Morgan PRE is a forex broker established in 2024, providing trading services in forex, commodities, stock indices, precious metals, and energy derivatives. It offers leverage as high as 1:1000, which is far beyond the industry standard. However, a closer examination reveals that its regulatory information is misleading. This article provides a detailed analysis of Morgan PRE’s corporate background, regulatory status, account types, and the risks associated with high leverage, helping investors make a more informed decision.

Company Background Analysis

1. Morgan PRE’s Establishment and Background Information

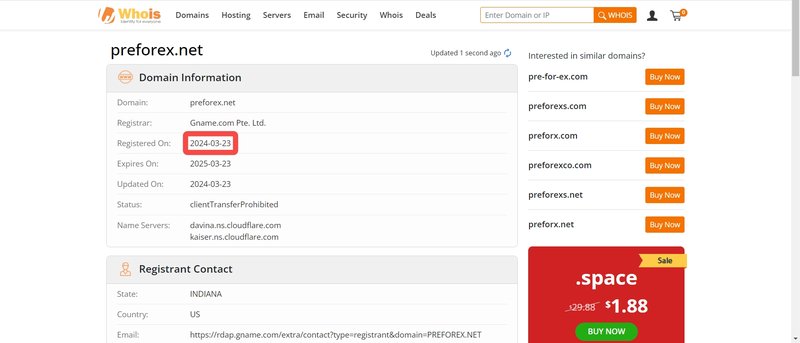

Morgan PRE Limited is a newly established forex broker, founded in 2024 and registered in New York, USA, with the address 1585 Broadway, New York, 10036. This is a prominent commercial area in New York, but for a new company, this address might be used to increase its credibility. The domain for Morgan PRE’s official website was registered as recently as March 23, 2024, showing that it has a very short history as a broker.

2. Lack of MT4 or MT5 Trading Platform Support

Morgan PRE does not support MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are widely used in the industry, and instead uses its own or another unidentified platform. This is unlike most regulated forex brokers, as MT4 and MT5 have become industry standards due to their stability and global acceptance. Choosing a non-standard platform may affect users’ trading experience and trust, as it could also raise concerns about transparency and security.

Short Domain Registration Period: A Warning Sign

1. Short Domain History Raises Red Flags

Morgan PRE’s domain was registered on March 23, 2024, which means the platform has only been active for a short period. For a financial institution, a short domain history often indicates that it has not yet been tested by the market over time, creating uncertainties in terms of technical stability, fund security, and customer service quality.

2. Lack of Long-Term Track Record: Investors Should Be Cautious

Without a track record of long-term operations, it’s unclear if a newly established broker can operate stably in the market and provide reliable services. Investors should be particularly cautious when choosing such platforms to avoid losses due to sudden platform closures or fund issues.

Morgan PRE’s Regulatory Status: Misleading Claims and the Truth

Morgan PRE Limited claims to be regulated by several international financial authorities, including the Investment Industry Regulatory Organization of Canada (IIROC), the National Futures Association (NFA) in the USA, and the Financial Crimes Enforcement Network (FinCEN). However, a thorough investigation shows that these claims are false.

1. Verification of IIROC Regulatory Information

Morgan PRE claims on its website that it is regulated by IIROC. However, upon checking IIROC’s official website, no records of Morgan PRE Limited were found. As IIROC regulates all investment activities in Canada, Morgan PRE’s claim is misleading and misguides investors.

2. False NFA and FinCEN Information

Morgan PRE also claims to be registered with the NFA and FinCEN in the United States and regulated as a Money Services Business (MSB). However, searches in the NFA and FinCEN databases revealed no entities named Morgan PRE Limited. Furthermore, Morgan PRE failed to provide any regulatory license numbers on its website, further confirming that these claims are unsubstantiated.

3. Impact of Misleading Regulatory Information on Investors

A financial company using false regulatory information can mislead investors when assessing its legitimacy. This behavior may cause investors to mistakenly believe that their funds are secure when, in fact, an unregulated platform may leave them with no recourse in case of issues.

