Discovery FX is a forex broker; however, it lacks proper regulatory licenses, and its registration information is questionable. Investors should carefully evaluate its credibility before choosing this platform.

Company Overview

Discovery FX claims to be a forex broker registered in Samoa, offering trading services in forex, precious metals, and other financial products. The company supports multiple languages, including Simplified Chinese, Traditional Chinese, English, Japanese, and Indonesian, catering to a global clientele. According to its official website, Discovery FX provides two types of trading accounts and supports popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

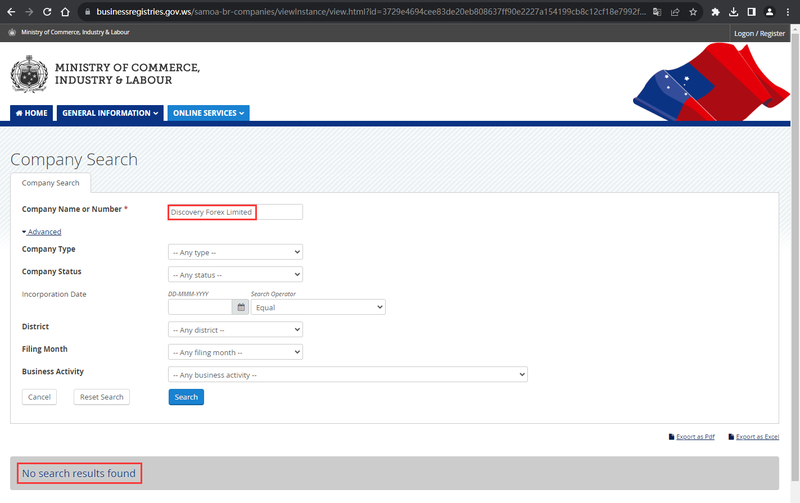

Although Discovery FX offers a wide range of trading services, there are doubts about its registration information. The company claims registration in Samoa, but no Discovery FX records appear in Samoa’s business registry. However, its affiliated entity, Discovery Capital Group PTY LTD, registers in Australia, and the Australian Securities and Investments Commission (ASIC) verifies this.

Domain Information and Concerns

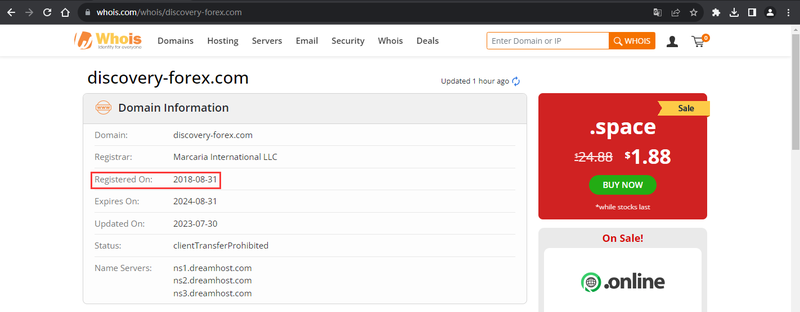

A Whois database search shows that Discovery FX registered its domain on August 31, 2018, and it has been active for over five years.While domain registration duration alone does not confirm a company’s legitimacy, a longer registration period suggests that the company has been active in the market for a considerable time, which can help increase its credibility. However, inconsistencies between the domain registration details and the company’s background information still raise concerns about its transparency.

Firstly, despite Discovery FX’s claim of being registered in Samoa, there is no corresponding record in Samoa’s official registry. The mismatch between the company’s official registration information and its claims casts uncertainty for potential investors.

Secondly, while Discovery FX claims its affiliated entity, Discovery Capital Group PTY LTD, registers in Australia, and ASIC confirms this information, the exact operational scope and functions of the affiliated entity remain unclear. Such a complex corporate structure may create barriers for investors trying to understand the company’s background.

Regulatory Information and Concerns

Discovery FX claims to hold two major regulatory licenses: one from the U.S. Financial Crimes Enforcement Network (FinCEN) for money services businesses (MSB license) and an authorized representative (AR) license from the Australian Securities and Investments Commission (ASIC). However, there are significant controversies surrounding these claims.

