Mtrading, as a broker offering various financial product trading services, has questionable registration, regulatory, and risk information, requiring investors to exercise caution when choosing this platform.

Overview of the Platform Background

Mtrading is a broker catering to global investors, offering trading services in metals, energy, stocks, indices, and other financial products. To meet the needs of different markets, the Mtrading website supports multiple languages, including Simplified Chinese, English, Spanish, Russian, Indonesian, Malay, Vietnamese, and Thai, demonstrating its global business reach. The account registration page on the platform also supports these languages, facilitating participation from investors in various countries.

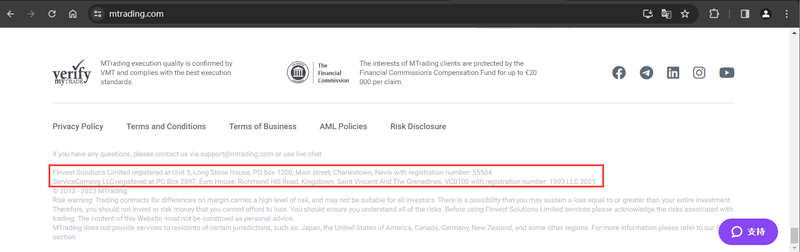

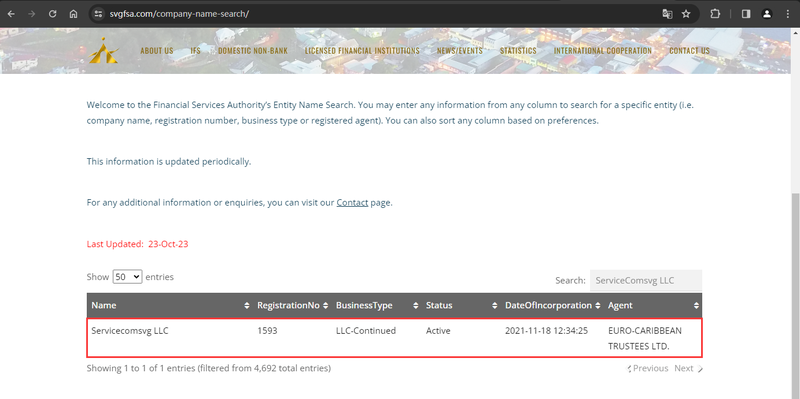

However, despite Mtrading’s extensive global operations, its corporate background lacks transparency. Mtrading claims to be registered in Saint Kitts and Nevis, but public channels do not verify this information, raising investor concerns. Mtrading also links to a related company, ServiceComsvg LLC, registered in Saint Vincent and the Grenadines. According to public records, the registration information of ServiceComsvg LLC can be verified through the Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA), which provides some support for Mtrading’s legitimacy.

Despite this, investors should carefully assess the risks associated with Mtrading, particularly in terms of its regulatory and compliance issues. The platform displays several risk factors that warrant caution when choosing it as a venue for forex and financial derivatives trading.

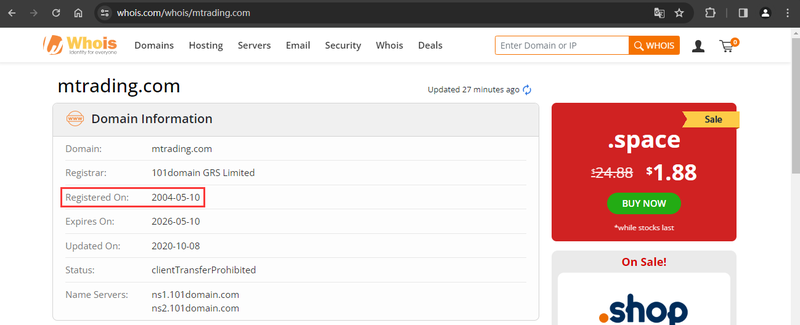

Domain Information

Domain registration time can often help assess the operational history and stability of a financial institution. According to Whois, the domain for the Mtrading website was registered on May 10, 2004, indicating nearly 20 years of online presence. This long domain history suggests that the platform has been operational for an extended period, which could imply more experience compared to newer platforms.

However, a long domain history does not necessarily guarantee the safety of the platform itself. While the domain’s longevity reflects some operational continuity, it does not directly prove the company’s legitimacy or compliance in other areas. Investors should still consider other key factors such as company registration and regulatory qualifications.

Registration Information and Risks

According to its website, Mtrading claims to be registered in Saint Kitts and Nevis. However, attempts to verify this registration information through public channels have been unsuccessful. Neither government departments in Saint Kitts and Nevis nor third-party websites provide verifiable registration records for Mtrading. This lack of transparency raises concerns about the platform’s credibility.

