Raze Markets claims to offer a variety of financial trading services to global investors, but its corporate background and regulatory information appear unclear, raising many questions.

1. What is Raze Markets?

Raze Markets is an online trading platform that provides a variety of financial products for trading. The platform claims to allow global investors to trade in forex, precious metals, energy, indices, and cryptocurrencies. As a comprehensive trading platform, Raze Markets aims to attract various types of investors and meet their diverse needs.

2. Core Business of Raze Markets

Raze Markets’ main business includes forex, precious metals, energy, stock indices, and cryptocurrency trading. This diversified product line makes it appear to be a one-stop financial trading platform, offering investors a wide range of trading options. However, with many similar platforms in the market, investors need to be extra cautious when making their choice.

3. Raze Markets’ Corporate Background and Registration Information

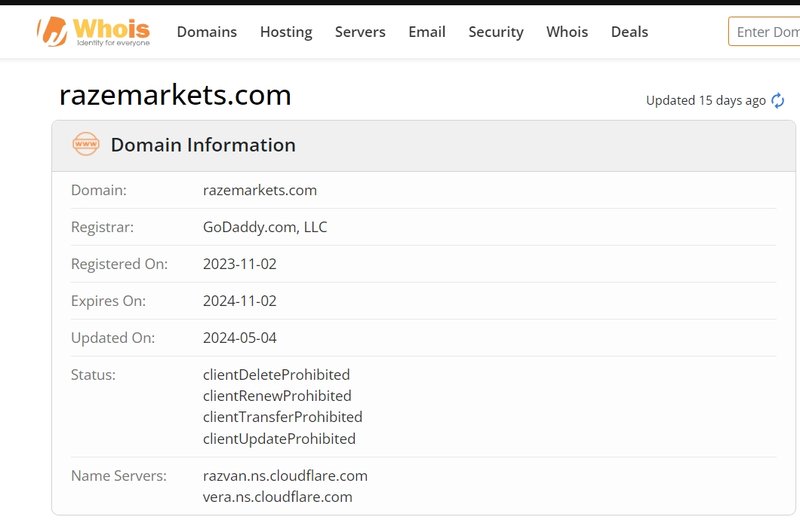

According to the information on its official website, Raze Markets is operated by Raze Global Markets Ltd, registered in Saint Lucia with registration number 2023-00261. Its domain (https://www.razemarkets.com/) was established on November 2, 2023, indicating that the platform has a relatively short operating history.

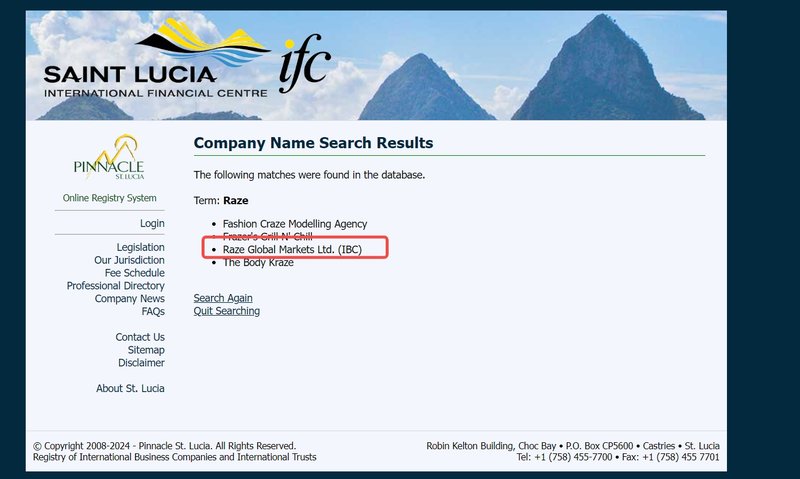

Although Raze Global Markets Ltd does exist in Saint Lucia’s company registration records, this alone cannot directly prove its legality or reliability. Saint Lucia is not known as a major international financial regulatory center and has relatively limited supervision of financial derivative brokerage services. Registering in Saint Lucia might merely be a way to take advantage of the country’s loose regulatory policies.

4. Role of the Saint Lucia International Financial Center (IFC)

The Saint Lucia International Financial Center (IFC) is one of the country’s financial regulatory agencies, responsible for company registration and regulatory affairs. However, it should be noted that the Saint Lucia IFC does not regulate financial derivative brokerage services. Therefore, although Raze Markets is registered in Saint Lucia and supervised by the IFC, this does not mean it has legal qualifications for forex or other financial product trading.

5. Current Regulatory Status of Raze Markets

Currently, Raze Markets claims to provide services to international investors but is not registered with or regulated by major global financial regulatory institutions (such as the UK’s FCA, the US’s CFTC, or Australia’s ASIC). For a platform offering such a wide variety of financial products, the lack of strict regulation poses a significant risk, as it means investors’ funds could be at risk.

6. Transparency Issues with Raze Markets

The platform raises many questions about its transparency. First, there is limited information about its corporate background and operating team, as the website does not provide key information such as detailed company history or team member introductions. Although the platform provides the company’s registration number and location, this information is insufficient to prove its compliance with operational qualifications. When selecting a trading platform, investors usually consider its transparency and the extent of information disclosure, areas where Raze Markets clearly falls short.

7. How to Assess the Reliability of a Trading Platform

When choosing a trading platform, investors should consider various factors, including but not limited to registration information, regulatory credentials, transparency of trading terms, quality of customer service, and user reviews and reputation. While Raze Markets claims to provide services to international investors, its regulatory status and level of information disclosure are notably lacking, which are areas investors should be wary of.

