Flaggroup is a financial platform lacking transparency and regulatory oversight. Despite its long-standing domain history, the platform provides little operational information, and investors should exercise caution when considering it.

1. Overview of Flaggroup

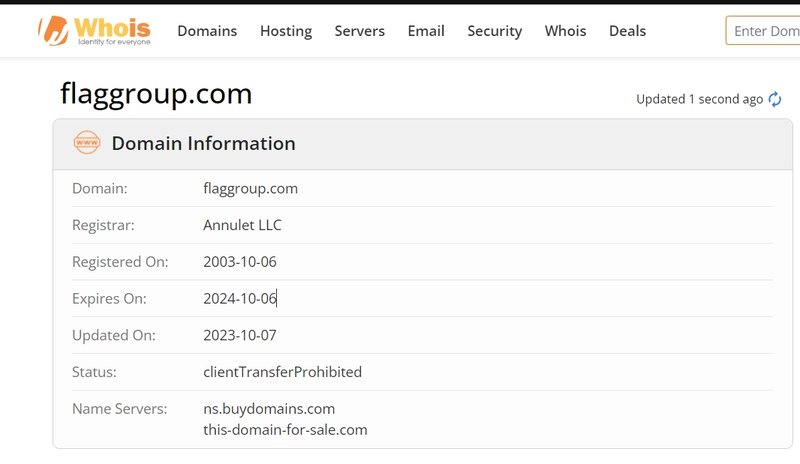

Flaggroup is a financial trading platform, and while its domain was registered in 2003, it did not make its online debut until 2024. The platform claims to offer investment and trading services, but due to the absence of public company registration and operational details, investors have raised concerns about its transparency and legitimacy. In today’s increasingly complex global financial markets, investors expect higher standards from trading platforms, including detailed information about their background, regulatory status, and security of funds.

2. Company Background of Flaggroup

Flaggroup’s domain was first registered on October 6, 2003, but it did not appear to operate publicly until May 25, 2024. The company has yet to disclose any corporate registration information, leading to widespread skepticism. Transparent corporate background information not only helps build investor confidence but also allows for a better understanding of the company’s operational history and leadership.

For an investment platform, publicly available corporate information is a critical indicator of its legitimate operation. Legitimate platforms typically provide details about their headquarters, registration, and key management team members. This information helps investors gauge the platform’s authenticity and assures them that their funds are secure.

In the case of Flaggroup, the absence of such basic corporate details makes it impossible for investors to verify its legitimacy. Without company registration records or a clear operational history, investors are left uncertain about the platform’s qualifications.

3. Lack of Regulatory Oversight

Currently, Flaggroup operates without any form of regulatory oversight. This means that no globally recognized financial regulatory body monitors the platform’s activities. For financial investors, regulation is a cornerstone of a platform’s security and reliability. In most countries, specific regulatory bodies oversee foreign exchange, contracts for difference (CFD) trading, and other financial investment services, enforcing strict rules to ensure fair trading and protect investor funds.

Well-known regulatory bodies such as the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC) require platforms to submit regular audit reports, manage client funds transparently, and undergo rigorous compliance checks. Flaggroup’s lack of regulation suggests that it may not adhere to these standards, leaving investor funds unprotected and without recourse to dispute resolution mechanisms.

Choosing a regulated platform can significantly reduce the risk of unfair trading practices and ensure that investor funds are not misappropriated. In this context, investors should be especially cautious of unregulated financial platforms like Flaggroup, as they may pose substantial financial risks.

4. Website Design and Suspicious Features

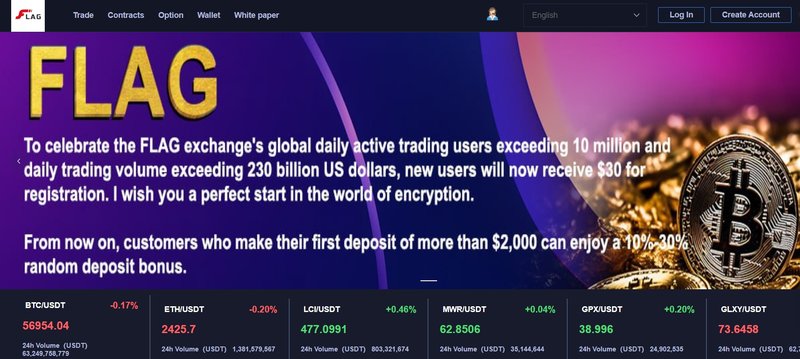

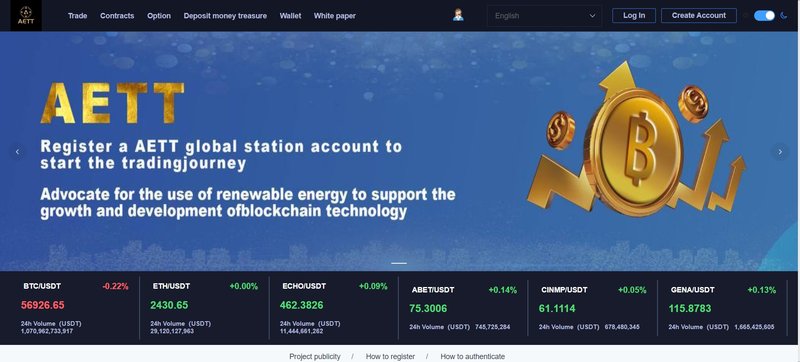

From a user experience and visual design standpoint, Flaggroup’s official website (https://www.flaggroup.co) does not display a high level of professionalism. Reports indicate that Flaggroup’s website design is identical to another platform, AETT Global (https://www.aettgroup.co), raising further concerns. Typically, legitimate financial platforms design unique websites that align with their brand identity and target user base to enhance user experience and build trust.

