LQDFX is a CFD broker registered in Saint Lucia, but its lack of transparent regulatory information and concerns about fund safety have raised questions among investors.

Company Overview

LQDFX is a CFD (Contract for Difference) broker founded on April 21, 2023, with its headquarters located in Sofia, Bulgaria. The company specializes in providing global investors with CFD, forex, and other financial trading services. While it claims to offer services worldwide, LQDFX explicitly states that it does not provide services to certain countries or regions, including North Korea, the UK, Syria, the US, Canada, and the European Economic Area. This indicates that LQDFX is unable to operate in these jurisdictions due to legal and regulatory restrictions.

LQDFX’s core business model is based on Straight Through Processing (STP) for online financial trading, primarily offering CFD trades. The company provides a range of real and demo trading accounts designed to meet the needs of different types of investors. However, the company is relatively new, and it has yet to receive official recognition or authorization from major global financial regulatory bodies, leading to concerns about its safety and legitimacy.

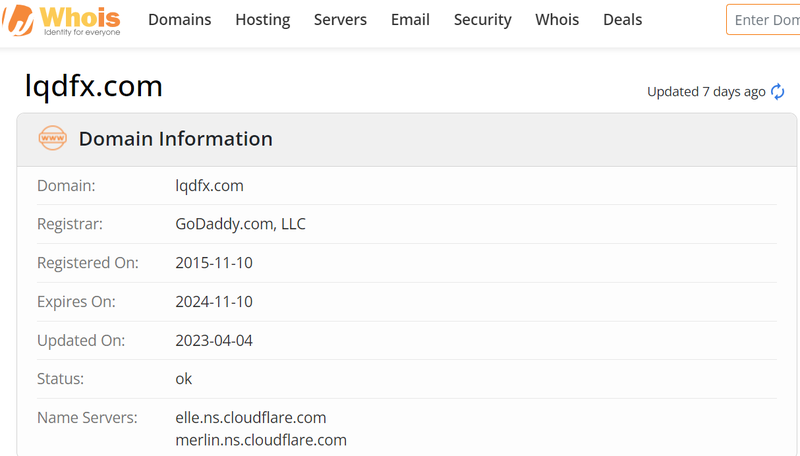

Domain and Registration Information

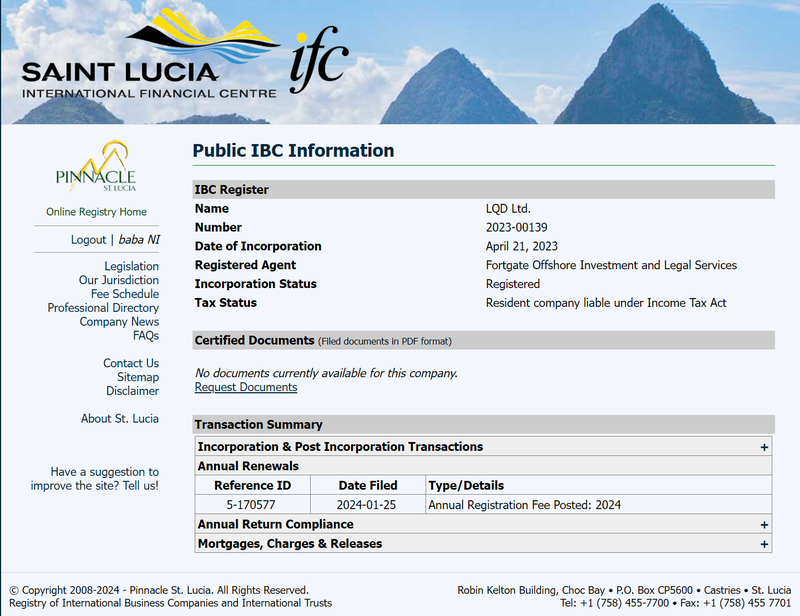

According to public information, LQDFX’s corporate entity is LQD Ltd, registered with the Saint Lucia International Business Companies and International Trusts Registry (IFC) under the entity number 2023-00139. The company’s registered address is in Rodney Bay, Gros-Islet, Saint Lucia, and it also has an office in Sofia, Bulgaria, located at 52 Han Omurtag St, 6th floor, Sofia, 1124, Bulgaria.

