ONEWAVE X Market presents significant scam risks due to fake registration information, opaque operations, and a lack of regulation. Investors should remain highly cautious when dealing with this platform.

In today’s online financial trading market, many investment platforms attract investors by promising high returns and innovation. As interest in forex trading, contracts for difference (CFD), cryptocurrencies, and other markets grows, some fraudulent actors are exploiting this opportunity by creating fake platforms to scam investors. ONEWAVE X Market is one such platform. While its website claims to offer a wide range of trading products and renowned trading software, the platform’s background, registration information, regulatory status, and transparency raise serious concerns. This article provides an in-depth analysis to help investors understand the potential risks of ONEWAVE X Market, enabling them to make informed decisions.

1. Overview of the Company: The True Nature of ONEWAVE X Market

ONEWAVE X Market is a newly established online trading platform claiming to offer trading in forex, CFDs, and cryptocurrencies. According to its official website (https://www.onewavex.org/), the platform claims its headquarters are in the UK, with an operational address in London, and that it is regulated locally. However, after thorough investigation, ONEWAVE X Market’s background information is highly questionable.

1.1 Suspicious Company Registration

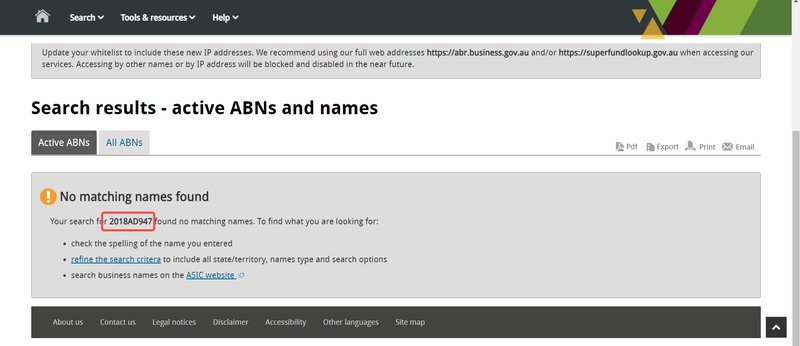

Firstly, ONEWAVE X Market lists a seemingly legitimate company registration number “ABN: 2018AD947” on its website. However, upon verification through official channels, no legal business record associated with this number could be found. This is often a sign that the platform may be using falsified registration details to cover up its illegal operations. Additionally, the platform claims to be registered in the UK. However, searches of the UK company registration database reveal no records of any company related to ONEWAVE X Market. This is a common practice among fraudulent platforms, which often fabricate trustworthy company backgrounds to gain investors’ trust.

1.2 Short Operating History Lacks Credibility

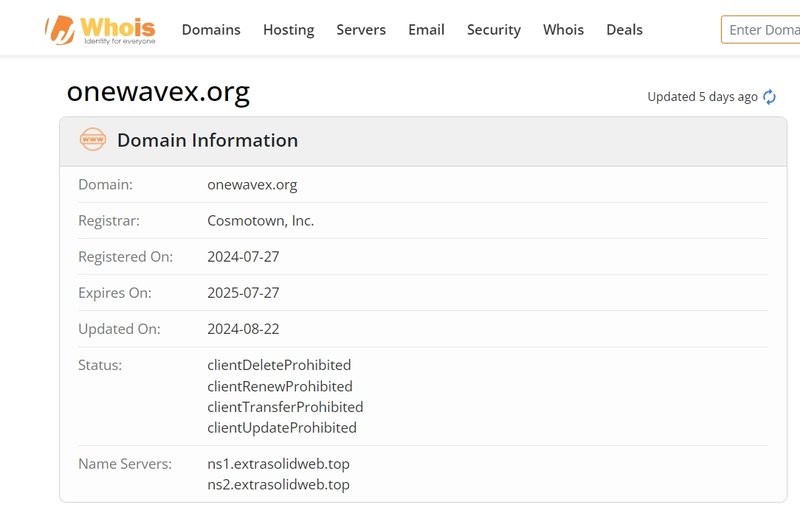

The domain for ONEWAVE X Market was registered on July 27, 2024, indicating a very short operating history. In contrast, many legitimate financial platforms have been in operation for years or even decades, showcasing stable customer service and secure funds management. Newly established financial platforms, especially those lacking regulatory oversight and legitimate registration, often carry higher risks. These platforms may attract substantial funds quickly and then shut down, leaving investors unable to recover their money. ONEWAVE X Market’s severe lack of transparency and false registration details cast serious doubt on its legitimacy. Any trading platform that provides false registration information should be considered highly dangerous.

2. Domain Information and Risks: Analyzing the Platform’s Short Lifespan and Operational Background

Domain information can provide valuable clues about a company’s operational timeline and legitimacy. Legitimate financial platforms typically have longer domain registration histories, indicating stability and reputation in the market. However, scam platforms often have short registration periods, a red flag investors should heed.

