While Athens Markets claims to offer forex trading services, its lack of registration and regulatory oversight makes it a high-risk platform, raising concerns over investor fund safety.

1. The Rise of Forex Scams: An Overview of Athens Markets

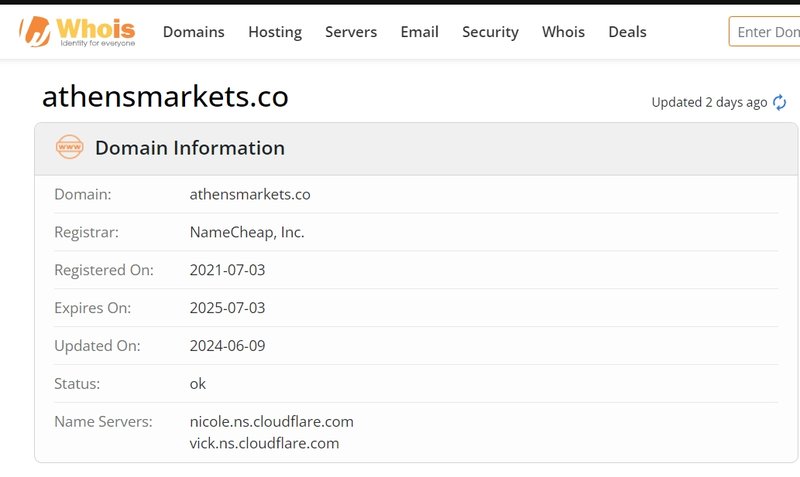

As the global forex market continues to expand, numerous platforms are emerging, offering promises of high returns and convenient trading services. However, many of these platforms conceal potential traps and risks, and Athens Markets is one such platform that investors should be wary of. Established on July 3, 2021, Athens Markets claims to offer forex trading services, but its company background and legitimacy have been widely questioned.

Athens Markets’ website claims the platform is operated by Athens Markets Ltd. However, the company has failed to provide any valid registration information in the relevant countries or regions. This lack of transparency is a common feature among many fraudulent platforms, which use false claims about their corporate background to exploit investor trust and cover up illegal operations.

2. The Major Risk of Lack of Regulation

The greatest risk posed by Athens Markets stems from its lack of oversight by any financial regulatory body. Legitimate financial institutions, such as forex brokers, typically register with the regulatory authority of the country where they operate and follow strict oversight. For example, forex platforms in the UK register with the Financial Conduct Authority (FCA), and in the US, brokers register with the Commodity Futures Trading Commission (CFTC).

Why is regulation so important?

Regulation not only provides legal protection but also ensures transparent fund management and operations. Unregulated platforms like Athens Markets are not subject to legal constraints and may engage in fund misappropriation or fraud at any time. Despite the enticing claims a platform may make, the absence of regulation means that investors are at risk of losing funds without any legal recourse.

Case Study: The “Secure Investment” forex scam that surfaced in 2016 is a prime example. This platform claimed a professional team operated it and attracted thousands of global investors. However, it never obtained regulation and suddenly disappeared, taking investors’ money with it. The Secure Investment scam shares many similarities with Athens Markets, including the lack of transparent regulation and corporate background, making it a warning sign for potential investors.

3. Misleading Marketing of Trading Platforms: MT4 and MT5 on Athens Markets

Athens Markets claims to offer access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, widely respected among global traders for their advanced charting and automated trading features. However, offering these platforms does not automatically make Athens Markets safe or legitimate.

Athens Markets does not provide its own proprietary trading platform or mobile app, relying solely on the MT4 and MT5 systems. This reliance on well-known software brands seems designed to attract investors by leveraging the reputation of these tools. However, using popular trading platforms does not replace the need for transparent regulation and solid fund protection mechanisms.

Case Analysis: In 2018, the European platform “Trade12” also used the MT4 platform, yet it was ultimately revealed to be a fraudulent operation. The platform used heavy advertising to attract users and used the MT4 brand to create an illusion of legitimacy. However, Trade12 was not regulated, and investors lost millions of dollars when the platform shut down. Athens Markets’ operations raise similar concerns, as despite offering reputable trading software, the platform’s overall legitimacy remains unverified. Both MT4 and MT5 are only as secure as the platform using them.

