CH Markets is an emerging forex broker whose regulatory and compliance status has been questioned amidst the rising tide of global financial fraud. Investors are advised to exercise caution and be vigilant in identifying and avoiding potential risks.

Company Background of CH Markets

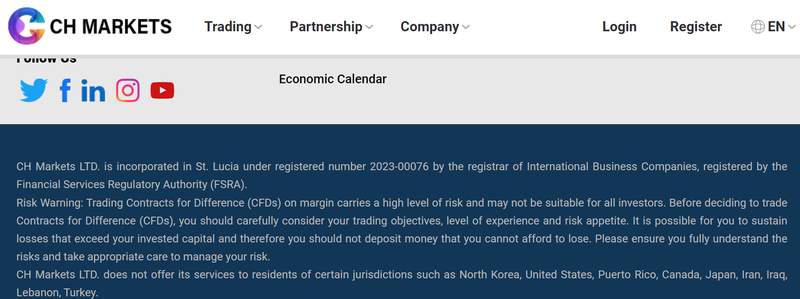

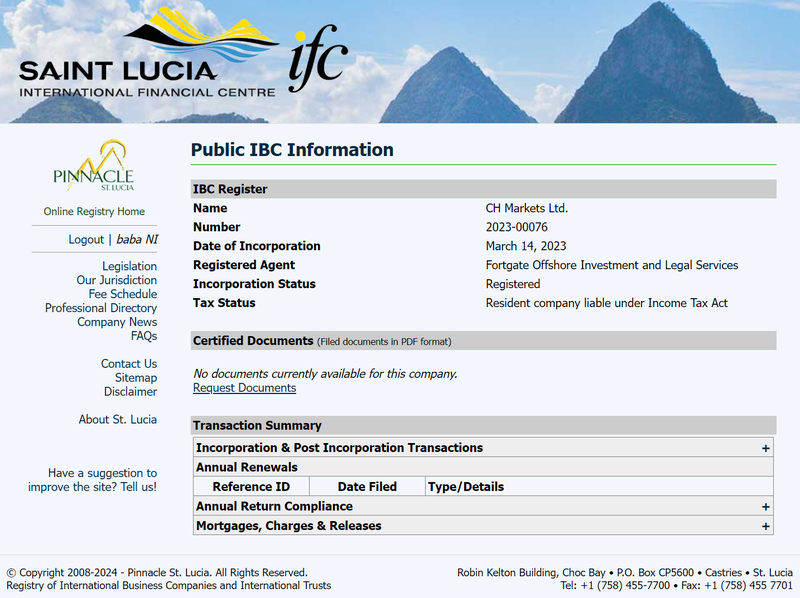

CH Markets’ website states the company is registered as CH Markets Ltd in Saint Lucia, with registration number 2023-00076. The registered address is Fortgate Offshore Investment and Legal Services Ltd., Rodney Bay, Saint Lucia. The company’s office is located in Istanbul, Turkey, at Maslak Mahallesi, Sümer Sokak, Ayazağa Ticaret Merkezi.

CH Markets offers its clients diversified trading services across forex, stocks, indices, commodities, and cryptocurrencies. Through its electronic trading platform, investors gain access to global financial markets and can trade within various asset classes. However, it is important to note that CH Markets explicitly states that it does not offer services to investors from specific countries and regions, including North Korea, the United States, Canada, Japan, Iran, Iraq, Lebanon, and Turkey. These restrictions may arise from differing financial regulations and legal environments across jurisdictions.

