This article provides an in-depth analysis of the background, registration, and regulatory status of the forex broker Londonex, as well as the potential risks associated with high leverage and zero-commission trading models. It aims to help investors understand the platform’s safety and investment risks.

I. Background Information on the Londonex Platform

Londonex is a forex broker established on May 4, 2023, headquartered in Saint Lucia. It offers global investors a wide range of financial trading services, including forex, stocks, commodities, indices, and cryptocurrencies. The platform provides a diverse array of financial products, covering both traditional and emerging markets, which attracts a wide range of investors. However, Londonex does not offer services to countries and regions where it may violate local laws or regulations, including the U.S., Canada, Japan, North Korea, Iran, and Iraq.

Despite its recent establishment, Londonex’s high leverage and zero-commission trading options have caught the attention of many investors. However, given its short operational history, the lack of transparency in its registration information, and the potential risks posed by high leverage, investors should exercise caution when choosing this platform.

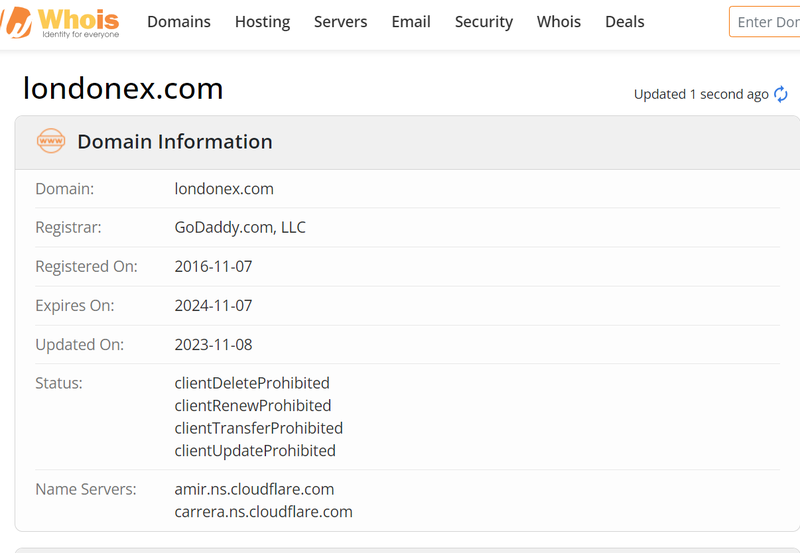

II. Domain Information

Whois data reveals that the Londonex website domain registered on November 7, 2016, likely served other purposes or underwent several ownership changes before its current role as the Londonex platform. It is important to note that, despite the long domain history, Londonex itself only officially registered and started operations in 2023. Therefore, the platform has less than a year of operation in the forex market. For any emerging platform, investors tend to focus on its stability, market performance, and user reviews, but with Londonex’s short history, it lacks sufficient data and feedback, making it difficult for investors to assess its reliability.

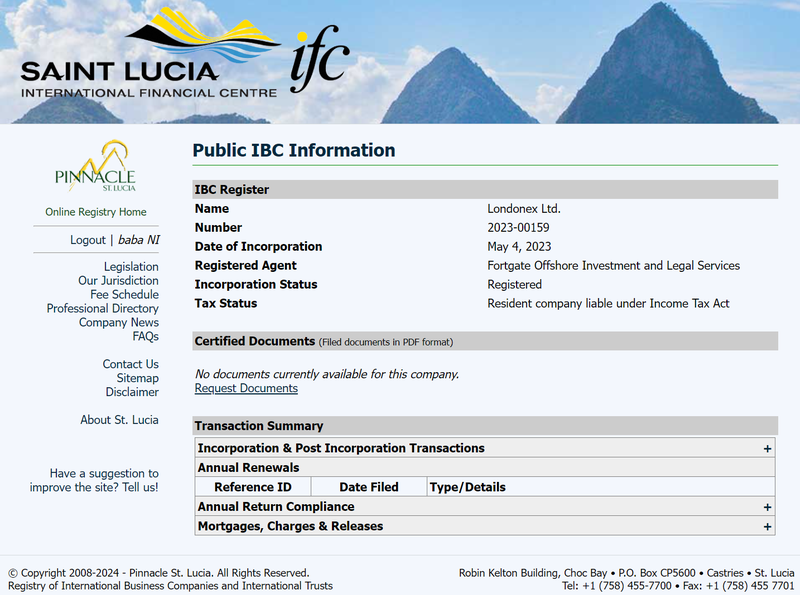

III. Registration Information and Regulatory Status

Londonex lists its registration information on its website, stating that Londonex Ltd runs the platform and registers it in Rodney Village, Saint Lucia. The company, with registration number 2023-00159, appears in the Saint Lucia International Business Companies and Trust Registry (IFC). However, further checks show no regulatory oversight by the Financial Services Regulatory Authority (FSRA) of Saint Lucia. Additionally, Londonex Ltd does not appear in the databases of other well-known international financial regulatory agencies, such as the UK’s FCA or Australia’s ASIC.

