In the competitive world of financial trading, the number of brokers offering services has risen, as has the number of non-compliant platforms using misleading claims to attract investors. Apexnumber claims to offer forex, commodities, stocks, futures, and other trading services to investors. However, a close examination of its registration and regulatory claims reveals multiple discrepancies. This article will provide an in-depth analysis of Apexnumber’s background, domain information, false registration and regulatory claims, and potential investment risks to help investors assess its credibility.

I. Platform Background: Apexnumber’s Basic Information

Apexnumber is a forex broker registered on September 2, 2023, claiming to offer users trading on mainstream platforms like MT4, MT5, and cTrader. It promotes a wide variety of financial products, including forex, commodities, indices, bonds, cryptocurrencies, stocks, and futures. The platform also claims not to serve customers in countries like the United States, Canada, Israel, New Zealand, Japan, and Iran, aiming to portray a globally compliant image.

1.1 Use of Multiple Mainstream Trading Platforms

Apexnumber offers well-known trading platforms, including MT4, MT5, and cTrader, which are respected in the trading world for their technical analysis tools, automation support, and broad user base. The platform offers a variety of product combinations and trading tools, promising professional technical support and high liquidity. However, despite its seemingly strong technological offerings, the company’s corporate background and regulatory compliance raise doubts about its legitimacy.

1.2 Three Account Types with Investment Thresholds

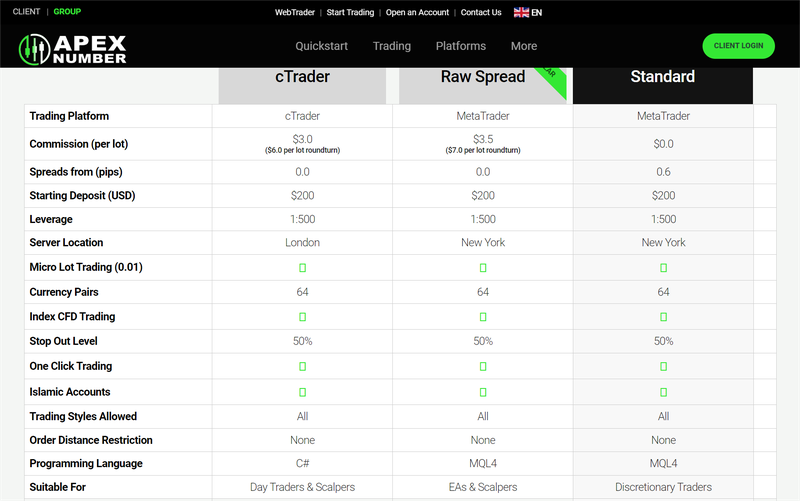

Apexnumber provides three account types: the cTrader Account, Raw Spread Account, and Standard Account, each with varying spreads and commission structures to meet different investor needs.

- cTrader Account: Zero spreads, minimum deposit of $200, and leverage up to 1:500.

- Raw Spread Account: Also zero spreads with a low commission, minimum deposit of $200, and leverage up to 1:500.

- Standard Account: No commission, with spreads starting from 0.6 points, and a minimum deposit of $200.

While these account features appear attractive, it’s essential for investors to understand that appealing account conditions cannot compensate for significant compliance issues in the company’s registration and regulatory status.

