Limexx is a scam platform posing as a legitimate broker by falsely using the name of IC Markets. Investors should be aware of its illegal practices and the associated risks.

1. What is Limexx? Platform Overview

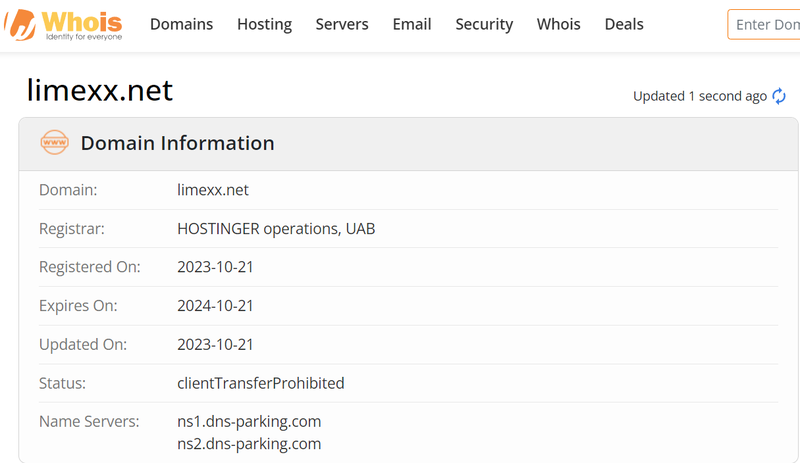

Limexx is a Contract for Difference (CFD) broker founded on October 21, 2023. The platform claims to offer investors a broad range of trading markets, including forex, commodities, indices, bonds, digital currencies, stocks, and futures. Limexx also states that it uses trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader to provide users with a convenient trading experience. However, the platform’s background and actual operations raise suspicions, as it shares common characteristics with known scam brokers.

2. Trading Markets Offered by Limexx and Its Operations

Limexx claims to provide investors with a variety of market trading options, including:

- Forex Trading: Offers trading in major currency pairs, emphasizing high leverage and low spreads, but fails to mention any risk warnings.

- Commodity Trading: Promises investment opportunities in commodities such as gold, silver, and oil, targeting risk-seeking investors.

- Indices, Bonds, and Futures Trading: Covers global indices, bonds, and futures contracts, providing users with diversified investment products.

- Digital Currency Trading: Provides cryptocurrency trading in an unregulated environment, highlighting potential profits but ignoring the risks involved.

Despite the apparent diversity of these products, Limexx does not provide transparent information about its trading mechanisms, leaving investors uncertain about the safety and destination of their funds.

