TNFL FX Forex broker falsely claims regulation, lacks transparency, and is highly similar to other suspicious platforms. Investors should be wary of its potential risks.

Introduction

TNFL FX is a foreign exchange broker registered on September 7, 2023, claiming to provide a variety of financial derivatives trading services, covering foreign exchange, stocks, futures, energy, precious metals and cryptocurrencies. The platform positions itself as an international service provider, claiming to be headquartered in London, UK, and to operate under dual supervision from both the UK and the United States. However, in-depth investigations reveal serious regulatory loopholes, along with significant issues regarding its registration information and legality. This makes TNFL FX appear more like a well-disguised foreign exchange fraud platform rather than a legal and credible trading platform.

In this article, we will analyze in detail the company background of TNFL FX, false regulatory information, similarities with other fraud platforms, and typical fraud cases in reality to help investors identify such potential financial traps.

1. Overview of TNFL FX and Its Trading Services

1.1 Introduction to TNFL FX Platform

TNFL FX claims to be a global forex broker that offers trading in derivatives such as forex, stocks, futures, precious metals, and cryptocurrencies. It asserts that its headquarters is located in London, UK, and is registered with Companies House. The platform promotes a wide range of financial services aimed at investors worldwide, attempting to establish itself as a leading forex broker on a global scale.

1.2 Main Trading Products and Services

TNFL FX promises to provide investors with trading services for the following major financial products:

- Forex Trading: Covers major, minor, and emerging market currency pairs, offering a variety of options for trading.

- Contracts for Difference (CFD) Trading: Users can trade CFDs on stocks from major global companies without actually owning the stocks.

- Futures Trading: Includes futures for energy, commodities, and indices, providing investors with a broad selection of futures markets.

- Precious Metals Trading: Trading in CFDs for traditional safe-haven assets such as gold and silver.

- Cryptocurrency Trading: Offers CFDs for major cryptocurrencies like Bitcoin and Ethereum.

While these product offerings appear attractive and cater to the needs of professional investors, concerns emerge about the platform’s actual operational status, particularly regarding regulation and security.

