KOT4X, founded in 2018, is an online forex broker that has raised questions about its legitimacy and regulaKOT4X is a forex broker established in 2018, offering a wide range of financial products and an attractive trading platform. However, questions surrounding its legitimacy and regulatory status have persisted. This article provides an in-depth analysis of KOT4X’s corporate background, regulatory structure, and real-world cases to help investors make more informed decisions when considering this platform.

Corporate Background: The Establishment and Development of KOT4X

KOT4X is a rapidly growing broker offering services in forex, metals, energy, stocks, and other financial products. Despite its global operations, its business model and registration location have raised some concerns about its legitimacy and regulatory compliance.

1.1 KOT4X’s Registration Location

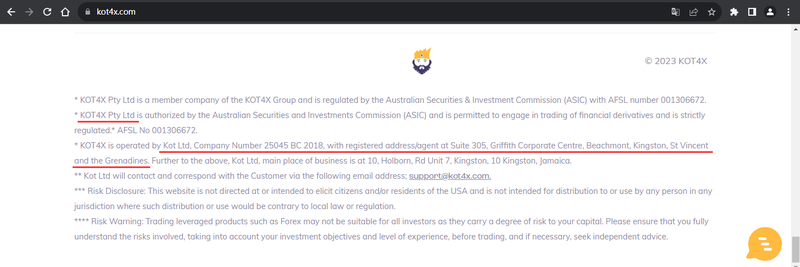

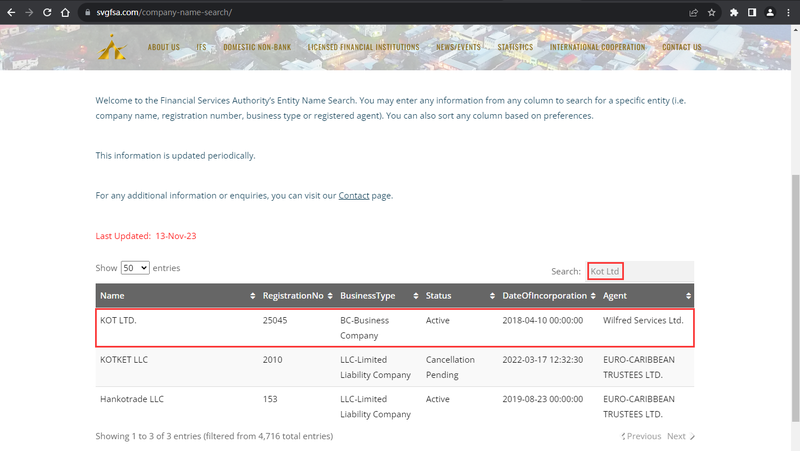

KOT4X is registered in Saint Vincent and the Grenadines, a known offshore financial hub due to its relatively lax financial regulations. Many companies choose this jurisdiction for its low barriers to entry and limited regulatory oversight. However, this lenient regulatory environment raises concerns about KOT4X’s compliance, particularly in terms of fund security and transparency.

1.2 KOT4X’s Operational Development

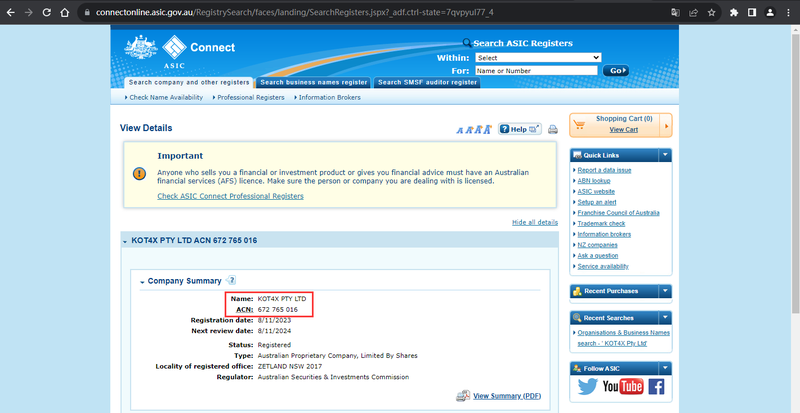

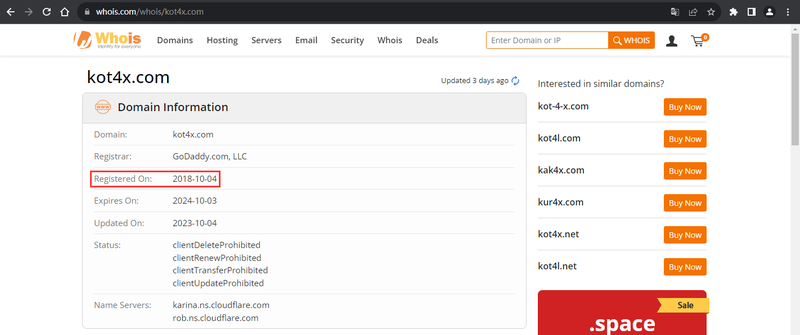

According to public data, KOT4X’s domain was registered in October 2018, indicating that the company has been in operation for over five years. KOT4X operates through its affiliated company, KOT4X Pty Ltd, which is registered in Australia, but its regulatory situation is more complex. While KOT4X has expanded its market due to its diverse range of trading products and appealing leverage options, questions about its legitimacy have also emerged as the business grows.

