1. Background of MYMA FXFP

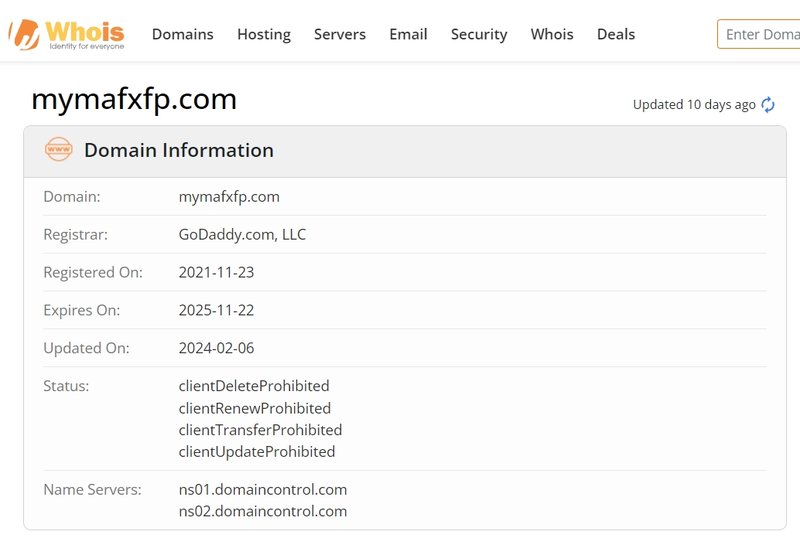

MYMA FXFP is a relatively new trading platform, with its domain registered on November 23, 2021. According to the platform, its main business includes trading services for foreign exchange, precious metals, indices, energy, and commodities. Despite its claims of offering a wide range of financial derivative trading services and appearing to be legitimate and attractive, the company’s background is ambiguous. The operating company, MYMA FXFP Ltd, has not provided clear corporate registration details, raising significant concerns among investors about its actual operational mechanisms and legality.

Typically, legitimate financial trading platforms list detailed company registration information, the countries in which they operate, and the relevant financial regulatory authorities. However, MYMA FXFP is vague on these points, and investors cannot find sufficient information about the company’s background through its official website. This lack of transparency is a major red flag, and investors should be cautious when dealing with such platforms.

2. Regulatory Issues with MYMA FXFP

In the financial trading sector, regulatory oversight is crucial to protecting investor interests. Legitimate forex and derivative trading platforms must follow supervision from financial regulatory authorities in their operating countries or regions. This ensures they comply with industry standards and regulations in areas such as client fund management, transaction execution, and risk disclosure.

However, MYMA FXFP does not have any regulatory credentials. After investigation, it is confirmed that MYMA FXFP Ltd is not registered with any major financial regulatory authority. This means its operations are not subject to external oversight, leaving investor funds vulnerable. In cases of financial disputes, investors will face significant difficulties recovering their money.

Historically, unregulated platforms have often attracted large deposits from users within a short time, only to take advantage of internal platform operations or fund transfer loopholes, making it impossible for investors to retrieve their money. For instance, a previous platform lured thousands of investors by falsely claiming international regulatory credentials and promising high returns. The platform quickly accumulated funds, then suddenly shut down and transferred investors’ funds to untraceable accounts, leaving them without any recourse.

3. Risks of Operating Without Regulation

For investors, choosing an unregulated platform exposes them to significant financial risks. Unregulated financial platforms may pose several dangers, including:

- No Protection for Funds: On legitimate platforms, investor funds are typically held in regulated segregated accounts, ensuring that platforms cannot misuse client funds. However, MYMA FXFP lacks regulation, leaving fund security unguaranteed, and the platform may be at risk of misappropriating client funds.

- Lack of Transparency in Transactions: Regulated platforms must adhere to strict transaction execution standards, ensuring fair, transparent, and non-manipulated pricing. Unregulated platforms may manipulate trading data to put clients at a disadvantage, such as artificially altering spreads or delaying trade execution, causing higher losses for investors.

- Difficulty in Legal Recourse:When problems arise on regulated platforms, investors can file complaints with regulatory authorities, who investigate and provide relief. However, for unregulated platforms like MYMA FXFP, investors cannot rely on legal channels to reclaim their funds, making recovery extremely difficult.

Real Case: Fraud by an Unregulated Platform

Unregulated platforms similar to MYMA FXFP are common in the financial market. In 2021, a trading platform called OceanFX rapidly gained popularity, claiming to offer leading global forex and derivative trading services. Through false high-yield advertisements, OceanFX attracted thousands of investors. Although OceanFX had no legitimate regulation, it forged documents from international regulatory bodies such as the UK’s Financial Conduct Authority (FCA) to gain investor trust.

Initially, OceanFX allowed a small number of investors to make withdrawals, attracting even more users to deposit larger amounts. However, as more investors joined, the platform suddenly encountered “technical difficulties,” preventing any withdrawals. Shortly after, the platform closed all accounts, and the funds vanished. Investigations revealed that operators had transferred the funds to offshore accounts. Due to the lack of regulatory oversight, investors had no realistic way to recover their losses.

This situation has parallels with the potential risks surrounding MYMA FXFP. The lack of regulation, opaque corporate information, and overly enticing investment promises are typical features of high-risk platforms. Investors should be particularly cautious of platforms that rapidly attract large deposits, as they risk significant financial losses.

4. Common Tactics of Unregulated Platforms

Unregulated platforms typically use certain tactics to attract investors and ultimately obtain their funds. Understanding these tactics can help investors identify potential frauds. Some common strategies include:

- Exaggerating Profitability: Unregulated platforms often exaggerate investment returns through advertisements or sales pitches, claiming that clients can achieve substantial profits. They may promise extremely high returns or even “risk-free” investments, attempting to allay investor concerns. In reality, all legitimate investments involve risk, and any platform promising “no risk” should be treated with suspicion.