2. Regulatory and Registration Concerns Regarding TNFL FX

2.1 Questionable Regulatory Claims

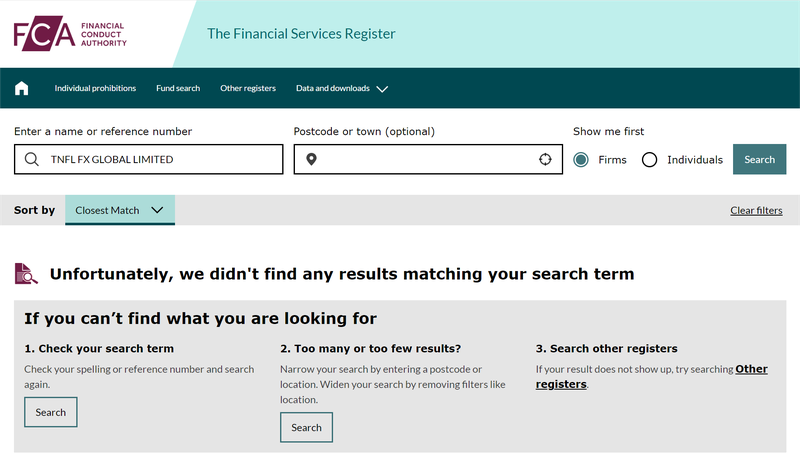

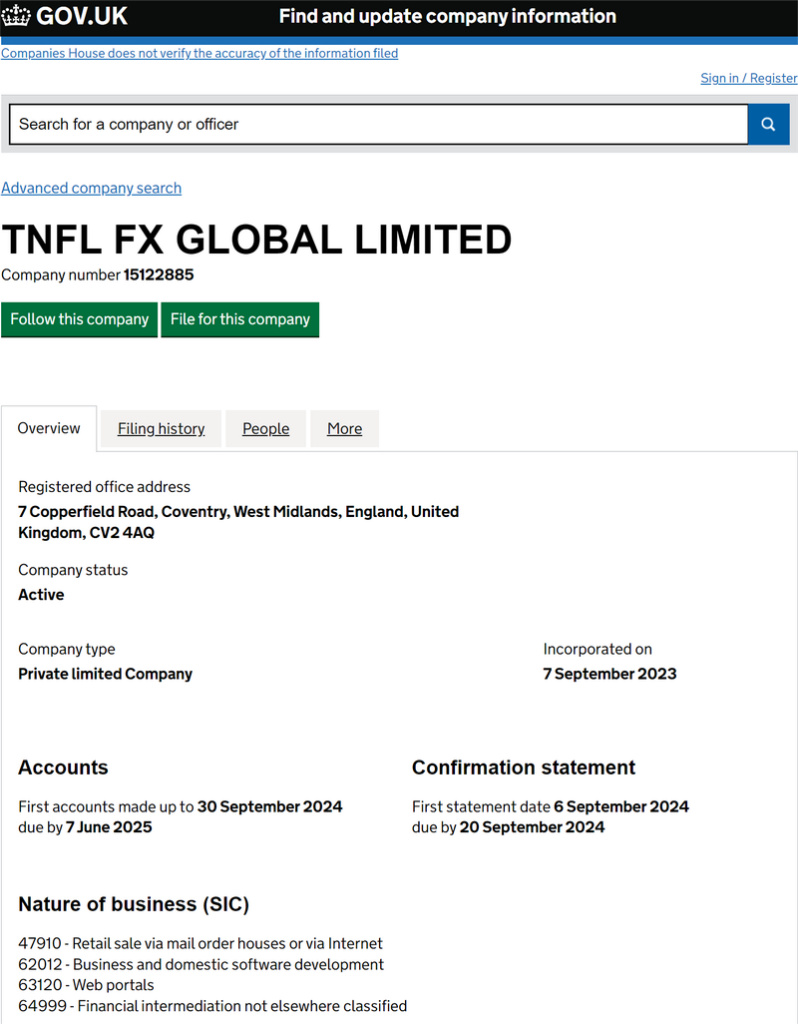

TNFL FX’s official website claims that its corporate entity, TNFL FX GLOBAL LIMITED, registers with Companies House in the UK and lists with the Financial Crimes Enforcement Network (FinCEN) in the United States. These statements aim to instill confidence in investors about the platform’s regulatory compliance.

However, upon verifying data from Companies House, I found that TNFL FX GLOBAL LIMITED holds the registration number 15122885, but it has not registered with the UK Financial Conduct Authority (FCA). Any financial institution operating in the UK must obtain approval and regulation from the FCA, but TNFL FX does not appear in the FCA’s registry. This absence indicates that TNFL FX is not subject to oversight by UK regulatory authorities, raising serious doubts about the legitimacy of its operations.

Furthermore, TNFL FX claims to be registered with FinCEN. However, further investigation reveals that FinCEN’s official website does not list this company as registered. This fact highlights that TNFL FX’s regulatory claims are entirely misleading, designed to mislead investors into believing the platform is legitimate.

2.2 Limited Contact Information and Opaque Operations

The TNFL FX website only provides a single email address as the sole means of customer support, without disclosing any office address or phone number. This operational model appears exceedingly secretive and lacks transparency. In typical financial services, reputable companies usually offer multiple contact methods and publicly disclose their office addresses for user inquiries. However, TNFL FX’s limited and singular contact option leaves investors with almost no effective means to reach the company in case of issues.

This lack of transparency casts significant doubt on whether the platform operates as a legitimate business.