A Whois search shows that LQDFX’s domain registration took place on November 10, 2015. While the domain has been around for a longer period, the company officially registered in April 2023, indicating that LQDFX has been in operation for less than a year. This discrepancy between domain registration and company registration has raised concerns among investors, especially in the financial industry, where history and experience are often key indicators of stability.

Lack of Transparent Regulatory Information

The local International Business Companies and Trust Registry (IFC) confirms LQDFX’s registration in Saint Lucia, but the company does not hold a registration with the Financial Services Regulatory Authority (FSRA) of Saint Lucia. As a result, LQDFX operates without regulation from the official financial authority of the country. For investors, financial regulation is a key factor in evaluating whether a broker is trustworthy.

LQDFX’s lack of regulation is not limited to Saint Lucia; the company cannot be found in the databases of other official financial regulatory bodies either. This raises significant concerns about the company’s legitimacy and transparency. Financial market participants typically favor brokers with strict regulation to ensure adherence to financial safety standards and customer protection rules. Without regulation, investors face the risk that their rights may not be fully safeguarded in case of issues with their funds.

Risks of Missing Regulatory Information

The absence of regulatory oversight poses several risks for investors who choose to trade with LQDFX:

- Fund Security Risk: Since LQDFX is not registered with a trusted financial regulator, the security of investors’ funds may be at greater risk. Regulated brokers are typically required to segregate client funds from company funds to prevent misuse. However, an unregulated broker may not offer such protection.

- Insufficient Client Protection: Regulated financial bodies usually require brokers to participate in investor compensation schemes, which ensure that clients receive partial or full compensation if the broker goes bankrupt or if there are issues with their funds. Without regulation, LQDFX may not be able to offer such protection to its clients.

- Potential Compliance Issues: LQDFX’s statement that it does not provide services to multiple countries suggests that its operations are restricted by the laws and regulations of these jurisdictions. This could indicate that the company has not met the legal requirements or failed necessary compliance checks in certain areas.

Trading Accounts

LQDFX offers multiple types of trading accounts to cater to a wide range of traders, from beginners to high-end investors. Here is a detailed overview of the five main account types:

