Bestzenith presents itself as an online trading platform, but its questionable registration, lack of regulation, and opaque deposit/withdrawal policies suggest significant risks for investors.

1. Overview of Bestzenith

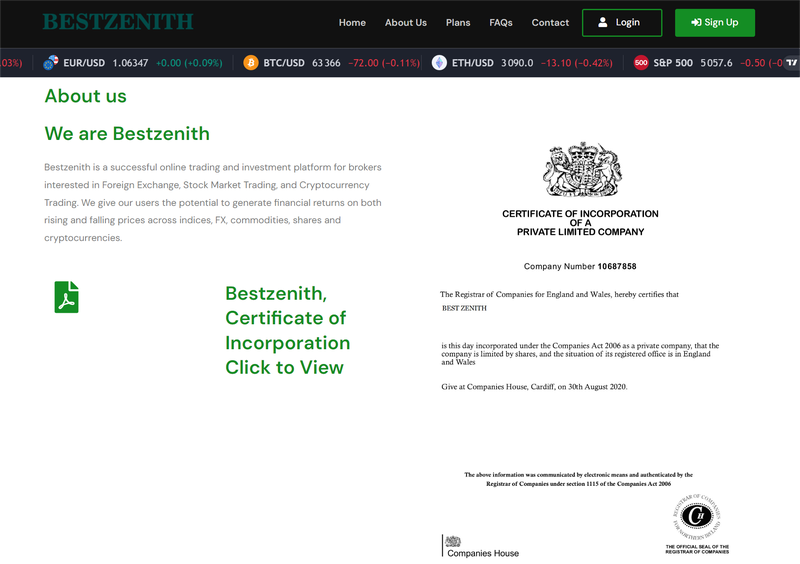

Bestzenith claims to be an online trading and investment platform offering access to various markets, including stocks, indices, forex, commodities, and cryptocurrencies. The platform boasts a self-developed trading system designed to provide investors with efficient trading tools and diverse investment options. Bestzenith aims to provide global users with flexible trading options and high returns. According to its website, Bestzenith offers multiple investment plans tailored for different investors and encourages users to quickly reap profits through its platform.

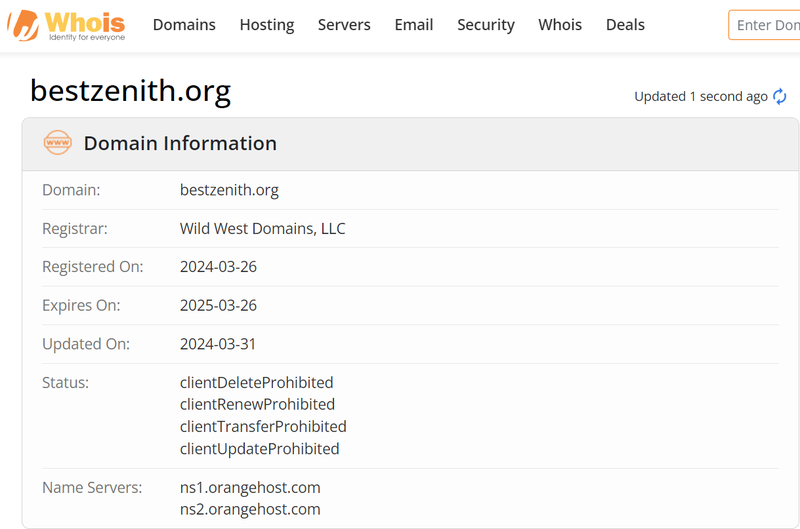

The domain registration information shows that Bestzenith’s official website was registered on March 26, 2024. While this positions it as a newly established broker, it also raises red flags about its credibility due to several irregularities, such as unclear corporate background, lack of regulatory oversight, and unusually high promised returns.

Bestzenith claims to be registered in the UK. However, after investigating the registration number provided, several issues and concerns emerge. Additionally, Bestzenith has not disclosed its deposit and withdrawal methods, further questioning the platform’s transparency and trustworthiness. Altogether, these factors suggest that Bestzenith might not be a reliable trading platform and could even be part of a larger scam operation.