3. Similarities Between TNFL FX and Other Suspicious Platforms

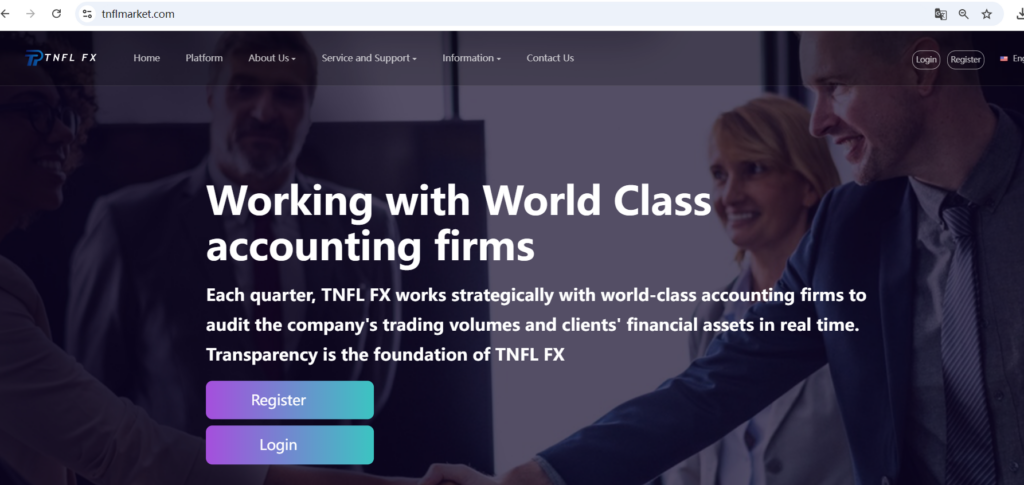

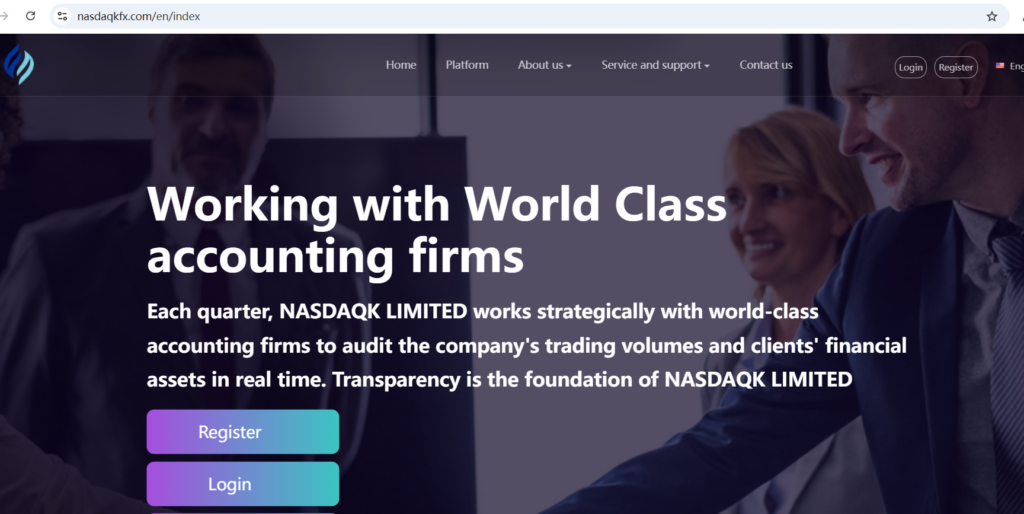

3.1 Website Design Similarities with Other Scam Platforms

An analysis of the TNFL FX official website reveals that its design, content layout, and even trading conditions closely resemble those of other well-known forex scam platforms. These include CPT Limited, Unisnfx, XCY Global Ltd, BCC Markets Limited, Texttforex, Maxtra Financial Limited, and GYG Investment Ltd. Not only do these platforms exhibit nearly identical website styles, service terms, and user agreements, but they also utilize the same technical templates for customer service and trading tools.

