Wingo Markets is a forex broker registered in the Comoros Union. Although some of its registration details are accurate, the lack of effective regulation presents compliance risks. Investors should proceed with caution.

Background Overview

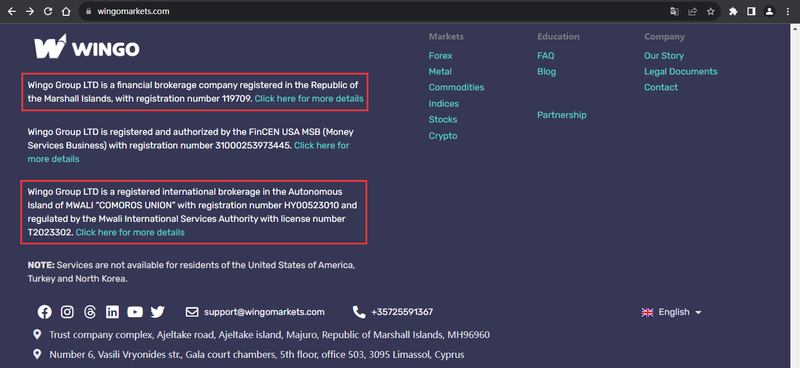

Wingo Markets is a newly established forex broker registered in 2023. It offers trading services in forex, metals, commodities, stocks, and indices. According to its website, Wingo Markets provides multilingual support, including English, Spanish, Persian, and Arabic, to attract customers from different regions. Its account registration page also supports these languages, reflecting its global ambitions.

However, there are concerns about its operational and regulatory background. While Wingo Markets is registered in the Comoros Union with some accurate information, its status in the Marshall Islands is invalid. This raises questions about its legitimacy and transparency. The forex market is high-risk, and investors should pay close attention to the platform’s regulatory status and background.

Doubts About Registration Information

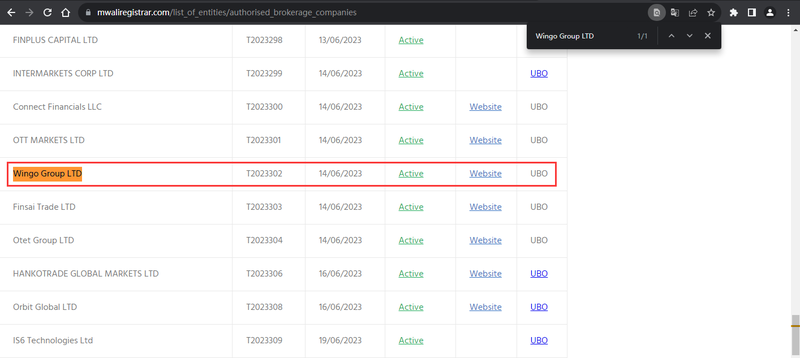

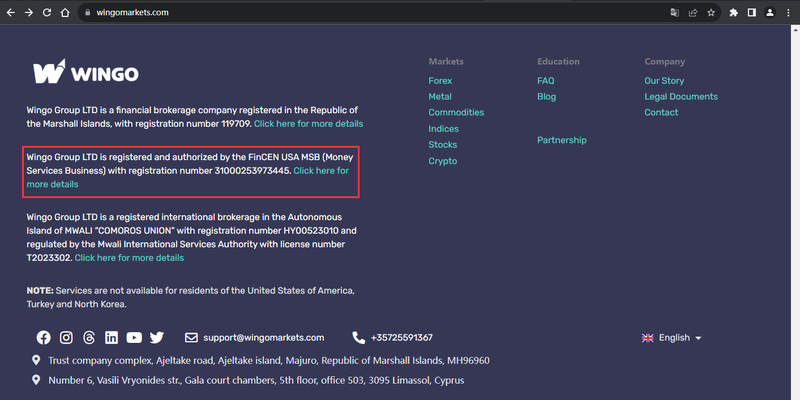

Wingo Markets’ website states that the company registers in both the Comoros Union and the Marshall Islands. The Moheli International Services Authority confirms Wingo Markets’ registration in the Comoros Union, granting it legal commercial status in that region. However, the Comoros Union does not strictly regulate the forex market, meaning a company registered there does not necessarily guarantee trustworthiness.