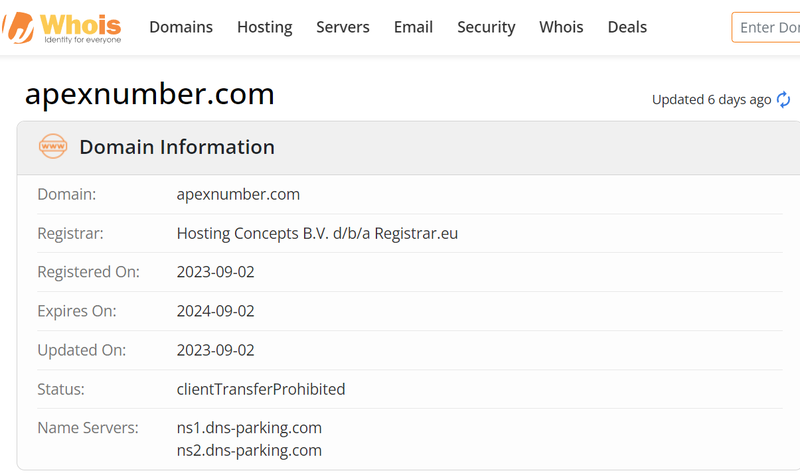

II. Domain Information: The Risks of Short-Term Registration

Apexnumber’s website domain registered on September 2, 2023, indicating that it is a relatively new trading platform. Domain registration information is a vital tool for investors to assess a platform’s history, and short-term registration often signals that the platform hasn’t stood the test of time.

2.1 Risks of Short-Term Domain Registration

Short-term registered domains often signal high-risk platforms and potential financial fraud. Apexnumber, registered only a few months ago, lacks a proven track record and has not demonstrated operational stability in the market. Investors should be cautious about new platforms that lack historical performance and market feedback, as these factors can pose considerable financial risks.

2.2 Lack of Domain Registration Transparency

Legitimate financial platforms typically disclose detailed domain information on their websites, such as the registered entity or domain holder. However, Apexnumber has not shared any such information on its website. This lack of transparency further exacerbates investors’ concerns. Given its short domain registration period and opaque domain information, the platform’s reliability warrants scrutiny.

Apexnumber’s short domain registration period and lack of transparency raise doubts about its operational stability and financial security.

III. False Registered Entities: Fictitious Legal Identity

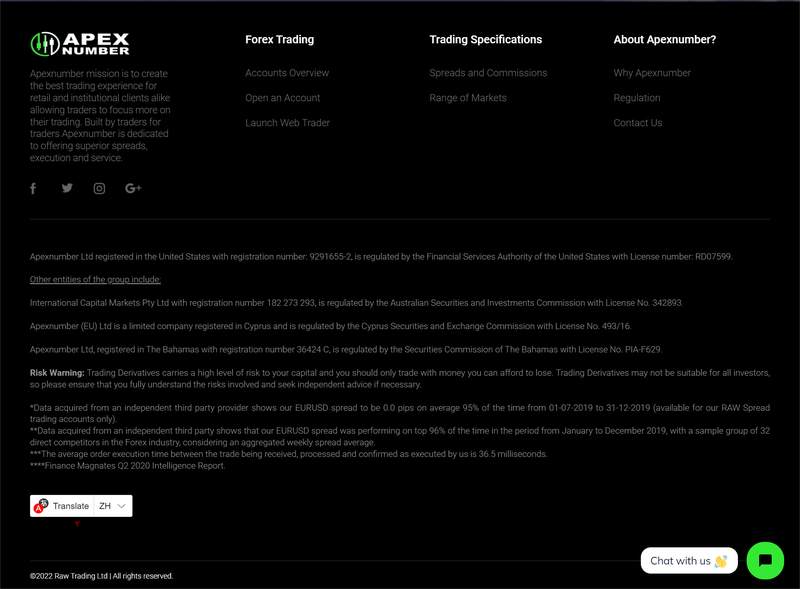

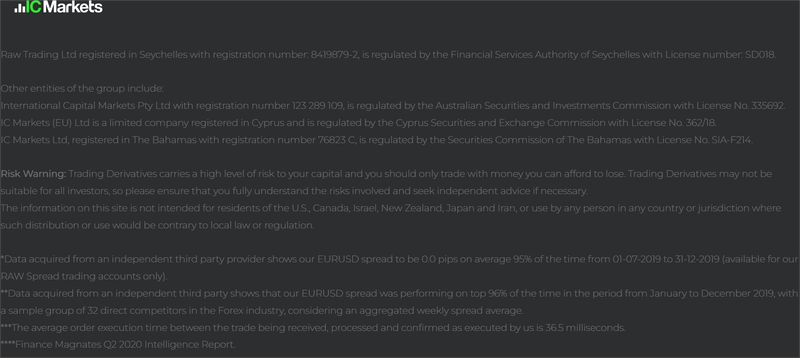

Legitimate financial platforms generally disclose their registered corporate information on their websites to demonstrate lawful and compliant operations. However, investigations reveal that Apexnumber’s registration information is largely falsified, with claims of registration in various countries under names that belong to other entities.