KOT4X’s Regulatory Information and Legitimacy

Although KOT4X claims to be regulated in multiple countries, including Australia, its actual regulatory framework is somewhat ambiguous, with potential gray areas that investors should be aware of.

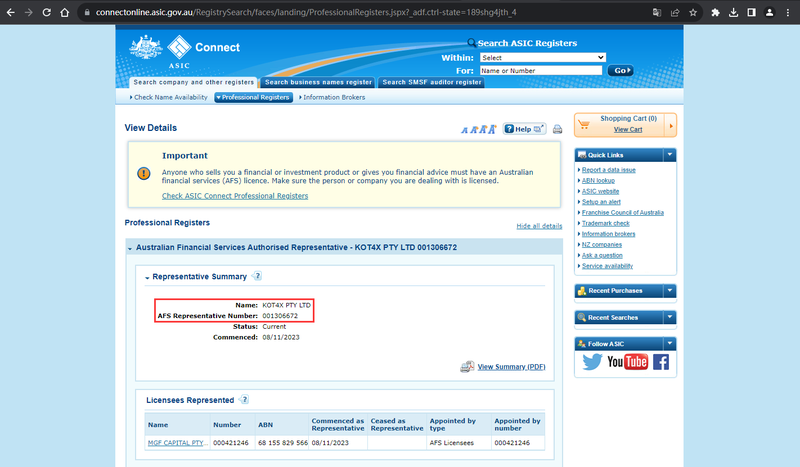

2.1 The Meaning of an AR License

KOT4X Pty Ltd holds an Authorized Representative (AR) license from the Australian Securities and Investments Commission (ASIC). However, this AR license differs from a full Australian Financial Services License (AFSL). The AR license only allows limited financial activities and is subject to less stringent oversight. Many firms obtain AR licenses through third-party companies to avoid strict regulatory scrutiny. As a result, AR license holders do not undergo the same level of compliance checks as AFSL holders, and investor protection mechanisms are weaker.

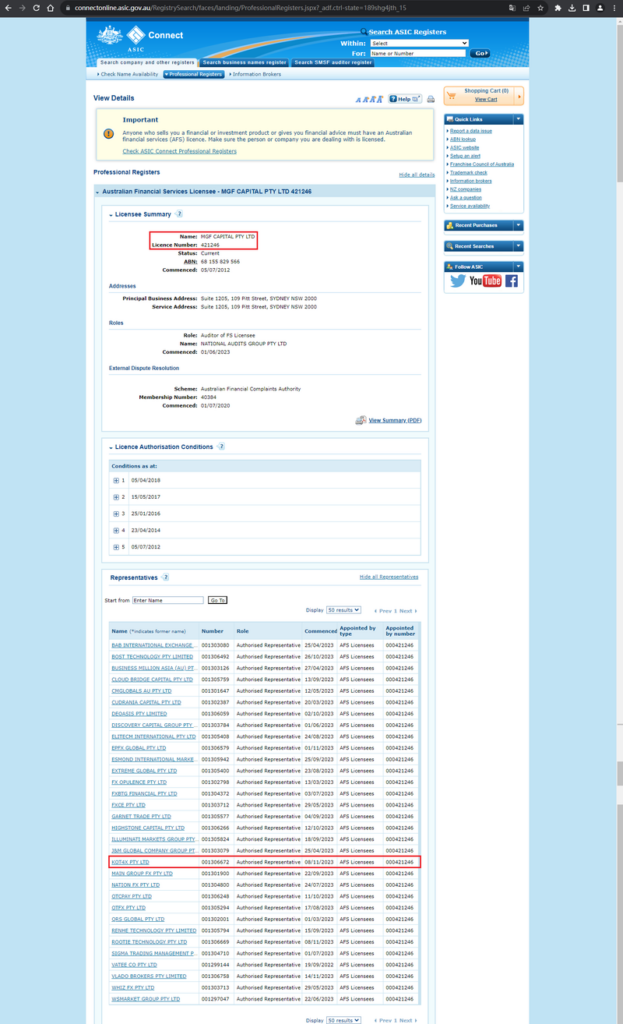

2.2 Regulatory Risks of the Authorized Representative License

KOT4X operates by purchasing its AR license from MGF CAPITAL PTY LTD, which has issued similar licenses to over 30 companies. KOT4X uses this license to operate, but there is no direct business connection between KOT4X and MGF CAPITAL PTY LTD. This setup raises several concerns:

- Lack of Regulation: Since AR license holders are not subjected to the same strict oversight, investors may find it difficult to seek assistance from regulators like ASIC if issues arise.