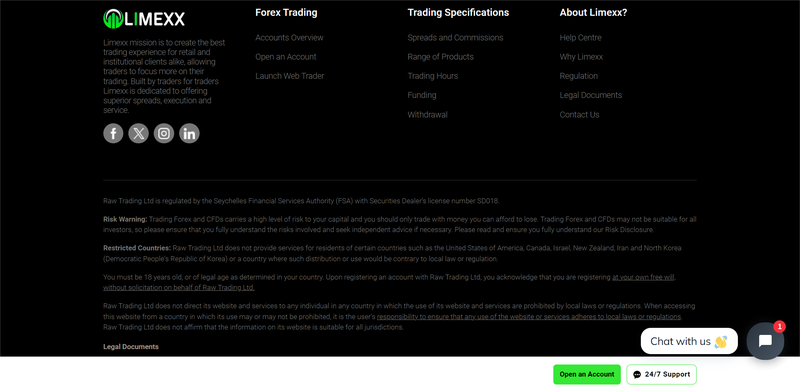

3. Company Registration Information: Limexx’s Registration and Regulatory Status

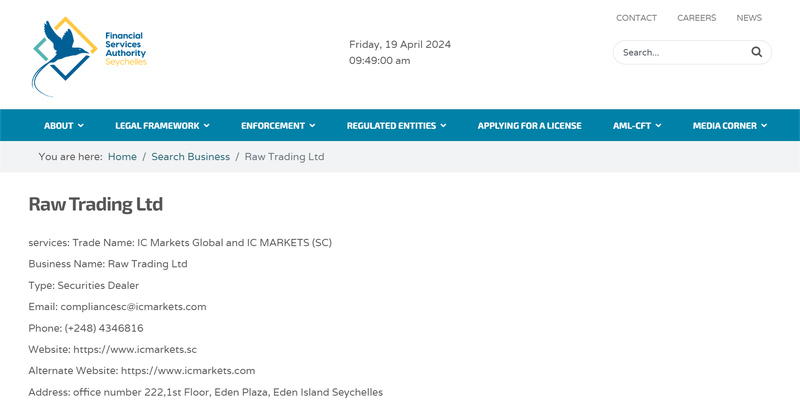

Limexx’s website claims that the platform’s registered corporate entity is Raw Trading Ltd, authorized by the Seychelles Financial Services Authority (FSA) under license number SD018. However, further investigation reveals that this registration belongs to IC Markets, a legitimate entity registered in Seychelles. IC Markets’ official websites are https://www.icmarkets.sc and https://www.icmarkets.com, both of which have no connection to Limexx. This indicates that Limexx has forged its registration and regulatory information, using IC Markets’ legitimacy to deceive investors.

4. The Relationship Between Limexx and IC Markets: How the Clone Scam Works

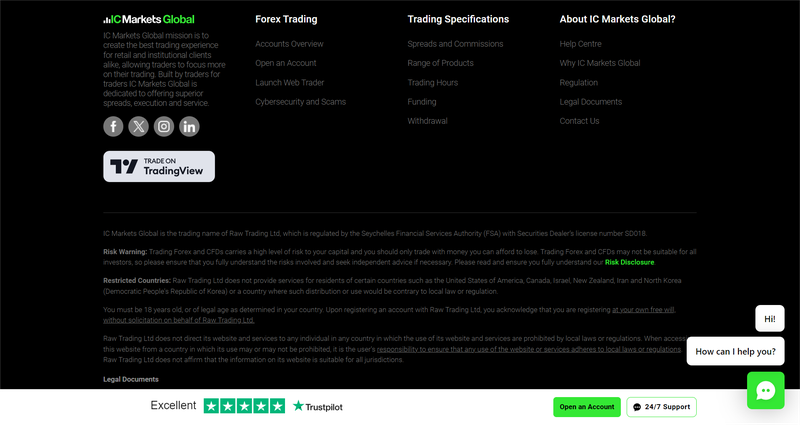

A clone scam occurs when a fraudulent platform steals the registration and regulatory information of a legitimate broker, posing as a regulated entity. Limexx employs this tactic by using the registration details of IC Markets’ entity, Raw Trading Ltd, to gain investor trust. However, the Seychelles Financial Services Authority (FSA) explicitly shows that Raw Trading Ltd is solely associated with IC Markets and has not authorized Limexx to use its regulatory number. This fraudulent behavior confirms that Limexx is not a legitimate trading platform but a scam website masquerading as IC Markets.

5. Similarities Between Limexx and Other Scam Platforms

In addition to its clone behavior, Limexx’s website design closely resembles those of other known scam platforms, such as Linoxx, ExpertSync, Continentaloptionslive, Venosvista, Fenext, and Elon-Mining. These platforms all copy the website layout and promotional style of IC Markets to appear as professional trading platforms. Common traits among these platforms include:

- Similar Website Design: Imitates IC Markets’ website style, including homepage layout, trading product introductions, and tool displays.

- Exaggerated Profits: Promises high returns and favorable trading conditions without clarifying the associated risks.

- Fake Regulatory Information: Provides false corporate registration and regulatory details that cannot be verified through official channels.

These traits suggest that these platforms might belong to the same scam syndicate or use a similar scam template.

6. Common Scam Tactics of Clone Brokers

Clone brokers often use the following tactics to scam investors:

- Forged Regulatory Information: Uses the corporate registration and regulatory information of a legitimate broker to appear as a regulated platform.

- Exaggerated Advertising: Promises high profits and low risks through false advertising to attract unaware users.

- Withdrawal Restrictions: Once investors deposit funds, clone platforms often limit withdrawals with various excuses or even close accounts.

- Manipulated Trading Data: Falsifies trading records and displays fake profit data to lure investors into investing more.

Limexx’s operational model closely matches these scam tactics, and investors should remain highly vigilant.

7. Case Analysis: IC Markets and Clone Scam Disputes

IC Markets is a well-regulated and reputable broker trusted by investors. However, clone scam brokers exploit this reputation by stealing IC Markets’ registration details and license numbers for fraudulent activities. These scammers create fake websites to impersonate IC Markets and attract investors. After investors deposit funds, they find themselves unable to withdraw or their accounts are blocked, realizing only then that they have been scammed. Limexx is using a similar tactic, exploiting IC Markets’ name to conduct clone fraud.