3.1 Fabricated U.S. Registration Information

Apexnumber claims to operate a U.S.-registered entity, “Apexnumber Ltd,” under business registration number 9291655-2 and asserts regulation by the “Financial Services Authority of the United States.” However, investigation reveals no such regulatory body exists in the U.S., exposing this as a fabricated claim. This lack of legitimate U.S. registration means Apexnumber avoids oversight by any recognized regulatory authority in the country.

3.2 False Australia and Cyprus Registration Information

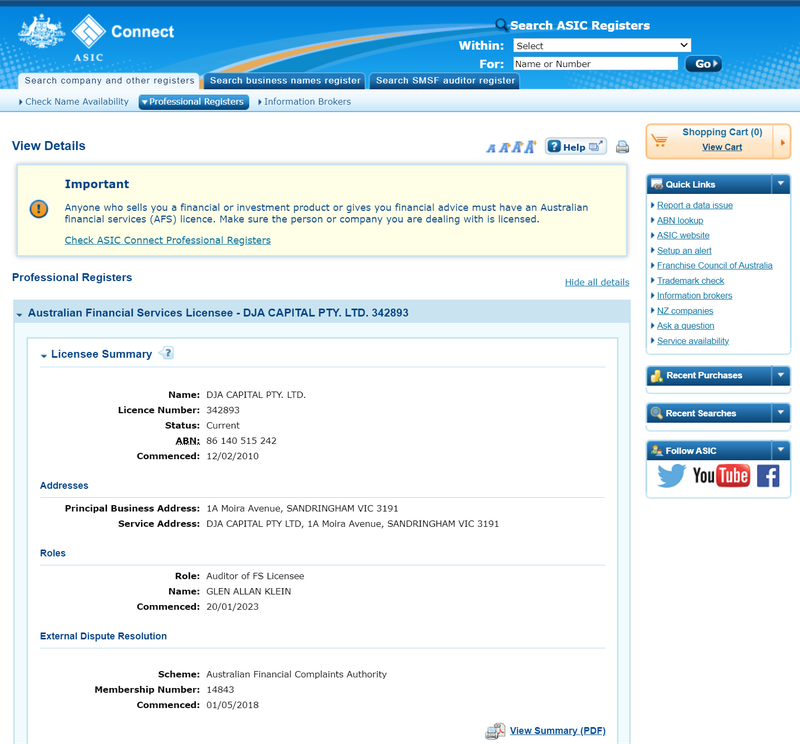

Apexnumber claims that its Australian entity, “International Capital Markets Pty Ltd,” holds regulation from the Australian Securities and Investments Commission (ASIC). However, a review of ASIC’s official records shows that registration number 342893 belongs to DJA CAPITAL PTY. LTD., a private company providing financial consulting services, not Apexnumber.

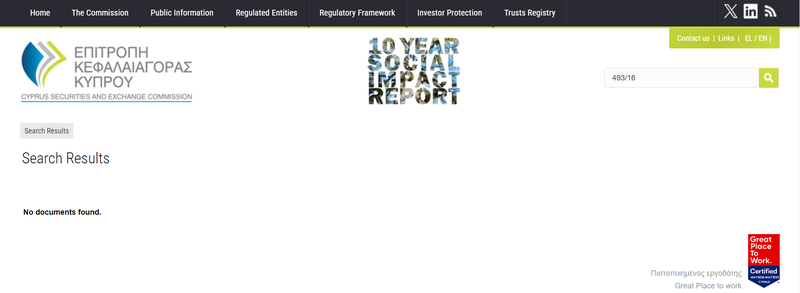

In Cyprus, Apexnumber also claims regulation by the Cyprus Securities and Exchange Commission (CySEC) with license number 493/16. However, CySEC’s public database contains no such license number associated with any entity. These false registration details further highlight Apexnumber’s efforts to deceive investors by fabricating or misappropriating other companies’ credentials.

Apexnumber’s registered information is falsified and misappropriates the legitimate registration information of other companies, severely undermining its credibility.

