor liquidity, making it difficult for them to retrieve their assets in the event of account or fund issues. This restriction further heightens the risk for investors.

Is CCFX Market Trustworthy?

Overall, while CCFX Market’s website promotes high returns and diverse investment options, its regulatory information, website design, and limited funding methods raise multiple red flags. Investors should exercise extreme caution when considering CCFX Market and carefully verify all details to avoid falling victim to fraud.

Frequently Asked Questions (FAQ)

1. Can CCFX Market’s regulatory information be trusted?

Research shows that CCFX Market copies regulatory information from other brokers and lacks genuine authorization from any regulatory authority.

2. Why doesn’t CCFX Market’s domain registration date align with its claimed operational history?

CCFX Market’s domain was registered in 2024, despite claims of extensive market experience. This discrepancy may indicate false advertising or an attempt to obscure its true history.

3. Are CCFX Market’s high-return investment plans realistic?

The short-term high returns promised by CCFX Market are nearly impossible to achieve in financial markets, suggesting that these plans are merely a tactic to attract deposits with minimal chances of actual payout.

4. Why does CCFX Market’s website resemble other brokers?

The website design of CCFX Market is almost identical to several other platforms, indicating that it may be part of a clone scam network, sharing content to deceive investors.

5. How can investors verify CCFX Market’s regulatory status?

Investors can visit the official websites of regulatory bodies in Seychelles (FSA), Curacao (CBCS), and the British Virgin Islands (FSC) to verify any regulatory claims. Any discrepancies should be viewed as a warning.

6. Why does CCFX Market only accept cryptocurrency transactions?

CCFX Market’s restriction to cryptocurrency transactions may be an attempt to make funds difficult to trace, a common tactic in fraudulent operations. Investors should approach this with caution.