4. Ambiguity of Forex Products: Athens Markets’ Product Shortcomings

Athens Markets claims its core business is forex trading. The platform lacks a clear list of products or detailed explanations. Investors cannot find information on trading pairs, spreads, or leverage. This lack of transparency is common in forex scams, where platforms withhold details to mislead investors about trading conditions.

Why is clear product information crucial?

Legitimate forex trading platforms typically provide detailed product information, including the available currency pairs, spread fees, and leverage ratios, allowing investors to make informed decisions. If this vital information is missing, investors cannot determine whether the trades align with their investment goals or risk tolerance.

Financial Scam Example: In 2011, a platform named “FXCM Asia” misled investors with vague product information and was eventually fined for fraud by Singaporean regulators. The platform deliberately concealed details about trading conditions, causing investors to misunderstand the true costs and leverage involved in their trades, leading to significant losses. This kind of ambiguity is a critical warning sign for investors considering Athens Markets.

5. Why Athens Markets Might Be a Scam

- Lack of regulation and high fund risk: As previously mentioned, Athens Markets has not disclosed any regulatory details nor registered with any major financial regulatory bodies. This gives the platform considerable freedom to manipulate investor funds, and once issues arise, it will be difficult for investors to recover their losses.

- Lack of transparent corporate background: While Athens Markets claims to be operated by Athens Markets Ltd, there is no publicly available or verifiable information about the company or its representatives. False company backgrounds are a hallmark of investment scams.

- Non-transparent product information: Athens Markets provides little to no details on its products, leaving investors in the dark about key data such as specific trading pairs, spreads, and leverage. This lack of transparency is not only irresponsible but is a common tactic in scams, where similar frauds have occurred many times before.

- Relying on third-party platforms to create a false sense of legitimacy: Athens Markets offers MT4 and MT5 platforms but does not have any proprietary trading systems or applications. This tactic is often used to create a veneer of legitimacy, misleading investors into believing the platform is recognized by trusted tools. However, trading software is merely a tool and does not guarantee the platform’s legitimacy.

6. User Experience and Technical Support at Athens Markets

When evaluating financial trading platforms, user experience and technical support are key factors influencing investors’ decisions. Although Athens Markets claims to offer the popular MT4 and MT5 trading platforms, its performance in other core service areas raises serious concerns. A deeper analysis of Athens Markets’ operations and technical support reveals potential issues and risks.

1. Limited Use of MT4 and MT5 Platforms

Although traders worldwide trust MT4 and MT5 for their powerful chart analysis and automated trading features, Athens Markets relies on these tools without ensuring the platform’s overall service quality.

- Platform support is lacking: Although MT4 and MT5 offer many features, their efficiency depends on the platform’s backend support and infrastructure. Reputable trading platforms often provide additional optimization and technical support to ensure stable trading operations. However, Athens Markets has not demonstrated any significant effort to improve the user experience or offer technical support, suggesting potential operational inefficiencies.

- Tool limitations: MT4 and MT5 offer standard trading tools, but Athens Markets lacks additional features such as proprietary tools or customizable strategies. This limitation reduces the platform’s value for traders looking for advanced and flexible options.

2. Inadequate Customer Support System

Successful trading platforms require not only a stable trading system but also robust customer support to resolve issues quickly. Athens Markets’ performance in this regard is questionable, with the following flaws:

- Lack of multi-channel support: Reputable forex platforms typically offer 24/7 multi-channel customer service through phone, email, and live chat, ensuring timely responses to investor concerns. Athens Markets does not provide a clear multi-channel support system, relying solely on basic email or web form submissions. This type of support is insufficient for the complex needs of the financial market, particularly in emergencies when investors need immediate assistance.

- Slow response times and limited efficiency: Most established platforms offer fast customer response services, ensuring that issues are resolved quickly. While Athens Markets displays contact information on its website, it does not demonstrate the capability to provide timely responses. This could lead to delays and unnecessary risks for users needing urgent resolution of trading issues.

3. Lack of Educational Resources

In forex trading, educational resources are crucial for helping traders improve their skills, understand market dynamics, and optimize strategies. High-quality platforms not only provide trading tools but also offer comprehensive learning resources to help users navigate the market. However, Athens Markets is notably deficient in this area.

- Lack of basic learning materials: While some forex platforms offer educational centers, webinars, and market analysis tools, Athens Markets does not provide any comparable learning resources. From beginner guides for new traders to strategy development support for advanced users, Athens Markets fails to provide sufficient educational assistance.