This lack of regulatory oversight raises concerns about the compliance of the Londonex platform. Although the company registers with the IFC, the absence of certification from globally recognized financial regulators raises questions about the platform’s transparency and legitimacy. For investors, choosing a platform that is not subject to strict regulation often carries higher risks to the security of their funds.

IV. The Significant Risks of High Leverage

Londonex offers leverage as high as 1:1000, far exceeding the leverage limits imposed in most regulated markets globally. High leverage can indeed provide traders with greater profit potential, but the associated risks cannot be ignored.

Leverage acts as a “double-edged sword”—while it can amplify profits, it also magnifies losses. Especially during times of high market volatility, high leverage can quickly result in large losses, even leading to margin calls or account liquidation. According to research from London financial markets, high leverage is one of the primary reasons individual investors frequently incur losses in forex trading. Investors choosing to trade with high leverage must have a deep understanding of the market and strict risk control strategies; otherwise, they could suffer irreparable losses in the face of market fluctuations.

V. Normal Leverage Limits in Financial Markets

In most strictly regulated markets worldwide, financial regulators impose leverage limits to protect investors. For instance, in Europe, the European Securities and Markets Authority (ESMA) sets a maximum leverage of 1:30 for retail forex traders, while the Australian Securities and Investments Commission (ASIC) limits leverage to between 1:30 and 1:50.

These restrictions aim to reduce the risks traders face from market fluctuations. While high leverage can generate large short-term gains, it also proportionally increases the risk. In contrast, Londonex’s offering of 1:1000 leverage far exceeds these limits, making the platform particularly high-risk. When selecting leverage, investors should carefully consider their risk tolerance and avoid blindly chasing short-term profits through excessive leverage.

VI. The Drawbacks of Zero-Commission Trading

Of the five account types Londonex offers, only the Raw Account charges a $10 commission, while the other accounts (Standard Account, Fixed Account, VIP Account, Crypto Account) are commission-free. Although zero-commission trading may appear advantageous to investors, it often hides other potential costs and risks.

Typically, forex platforms offering zero-commission trading compensate for the lack of commissions by widening spreads or imposing other hidden fees. For example, Londonex’s Fixed Account has a spread starting at 1.5 pips. While there is no commission, the wider spread means that the actual trading cost for traders is still relatively high. Additionally, the zero-commission structure may attract novice investors, but due to the lack of transparency in the fee structure, traders may face unexpected costs or unfavorable trading conditions when executing large trades.

Thus, when choosing a zero-commission platform, investors need to carefully consider the spreads, trading conditions, and other potential hidden costs to ensure they are not incurring losses due to unforeseen fees.

VII. Conclusion

In conclusion, despite being a new forex broker offering various account types and a wide range of trading products, Londonex raises concerns about its regulatory transparency, high leverage risks, and potential hidden costs in its zero-commission model. Investors must carefully assess the platform’s legitimacy and risks before choosing Londonex, to avoid unnecessary losses from high leverage or hidden costs.

For any investment platform, selecting one that is well-regulated and transparent is key to ensuring the security of funds. When considering emerging platforms like Londonex, investors should remain cautious and protect their interests.

FAQ

- Is Londonex regulated?

Londonex registers in Saint Lucia, but no records show regulation by the Saint Lucia Financial Services Regulatory Authority (FSRA) or other well-known international regulatory bodies. - What leverage does Londonex offer?

Londonex offers leverage of up to 1:1000, which is much higher than the leverage limits imposed by most regulated markets worldwide. - Are zero-commission accounts truly cost-free?

While some Londonex accounts offer zero-commission trading, the cost may be offset by wider spreads or other hidden fees, which can increase overall trading costs for investors. - Has Londonex been operating for a long time?

Londonex was established in May 2023 and has been in operation for less than a year as of early 2024. It is an emerging platform that has yet to withstand the test of time in the market. - What are the risks of high-leverage trading?

High-leverage trading can amplify profits but also magnify losses. In highly volatile markets, high leverage can result in significant losses, potentially leading to account liquidation. - Is Londonex suitable for beginner investors?

Due to the platform’s high leverage and zero-commission model, the risks are higher. It is not recommended for beginner investors to invest large sums without careful consideration of the risks involved.