Overview of AUSFIT

AUSFIT is a CFD broker based in Saint Vincent and the Grenadines. It offers trading in forex, indices, energy, precious metals, and stocks. AUSFIT claims regulation by several financial authorities. However, evidence reveals misleading regulatory information, which raises concerns for investors.

Basic Facts about AUSFIT

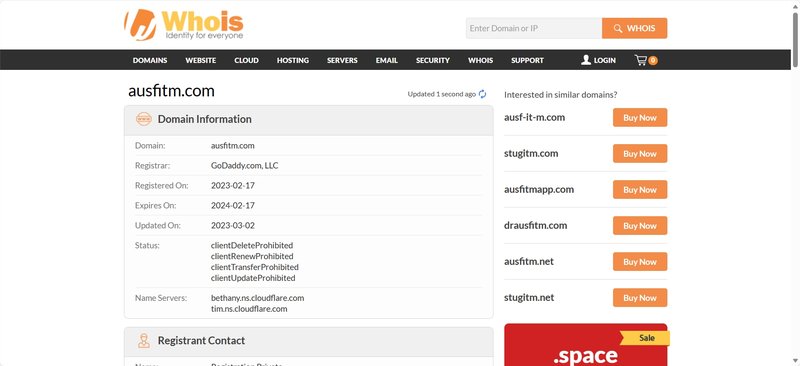

AUSFIT operates under the entity AUSFIT International Ltd., with a registration number 25198 IBC 2018, located in James Street, Kingstown, Saint Vincent and the Grenadines. AUSFIT states it has operated since 2018, but a Whois search shows the website domain was registered on February 17, 2023. This suggests a much shorter operational timeline than claimed.

As a CFD broker, AUSFIT primarily offers trading services in forex, indices, energy, precious metals, and stocks to users globally. The platform claims to support multiple languages, including English, Traditional Chinese, Japanese, Korean, Russian, German, French, Spanish, Arabic, Thai, Vietnamese, and Indonesian, aiming to attract a diverse international investor base.

However, despite its broad business claims and language support, investors should exercise caution when considering AUSFIT’s regulatory and compliance claims.

Contradiction Between AUSFIT’s Domain and Company Registration

AUSFIT claims it was established in 2018, but Whois searches show its domain was registered on February 17, 2023. This creates doubts about its operational history.

A company’s website is a crucial channel for customer interactions, and the domain’s registration date often reflects the company’s presence in the market. AUSFIT’s short online history, combined with its claims of long-standing market experience, creates a lack of transparency for potential investors.