IV. Fabricated Regulatory Claims: Invalid Investor Protection

A financial platform’s legitimacy relies on its regulation by reputable authorities. Apexnumber claims regulation from multiple well-known bodies, including those in the United States, Australia, Cyprus, and the Bahamas. However, detailed investigations reveal these claims as fabricated or based on stolen registration numbers.

4.1 Nonexistent U.S. Regulatory Body

Apexnumber claims regulation by the “Financial Services Authority of the United States,” an organization that does not exist. The major U.S. financial regulatory bodies are the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). Apexnumber has not provided any legitimate proof of regulation by these authoritative agencies.

4.2 False Global Regulatory Claims

Apexnumber claims registration in the Bahamas and regulation by the Securities Commission of the Bahamas (SCB). However, a check with the SCB’s public database reveals that license number PIA-F629 does not exist, and the Bahamas’ financial licensing categories do not include a “PIA” designation. These fabricated regulatory claims reveal that Apexnumber is not subject to any real regulatory oversight, leaving investors’ funds unprotected by any legal guarantees.

Apexnumber’s regulatory claims are entirely fictitious and lack verification by any reputable agency, posing significant risks to investor funds.

V. Various Investment Concerns: Lack of Transparency in Trading Terms

Aside from false registration and regulatory claims, Apexnumber’s investment information and trading conditions also raise several concerns, underscoring the need for investor caution when dealing with this platform.

5.1 Hidden Risks in Account Structure and Fees

While the three account types offered by Apexnumber appear attractive on the surface, particularly with promises of zero spreads and low commissions, the platform does not provide a transparent breakdown of potential hidden fees on its website. Without clear fee structures and detailed cost disclosures, investors could encounter unexpected costs during trading that could reduce their potential profits.

5.2 Risks of High Leverage

Apexnumber offers high leverage of up to 1:500 across all account types. Although high leverage can amplify returns, it also significantly increases risk, especially in volatile markets, where investors may quickly incur significant losses. Legitimate financial platforms typically restrict leverage to protect investors from excessive loss, whereas Apexnumber’s high leverage settings suggest that it may not prioritize investor safety.

5.3 Lack of Detailed Trading Information

Apexnumber does not provide specific trading details, such as minimum and maximum trading volumes or maximum position limits. This information is essential for investors to manage risk effectively. A lack of trading details means investors may face unexpected restrictions or rule changes during transactions, impacting the execution of their trading strategies.

While Apexnumber’s account structure and trading conditions may seem appealing, its lack of transparency, hidden fees, and high-leverage risk undermine investors’ financial security.

VI. Conclusion: Apexnumber Investment Risks Exposed

Through a detailed analysis of Apexnumber’s platform background, domain registration, false registration information, regulatory gaps, and investment concerns, it is clear that Apexnumber is a high-risk financial platform with fabricated registration and regulatory claims. Investors’ funds are not guaranteed or safeguarded by any regulatory oversight.

Investors should avoid platforms like Apexnumber that lack long-term market validation and make false claims. When selecting a financial trading platform, investors should prioritize those regulated by reputable financial authorities and that provide transparent investment information to ensure the security of funds and transaction transparency.

Frequently Asked Questions (FAQ)

1. Is Apexnumber regulated?

Apexnumber claims to be regulated by several regulatory bodies, but investigation shows these claims are false. The platform is not regulated by any reputable authority.

2. When was Apexnumber’s domain registered?

Apexnumber’s domain was registered on September 2, 2023, meaning it has a very short operating history and has yet to be proven in the market.

3. What trading products does the platform offer?

Apexnumber offers forex, commodities, indices, stocks, futures, and other financial products, but the platform’s specific trading details and terms are unclear.

4. Is the platform’s registration information legitimate?

Apexnumber’s registration information is falsified, misappropriating the legal registrations of multiple companies and fabricating regulatory and license numbers.

5. How should investors choose a legitimate financial platform?

Investors should check a platform’s legitimate registration and regulatory status, ensuring it is supervised by reputable financial authorities such as the FCA, CFTC, or CySEC to protect their funds.

6. How secure are funds with Apexnumber?

Apexnumber lacks any regulation and uses false registration information, meaning investors’ funds are not safeguarded, posing significant risk.