The ABUSA broker has raised concerns among investors, warranting caution regarding its operations and legitimacy.

Background of ABUSA Broker

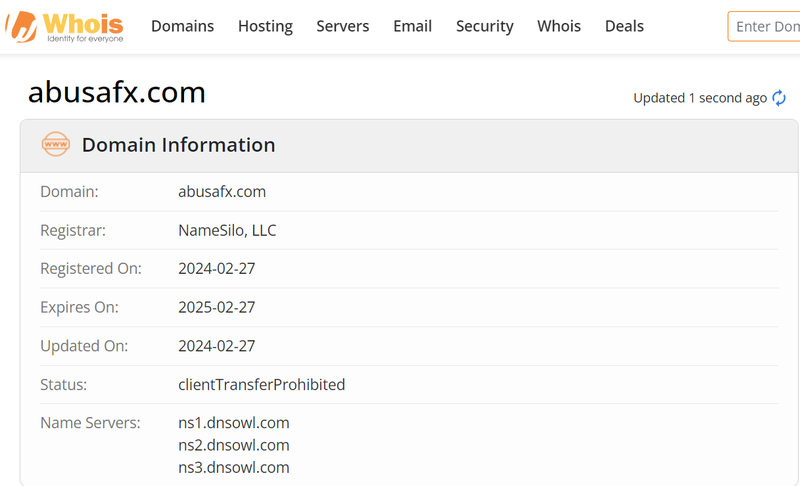

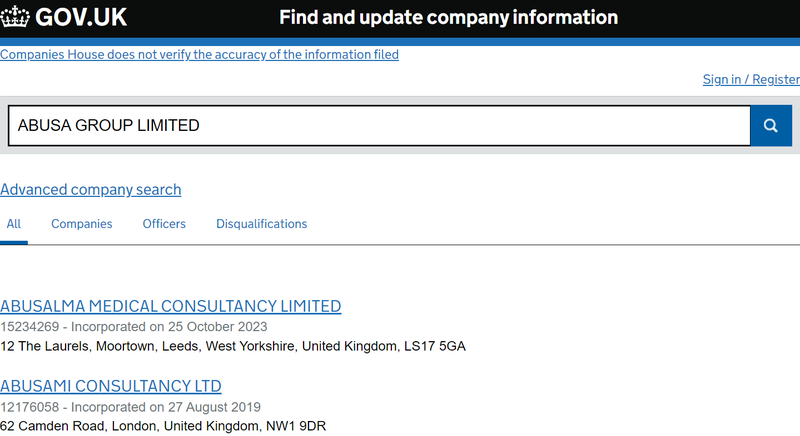

In the financial market, many investors are eager to find new trading platforms for higher returns. However, the emergence of ABUSA has sparked numerous doubts. Since its registration in 2024, the platform claims to offer a variety of financial derivatives trading services, including forex, stocks, futures, energy, precious metals, and cryptocurrencies. Despite its website stating that its headquarters are in London and it is registered as ABUSA GROUP LIMITED, in-depth investigations reveal a lack of transparency in its registration information, raising questions about its legality.

ABUSA’s marketing emphasizes its “professional trading” services, attracting many novice investors. Many are drawn in by promises of high returns, believing that investing in forex and cryptocurrencies is a quick path to wealth. However, the insufficient background information presents clear risks for investors facing such an ambiguous trading platform.

Corporate Registration and Regulatory Status

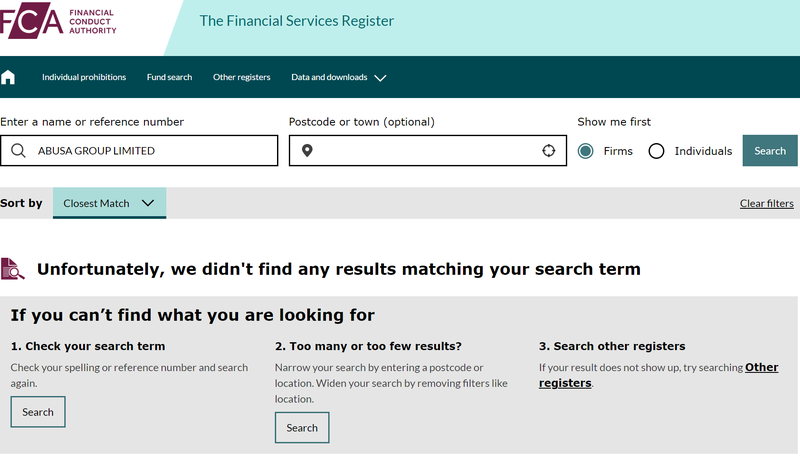

Upon checking with the UK Companies House and the Financial Conduct Authority (FCA), we found no records of any registration for ABUSA GROUP LIMITED. Furthermore, the U.S. Financial Crimes Enforcement Network (FinCEN) also lacks any registration information for this entity. This lack of regulatory oversight significantly questions the platform’s legitimacy.