CH Markets’ Regulatory Status and Risk Awareness

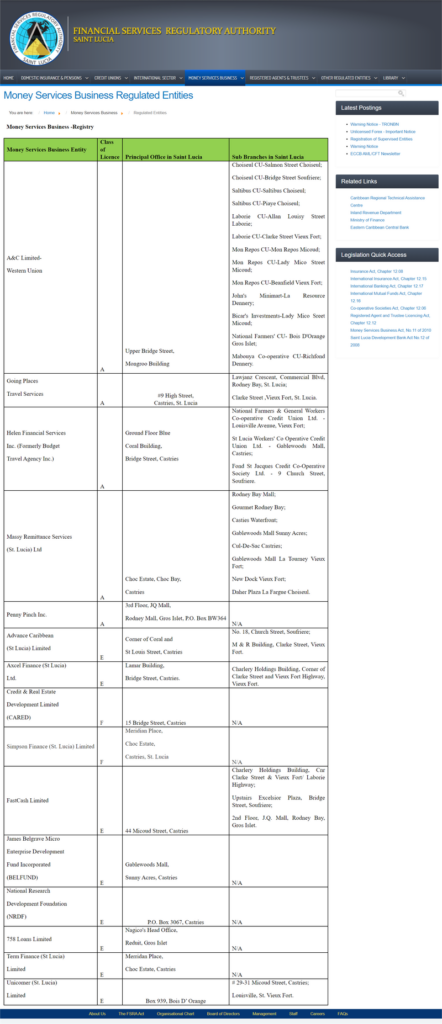

CH Markets registers in Saint Lucia, but FSRA records do not list it as a registered broker. While company details are available from Saint Lucia’s registry, the broker has not disclosed regulatory oversight information.

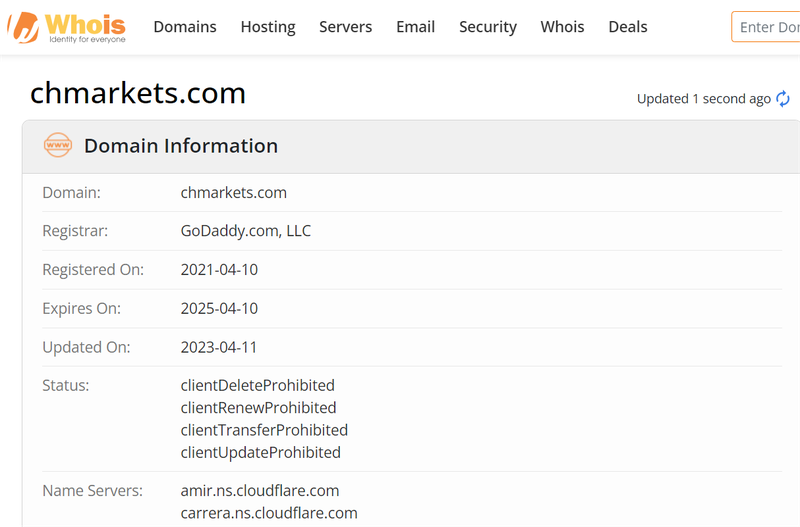

Furthermore, a Whois domain lookup reveals that CH Markets’ website domain was registered on April 10, 2021. As of January 2024, the company has been operating for less than a year. This indicates that although CH Markets has a relatively short operational history, its predecessor or management team may have had some market presence beforehand.

The forex industry has many unregulated brokers, especially in offshore financial centers. Not all engage in misconduct, but investors should be cautious with platforms lacking regulatory oversight or monitoring by major financial regulators.

The Current State and Evolution of Financial Fraud

In today’s globalized financial markets, financial fraud has become increasingly sophisticated and harder to detect, especially with the proliferation of online financial services. Fraudsters can now easily access potential victims worldwide. Below is an overview of current fraud trends and common scam tactics:

- Prevalence of Financial Fraud Financial fraud spans a broad spectrum, from simple phone scams to elaborate online fraud schemes. Victims can be individual investors or even large institutions. Scammers often lure unsuspecting investors by promoting high-return projects and promising attractive profits.

In recent years, the number of financial scams has risen sharply, particularly in the aftermath of the pandemic. Fraudsters have exploited investors’ concerns over economic uncertainty and low-interest rates to pitch fake high-return investment opportunities. New investors, especially those unfamiliar with high-frequency trading, cryptocurrencies, or the forex market, are frequent targets.

- Common Financial Scam Tactics

- Ponzi Schemes: One of the most notorious scams, Ponzi schemes use funds from new investors to pay returns to earlier investors. Fraudsters attract large amounts of money by promising high returns, but there are no actual investments. Eventually, the scheme collapses, causing significant losses to investors.