Similar website designs across multiple platforms may indicate that the same group mass-produces these platforms, aiming to attract different investors with similar layouts instead of offering quality service or innovation. This approach not only lacks originality but also casts doubt on the platform’s professionalism.

Moreover, Flaggroup’s website design is of low quality, lacking the visual appeal and functionality expected from a professional financial platform. This detracts from investor trust and suggests that the platform may not have invested enough resources into optimizing user experience or maintaining technical infrastructure.

5. Lack of Trading Information

A legitimate financial platform typically provides investors with detailed information about its trading conditions, including account types, trading platforms, leverage ratios, spreads, commissions, and deposit/withdrawal methods. However, Flaggroup has not offered enough transparency in these areas. The platform does not specify its supported trading instruments, leverage ratios, or procedures for fund deposits and withdrawals, leaving investors with more uncertainty when considering whether to engage with the platform.

For any investor, understanding a platform’s trading conditions is crucial. For example, account types and spreads directly affect trading costs, while leverage ratios determine the risk and return potential of an investment. A well-established financial platform usually offers multiple account types to cater to different investor needs, along with clear information on fees and leverage ratios. Flaggroup’s failure to provide this information further heightens concerns about its transparency.

Additionally, the platform has not clarified its deposit and withdrawal processes. A transparent and convenient process for handling deposits and withdrawals is a key indicator of a reliable platform. Investors need to know when their funds can be safely deposited into accounts, when they can be withdrawn, and whether any additional fees apply. The absence of this critical information can lead to complications during transactions or, in the worst-case scenario, result in financial loss for investors.

6. The Importance of Investor Protection

In modern financial markets, investor protection mechanisms are vital. Legitimate financial platforms typically implement several measures to safeguard investors’ interests, including fund segregation, negative balance protection, and dispute resolution services. Segregated accounts keep customer funds separate from the platform’s operating funds, while negative balance protection limits an investor’s losses to their account balance, even in volatile markets.

Flaggroup has not indicated whether it implements any of these protective measures. The absence of clear fund protection mechanisms increases the potential financial risk for investors and raises doubts about the overall security of the platform.

7. How to Assess the Legitimacy of a Financial Platform

When selecting a trading platform, investors should prioritize transparency and legitimacy. The following points can help evaluate a platform’s safety and trustworthiness:

- Check the platform’s regulatory information: A regulated platform will clearly state which financial regulatory body oversees its operations and provide a license number. Investors can verify these details through the regulatory body’s official website.

- Examine company background: A legitimate trading platform usually discloses its company registration and management team details. Investors can verify the company’s background by searching public records or checking relevant corporate registration information.

- Read user reviews and feedback: Investors can gain insights into other users’ experiences by reading online reviews, forum discussions, or third-party review websites. If a platform receives numerous negative reviews, particularly concerning fund safety or customer support, its credibility should be questioned.

- Ensure fund security measures are in place: Reputable platforms will clearly explain their deposit/withdrawal processes, fees, and fund protection mechanisms. If a platform lacks transparency in this area, investors should exercise caution.

- Website design and functionality: A professional platform often features a well-designed website with rich functionality, such as multilingual support, trading tools, and account management features. This not only enhances the user experience but also demonstrates the platform’s commitment to technical support.

While Flaggroup’s domain has been registered for many years, its actual presence in financial markets is recent, and the platform lacks transparency in terms of corporate background and regulatory information. These issues, combined with poor website design, suggest that investors should approach Flaggroup with caution. When entering the financial market, investors should prioritize regulated platforms with high transparency to ensure the safety of their funds and fair trading practices.

FAQs

- Is Flaggroup regulated?

Flaggroup is not regulated by any financial authority, which means that investor funds lack protection. - What products does Flaggroup offer?

Flaggroup has not disclosed specific information about its trading products or account types, leaving investors uncertain about its service offerings. - How can I determine if a platform is safe?

You can check for regulatory information, read user feedback, verify company background, and ensure that security measures are in place to determine the safety of a platform. - Does Flaggroup provide fund protection?

Flaggroup has not indicated whether it offers fund segregation or negative balance protection to safeguard investor funds. - How can investors protect their funds?

Investors should choose regulated trading platforms and understand the platform’s deposit and withdrawal processes to ensure the safety of their funds. - Is Flaggroup’s website professional?

Flaggroup’s website design is identical to another platform, AETT Global, which lacks uniqueness and professionalism, potentially affecting its credibility.