Trade Time is a relatively new forex broker that claims to offer a wide range of financial trading services globally. However, concerns about its short operational history, unclear regulatory status, high leverage, and low commission structure raise questions about its reliability and risk factors.

Overview of the Platform

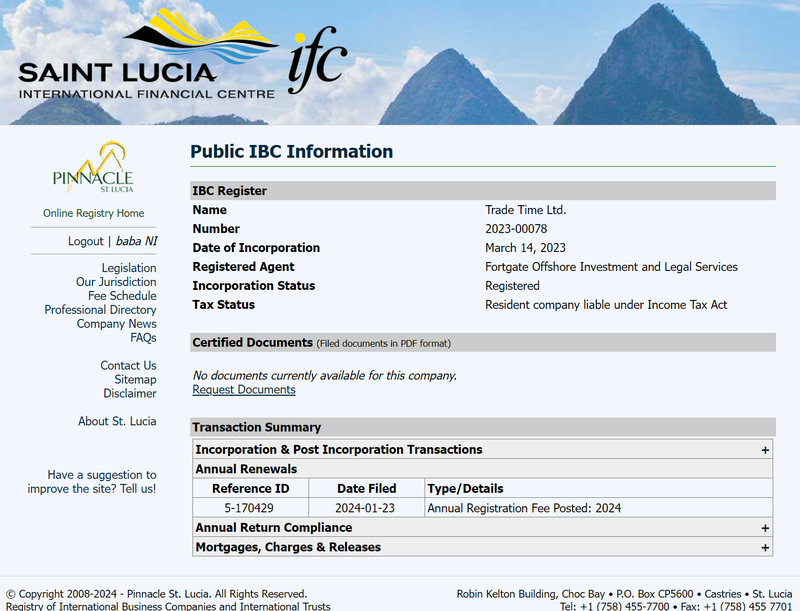

Trade Time is a forex broker established on March 14, 2023, and registered in Saint Lucia. Its headquarters are located in Istanbul, Turkey. The platform offers a variety of financial instruments for trading, including forex, stocks, commodities, indices, and cryptocurrencies. Trade Time aims to cater to global investors, but its operations have raised several red flags that warrant closer scrutiny.

The company’s official website states that it does not offer services in certain countries and regions, such as the United States, Canada, Japan, Iran, North Korea, Lebanon, and Turkey. This limitation suggests potential compliance issues with the regulatory requirements in those regions, which could raise concerns about its global expansion strategy.

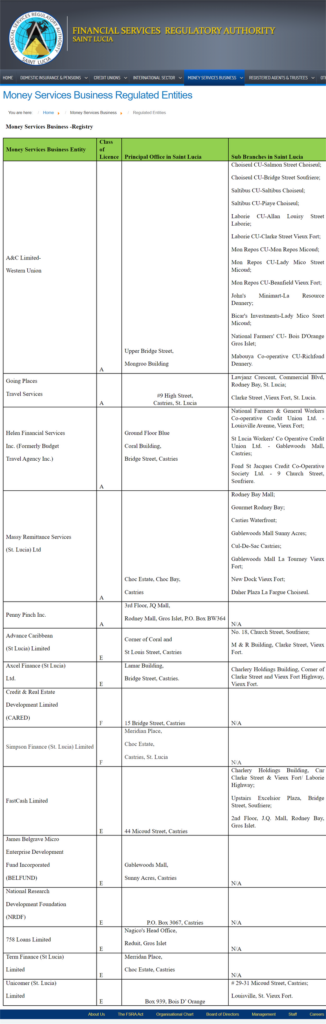

Trade Time claims to be registered with the International Business Companies (IFC) Registry in Saint Lucia and regulated by the local Financial Services Regulatory Authority (FSRA). However, a deeper investigation into these claims reveals discrepancies that cast doubt on the platform’s transparency and legitimacy. For a newly established platform in the highly regulated financial trading industry, this lack of transparency raises significant concerns.