- Authenticity of the FinCEN license:

FinCEN’s primary role is anti-money laundering (AML) and counter-terrorism financing, and it does not regulate or issue licenses to forex brokers. Therefore, the FinCEN license claimed by Discovery FX does not provide any substantial legal protection for its forex business. FinCEN does not issue operating licenses to financial traders, making Discovery FX’s claim misleading. - ASIC’s AR license:

Discovery Capital Group PTY LTD, Discovery FX’s affiliated entity, holds an AR license from ASIC, obtained through partnerships with third-party companies like MGF Capital PTY LTD. This method of acquiring AR licenses typically involves weaker regulatory oversight and may not provide strong investor protection. According to ASIC’s records, over 30 similar companies have acquired AR licenses through this method, raising concerns about the legitimacy of such businesses.

In summary, although Discovery FX claims to have multiple regulatory credentials, the actual regulatory oversight appears weak, and investors should remain cautious when considering this platform.

Is the Company Trustworthy?

Based on the above information, there are significant doubts about Discovery FX’s legitimacy and credibility. While the company’s website and promotional materials claim it holds various regulatory licenses, several issues raise concerns:

- Lack of transparency in registration information:

The company claims registration in Samoa, but the official registry shows no records, raising questions about its transparency. - Insufficient regulatory credentials:

The regulatory licenses that Discovery FX claims to hold do not offer strong legal protection. FinCEN does not regulate forex brokers, and Discovery FX acquired the AR license from ASIC through third-party partnerships, resulting in weaker oversight. - Complex corporate structure:

Discovery FX maintains a complex operating structure with multiple affiliated entities, and some lack clear definitions. This complexity makes it difficult for investors to evaluate the company’s credibility.

Given these uncertainties, investors should approach Discovery FX with caution. In the financial markets, choosing brokers with strict regulatory oversight and transparent information is crucial. With Discovery FX’s unclear registration and regulatory controversies, investors must remain vigilant to avoid potential risks.

What Should You Do If You Encounter Similar Scam Websites?

If you come across a forex broker like Discovery FX, which has unclear information and weak regulatory oversight, you should take the following steps to protect yourself:

- Check official regulatory databases:

Before choosing a forex broker, verify if the company registers with an official regulatory body. You can check through agencies like the U.S. CFTC, UK FCA, or Australian ASIC. If no records are found, exercise caution. - Verify domain registration information:

Use tools like Whois to check the company’s domain registration date and location. A short domain registration period or a mismatch between the registered location and the claimed business address may indicate misleading information. - Avoid being lured by high return promises:

Some forex platforms may attract investors by promising high returns. Remember that high returns often come with high risks. Do not be misled by overly optimistic promotions. - Invest cautiously and avoid large deposits:

Before confirming a platform’s legitimacy, avoid making significant deposits. Start with small amounts to test the platform’s reliability and check whether withdrawals can be processed smoothly. - Consult financial experts:

If unsure about the platform’s legitimacy, seek advice from financial professionals or experts. You can also join investor protection organizations for assistance. - Report suspicious platforms:

If you confirm that a platform is a scam, report it to the relevant regulatory authorities, such as the U.S. CFTC or Australian ASIC, to help protect other investors from losses.

Although Discovery FX showcases various regulatory licenses and compliance information on its website, its true background and legitimacy are questionable. The company’s registration does not appear in Samoa’s commercial registry, and its FinCEN license does not apply to forex brokers, further raising concerns about its legitimacy. Additionally, its affiliate in Australia holds an AR license through a third party, which provides weaker regulatory oversight.

Investors should always exercise caution when choosing a forex broker, prioritizing those with strong regulatory oversight and transparent information. For platforms like Discovery FX, with unclear registration and weak licensing credentials, thorough research is essential to avoid potential investment pitfalls.

FAQ

- Is Discovery FX a legitimate forex broker?

Discovery FX claims to hold multiple regulatory licenses, but its registration and regulatory oversight are questionable. Its legitimacy has yet to be fully confirmed. - What does Discovery FX’s FinCEN license mean?

FinCEN does not regulate forex brokers or issue operating licenses. Therefore, Discovery FX’s FinCEN license does not apply to its forex trading business. - Is Discovery FX regulated by Australia’s ASIC?

Discovery FX’s affiliate holds an AR license from ASIC, obtained through a third-party company, resulting in weaker regulatory oversight. - How can I verify the legitimacy of a forex broker?

Investors should verify a broker’s registration through official regulatory databases such as the U.S. CFTC, UK FCA, or Australian ASIC. - Why can’t I find Discovery FX’s registration information in Samoa?

Although Discovery FX claims registration in Samoa, the official business registry shows no records, raising concerns about its transparency. - What should I do if I suspect a scam platform?

Immediately stop trading, avoid further losses, and report the suspicious platform to relevant regulatory authorities like the U.S. CFTC or Australian ASIC.