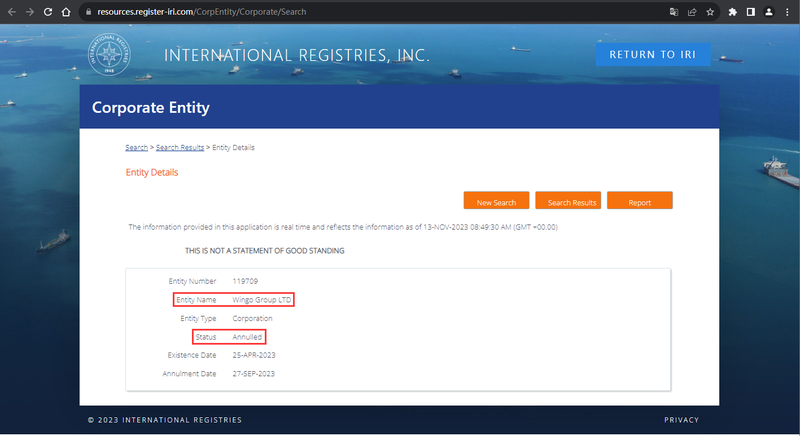

More concerning is the invalidity of its Marshall Islands registration, as confirmed by the INTERNATIONAL REGISTRIES, INC. The Marshall Islands operates as an offshore jurisdiction with loose regulatory oversight, and many companies register there to avoid stricter financial regulations. The loss of this registration further questions Wingo Markets’ legitimacy as a trustworthy broker.

Domain Registration Risks

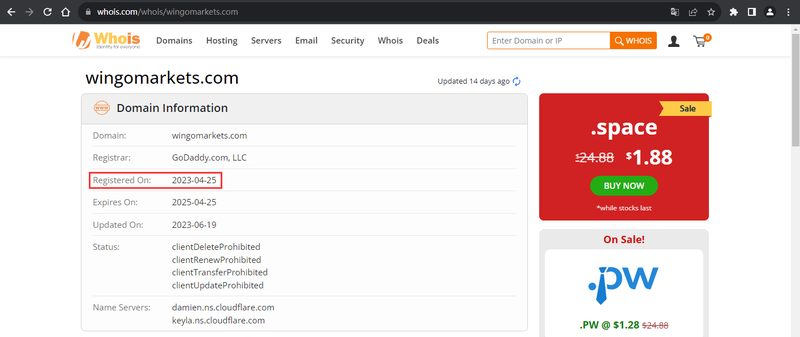

A Whois query reveals that Wingo Markets registered its domain on April 25, 2023, making it less than a year old. This short operating history means the platform has not yet faced long-term market scrutiny. New platforms often pose higher risks since they lack established credibility or a track record to prove reliability.

While a short domain registration does not directly imply fraud, long-established platforms tend to be more stable and trustworthy. Wingo Markets, being a new entity, needs more time and transparent operations to earn investor trust. Additionally, some fraudulent platforms buy or extend older domain names to appear more established, misleading investors. Therefore, domain registration time alone is insufficient for assessing a platform’s legitimacy. It’s essential to consider regulatory status and user feedback for a comprehensive evaluation.

Lack of Regulatory Information and Concerns

Wingo Markets claims to hold a Money Services Business (MSB) license from the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). However, FinCEN’s main role is to combat money laundering and terrorist financing, not to regulate forex brokers. Holding a FinCEN MSB license only means the company is under U.S. financial crime monitoring but does not imply regulatory oversight of its forex business.