2.1 Short Domain Registration Time

According to Whois data, the ONEWAVE X Market domain was registered on July 27, 2024. This means the platform has been operational for less than a year. Newly registered domains often signal short-term operations and instability compared to established financial trading platforms with years of history and market presence. Scam platforms typically attract large amounts of investor funds in a short period before quickly shutting down, making it difficult for investors to trace their lost funds. ONEWAVE X Market’s short-term registration further increases the likelihood that it is a short-lived financial scam. Investors should be particularly cautious of new trading platforms, as they are often “fly-by-night” operations designed to steal unsuspecting investors’ money.

2.2 Lack of Verified Registration Information

Along with its short domain registration time, ONEWAVE X Market claims UK registration, but searches of relevant databases show no record of the company. The UK enforces strict regulations for financial markets, and legally registered companies appear in the Financial Conduct Authority (FCA) or Companies House records. ONEWAVE X Market’s inability to provide verifiable registration details further exposes its illegal nature. Fraudulent platforms often claim international registrations to create the illusion of global legitimacy. In reality, these platforms usually have no legal presence in the jurisdictions they claim to operate in, or they register in offshore countries with lax financial oversight to avoid regulation and accountability. The short domain registration and lack of registration information suggest that ONEWAVE X Market is not a legitimate financial service provider. Investors should avoid placing their funds in such opaque, newly established platforms.

3. Lack of Effective Regulation: The Major Risks of Unregulated Platforms

Financial regulation is essential for safeguarding investors’ rights. Without the supervision of an authoritative regulatory body, investors’ funds are not protected. Financial regulators ensure platforms operate legally, protect investors’ funds, and investigate any potential illegal activities. Choosing a regulated platform is one of the most critical steps investors can take to protect their assets.

3.1 False Regulatory Claims

ONEWAVE X Market claims UK regulation but fails to provide any concrete certificates or qualifications. Further investigation shows the platform is not listed with the UK’s Financial Conduct Authority (FCA). Scam platforms often use false regulatory claims to gain investor trust by falsely linking themselves to reputable regulators. Legitimate forex or CFD trading platforms typically have licenses from regulatory bodies, which supervise the platform’s operations. Prominent regulatory bodies include the FCA (UK), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). ONEWAVE X Market’s failure to provide proof of regulation seriously undermines its credibility.

3.2 Risks of Unregulated Platforms

Unregulated platforms are free to operate without legal oversight, meaning they can act without constraints. If issues arise, such as delayed withdrawals, refusal to process withdrawals, account freezes, or misappropriation of funds, investors will find it extremely difficult to recover their losses through legal means. Unregulated platforms may also manipulate trading data or market prices to increase investor losses. In highly volatile markets like forex and CFDs, where funds move quickly and transactions are complex, the lack of regulatory oversight makes it easier for platforms to close down suddenly with investor funds. Statistics show that most financial fraud cases occur on unregulated platforms. Since ONEWAVE X Market is not regulated by any reputable authority, investors’ funds are at high risk. Once funds are deposited into the platform, there is a significant risk of financial loss.

4. Lack of Transparency in Spreads, Leverage, and Commissions: Potential High-Cost Traps

The transparency of trading fees is a key factor in determining whether a financial platform is trustworthy. Forex and CFD platforms typically charge spreads and commissions based on the types of trades and accounts, and they offer various leverage options. However, ONEWAVE X Market does not disclose these critical details, making the actual trading costs highly opaque.

4.1 Unclear Spreads and Commissions

ONEWAVE X Market does not clearly outline its trading spreads or commission structures on its website. Spreads are an important cost for investors when making trades, while commissions are fixed fees charged by the platform. Legitimate trading platforms usually provide this information transparently for investors to review. However, ONEWAVE X Market’s lack of such information suggests the platform may impose hidden fees, increasing investors’ trading costs. Without clear fee structures, investors may find the actual trading costs to be much higher than expected, not only eating into profits but also leading to significant losses. Additionally, hidden fees may appear in other forms, such as widening spreads or increasing slippage, which can drastically affect trade outcomes.

4.2 Risk of High Leverage

ONEWAVE X Market also fails to disclose its leverage ratios. Leverage is a double-edged sword in forex and CFD trading, as it can magnify gains but also amplify losses. Legitimate financial platforms typically limit leverage according to regulatory guidelines. For example, the European Securities and Markets Authority (ESMA) caps leverage at 1:30 to prevent retail investors from suffering massive losses during market fluctuations. If ONEWAVE X Market offers excessively high leverage, such as 1:1000 or more, it significantly increases the risk for investors. On an unregulated platform, high leverage can lead to rapid liquidation of positions during small market movements, causing investors to lose their entire funds. The lack of transparency in ONEWAVE X Market’s trading costs, combined with potentially high leverage, further increases the risk of financial loss for investors. Trading without clear information on spreads, commissions, and leverage can lead to severe financial losses.