- Fake Investment Platforms: These platforms mimic legitimate financial markets to attract investor funds. In the initial stages, investors may receive small returns, fostering trust, but they are eventually unable to withdraw their principal or larger profits.

- Cryptocurrency Scams: As the cryptocurrency market has grown, so have scams involving fake token sales, counterfeit wallet apps, and hacking attempts. Many fraudsters capitalize on the public’s curiosity and lack of understanding of cryptocurrency markets to perpetrate fraud.

- Forex Trading Scams: Similar to fake investment platforms, forex trading scams often involve falsified trading records or deceptive promises, enticing investors to deposit large sums. Unregulated forex brokers or platforms often conceal high trading fees or manipulate prices, leading to severe losses for investors.

- How Scammers Entice Investors

- Promises of High Returns: Scammers frequently use the promise of short-term high returns to lure investors. Many scams guarantee “risk-free high returns,” which are virtually impossible in legitimate investments.

- Fake Celebrity Endorsements: Fraudsters use photos or fake endorsements from famous personalities to increase credibility, deceiving uninformed investors into believing the scam is legitimate.

- Complex Terminology and Techniques: Some fraudsters use sophisticated financial jargon and professional tools to appear credible, even simulating legitimate trading platforms to give investors a false sense of security.

How to Identify and Prevent Financial Fraud

To avoid falling victim to financial fraud, investors need to stay vigilant and take the following precautions:

- Verify the Broker’s Regulatory Status Choose platforms regulated by reputable financial authorities, such as the FCA in the UK, ASIC in Australia, or ESMA in the EU. These regulators enforce strict standards in financial markets and ensure investor protection.

- Be Wary of Promises of “High Returns” All investments carry risks, and high returns often come with high risk. Any investment opportunity promising risk-free high returns is most likely a scam.

- Protect Personal Information Avoid providing personal or financial information to unknown individuals or companies. Scammers frequently impersonate legitimate institutions to steal such information for fraudulent activities.

- Check Platform Transparency Legitimate investment platforms should publicly provide clear information about their company registration, regulatory status, and detailed terms of service. By researching a platform’s registration and regulatory history, investors can gauge its legitimacy.

- Consult a Professional Advisor Before making significant investments, it is advisable to consult a certified financial advisor or lawyer to verify the legality and security of the investment platform and products.

CH Markets’ Potential Risks and Investment Advice

CH Markets lacks transparent regulatory support and is registered offshore. Investors should be extremely cautious with such platforms. The company offers various financial instruments but has a short operational history. Its absence of regulation by major financial authorities poses significant risks.

The forex and cryptocurrency markets already exhibit high volatility and risks. Coupled with unregulated platforms, investors should remain alert to potential financial traps. Investors interested in CH Markets should start with small amounts. Monitor trading fees, fund withdrawal, and customer service carefully before committing larger sums.

FAQ: CH Markets and Financial Fraud Prevention

What is CH Markets?

CH Markets is a forex broker registered in Saint Lucia, offering trading services across forex, stocks, indices, commodities, and cryptocurrencies.

Is CH Markets regulated?

As of now, CH Markets has not provided detailed information on its regulatory status and is not recognized by financial regulatory bodies in Saint Lucia or other major jurisdictions.

How to avoid forex scams?

To avoid forex scams, investors should choose regulated platforms, ignore “risk-free high returns,” and verify the platform’s registration and regulatory status.

What is a Ponzi scheme?

A Ponzi scheme uses funds from new investors to pay returns to earlier investors. Fraudsters promise high returns but do not make any actual investments, leading to the collapse of the scheme and significant investor losses.

What are common cryptocurrency scams?

Common cryptocurrency scams include fake token sales, counterfeit wallet apps, and hacking attempts. Fraudsters typically exploit public interest in cryptocurrencies and a lack of knowledge to perpetrate scams.

How to verify the legitimacy of a financial platform?

Investors can check a platform’s registration details and its regulatory certification records to confirm its legitimacy. Legitimate platforms are typically supervised by well-known regulatory bodies and have a transparent compliance record.