2. Suspicious Domain Registration

Bestzenith’s domain was registered on March 26, 2024. This relatively recent registration is unusual for an investment platform, especially one that deals with the financial markets. New platforms without a long track record or reviews from a customer base typically face challenges in gaining investor trust. Credibility is crucial in the finance world, and Bestzenith’s short operational history does not provide investors with the reassurance needed to trust their money with such a platform.

The close proximity of the domain registration to the platform’s market launch is another concern. Established financial platforms usually take years to build up their reputation through transparent operations and verifiable legal registration. Bestzenith, on the other hand, has suddenly appeared on the scene with little background information, and its aggressive promotional campaigns only further suggest potential hidden risks.

Many investors often check the domain registration history of a platform before making investments. Bestzenith’s newly registered domain provides little historical insight, especially when combined with its other questionable features, making the platform even more suspicious.

3. Fake Regulatory Information

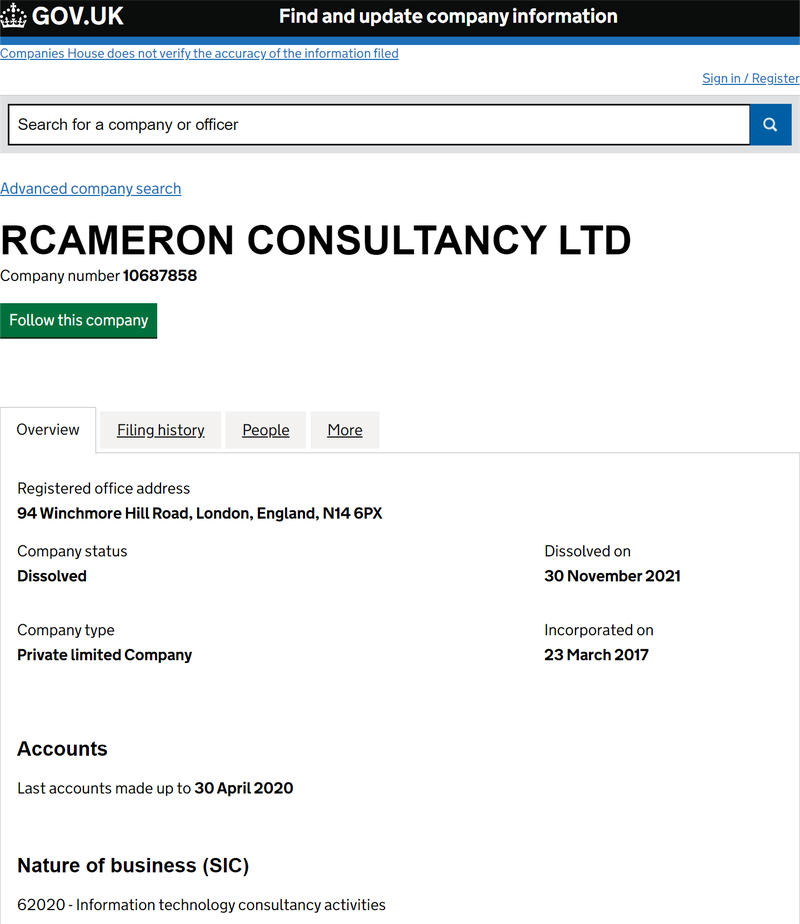

Regulation is the cornerstone of legitimacy and safety for investment platforms. Bestzenith claims on its website to be registered in the UK with registration number 10687858 and asserts compliance with UK financial market regulations. Bestzenith presents this registration as proof of its official status and operation under UK law. However, a check of the Companies House database shows that registration number 10687858 belongs to RCAMERON CONSULTANCY LTD, which has no affiliation with Bestzenith.