5. Classic Characteristics of Financial Scams: How to Identify Potential Frauds

ONEWAVE X Market exhibits many classic signs of a fraudulent financial platform. Investors can identify potential scams by paying attention to the following warning signals.

5.1 Fake Registration and Opaque Company Background

Fraudulent platforms often use fake registration information to disguise their illegal operations. By providing false company registration numbers and unrealistic business backgrounds, these platforms attempt to appear legitimate to gain investors’ trust. ONEWAVE X Market’s registration number “ABN: 2018AD947” is a typical example of falsified registration, as verification shows that this number does not exist, indicating that the platform is not operating legally.

5.2 Unregulated Platforms with High Risk

Scam platforms are often unregulated by any authoritative bodies because they do not want to undergo strict legal and financial scrutiny. Without regulation, if a platform steals investor funds, there is almost no legal recourse for investors to recover their losses. ONEWAVE X Market’s unregulated status highlights its high-risk nature.

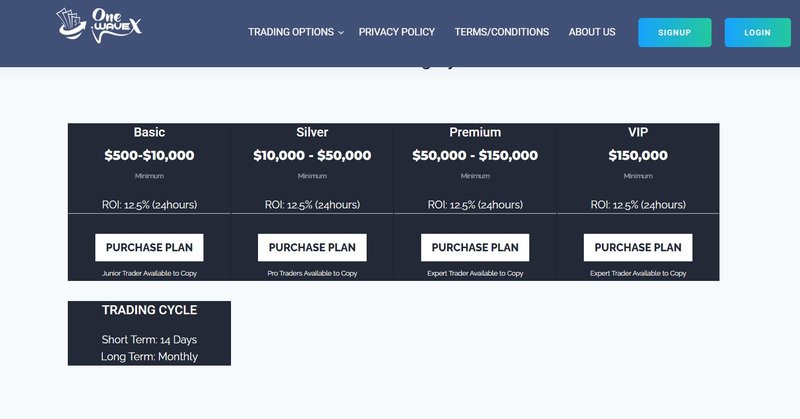

5.3 Attractive High Leverage and Enticing Offers

Scam platforms frequently attract investors with extremely favorable trading conditions, such as high leverage and low entry thresholds. While high leverage can increase profits, it also magnifies the risk of loss during market fluctuations. For inexperienced investors, these tempting offers often lead to significant losses.

5.4 Short Domain Registration Period

Fraudulent platforms typically operate with short-term domain registrations, collecting funds quickly before disappearing. ONEWAVE X Market’s domain has only been registered for a few months, which is characteristic of “fly-by-night” scams. These short-term platforms usually shut down after scamming investors, making fund recovery nearly impossible.

ONEWAVE X Market displays multiple characteristics of fraudulent platforms, including fake registration, lack of regulation, high leverage, and a short domain registration period. Investors should remain highly vigilant and avoid falling into such financial traps.

6. Conclusion: Stay Away from ONEWAVE X Market and Choose Regulated Platforms

Based on a detailed analysis, it is evident that ONEWAVE X Market presents serious risk factors, including false registration information, lack of regulation, and opaque trading conditions. These characteristics indicate that the platform is likely a carefully designed financial scam aimed at stealing investors’ funds. Investors should exercise extreme caution when dealing with unregulated and non-transparent financial platforms. When choosing a financial trading platform, investors must prioritize regulation and transparency. Platforms regulated by reputable financial authorities (such as FCA, ASIC, CySEC) can provide the necessary protection and legal recourse to safeguard investors’ funds. The numerous red flags surrounding ONEWAVE X Market indicate the platform is untrustworthy, so investors should avoid it to prevent financial losses.

Frequently Asked Questions (FAQ)

- Is ONEWAVE X Market regulated? No, ONEWAVE X Market is not regulated by any reputable financial authority, and its claimed regulatory information cannot be verified.

- When was ONEWAVE X Market’s domain registered? The domain for ONEWAVE X Market was registered on July 27, 2024, indicating a very short operational history.

- What account types does ONEWAVE X Market offer? ONEWAVE X Market does not provide clear information on its account types or trading conditions, making it difficult for investors to assess actual trading costs.

- Are spreads and commissions transparent? The platform does not disclose detailed information about spreads or commissions, raising concerns about hidden fees and lack of cost transparency.

- Is the leverage offered by ONEWAVE X Market safe? The platform does not specify its leverage ratio, but high leverage can significantly increase risks, especially on an unregulated platform.

- How can I choose a safe trading platform? Investors should select platforms regulated by internationally recognized financial authorities (such as FCA, ASIC, CySEC) to ensure fund safety and transparency in trading practices.