In the financial sector, legality and regulation are crucial. For instance, reputable brokers like IG Group and CMC Markets are supervised by multiple national regulatory bodies, ensuring transparent and safe trading. In stark contrast, ABUSA completely lacks such necessary regulatory support, posing high potential risks for investors who might face significant financial losses while trading on this platform.

Design and Content Plagiarism

The website design and content of ABUSA closely resemble those of other known potential scam platforms like CPT Limited and Unisnfx. Such design patterns are a hallmark of scam platforms, where fraudsters mislead investors by copying existing platforms to gain their trust.

This situation is not uncommon in the scam world. For example, Fx-Trade and InvestForex also adopted similar designs to confuse potential victims and lure more investors. Many individuals, lacking professional knowledge, may be easily misled by these counterfeit sites, ultimately resulting in substantial financial losses.

How to Identify Financial Scams?

Identifying financial scams is not an easy task, as many scammers employ clever tactics to conceal their true intentions. Here are some common characteristics of scams to help investors remain vigilant:

- Lack of Regulation: Absence of certification from any financial regulatory authority is a primary warning sign. Legitimate platforms typically display their regulatory information on their websites.

- Promises of High Returns: Promising quick, high returns is often a trap. Scammers may attract investors with “risk-free investments,” but the actual risks are exceedingly high.

- Opaque Operations: If platform information is vague and difficult to verify, investors should thoroughly review the company’s history and user feedback before registering.

Real Case Analysis

- Wirecard Scandal: The German payment company Wirecard collapsed after being exposed for financial fraud, leading to billions of euros in losses for numerous investors. This incident illustrates how unregulated financial firms can cause widespread investor losses.

- BitConnect: This was a Ponzi scheme where investors were promised high returns, resulting in the majority losing their investments. The collapse of BitConnect serves as a reminder for investors to conduct thorough research when selecting investment projects.

These cases emphasize the necessity for in-depth investigation and verification when investing, ensuring a clear understanding of a platform’s background and market reputation.

What Should I Do If I’ve Been Scammed by ABUSA?

1. Can I Get My Money Back?

The likelihood of recovering funds depends on various factors, including the specifics of the transactions and payment methods used. If payment was made via credit card, you might be able to request a refund through your card issuer. However, recovery becomes significantly more challenging for bank transfers or cryptocurrency transactions.

For instance, some victims who paid scam platforms via credit card managed to recover part of their funds through their card issuers. Conversely, many victims who used cryptocurrency transfers face little chance of recovery since the irreversibility of cryptocurrency transactions makes tracing funds extremely difficult.

2. Is It Reliable When Someone Claims They Can Help Me Recover My Funds?

Many so-called “fund recovery companies” advertise online that they can help victims recover lost funds. While some companies may provide legitimate services, many are also scams. When selecting these companies, it’s crucial to proceed cautiously, reviewing their history and user feedback. Seeking professional legal advice can help ensure that the chosen entity is credible.

3. Where Can I Report ABUSA?

Investors can report to local consumer protection agencies or financial regulatory authorities. For example, in China, you can report to the China Securities Regulatory Commission; in the UK, contact the FCA. These organizations typically investigate financial fraud and take appropriate actions.

Additionally, dedicated channels for reporting financial scams can often be found on social media platforms, where victims can share their experiences and raise public awareness.

4. Are There Groups for ABUSA Victims?

Social media and dedicated investment forums often feature victims sharing their experiences. Joining these groups can provide you with more information and connect you with others who have had similar experiences. In these communities, victims can exchange ideas, share strategies for coping, and collectively seek solutions.

In the current complex financial market, investors must possess a high degree of vigilance and judgment. The situation surrounding the ABUSA broker serves as a reminder to exercise caution when selecting trading platforms, ensuring their legality and transparency. By enhancing financial knowledge and understanding the market, investors can better safeguard their assets and avoid falling into scams.

Frequently Asked Questions (FAQ)

Q1: Is ABUSA Broker Legitimate?

A1: Based on current information, ABUSA Broker lacks necessary regulation, and its registration information is opaque, raising concerns about its legitimacy.

Q2: What should I do if I’ve lost money investing with ABUSA?

A2: First, try to request a refund through your card issuer or bank, and consider seeking professional legal advice for other potential recovery options.

Q3: How can I determine if a trading platform is safe?

A3: Check if it is regulated, review user ratings and feedback, and understand its operational history and transparency.

Q4: Are there discussion groups for victims of ABUSA?

A4: Yes, social media and investment forums often have victims sharing experiences and information.

Q5: Are ABUSA’s promised high returns trustworthy?

A5: Generally, promised high-return investment projects pose high risks and should be approached with caution.

Q6: Who should I report to if I encounter financial fraud?

A6: You can report to local consumer protection agencies or financial regulatory authorities, and also report on social media platforms.