In contrast, ServiceComsvg LLC, Mtrading’s related company, registers in Saint Vincent and the Grenadines, and investors can confirm this through the SVGFSA website. However, Saint Vincent and the Grenadines lacks stringent financial regulation, especially for forex companies, as the SVGFSA does not “regulate, monitor, authorize, or license” companies involved in forex trading. This means that even if ServiceComsvg LLC’s registration is legitimate, it is not subject to actual regulatory oversight by local financial authorities.

For investors, the platform’s registration location and regulatory environment are directly tied to the safety of their funds and the platform’s operational legitimacy. If a platform lacks strict regulatory oversight, the authenticity of its registration may offer little protection. Thus, the inability to verify Mtrading’s registration, combined with its association with a loosely regulated entity, heightens the platform’s potential risks.

Regulatory Concerns

Regulatory supervision in financial markets is crucial to ensure that platforms operate in compliance with the law. However, Mtrading’s website does not provide any information about being under financial regulatory supervision or having the necessary authorizations. This indicates that Mtrading may not be subject to strict financial regulations, increasing the risk for investors trading on the platform.

Although Mtrading links to ServiceComsvg LLC, the SVGFSA in Saint Vincent and the Grenadines clearly states that it does not regulate forex or brokerage companies. Therefore, investors cannot rely on regulatory oversight from this jurisdiction to ensure Mtrading’s compliance or legitimacy.

For forex and derivatives trading platforms, being under strict regulatory supervision is crucial. A platform without regulation or located in a region with weak regulatory oversight usually increases the risk to investors’ funds. In Mtrading’s case, despite its long operational history, the lack of clear regulatory qualifications casts doubt on the platform’s legitimacy and security.