This widespread similarity suggests that TNFL FX likely shares technical support with these scam platforms and could be part of a broader operation run by the same fraudulent group. These platforms continue to perpetrate scams globally by frequently changing names and domain names.

3.2 Common Scamming Patterns

TNFL FX shares not only website design similarities with these scam platforms but also employs highly similar fraudulent tactics, typically including the following:

- False Regulatory Claims: Claiming to be regulated by reputable financial authorities while lacking any actual oversight.

- Attractive Trading Conditions: Offering unrealistic high leverage and low spreads to entice investors to deposit funds quickly.

- Withdrawal Restrictions: Delaying or blocking withdrawal requests with various excuses, and even demanding additional fees.

- Lack of Customer Service: When investors encounter issues or file complaints, customer support becomes unresponsive, with emails going unanswered.

These common operational patterns indicate that TNFL FX may be part of a global financial scam network that specifically targets unsuspecting investors for fraudulent activities.

4. Real Cases: Lessons Learned from Forex Scams

4.1 Case One: Scam of a Platform with False Regulatory Claims

In the UK, a forex broker claiming to be regulated by the FCA attracted a large number of investors, who were drawn in by the platform’s high leverage and low fees. However, when investors attempted to withdraw their funds, the platform repeatedly delayed the process with reasons such as “account verification” and “transaction fees,” ultimately locking a significant amount of investor funds. The FCA eventually discovered the platform and shut it down, but most investors were unable to recover their funds.

4.2 Case Two: A Multinational Scam Network Sharing Website Templates

In a similar case, multiple forex brokers used identical website templates and interface designs while frequently changing their brand names to conduct scams. These platforms employed consistent fraudulent tactics, enticing investors to deposit large sums of money, then deliberately obstructing withdrawals or shutting down the platform when investors requested their funds. By frequently changing domain names and brand identities, these scam groups carried out financial fraud in several countries, affecting thousands of investors.

These cases warn investors to remain highly vigilant when selecting forex brokers, especially those claiming to be regulated but lacking verifiable legitimacy.

5. How to Identify and Avoid Forex Scam Platforms

5.1 Verify the Platform’s Regulatory Credentials

Legitimate financial platforms should be registered with relevant regulatory authorities. Investors can check their regulatory numbers through official websites. For example, the UK’s FCA, Australia’s ASIC, and the USA’s CFTC all provide public verification services. If a platform claims to be regulated but lacks verifiable information on these regulatory sites, investors should be cautious.

5.2 Be Wary of Similar Website Designs and Suspicious Operational Practices

Investors should pay attention to whether the forex broker’s website exhibits noticeable similarities to other known scam platforms. Multiple platforms sharing the same design template may signal a scam network. Additionally, if a platform only provides a single contact method or does not disclose a clear office address, investors should remain skeptical.

5.3 Unrealistic Promises of High Returns

Scam platforms often promise exceptionally high returns and low fees; however, in reality, high returns always come with high risks. Investors should avoid being lured by overly enticing offers and rationally assess the legitimacy and risks associated with the investment platform.

6. FAQ – Frequently Asked Questions

- Is TNFL FX regulated by the FCA or FinCEN? No, despite TNFL FX’s claims of being regulated by the FCA and FinCEN, verification shows that the company is not registered with any regulatory agency, thus lacking effective oversight.

- What trading products does TNFL FX offer? TNFL FX claims to provide trading in forex, CFDs on stocks, futures, precious metals, and cryptocurrencies, but its legitimacy is questionable.

- Why is TNFL FX so similar to other platforms? TNFL FX shares identical website designs and operational patterns with other scam platforms, indicating it may belong to the same fraudulent network.

- How can I avoid forex scams? Verifying regulatory information, being wary of similar website designs, and staying alert to the trading conditions offered by platforms are key to avoiding forex scams.

- Is TNFL FX safe? The regulatory and registration information of TNFL FX is opaque, and its high similarity to other scam platforms suggests that investors should proceed with caution.