- Fake Customer Reviews: To boost credibility, some unregulated platforms create fake customer testimonials, false online reviews, or fabricated investment success stories to attract new investors. These reviews often paint a picture of strong profitability and high investor returns. Investors should verify the sources of these reviews or look for genuine feedback on independent financial forums.

- Using Complex Technical Jargon: Unregulated platforms often use complex financial jargon to confuse investors unfamiliar with the financial market. They use technical language and fake market analysis to give the impression of expertise. This tactic is particularly effective on novice investors, who may be misled by the seemingly professional discourse.

- Encouraging Investment Upgrades: Unregulated platforms may employ “investment upgrade” strategies to encourage investors to increase their contributions. Initially, they may offer small returns to lower investors’ defenses, then persuade them to invest more by promising even higher returns. Once investors deposit larger amounts, the platform may freeze their accounts or block withdrawals.

- Delaying or Denying Withdrawal Requests: A common issue with unregulated platforms is the delay or outright denial of withdrawal requests. They may cite “account verification issues” or “technical problems” to stall or refuse investor withdrawals. When this happens, it often signals that the funds have already become unrecoverable.

5. How to Choose a Safe Financial Platform

To ensure the safety of their funds, investors must choose legitimate, regulated platforms. Here are some tips for selecting a trustworthy financial platform:

- Look for Regulatory Oversight: Platforms regulated by well-known authorities such as the UK’s FCA, the US Commodity Futures Trading Commission (CFTC), or the Australian Securities and Investments Commission (ASIC) are generally safer. These organizations impose strict regulations on fund management, trade execution, and customer service.

- Transparent Operating Records: Legitimate financial platforms typically disclose their operating history, management team, financial status, and other relevant information. Investors can learn about the platform’s background through official websites or regulatory reports. It is advisable to choose platforms with a long history and transparent operations.

- Compliance with Information Disclosure: Regulated platforms provide detailed disclosure documents, clearly explaining their terms of service, risk warnings, and how they handle client funds. These disclosures help investors understand potential risks and ensure that the trading process complies with relevant regulations.

- Reliable Customer Service: A trustworthy platform should have responsive customer service, capable of answering inquiries and resolving issues in a timely manner. Before investing, investors can test the platform’s customer service to assess its quality.

- Third-Party Reviews and User Feedback: Investors can look for platform reviews on independent financial websites, user forums, and social media. Choosing a platform with many positive reviews typically indicates higher security.

Market Examples of Other Fraudulent Cases

There have been several cases where unregulated platforms led to significant investor losses. Here’s a typical case demonstrating how unregulated platforms trick investors:

In 2020, a platform called CryptoWise rapidly expanded its user base through massive social media advertisements. CryptoWise promised up to 200% returns through cryptocurrency trading, attracting thousands of investors. Initially, the platform allowed small investors to make withdrawals, leading many to believe it was reliable. However, when more investors deposited larger sums, CryptoWise announced a “system upgrade” and froze all accounts. Investors’ withdrawal requests were repeatedly denied, and eventually, the platform shut down, leaving no trace of the funds.

Such cases highlight how unregulated platforms attract large deposits in a short time before disappearing. The absence of regulatory oversight allows platform operators to evade legal responsibility, causing massive financial losses for investors.

6. How Should Investors Handle Potential Risks?

For those who have invested in or are considering investing in platforms like MYMA FXFP, here are some suggestions for managing potential risks:

- Cut Losses Quickly: If you notice abnormal behavior, such as withdrawal delays or illogical investment returns, stop investing immediately to avoid further losses. If possible, submit withdrawal requests and retrieve any remaining funds.

- Gather Evidence and Report: If fraud is confirmed, retain all transaction records, emails, and relevant evidence. These materials are critical in legal proceedings. Investors can file complaints with local financial regulators or consumer protection organizations and seek legal assistance.

- Increase Investment Knowledge: Learning about financial markets and common investment scams is an essential method to avoid traps. Investors should actively educate themselves on how to identify illegal platforms and high-risk investments to make more informed decisions.

- Seek Professional Advice: For complex investment opportunities, consult with a professional financial advisor to ensure the chosen platform is legitimate and aligns with personal investment goals and risk tolerance.

By following these measures, investors can effectively avoid the potential threats posed by high-risk platforms, ensuring the safety of their funds and remaining secure in a constantly evolving financial market.

FAQ

- Is MYMA FXFP regulated?

No, MYMA FXFP does not have any regulatory credentials and is not supervised by any financial regulatory body. - Is it safe to trade on MYMA FXFP?

Due to the lack of regulation and transparent company background, trading on MYMA FXFP carries significant risks, and the safety of investor funds is not guaranteed. - How can I verify if a platform is regulated?

Investors can check the official websites of financial regulatory authorities (such as FCA, ASIC, etc.) to confirm whether the platform holds a valid financial license. - What should I do if I encounter issues with MYMA FXFP?

If you face any problems, it is advised to keep all transaction records and contact the platform’s customer service immediately. You can also seek help from legal authorities, but due to the platform’s lack of regulation, the chances of recovering funds are low. - How is MYMA FXFP different from other forex platforms?

MYMA FXFP lacks legal regulatory credentials and operates with an unclear company background, which distinguishes it from legitimate, regulated forex platforms. Investors should approach this platform with caution. - How can I avoid similar investment scams?

Before investing, verify that reputable regulatory authorities supervise the platform. Avoid falling for promises of high returns, stay vigilant, and diversify your investments to protect your funds effectively.