8. How to Identify Clone Brokers: Avoiding Scams

Investors can use the following methods to identify clone brokers:

- Verify Regulatory Information: Check the broker’s registration information on the official website of the regulatory authority to ensure consistency with the platform’s claims.

- Examine the Website Domain: Legitimate brokers’ official domains usually match the information registered with the regulatory body. Platforms that use unregistered domains should be approached with caution.

- Check Customer Reviews: Look up other investors’ reviews to assess the platform’s credibility and reputation.

9. Key Elements for Choosing a Legitimate Trading Platform

When selecting a legitimate trading platform, pay attention to the following aspects:

- Regulation: Ensure that the platform is regulated by reputable financial authorities such as the UK’s FCA, Australia’s ASIC, or Cyprus’s CySEC.

- Transparent Operations: Legitimate platforms openly disclose their trading mechanisms, fee structures, and corporate information.

- Secure Trading Environment: Regulated brokers typically provide measures such as segregated client funds and transparent trading records to protect investors’ funds.

10. How Can Investors Verify a Platform’s Authenticity?

Investors should follow these steps to verify a platform’s authenticity:

- Check Regulatory Information: Look up the platform’s license number on the regulatory authority’s official website to ensure it matches the provided information.

- Contact the Regulator: If unsure, directly contact the regulatory authority to verify the platform’s legitimacy.

- Examine Corporate Entity: Search the company registry for the platform’s corporate entity to confirm its existence and its legal operating status.

11. How to Protect Yourself From Clone Broker Scams

Investors should stay vigilant and take the following measures to protect themselves:

- Choose Reputable Platforms: Opt for well-known, strictly regulated platforms and avoid unfamiliar or newly established ones.

- Remain Calm: Approach high-profit claims with caution and fully understand the investment risks involved.

- Monitor Your Account: Regularly monitor your account, and if any irregularities occur, contact the regulatory authority and halt further investments.

12. What to Do If You’ve Already Invested in Limexx

If you have already invested in Limexx, take the following steps immediately:

- Stop Further Investment: Avoid putting in more funds to prevent additional losses.

- Contact Customer Support: Try to contact the platform’s customer support to request a withdrawal or clarify your account status.

- Gather Evidence: Keep all transaction records and communication logs for potential evidence.

- Report to Regulators: Report Limexx’s illegal actions to the relevant regulatory authorities and seek professional assistance.

13. Consequences of Investment Scams and Countermeasures

The consequences of investment scams often include financial loss, psychological stress, and damage to credit. Investors should act promptly:

- Report to Police: Inform local law enforcement agencies about the scam to increase the chances of recovering losses.

- Seek Legal Advice: Consult a professional lawyer to explore possible legal channels to recover losses.

- Enhance Investment Knowledge: Educate yourself on financial knowledge to better understand investment risks and avoid falling for scams again.

14. Steps to Report a Clone Scam Platform to Regulators

- Collect Evidence: Gather relevant transaction records, conversation screenshots, and other proof materials.

- Visit Regulator’s Website: Find the reporting page on the regulator’s website, fill out the complaint form, and upload the evidence.

- Provide Detailed Information: Clearly describe the platform’s actions and your investment experience to assist in the investigation.

15. FAQ: Common Questions About Limexx and Clone Brokers

- Q1: Which regulatory authority oversees Limexx?

- A1: Limexx claims to be regulated by the Seychelles Financial Services Authority (FSA), but it is actually a clone of IC Markets and is not legally regulated.

- Q2: Why are clone brokers so effective in scamming?

- A2: Clone brokers use the registration and regulatory information of legitimate platforms, impersonating regulated platforms to exploit investors’ trust.

- Q3: How can investors verify a broker’s regulatory information?

- A3: Check the broker’s license number on the official website of the claimed regulatory authority and verify its corporate entity and legitimate website.

- Q4: Can investors recover funds after being scammed?

- A4: Although recovering funds can be challenging, investors should report to regulators and police promptly to maximize their chances of recovering losses.

- Q5: Why is Seychelles regulation considered unreliable?

- A5: Seychelles regulation is relatively lax, and its regulatory body exerts weak control over brokers, making clone scams more common in the region.

- Q6: How to select a safe trading platform?

- A6: Choose platforms regulated by reputable financial authorities (e.g., FCA, ASIC, CySEC) and focus on transparency and customer reviews.