Account Types and Leverage Analysis

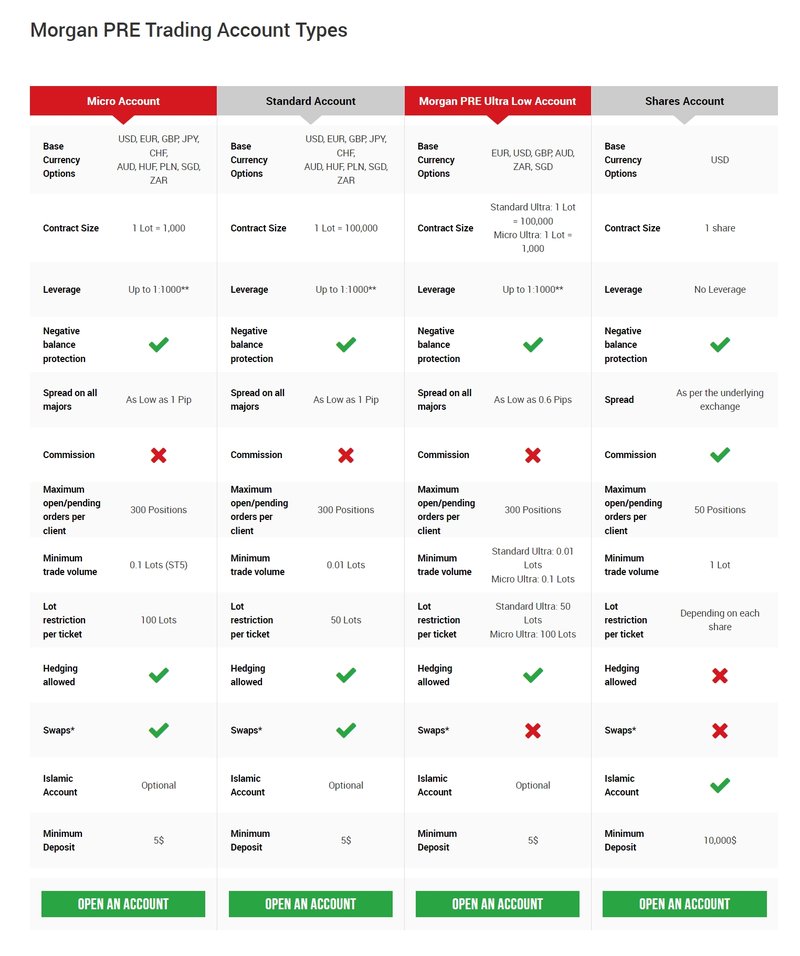

Morgan PRE offers four types of accounts: Micro Account, Standard Account, Morgan PRE Ultra Low Account, and Shares Account. Although these account types appear diverse, they share common risks, particularly with the high leverage and low deposit requirements.

1. Micro Account

The Micro Account offers leverage up to 1:1000, with a minimum deposit of only $5. This type of account may seem suitable for beginners, but such high leverage means that even small market fluctuations could lead to account liquidation, posing significant risks for inexperienced traders.

2. Standard Account

The Standard Account also provides leverage up to 1:1000 with a minimum deposit of $5. While this setup may appeal to experienced traders, high leverage also carries high risk, and even experienced investors could face substantial losses in a volatile market.

3. Morgan PRE Ultra Low Account

This account type offers low spreads with leverage of up to 1:1000, targeting traders seeking low-cost trading conditions. However, despite the low spreads, the high leverage remains a significant risk that should not be underestimated.

4. Shares Account

The Shares Account does not offer leverage but requires a minimum deposit of $10,000 and charges commission fees. This account is suitable for those focusing on stock investments, but such a high deposit requirement makes it less accessible for most investors.

The Risks of 1000x Leverage: Real-World Cases

1. The Dangers of Excessive Leverage

Morgan PRE offers leverage as high as 1:1000, which is significantly higher than the standard leverage range of 1:30 to 1:100 offered by most regulated platforms. Such high leverage means that even a 0.1% fluctuation in the market could result in massive losses or forced liquidation of an account. For novice investors without proper risk management, this is nearly impossible to manage.

2. Real Case: The Swiss Franc Flash Crash

In 2015, the Swiss National Bank removed the Swiss Franc’s cap against the Euro, leading to massive market volatility. Many traders using high leverage, including up to 1:400 and 1:1000, faced severe losses within minutes as their accounts were liquidated. Some traders even ended up owing more than their account balances. This real-world example highlights the severe risks of excessive leverage. Morgan PRE’s leverage settings could lead to similar investor losses in the event of major market movements.

Investing Requires Caution: Compliance and Transparency Are Key

1. Choosing Platforms with Strict Regulation

When choosing a broker, investors should prioritize platforms regulated by reputable financial authorities such as the FCA, ASIC, or CySEC. These organizations have stringent requirements on financial health, client fund protection, and fair trading practices, providing effective safeguards for investors.

2. Reducing Leverage and Managing Risk

While high leverage can amplify profits, it also multiplies risks. Investors should select accounts with lower leverage and implement effective risk management strategies such as setting stop-loss orders and properly allocating their capital to better protect their funds.

Is Morgan PRE Trustworthy?

Overall, Morgan PRE shows multiple issues, especially regarding misleading regulatory claims and high leverage risks. Despite claiming to be regulated by several authorities, the investigation reveals these claims to be false. When choosing a platform, investors should avoid brokers with no regulation or transparency to ensure their funds’ safety. Therefore, it is recommended that investors opt for platforms with clear regulatory backgrounds, a long operational history, and positive user feedback.

FAQ

- Is Morgan PRE really regulated by IIROC and NFA?

No, verification shows that Morgan PRE is not registered with these regulatory bodies. - What are the main differences between the Micro Account and Standard Account?

Both accounts have the same leverage and minimum deposit requirements, but they are designed for traders with different levels of experience. - Is 1:1000 leverage safe?

Such high leverage is extremely risky, especially for novice traders, as even minor market fluctuations can cause liquidation. - Is Morgan PRE safe for deposits and withdrawals?

Without legitimate regulation, the safety of funds is highly questionable. - Does the lack of MT4/MT5 support affect trading?

Yes, the lack of MT4/MT5 support may impact user trust and trading experience, as these platforms are industry standards. - Are there better, more regulated alternatives?

It is advisable to choose brokers regulated by major financial authorities with positive user reviews and a long operational history.