8. User Feedback and Reputation of Raze Markets

Due to its short operating history, Raze Markets has not yet accumulated a large number of user reviews online. However, some investors in trader communities and forums have expressed concerns, mainly about fund safety and withdrawal procedures. Before selecting a platform, investors should learn from other users’ real experiences to evaluate the platform’s reputation and service quality.

9. Trading Conditions and Account Types of Raze Markets

According to information on the official website, Raze Markets offers multiple account types to meet the needs of different investors. In terms of trading conditions, the platform provides various leverage options and trading tools. However, detailed information on spreads, fees, and leverage rules has not been fully disclosed, making it difficult for investors to understand trading costs comprehensively. This lack of transparency is often a characteristic of high-risk platforms.

10. Fund Security and Withdrawal Policy

The fund security and withdrawal policy of Raze Markets remains unclear. Generally, legitimate trading platforms provide detailed policies on fund deposits and withdrawals, including deposit methods, withdrawal timelines, fees, and other details. However, the information provided by Raze Markets in these areas is very limited, raising concerns about the safety of investors’ funds.

11. Quality of Customer Service and Support

Quality customer service is a crucial indicator of the reliability of a trading platform. Whether Raze Markets offers 24/7 customer support, as well as the responsiveness and professionalism of its customer support team, needs further assessment. Investors can test the quality of service by contacting the platform’s customer support to evaluate its operational reliability.

12. Potential Risk Analysis of Raze Markets

Based on the information above, Raze Markets presents several potential risks. First, the uncertainty of its registration location and regulatory information may not provide sufficient protection for investors’ funds. Second, the platform’s short operating history and lack of long-term experience and user reputation increase the risks for investors. Additionally, its lack of transparency makes it difficult for investors to fully understand its trading rules and policies.

13. Comparison of Raze Markets with Competitors

Compared to other regulated trading platforms in the market, Raze Markets is at a disadvantage in terms of transparency, regulatory information, and user reviews. When choosing a trading platform, investors generally prioritize those regulated by internationally recognized institutions (such as FCA, ASIC, CFTC) to ensure fund security and fair trading.

14. How to Protect Your Investment

Investors should always be vigilant and choose regulated platforms for trading. Additionally, they should fully understand the platform’s trading rules, fee structure, deposit and withdrawal policies, and quality of customer service. For platforms that lack transparency and have unclear regulatory information, investors need to be extra cautious to avoid unnecessary losses.

15. Conclusion: Is Raze Markets Worth Trusting?

Although Raze Markets claims to provide a variety of financial trading services to global investors, its corporate background and regulatory information lack transparency, making it difficult for investors to judge its real reliability. Given that it is registered in Saint Lucia, a country that does not strictly regulate financial derivative trading, and that it is not regulated by major international institutions, investors should exercise caution when considering Raze Markets. Overall, investors should consider the platform’s transparency, regulatory information, and user reputation to ensure the safety of their investments.

Frequently Asked Questions (FAQ) About Raze Markets

1. Is Raze Markets Legal?

Raze Markets registers in Saint Lucia under Raze Global Markets Ltd with registration number 2023-00261. However, Saint Lucia lacks strict regulation for financial derivative trading, making Raze Markets’ legality and credibility questionable. The platform does not have registration with major financial regulators like the UK’s FCA, the US’s CFTC, or Australia’s ASIC, so investors should exercise caution when assessing its legality.

2. Is Raze Markets Regulated?

Currently, Raze Markets lacks regulation from internationally recognized financial institutions. Although it registers in Saint Lucia, the Saint Lucia International Financial Center (IFC) does not oversee forex and derivative brokerage businesses.Therefore, Raze Markets’ regulatory status is uncertain, and investors need to consider its potential risks carefully.

3. Is Trading Funds on Raze Markets Safe?

Raze Markets fails to provide evidence of regulation by international agencies, raising concerns about the safety of funds. Legitimate trading platforms usually detail how they store client funds, use segregated accounts, and outline withdrawal policies. However, Raze Markets lacks clarity in these areas, making it hard for investors to assess if their funds receive adequate protection.

4. How to Open an Account on Raze Markets?

On the Raze Markets website, investors can open a trading account by filling in basic information and submitting identity verification documents. However, before opening an account, investors should carefully review the platform’s trading terms, fee structure, and fund security policies, while also considering its regulatory status and user reputation to protect their interests.

5. What Financial Products Does Raze Markets Offer?

Raze Markets claims to offer trading services for forex, precious metals, energy, indices, and cryptocurrencies. This diversified product line makes it appear to be a comprehensive financial trading platform. However, due to a lack of transparent regulation and detailed trading terms, investors should remain cautious and fully understand the risks associated with each product before trading.

6. What Deposit and Withdrawal Methods Does Raze Markets Support?

Raze Markets has not disclosed detailed information about its deposit and withdrawal methods and policies. Generally, legitimate trading platforms offer multiple deposit and withdrawal methods, including bank transfers, credit cards, and e-wallets, and clearly explain withdrawal times and fees. However, Raze Markets’ related information remains unclear, and investors should inquire with customer service before making a deposit.

7. What Are Raze Markets’ Trading Fees and Spreads?

Raze Markets has not explicitly listed its trading fees, spreads, or leverage rules on its website. Transparent trading costs are a key feature of legitimate trading platforms, so investors should be wary of platforms that do not disclose their fee structure to avoid hidden costs during trading.

8. How Is Raze Markets’ Customer Service?

Currently, the quality of Raze Markets’ customer service is yet to be verified. Generally, legitimate trading platforms provide 24/7 customer support, including phone, email, and online chat. When considering Raze Markets, investors can first try contacting their customer support team to test the speed and professionalism of their response.