- Opacity in Compliance: Companies holding AR licenses are not required to disclose detailed financial or operational information, making it hard for investors to assess their actual compliance and financial health.

Real-World Case: The Risks of Operating Under an AR License

To further understand the potential risks associated with KOT4X’s regulatory framework, let’s look at a real-world case:

3.1 Case Background: A UK Investor’s Loss

In 2021, a UK investor named George Richardson traded cryptocurrencies through the KOT4X platform. Initially, George found the platform user-friendly, with smooth deposits and a good trading experience. However, during a period of market volatility, George’s account experienced significant losses, with multiple margin calls.

He tried to contact the platform’s customer service for assistance, but responses were slow. When George attempted to withdraw his remaining funds, the platform requested numerous identification documents and imposed high withdrawal fees. Even after submitting all the necessary documents, the withdrawal process was delayed for several months, and George only managed to recover part of his funds.

3.2 ASIC’s Inability to Act

George filed a complaint with the Australian Securities and Investments Commission (ASIC) to seek help, but since KOT4X only holds an AR license, ASIC could not intervene directly. George realized that while the platform claimed to be regulated, the license it held was insufficient to provide any real protection for investors. This case highlights how the use of an AR license allows companies to evade strict regulatory responsibilities, leaving investors vulnerable.

3.3 Lessons From This Case

George’s experience shows that, despite KOT4X’s appearance of legitimacy, its weak regulatory framework offers little legal recourse when investors face financial losses. Potential investors must understand the risks involved in such platforms and be cautious before committing funds.

Global Regulatory Differences: The Challenges of KOT4X’s International Operations

KOT4X exploits differences in international regulatory environments to operate across multiple countries. While this provides operational flexibility, it also complicates legal recourse for investors.

4.1 Lenient Regulations in Saint Vincent and the Grenadines

KOT4X’s registration in Saint Vincent and the Grenadines takes advantage of the country’s lenient regulatory policies. Although it offers a simple registration process and lower costs, the country’s regulatory bodies provide little oversight of financial companies’ operations, especially concerning fund security and investor protection.

4.2 Regulatory Challenges in Australia

While Australia has a strict regulatory environment, KOT4X does not hold a full AFSL license from ASIC. This means that when disputes arise, investors struggle to seek help from Australian regulators, exacerbating the challenges of cross-border legal recourse.

Customer Service and User Experience: KOT4X’s Strengths and Weaknesses

In addition to regulatory concerns, KOT4X’s customer service and user experience are also important factors for investors to consider.

5.1 Strengths of the Platform’s Operations

KOT4X’s platform is straightforward and easy to navigate, with a wide range of financial products, including forex, metals, energy, and indices. It also allows users to adjust leverage based on their risk preferences, which can be attractive to experienced traders.

5.2 Limitations of Customer Service

Despite the platform’s functional strengths, its customer service has notable shortcomings. KOT4X only provides support in English, which can be inconvenient for non-English-speaking investors, particularly those in Asia. Additionally, response times are slow, especially when dealing with financial issues, and the process for resolving user complaints is often long and complex.

Investor Protection Measures and Recommendations

To mitigate the risks of trading on platforms like KOT4X, investors should take the following protective measures:

6.1 Choose Directly Licensed Companies

When selecting a forex broker, prioritize companies that hold a full financial services license, as they are subject to stricter regulations and provide stronger protection for investor funds.

6.2 Ensure Fund Safety

Investigate whether the platform segregates client funds from operational funds, and confirm whether they offer any form of investor compensation fund. These measures can help reduce the risk of significant financial loss in extreme situations.

6.3 Invest Cautiously

Even if a platform is legally registered, investors should be cautious and avoid investing large amounts of money, especially if they are unfamiliar with the platform’s operations and regulatory status.

FAQ

1. Is KOT4X regulated?

KOT4X operates through its affiliate holding an Australian Authorized Representative license, but it does not hold a full financial services license, which limits the regulatory oversight.

2. Is KOT4X safe?

Due to KOT4X’s reliance on an Authorized Representative license, its investor protection mechanisms are weaker, posing certain risks to investors’ funds.

3. How is the KOT4X trading platform?

KOT4X offers a user-friendly platform with a diverse range of products, but its customer service is limited, and the withdrawal process can be complex.

4. Why did KOT4X choose to register in Saint Vincent and the Grenadines?

Saint Vincent and the Grenadines is known for its lenient financial regulations, attracting many financial services companies seeking lower operational costs and less regulatory scrutiny.

5. How to handle fund issues on KOT4X?

If you encounter fund issues on the platform, promptly contact customer service and gather relevant evidence to prepare for potential legal action if necessary.

6. Is KOT4X suitable for beginner investors?

Due to the platform’s regulatory weaknesses and customer service limitations, KOT4X may not be the best choice for inexperienced investors.