This article provides an in-depth analysis of FxCape’s company background, domain registration time, regulatory information, account types, spreads, leverage, and other trading conditions, helping investors evaluate the platform’s legitimacy and potential risks.

1. Overview of the Company Background

1.1 Basic Information About FxCape

FxCape is a forex brokerage platform with an official website located at https://fx-cape.com. It was established on January 10, 2024, and claims to be headquartered in London, United Kingdom, at Tower 42, The City of London, EC2N 1HQ, UNITED KINGDOM. The platform offers a wide range of trading products, including forex, contracts for difference (CFDs), and other financial instruments.

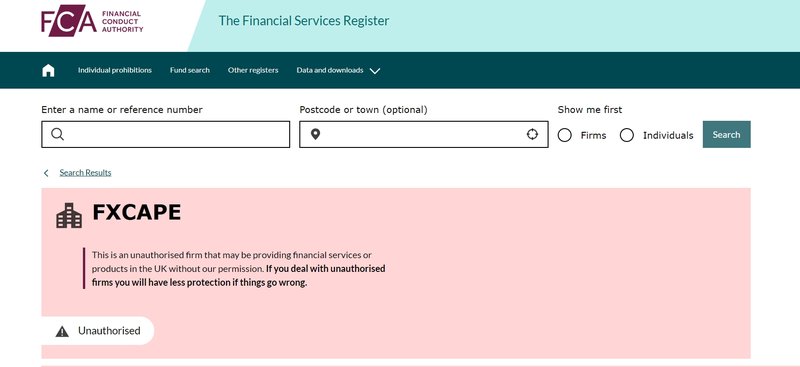

Although FxCape claims to operate in the UK, an in-depth search revealed no evidence that the company is registered with the UK’s Financial Conduct Authority (FCA). This indicates that FxCape is not regulated by the UK or any other internationally recognized financial regulatory body. For a broker offering high leverage and complex financial products, the lack of effective regulation is a significant risk factor.

1.2 Questions About Transparency and Credibility

FxCape’s background and registration details are vague, and the platform lacks operational transparency. Typically, legitimate financial companies publicly disclose their registration information and are subject to the strict supervision of local financial regulators. FxCape has failed to provide any proof of its registration or regulation, making it difficult for investors to trust the platform’s legitimacy. Transparent operational information and regulatory licenses are key indicators of a platform’s safety, and FxCape’s shortcomings in these areas increase the risk.

2. Very Short Domain Registration Time

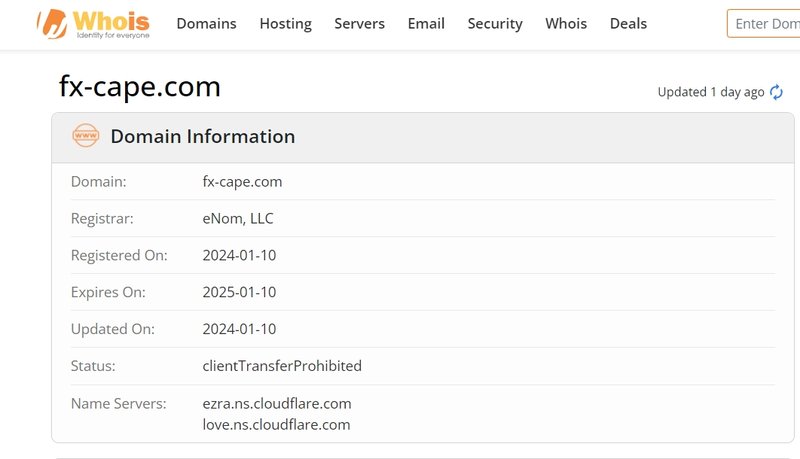

2.1 Domain Registration Date of FxCape

According to Whois data, FxCape’s domain was registered on January 10, 2024, meaning it has been in operation for only a few months. Compared to long-standing and widely trusted brokers in the market, FxCape’s short existence raises concerns about its stability and reliability. In the financial market, a shorter operational history often indicates that the platform has not yet been tested by the market and lacks sufficient user feedback and trust.

2.2 Potential Risks of New Platforms

Newly established financial platforms, especially those lacking clear regulation, are often prone to operational instability or fraud. FxCape’s short-term existence heightens these concerns. Investors should exercise caution when choosing newer and unregulated platforms, as these platforms may shut down suddenly after attracting investor funds, resulting in significant financial losses.

Many fraudulent platforms lure investors with high leverage and attractive trading conditions, only to disappear after collecting a large amount of funds early in their operations. FxCape’s short operating history, lack of regulation, and opacity make it a high-risk investment option.

3. Non-transparent Registration and Regulatory Information

3.1 False Regulatory Claims by FxCape

FxCape claims to operate in London, UK, but an investigation into the FCA’s records reveals no registration information for the company. Legitimate forex and CFD brokers are typically registered in the countries where they operate and are regulated by financial authorities. This ensures both the platform’s legitimacy and the safety of investors’ funds.

FxCape’s failure to provide proof of regulation suggests that it may not be subject to supervision by any financial regulatory body. Unregulated financial platforms are often less transparent and may engage in unethical behavior such as misappropriation of funds, market manipulation, or other illegal activities, leaving investors’ funds unprotected.