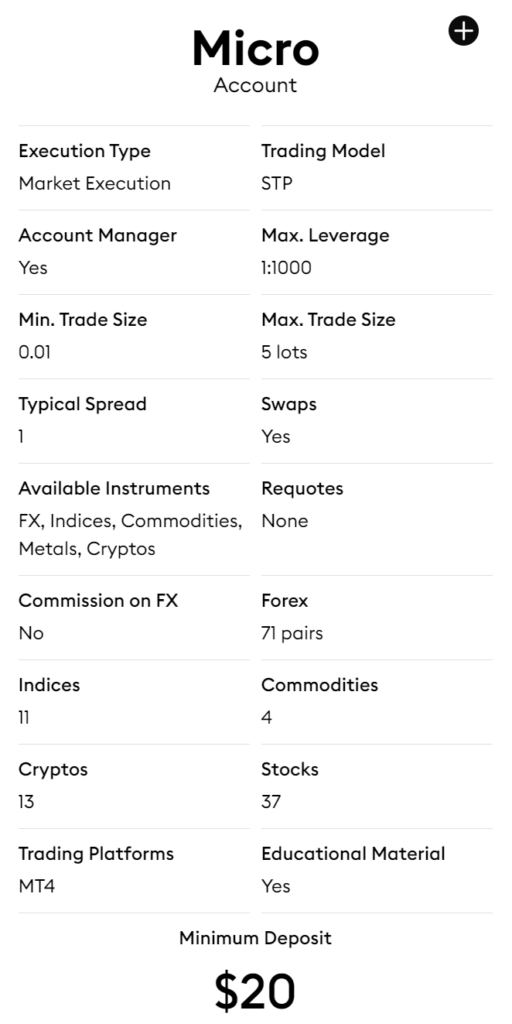

Micro Account

- Minimum deposit: $20

- Leverage: Up to 1:1000

- Minimum lot size: 0.01 lot

- Maximum lot size: 5 lots

- Spread: 1 pip

- Commission: None

The Micro Account is suitable for beginner traders with limited funds. The low deposit requirement and high leverage provide significant market access. However, the high leverage also introduces substantial risk, especially for inexperienced traders.

ECN Account

- Minimum deposit: $500

- Leverage: Up to 1:300

- Spread: 0.1 pip

- Commission: $2.5 per standard lot

The ECN Account offers lower spreads and direct market access, making it suitable for active traders seeking tighter spreads and faster execution speeds. However, the higher minimum deposit may not be suitable for all traders.

Gold Account

- Minimum deposit: $500

- Leverage: Up to 1:300

- Spread: 0.7 pips

- Commission: None

The Gold Account is similar to the ECN Account but without trading commissions, offering relatively low spreads. This account is ideal for traders who prefer to avoid additional trading fees.

VIP Account

- Minimum deposit: $25,000

- Leverage: Up to 1:100

- Spread: 0.1 pip

- Commission: $1.5 per standard lot

The VIP Account is designed for professional traders and high-net-worth individuals. It requires a higher initial deposit and offers better trading conditions, such as lower spreads and faster market execution.

Islamic Account

- Minimum deposit: $20

- Leverage: Up to 1:300

- Spread: 0.7 pips

- Commission: None

The Islamic Account caters to traders following Islamic law by not charging interest or swap fees, aligning with Sharia financial principles.

Concerns Regarding Fund Security

While LQDFX provides various account types, its lack of transparent regulatory information has led to concerns about the security of clients’ funds. An unregulated broker raises concerns about the proper segregation of client funds from company funds and the existence of protective mechanisms for client assets. LQDFX does not clearly state its transparency measures for fund handling, which further raises doubts about its ability to safeguard investor capital.

Additionally, LQDFX offers very high leverage on some accounts, such as 1:1000 for the Micro Account. While high leverage can amplify profits, it can also increase the potential for significant losses, especially for beginner traders. The combination of high leverage and lack of regulatory oversight can be a risky proposition for inexperienced investors.

Conclusion

LQDFX, a recently established CFD broker, provides a range of trading accounts and various methods for accessing markets. However, the absence of regulatory oversight and concerns about fund security make it necessary for investors to exercise caution when considering this platform. Financial regulation plays a critical role in protecting investors, and LQDFX’s lack of transparency and compliance raises questions about its credibility. Investors should carefully assess the risks and exercise caution when deciding to trade with LQDFX.

FAQ

- Is LQDFX regulated?

LQDFX holds registration in Saint Lucia but operates without regulation from the financial authorities in Saint Lucia or any other country. - What types of accounts does LQDFX offer?

LQDFX offers five types of accounts: Micro Account, ECN Account, Gold Account, VIP Account, and Islamic Account. - What is the minimum deposit requirement for LQDFX?

The minimum deposit varies by account type, with the Micro Account requiring $20 and the VIP Account requiring $25,000. - What is the maximum leverage offered by LQDFX?

The Micro Account offers leverage up to 1:1000, while the VIP Account offers leverage up to 1:100. - Is LQDFX suitable for beginner traders?

Although LQDFX offers a low entry threshold for the Micro Account, the high leverage could increase risks for beginner traders. - How secure are funds with LQDFX?

Due to the lack of regulation, the security of funds with LQDFX remains uncertain. Investors are advised to be cautious.