Margin Risks

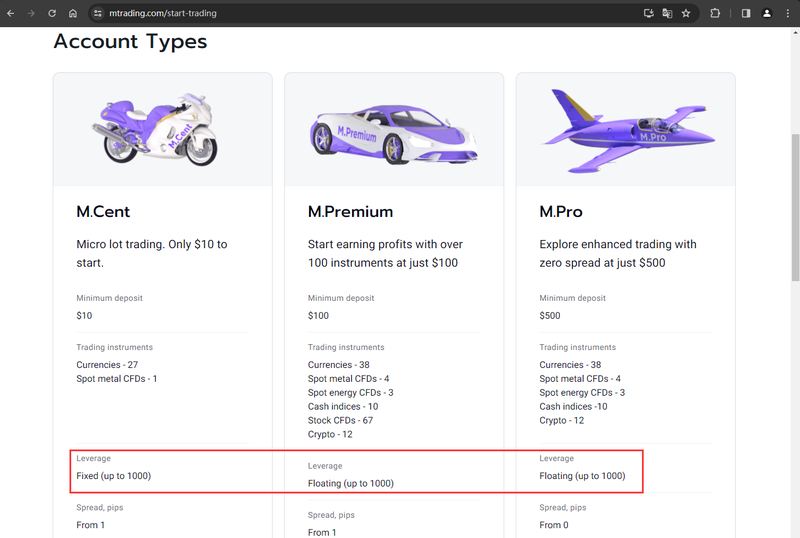

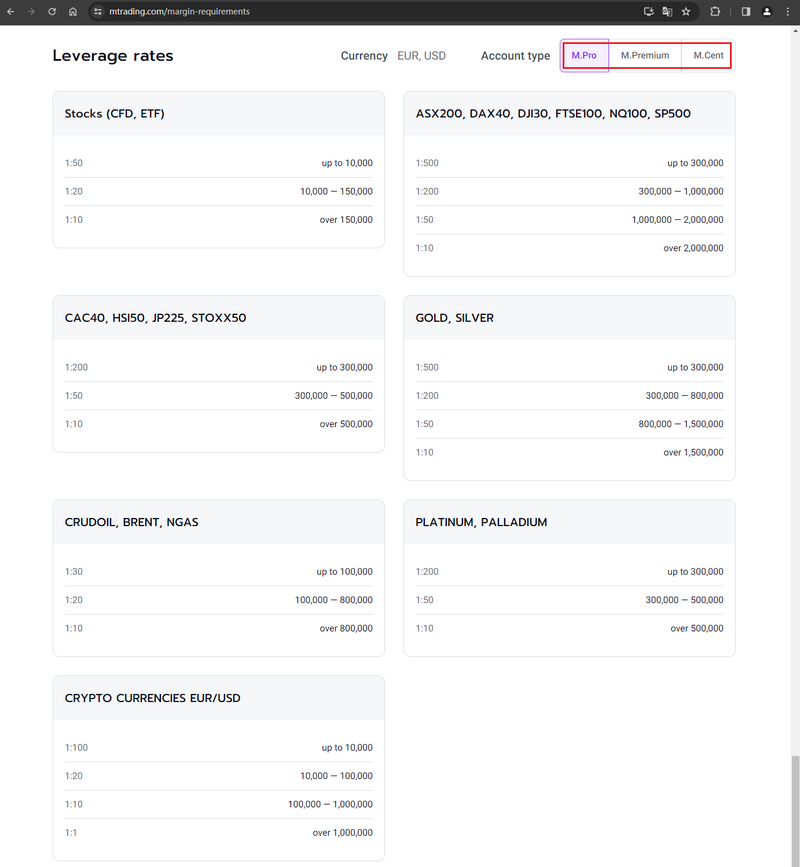

Regarding margin requirements for trading products, Mtrading’s website indicates that the margin levels vary depending on the account type. According to the site, different account types offer different margin levels, allowing investors to choose the one that suits their trading style. Additionally, Mtrading provides specific margin requirements for metals, energy, stocks, indices, and other products.

While Mtrading offers detailed margin level information, high leverage trading is always a double-edged sword. High leverage can increase potential profits but also significantly raises the risk of losses. If the market fluctuates sharply, investors may face substantial losses, possibly leading to margin calls. Thus, even though Mtrading offers high leverage options across different accounts, investors should exercise caution, particularly in volatile market conditions.

Furthermore, financial authorities typically set leverage limits to protect investors from excessive risk. However, Mtrading lacks strict regulatory oversight, so investors should remain especially cautious about the risks associated with its high leverage offerings. In the absence of a strong regulatory framework, the platform may relax leverage limits, increasing the potential for investor losses.

Beware of Financial Fraud

Investors must always be on guard against the risk of financial fraud in the markets. Due to Mtrading’s lack of transparent registration information and clear regulation, it could pose potential risks. Financial scams often lure investors with promises of high returns and low risk, but these promises often fail to materialize, resulting in substantial financial losses for investors.

To avoid falling victim to financial fraud, investors should remain vigilant, particularly when dealing with opaque trading platforms. When selecting a forex or financial derivatives trading platform, investors should ensure that the platform has legitimate registration, is under the supervision of strict regulatory authorities, and provides transparent trading conditions.

The Dangers of Financial Fraud

Financial fraud not only causes financial losses but can also severely impact an investor’s psychological well-being and quality of life. Victims often face financial difficulties, with some even falling into debt. Additionally, fraudulent activities undermine the trust in financial markets, affecting the reputation of legitimate platforms. Therefore, when choosing a trading platform, investors should prioritize verifying its registration and regulation to minimize the risk of falling prey to fraud.

The effects of financial fraud extend beyond individual losses and can negatively impact the broader financial market. As scams increase, investor confidence decreases, reducing market liquidity and stability. Therefore, choosing a legitimate, compliant, and well-regulated platform is critical for both investor protection and the healthy development of the market.

Mtrading, as a broker offering diversified financial product trading services, may boast nearly 20 years of domain registration history and support for multiple languages catering to global investors. However, significant doubts remain about its registration and regulatory standing. Although the platform claims registration in Saint Kitts and Nevis, this information remains unverified. Its related company, ServiceComsvg LLC, is legally registered in Saint Vincent and the Grenadines but lacks stringent financial regulation. Mtrading’s high leverage trading, although appealing, also carries substantial risks, especially given the platform’s lack of effective regulatory oversight, which should prompt investors to exercise caution.

To avoid financial fraud, investors should prioritize a platform’s legitimacy and compliance when making their choice. Although Mtrading offers a range of trading services, the potential risks should not be overlooked. Investors should fully understand a platform’s registration background, regulatory qualifications, and associated risks to avoid suffering unnecessary losses.

FAQ

- Where is Mtrading registered?

Mtrading claims registration in Saint Kitts and Nevis, but public channels do not verify its registration information. - Is Mtrading regulated?

Mtrading’s related company, ServiceComsvg LLC, registers in Saint Vincent and the Grenadines, but the country’s Financial Services Authority (SVGFSA) does not oversee forex or brokerage activities. - What products does Mtrading offer?

Mtrading provides trading services in metals, energy, stocks, indices, and other financial products. - What is the leverage ratio offered by Mtrading?

The leverage ratio offered by Mtrading varies based on account type, with high leverage options available, but investors should be cautious of the risks. - Is Mtrading suitable for novice investors?

Given concerns about the platform’s registration, regulatory status, and the risks of high leverage trading, novice investors should avoid it. - What risks are associated with Mtrading?

Key risks include unverifiable registration information, lack of strict regulation, and the potential for significant losses due to high leverage trading.