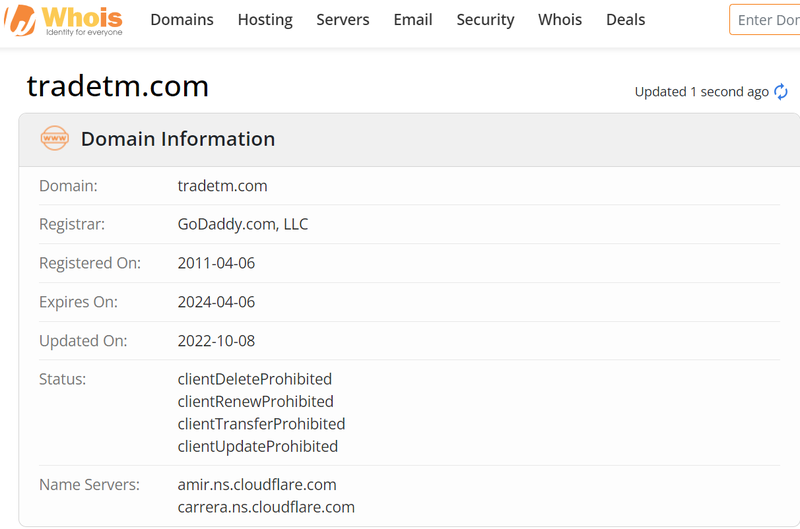

Risk of Short Domain Registration History

According to Whois data, Trade Time’s website domain was registered on January 18, 2011. Despite this early domain registration, Trade Time as a company was only founded in 2023, meaning the platform has been operational for less than a year. The domain’s existence for over a decade does not reflect the broker’s real-world history or track record, which is alarmingly brief for a financial service provider.

Here are the risks posed by this short operational history:

- Lack of Market Reputation:

Since Trade Time has been active for less than a year, investors cannot easily assess its past performance, user feedback, or long-term stability. This makes it difficult for traders to evaluate the platform’s reliability. - Potential for Sudden Exit:

New platforms are more prone to financial difficulties or abrupt market exits. Trade Time’s limited history raises concerns about whether it has the experience and resilience to remain viable in the long term, especially during financial market turbulence. - Instability:

A short operating history may mean that Trade Time lacks the necessary experience to handle market volatility effectively. The platform might struggle to provide adequate protection for investors during periods of high market stress.

In summary, while the early domain registration might give the impression of longevity, the platform’s actual operational timeline is too brief for traders to fully trust its stability and reliability.

False or Misleading Registration and Regulatory Claims

Trade Time claims registration with Saint Lucia’s International Business Companies Registry under number 2023-00078 and regulation by the Financial Services Regulatory Authority (FSRA). Although a company with this registration number appears in Saint Lucia’s IFC registry, no verifiable record shows Trade Time as a regulated entity by the FSRA.

Moreover, Trade Time is not listed with any other major international financial regulators, such as the UK’s Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). The lack of recognized regulatory oversight poses serious risks to investors.

Key concerns regarding these false or misleading regulatory claims include:

- Security of Investor Funds:

Without proper regulatory oversight, there is no guarantee that Trade Time will handle client funds securely. If the company faces financial difficulties or engages in fraudulent activities, investors may have limited legal recourse to recover their money. - Lack of Transparency:

Regulated brokers must follow strict transparency and compliance standards, including verifying client identities, adhering to anti-money laundering (AML) regulations, and providing accurate information about fees and services. Unregulated platforms, like Trade Time, may operate outside these norms, increasing the risk of misconduct. - Fraud Risk:

Unregulated brokers may lure clients with false promises or misleading information. While there’s no definitive evidence that Trade Time intends to defraud investors, its lack of clear regulatory oversight and transparency raises serious red flags for potential traders.

In short, Trade Time’s failure to provide verifiable proof of regulatory status calls its legitimacy into question. Investors should be cautious about entrusting their funds to a broker with such vague and possibly deceptive regulatory claims.

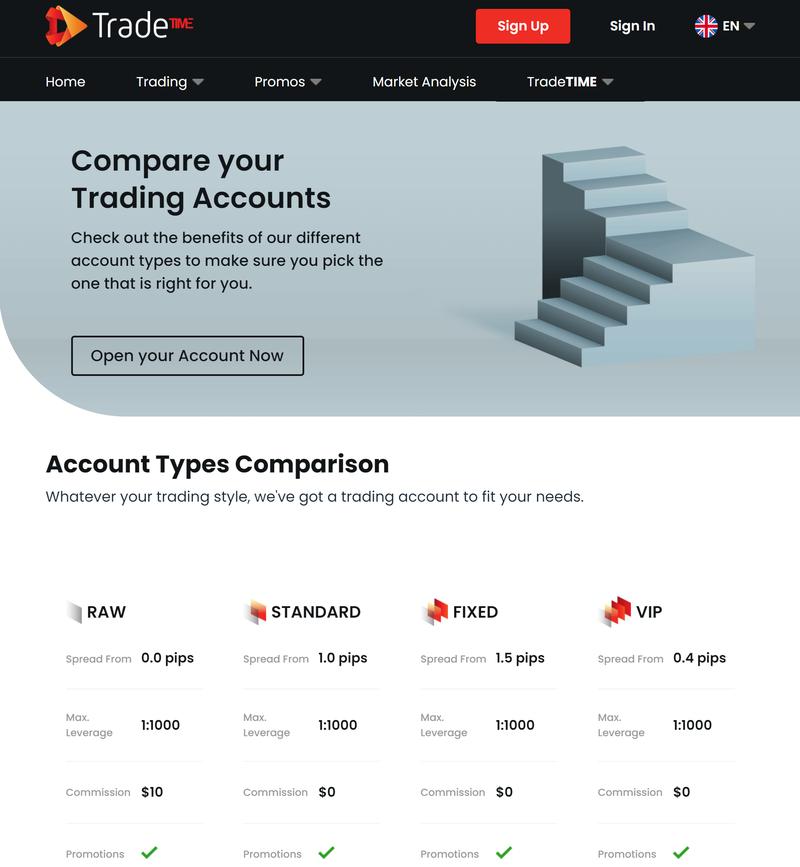

Risks from High Leverage and Tight Spreads

Trade Time offers four types of trading accounts: RAW Account, Standard Account, Fixed Account, and VIP Account. All of these accounts offer leverage up to 1:1000, with varying spreads. Specifically:

- RAW Account: Spreads start from 0 pips, but there’s a $10 commission per lot.