False Regulatory Claims

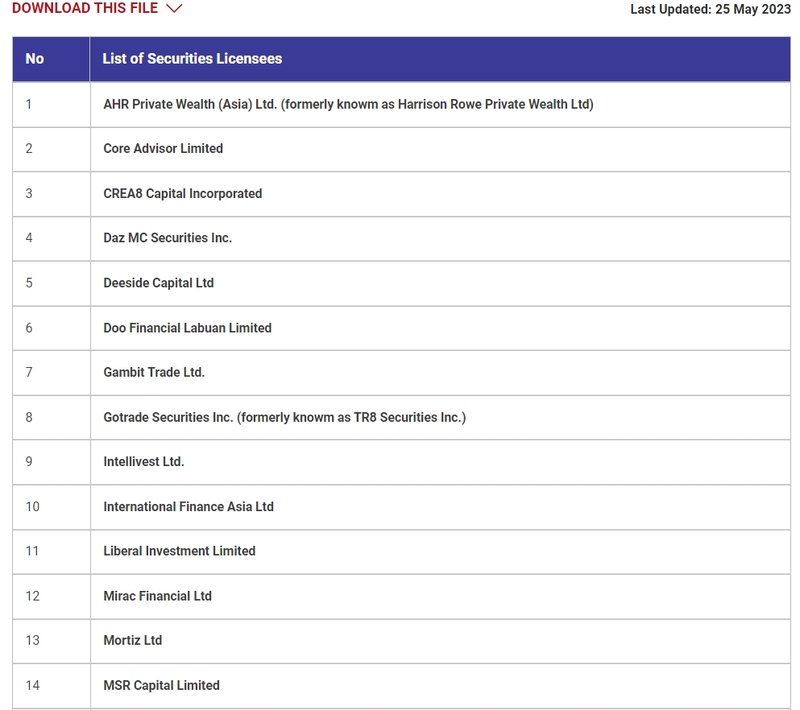

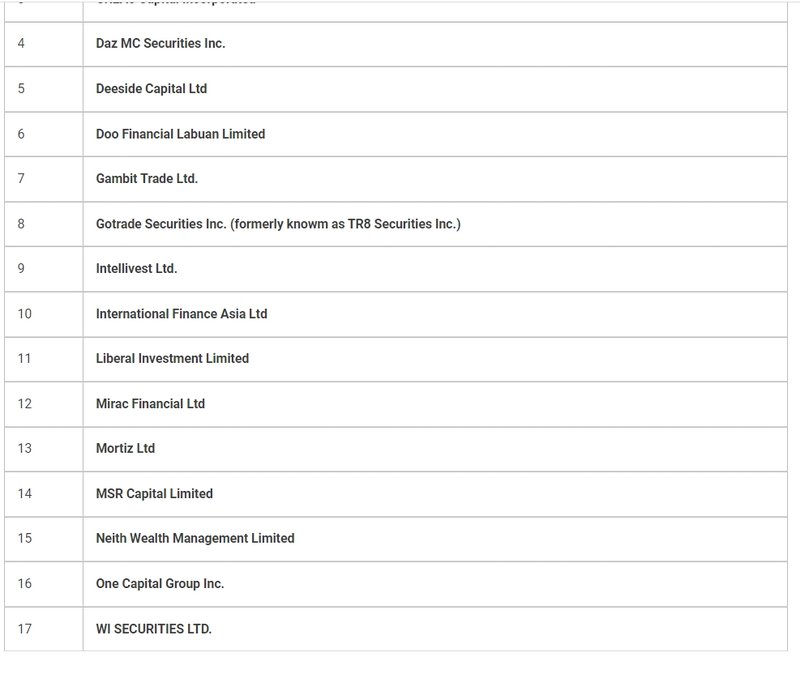

AUSFIT states on its website that several financial authorities regulate it, including the Labuan Financial Services Authority (LFSA). Specifically, it mentions holding a license (MB/22/0100) from LFSA. However, verifying through the LFSA’s official website shows that AUSFIT International Ltd. lacks authorization from this regulatory body. This misleading regulatory claim raises red flags about the platform’s legitimacy.

In the financial market, regulation ensures that platforms operate legally and protect investors’ funds. Reputable regulators like the FCA, CySEC, and ASIC ensure strict oversight. They focus on preventing investor losses. These bodies enforce high standards for financial platforms. AUSFIT’s lack of genuine regulatory oversight means that investor funds may be at significant risk.

AUSFIT’s High-Risk Business Model

CFDs are derivative financial instruments that allow investors to trade based on price fluctuations of an underlying asset without owning the asset itself. These trades often involve high leverage, which allows investors to control large positions with a relatively small amount of capital. However, leverage amplifies both potential gains and risks, and in volatile markets, losses can exceed initial investments.

AUSFIT provides CFD trading in forex, indices, energy, precious metals, and stocks, all of which experience significant volatility.The use of high leverage further increases the risk. AUSFIT lacks proper regulatory oversight, exposing investors to significant risks. These risks involve transparency problems, frozen accounts, and withdrawal issues. CFD trading without regulation adds more danger. Investors need to stay highly cautious.

AUSFIT’s Global Reach and Language Support

AUSFIT operates in Asia, Europe, and Africa. It supports up to 12 languages. These include English, Traditional Chinese, Japanese, Korean, and Russian. Other supported languages are German, French, Spanish, Arabic, Thai, Vietnamese, and Indonesian.This suggests the company is targeting a wide range of international investors.

While multi-language support enhances the platform’s accessibility, it does not compensate for the lack of transparency and issues surrounding AUSFIT’s regulatory claims. Language support and global reach do not indicate the platform’s legitimacy or safety. Investors must thoroughly evaluate the platform’s operational integrity.

AUSFIT’s Registration and Regulatory Issues

AUSFIT registers in Saint Vincent and the Grenadines, a popular offshore hub for high-risk companies due to its lenient regulations. The Financial Services Authority (FSA) allows companies to operate and conduct financial activities there.However, its regulatory standards fall short compared to those of major global markets. This lax regulation offers little protection to investors.

Furthermore, AUSFIT claims to have permission to conduct securities trading in Saint Vincent and the Grenadines. The offshore regulations in that region are much looser than in Europe, the US, or Australia. This creates higher risks for investors. If the platform fails or commits fraud, recovering funds may be difficult.

Conclusion: High Risk for Investors

AUSFIT, despite its claims of offering diverse financial trading services across international markets, has significant issues related to regulatory transparency and business legitimacy. The discrepancy between its website’s domain registration date and its claimed establishment year, coupled with false regulatory claims and a high-risk business model, poses serious concerns for investors.

For those considering investing in CFDs or any other high-risk financial instruments, it is crucial to choose platforms regulated by credible authorities. AUSFIT’s misleading regulatory information and offshore registration make it a high-risk platform, and potential investors should approach with extreme caution.

FAQs

- Is AUSFIT regulated?

AUSFIT claims regulation by the Labuan Financial Services Authority, but this has been proven false. The company is not regulated by any recognized authority. - Is AUSFIT’s company registration reliable?

AUSFIT registers in Saint Vincent and the Grenadines, where weak regulatory oversight offers minimal protection for investors. - What financial products does AUSFIT offer?

AUSFIT offers CFDs on forex, indices, energy, precious metals, and stocks. - How long has AUSFIT been operational?

AUSFIT’s website domain was registered on February 17, 2023, indicating a very short operational history. - Does AUSFIT serve global investors?

Yes, AUSFIT claims to serve Asia, Europe, and Africa, offering support in multiple languages, including English, Traditional Chinese, Japanese, and Korean. - Are the risks of trading with AUSFIT high?

Yes, due to its lack of regulatory oversight and high-leverage CFD offerings, trading with AUSFIT carries significant risks.