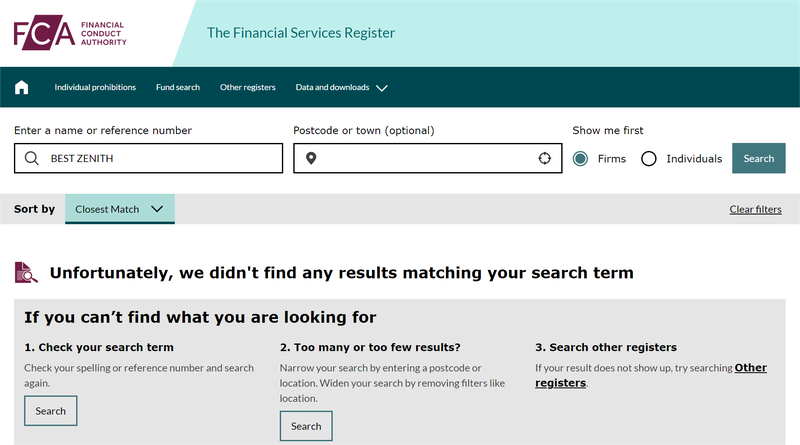

The false registration information strongly indicates fraudulent behavior. The platform appears to intentionally mislead investors into thinking it operates under UK law. Investors often trust platforms claiming to fall under the UK Financial Conduct Authority (FCA). However, the FCA database shows no records for Bestzenith or the provided registration number.

This means Bestzenith is not subject to any legitimate regulatory oversight, leaving investors’ funds unprotected. Without regulatory oversight, investors have no legal recourse if the platform engages in fraudulent activities. This pattern of providing false information matches that of other known financial scams, and Bestzenith shares similarities with a number of them.

Moreover, the design of Bestzenith’s website closely resembles several known scam platforms, including rorysassets-ltd, Arbonnecloudminingfx, Mexon-investments, and others. These platforms have been exposed as fraudulent schemes, using the same approach of luring investors in with high returns and false promises. The resemblance in website design further suggests that Bestzenith may be part of the same network or using similar scam tactics.

4. Risks with Deposits and Withdrawals

A critical feature of any investment platform is the transparency of its deposit and withdrawal processes. Reputable platforms clearly disclose supported payment methods, minimum deposit/withdrawal amounts, transaction fees, and processing times. This information helps investors understand how they can manage their funds on the platform. However, Bestzenith has not provided any details regarding its deposit and withdrawal methods, which is a major red flag.

Investors usually deposit funds through options provided by the platform, expecting to withdraw their profits or capital when needed. Without clear information on deposit and withdrawal processes, investors on Bestzenith could encounter serious obstacles when attempting to withdraw their funds. Furthermore, Bestzenith fails to disclose minimum deposit requirements or potential transaction fees, leaving investors vulnerable to unexpected costs or even the inability to withdraw their funds.

The platform lacks transparency about deposit and withdrawal procedures, which suggests it may control investors’ money after deposits, potentially blocking access to their funds. Fraudulent platforms often use such tactics, luring investors to deposit funds and then making it nearly impossible to withdraw due to arbitrary terms or excuses from the platform.

Without a clear policy for managing funds and a transparent withdrawal process, Bestzenith poses a significant risk to investors. Entering the platform without knowing whether funds can be safely withdrawn is a warning sign of potential financial loss.

5. Doubts and Risks with Trading Accounts

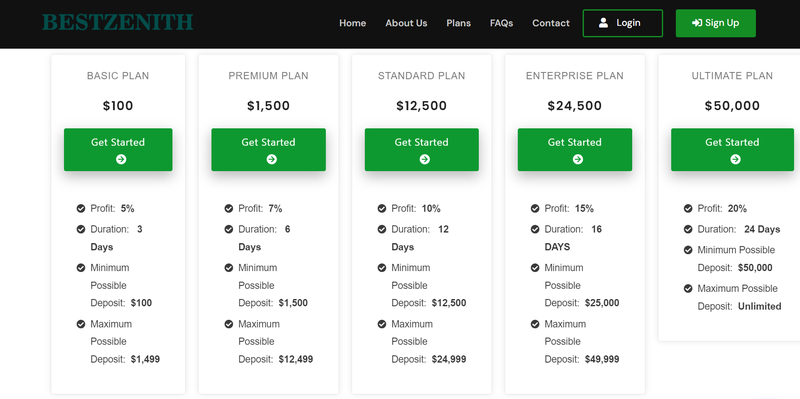

Bestzenith offers five different investment plans to attract users, ranging from the BASIC PLAN to the ULTIMATE PLAN. These plans promise varying returns and investment periods, with investment amounts ranging from $100 to $50,000 and beyond. Here are the details of these plans:

- BASIC PLAN: Minimum investment of $100, maximum $1,499, with a 5% return over 3 days.