- Standard Account: Spreads start from 1 pip, with zero commission.

- Fixed Account: Spreads are fixed starting from 1.5 pips, with no commission.

- VIP Account: Spreads start from 0.4 pips, also with no commission.

High Leverage Risks:

The 1:1000 leverage offered by Trade Time allows traders to control large positions with a small amount of capital. While this can amplify profits, it also significantly increases the risk of substantial losses, especially in volatile markets. Most well-regulated brokers limit leverage to 1:30 or 1:50 to protect clients from excessive risk. Trade Time’s high leverage far exceeds these limits, making it much riskier for traders, particularly those with less experience.

Spread Risks:

Low or tight spreads, such as those starting from 0 pips in the RAW Account, may appear attractive to traders, especially those who rely on frequent trading for small profits. However, low spreads often carry the risk of slippage, where the execution price deviates from the expected price during volatile market conditions. This can result in traders paying more than anticipated for their trades.

Additionally, the RAW Account has a $10 commission per lot traded, which may offset any benefits from the low spreads. In contrast, accounts with no commission often come with wider spreads, which could lead to higher overall trading costs in the long run.

The combination of high leverage and low spreads appeals to risk-tolerant traders, but it also carries the potential for significant losses that traders should not overlook. Investors should carefully evaluate whether these risks align with their financial goals and risk tolerance.

Potential Risks from Low Commission Structures

Trade Time’s account offerings include three accounts with zero commissions (Standard, Fixed, and VIP Accounts) and only the RAW Account charges a $10 commission per lot. While low or no commission accounts might initially seem appealing, there are hidden risks involved:

- Hidden Costs:

Although Trade Time advertises zero commission, the real cost to traders may be reflected in other areas, such as wider spreads or slippage during order execution. These hidden costs could significantly increase the total trading expenses for investors. - Lack of Transparency:

Brokers offering zero commissions often recoup their costs in less obvious ways. The lack of transparency in how Trade Time earns revenue from trades raises questions about whether traders are truly getting a cost-effective deal. Investors should be cautious about the overall quality of execution when using a low-cost broker. - Service Quality Concerns:

Low or no commission structures can sometimes indicate a reduction in the quality of service or customer support, as the broker seeks to minimize operational costs. For frequent traders or those executing large-volume trades, this could lead to delays, poor customer service, or inadequate trade execution.

While Trade Time’s low commissions might attract new traders, it’s important to remain mindful of the potential hidden costs and quality issues that may come with such pricing strategies.

Although Trade Time presents itself as a global forex broker offering competitive trading conditions, several factors raise doubts about its credibility. The short operational history, false or misleading regulatory claims, high leverage levels, and low commission structures all point to a platform that carries considerable risk for investors.

Before choosing a trading platform, investors should carefully consider the broker’s regulatory background, operational transparency, and potential hidden costs. In the case of Trade Time, the lack of regulatory clarity and the presence of high-risk trading conditions suggest that potential investors should proceed with caution and prioritize platforms with a more established track record and stronger regulatory oversight.

Frequently Asked Questions (FAQ)

1. Is Trade Time regulated?

Trade Time claims FSRA regulation in Saint Lucia, but official sources do not confirm this. Additionally, the platform lacks listings with major regulators such as the FCA or ASIC.

2. What is Trade Time’s leverage ratio?

Trade Time offers leverage up to 1:1000, which is significantly higher than the limits imposed by most regulated brokers. This high leverage poses a substantial risk for traders.

3. What are Trade Time’s spreads?

Spreads vary depending on the account type. For example, the RAW Account offers spreads from 0 pips but charges a $10 commission per lot. Other accounts have wider spreads but no commission.

4. Does Trade Time really offer zero-commission accounts?

Yes, Trade Time offers several zero-commission accounts. However, traders should be cautious of hidden costs that might arise from wider spreads, slippage, or poor execution quality.

5. How long has Trade Time been operational?

Trade Time was established in March 2023, meaning it has been operational for less than a year. Its short history is a potential red flag for investors looking for a stable and reliable broker.

6. Is it safe to trade with Trade Time?

Given the platform’s unclear regulatory status, short operational history, and high leverage, investors should exercise caution when considering trading with Trade Time. It’s advisable to explore more established and regulated alternatives.