- Limited market analysis tools: In the fast-paced forex market, traders rely on real-time market analysis and technical indicators. While Athens Markets claims to integrate tools like TradingView, these features are not yet available on the platform. The lack of robust market analysis tools makes it difficult for investors to make informed decisions, increasing trading risks.

4. Restrictions on Deposit and Withdrawal Processes

Fund liquidity is a critical concern for traders, as the security and accessibility of funds directly impact their trust in the platform. The inconvenience surrounding Athens Markets’ deposit and withdrawal processes has raised questions about its legitimacy.

- Lack of transparency in fund flow: Legitimate forex platforms clearly disclose their fees and processing times for deposits and withdrawals. However, Athens Markets does not provide specific details regarding fees or procedures for fund transactions. Investors have little visibility into how their money is handled, increasing the risk of fund restrictions or other issues.

- Complicated withdrawal terms: Reliable trading platforms typically offer various withdrawal options and promptly transfer funds. Athens Markets does not clearly outline its withdrawal process and provides no details about potential fees or delays. This can lead to unnecessary obstacles for traders trying to access their funds, increasing investment uncertainty.

5. Payment Channels and Compliance Issues

Forex platforms usually ensure the safety and transparency of fund flows through partnerships with reputable payment service providers. However, Athens Markets lacks sufficient transparency in its payment channels, further increasing the platform’s risks.

- Lack of transparency in payment systems: Athens Markets does not list its payment processors or provide clear information on how funds are handled. This lack of transparency in payment systems can lead to uncertainty in fund transfers and put investor money at risk.

- Limited payment options: Legitimate platforms typically offer users multiple payment options, such as credit cards, bank transfers, and electronic payment methods, for easy deposit and withdrawal of funds. Athens Markets offers limited payment options, highlighting its shortcomings in fund handling and potential risks.

7. Conclusion

Athens Markets claims to offer forex trading services, but it lacks clear registration and financial regulation. This makes it a risky investment platform. As forex scams rise globally, investors need to stay alert when selecting platforms to avoid losses. Regulation and transparency are essential for evaluating a forex platform’s legitimacy. Athens Markets fails in both, urging investors to stop any involvement immediately.

Athens Markets Scam Frequently Asked Questions (FAQ)

1. What is Athens Markets?

Athens Markets is a platform claiming to provide forex trading services, with its domain established on July 3, 2021. Athens Markets Ltd claims to operate the platform, but it provides no legal registration information or financial regulatory supervision. This lack of transparency and regulation makes Athens Markets a high-risk platform.

2. Why isn’t Athens Markets regulated?

Athens Markets lacks regulation and is absent from major financial regulatory listings like the UK’s FCA or the US’s CFTC. Without oversight, investor funds remain unprotected, making it hard to recover losses in case of disputes.

3. Are the forex trading services offered by Athens Markets reliable?

Although Athens Markets claims to offer forex trading services, it has not provided details about its trading products or conditions, such as spreads or leverage ratios. This lack of transparency means investors cannot fully understand the risks involved. Therefore, the platform’s services are highly unreliable.

4. Does the use of MT4 and MT5 prove Athens Markets is legitimate?

While MT4 and MT5 are globally recognized trading software used by many legitimate forex brokers, the use of these platforms does not validate the legitimacy of Athens Markets. Unregulated platforms, even if they use advanced trading tools, may still engage in fraudulent activities.

5. How can investors tell if Athens Markets is a scam?

Investors should focus on the following points:

- Regulatory information: Is the platform regulated by a legitimate financial authority?

- Company background: Has the platform provided verifiable registration and background information?

- Product transparency: Does the platform provide detailed information about trading products such as spreads and leverage?

- High return promises: Be cautious of any platform offering low-risk, high-return investments.

Athens Markets falls short in all these areas, and investors should exercise extreme caution.

6. What should I do if I’ve already invested in Athens Markets?

If you have already invested in Athens Markets, it is recommended to take the following steps:

- Try to withdraw your funds from the platform as soon as possible to minimize losses.

- Keep all transaction records and communications with the platform as evidence for potential legal action.

- Report the platform’s misconduct to local financial regulators and consult legal professionals.

- Warn friends and family to avoid falling into similar investment traps.