3.2 Risks of Unregulated Platforms

Financial regulators are responsible for overseeing brokers’ fund management, market conduct, and customer protection. FxCape, as an unregulated platform, means it is not subject to independent scrutiny, and its fund management is opaque. Unregulated platforms are more likely to be involved in fraudulent activities, especially when offering high-leverage trading, which significantly increases the risk of investor losses. The absence of regulation also means that investors cannot rely on legal recourse to protect their funds in case of problems.

When selecting a trading platform, investors should prioritize those regulated by globally recognized financial authorities such as the FCA, CySEC, or ASIC, as this ensures the protection of both their funds and their rights.

4. Tempting but Risky Account Information

4.1 Variety of Account Types

FxCape offers several account types to attract different levels of investors, including Basic, Pro, Gold, Platinum, Diamond, and VIP accounts. Each account type offers different trading conditions, but all share the same high leverage, with a maximum of 1:500.

- Basic Account: Spread starts from 1.9 pips, with 1:500 leverage, aimed at beginners, but the relatively high spread increases trading costs.

- Pro Account: Offers lower spreads while maintaining high leverage of 1:500, suitable for more experienced traders.

- Gold Account: Provides up to 25% trading bonuses and lower spreads, but the bonus policy often comes with strict withdrawal conditions.

- Platinum Account: Extremely low spreads, fewer commissions, and a 50% trading bonus, but high leverage remains a concern.

- Diamond Account: Offers zero spreads and a 75% high trading bonus, targeting high-net-worth investors, though the high bonus may come with stringent conditions.

- VIP Account: Specific trading conditions are not disclosed, but this account is usually tailored for high-net-worth clients, offering customized services.

4.2 Risks of High-Bonus Accounts

FxCape’s account offerings include several that feature high trading bonuses, which may seem enticing. However, in practice, investors often need to meet specific trading volumes or conditions to withdraw the bonus or profits. This opaque bonus policy may be a tactic to attract funds, especially in an unregulated environment, where the risk of losing funds is much greater.

On unregulated platforms, high-bonus accounts often come with difficulties in withdrawal, hidden fees, or other unfavorable terms. Investors should be highly cautious when considering such accounts and read the bonus policy thoroughly.

5. Doubts About Spreads and Leverage

5.1 Hidden Risks Behind Non-transparent Spreads

FxCape offers spreads starting from 1.9 pips, with the Diamond account claiming to provide zero spreads. On the surface, these trading conditions seem attractive to investors, but on unregulated platforms, the accuracy and transparency of these spreads cannot be guaranteed.

During periods of market volatility, the platform may manipulate spreads, causing investors to pay much higher trading costs than the platform claims. Furthermore, zero spreads are often accompanied by hidden fees, such as high commissions or increased trading costs. These additional fees may not be obvious during trading but can significantly impact investors’ profits.

5.2 Risks of High Leverage

FxCape offers leverage as high as 1:500 across all account types. While high leverage can amplify profits, it also significantly increases the risk of losses. High leverage is particularly suitable for experienced traders, but for novice investors, excessive leverage means that their funds can be depleted quickly during market fluctuations.

Most global regulators (such as ESMA and ASIC) cap leverage for retail clients at 1:30 or 1:50 to prevent excessive risk. FxCape’s high leverage ratio not only exceeds international regulatory standards but also poses a risk of margin calls or large losses during periods of extreme market volatility.

6.

FxCape, as an unregulated forex broker, offers various account types and seemingly attractive trading conditions. However, its brief operating history, lack of transparent regulatory information, high leverage, and opaque trading conditions make the platform risky. Both novice and experienced investors should exercise caution when considering this platform.

Unregulated financial platforms often pose significant risks regarding fund safety and trading fairness. FxCape’s short operating history and high-risk trading conditions could put investors’ funds in serious jeopardy. To ensure the safety of their capital, investors should opt for platforms regulated by internationally recognized authorities.

FAQ

- Is FxCape regulated?

No, FxCape is not regulated by any financial regulatory authority. Despite claiming to operate in London, it does not hold an FCA license. - What is FxCape’s leverage?

FxCape offers high leverage of up to 1:500 for all account types, far exceeding the limits set by most international regulators, increasing trading risks. - Are FxCape’s spreads transparent?

FxCape claims to offer spreads starting from 1.9 pips and zero spreads in some accounts. However, on an unregulated platform, spreads may fluctuate significantly, and hidden fees could increase actual trading costs. - What account types does FxCape offer?

FxCape offers Basic, Pro, Gold, Platinum, Diamond, and VIP accounts, each with different spreads, leverage, and bonus policies, but the transparency of these conditions is questionable. - Is FxCape’s bonus policy reliable?

FxCape offers bonuses of up to 75%, but such bonuses often come with strict withdrawal conditions. On an unregulated platform, the bonus policy may be opaque, so investors should proceed with caution. - How do I choose a safe forex trading platform?

Choose platforms regulated by internationally recognized financial authorities such as the FCA, CySEC, or ASIC to ensure fund security and transparent trading conditions, and avoid unregulated platforms like FxCape.