In the forex market, financial authorities like the UK’s Financial Conduct Authority (FCA) or Australia’s Securities and Investments Commission (ASIC) typically issue genuine regulatory licenses. These agencies provide strong regulatory oversight, ensuring investor safety.

For Wingo Markets, holding a FinCEN MSB license is not sufficient proof of legality or safety. Without solid regulatory backing, the transparency of the platform’s operations and the safety of investor funds remain questionable. In such a case, investors should exercise extreme caution to avoid potential losses due to insufficient regulation.

Signs of a Potential Fraudulent Platform

Wingo Markets shows characteristics often associated with fraudulent platforms. Firstly, it is registered in offshore jurisdictions with loose regulatory environments, such as the Comoros Union and the Marshall Islands. While this doesn’t automatically indicate wrongdoing, it does offer non-compliant platforms opportunities to avoid stricter oversight.

Secondly, the platform’s invalid Marshall Islands registration and reliance on a FinCEN license that doesn’t cover forex trading create further concerns. This situation is not uncommon in the forex industry, where some platforms exaggerate their legality to lure investors, ultimately leading to financial losses.

Thirdly, Wingo Markets operates as a newly launched platform with a short operating history, lacking the reputation of more established platforms. New platforms often offer high returns or attractive bonuses to lure investors, but after substantial deposits, issues like withdrawal difficulties or frozen accounts can arise, leading to financial losses for investors.

How to Verify Platform Compliance

To avoid non-compliant or fraudulent platforms, investors should follow these steps to verify the legitimacy of a forex broker:

- Check Regulatory Information

Investors should review the broker’s website for regulatory details. Legitimate platforms typically display their regulatory body and license numbers prominently. - Verify with Regulatory Authorities

After finding regulatory information, investors should visit the relevant regulator’s website to verify the license number or company name. Respected global forex regulators include the UK FCA, Australian ASIC, and Cypriot CySEC. - Check Registration Information

Investors should query the official company registry to confirm if the platform registers in the jurisdiction it claims. For instance, investors should verify Wingo Markets’ Comoros registration with the appropriate authorities. - Review User Feedback and Industry Reports

User reviews and third-party industry reports can provide clues about the platform’s reliability. Be wary of reviews mentioning withdrawal problems or poor service. - Evaluate Platform Transparency

Legitimate brokers usually provide clear contact information, office addresses, and detailed company information. Non-transparent companies often obscure or hide these critical details.

Conclusion: Is Wingo Markets Trustworthy?

A comprehensive analysis of Wingo Markets’ background, registration information, domain history, and regulatory status raises several red flags about the platform’s compliance and reliability. While its registration in the Comoros Union is valid, the country’s loose regulatory environment offers little protection for investors. More concerning is the invalidity of its Marshall Islands registration, which further undermines its credibility.

Additionally, Wingo Markets’ FinCEN MSB license, while valid, does not apply to its forex trading operations. The platform’s short operating history and lack of substantial regulatory backing make it a high-risk option for investors. Overall, Wingo Markets presents significant regulatory and transparency concerns, and investors should approach it with caution, ideally opting for more transparent and strictly regulated platforms to ensure the safety of their funds.

FAQ

- Is Wingo Markets a legitimate forex broker?

Wingo Markets is registered in the Comoros Union but lacks effective regulation, raising doubts about its legitimacy. - Is Wingo Markets regulated?

Wingo Markets holds a FinCEN MSB license, but this does not regulate forex trading. It is not effectively regulated. - How can I verify a forex broker’s compliance?

Investors should check regulatory details and verify license numbers with the respective regulatory body. - Is Wingo Markets’ domain registration reliable?

Wingo Markets’ domain is less than a year old, indicating a short operating history, which raises concerns. - What does Comoros registration mean for investors?

Comoros has loose financial regulations, meaning companies registered there may lack proper oversight. - Should I trade with Wingo Markets?

Given Wingo Markets’ registration and regulatory issues, it is advised to choose more transparent, strictly regulated brokers for safer trading.