- PREMIUM PLAN: Minimum investment of $1,500, with a 7% return over 6 days.

- STANDARD PLAN: Return of 10%, with an investment range of $12,500 to $24,999 over 12 days.

- ENTERPRISE PLAN: Minimum investment of $25,000, with a 15% return over 16 days.

- ULTIMATE PLAN: Minimum investment of $50,000, with a 20% return over 24 days and no maximum investment limit.

While these plans appear highly attractive, offering extremely high returns within short periods, they raise serious concerns. Legitimate financial markets typically see returns fluctuate based on market conditions, and large returns often take time to accumulate. Bestzenith’s promise of such high returns in such a short time frame is highly suspect and indicative of a potential Ponzi scheme. In a Ponzi scheme, early investors are paid returns from the funds of new investors rather than from legitimate profits. When new investor funds dry up, the scheme collapses, leaving most investors with significant losses.

Ponzi schemes typically lure investors by offering enticing returns, as seen with Bestzenith’s promises. The ULTIMATE PLAN’s 20% return over just 24 days is especially unrealistic and should raise alarms for any potential investor. The platform also provides no clear explanation of how it generates such returns, which is another sign of potential fraud. Investors must stay cautious of platforms that claim to offer guaranteed high returns without providing clear explanations or evidence of how those profits are generated.

6. Conclusion

Upon investigation, Bestzenith exhibits many characteristics typical of financial scam platforms, including a newly registered domain, false corporate registration information, lack of regulatory oversight, opaque deposit/withdrawal policies, and overly attractive investment plans with unrealistic returns. Its website’s design also matches several known scam platforms, further supporting the conclusion that Bestzenith is a high-risk, potentially fraudulent operation.

Bestzenith’s combination of high-risk features suggests that investors should approach such platforms with extreme caution. High returns often accompany high risks, but in this case, the risks seem far greater than the rewards. Without proper regulation or clear transparency, investors’ funds are at serious risk. Investors should resist the temptation of Bestzenith’s high return promises and avoid depositing funds into the platform without fully understanding its legal status and financial safety measures.

7. Bestzenith Frequently Asked Questions (FAQ)

1. Is Bestzenith a legitimate platform?

Bestzenith’s registration information is inaccurate, and it is not regulated by the UK Financial Conduct Authority (FCA). This suggests that the platform may not be legitimate, and investors should be cautious.

2. What investment plans does Bestzenith offer?

Bestzenith offers five investment plans: BASIC, PREMIUM, STANDARD, ENTERPRISE, and ULTIMATE PLAN, with promised returns ranging from 5% to 20%, and investment periods from 3 to 24 days.

3. Why are Bestzenith’s returns so high?

Bestzenith promises returns that far exceed normal market conditions, which is a major warning sign. High returns are often used to lure in investors, but they usually indicate high risks or potential fraud.

4. How does Bestzenith handle deposits and withdrawals?

Bestzenith provides no information on how deposits and withdrawals are handled, which creates the possibility that investors could face difficulties when trying to access their funds.

5. What are the major risks of investing with Bestzenith?

Bestzenith’s main risks include unregulated operations, unclear fund management policies, difficulties with withdrawals, and the potential for a Ponzi scheme-like structure. Investors may face significant financial losses.

6. Can I trust Bestzenith’s regulatory information?

No. Bestzenith’s registration information is false, and there is no evidence of regulation from the UK FCA. This raises serious doubts about the platform’s trustworthiness.