In recent years, the number of financial trading platforms has surged, with many claiming to offer convenient and high-return investment opportunities. However, as the market grows, fraudulent platforms have also become more prevalent. Bestcoin is one such platform that has raised concerns among investors. Established in October 2023 as a CFD (Contract for Difference) broker, Bestcoin lacks transparency, with missing registration and regulatory information, raising serious risk concerns. This article aims to help investors identify the characteristics of such dubious platforms and provide practical advice on avoiding financial scams.

1. Overview of Bestcoin and Analysis of Its Issues

Bestcoin claims to offer a range of financial trading services, including stocks, futures, and cryptocurrencies. However, a deeper analysis of its operations reveals several red flags:

Lack of transparent corporate information: Bestcoin does not disclose its corporate registration, making it difficult for investors to verify its legitimacy.

No regulatory oversight: Legitimate financial brokers typically fall under the strict supervision of regulatory bodies. Bestcoin, however, has not provided any details about its regulatory status.

Unclear headquarters location: The platform has not disclosed its actual office address, further complicating efforts to verify its authenticity.

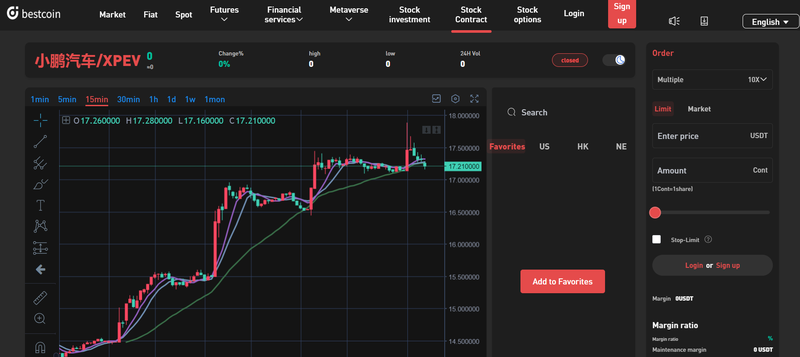

Weak technical support: Bestcoin only offers its proprietary Webtrader platform, and the download link for its mobile platform is non-functional, indicating potential issues with its technological capabilities.

These concerns raise serious fraud warnings, and investors should exercise caution when considering trading on such platforms.

2. Common Types of Financial Trading Platforms

Before discussing fraudulent platforms, it’s important to understand the various types of trading platforms in the financial market:

- Stock trading platforms: These allow investors to buy and sell stocks. Popular platforms include E*TRADE and Fidelity, which are usually regulated by authoritative bodies and provide comprehensive corporate information.

- Futures and options platforms: These platforms allow investors to trade contracts based on future price fluctuations, including well-known platforms like the Chicago Mercantile Exchange (CME) and Intercontinental Exchange (ICE).

- CFD (Contract for Difference) platforms: Investors can profit from price fluctuations without owning the underlying asset. While legitimate platforms like eToro and Plus500 exist, this type of trading carries higher risk.

- Cryptocurrency trading platforms: Specializing in the buying and selling of digital assets like Bitcoin and Ethereum, legitimate platforms include Coinbase and Binance.

- Hybrid trading platforms: These platforms enable users to trade multiple financial products, such as stocks, futures, and cryptocurrencies, and are often found in multi-asset brokers.

3. Common Financial Scam Tactics

Fraudulent platforms like Bestcoin often exhibit several classic scam characteristics. Here are some common tactics:

- False promises of high returns: Scammers often lure investors with promises of large returns. In reality, high returns usually come with high risks, and investors should be wary of such overly enticing claims.

- Concealment of accurate information: Legitimate financial platforms provide detailed company registration and regulatory information, often under the supervision of respected regulatory bodies. Fraudulent platforms, however, tend to withhold or obscure such information, making it difficult for investors to verify their legitimacy.

- Technical glitches and frozen funds: Fraudulent platforms often create complicated transaction processes. When users attempt to withdraw their funds, they may face numerous obstacles, or their accounts may be frozen, preventing them from retrieving their money.

- Ponzi scheme tactics: Some platforms use funds from new investors to pay earlier investors, eventually causing the platform to collapse when the cash flow runs out.

4. How to Identify Potential Scam Platforms

To avoid falling into the trap of fraudulent trading platforms, investors should remain vigilant. Here are some key points to consider when evaluating a platform:

- Check registration and regulatory information: Any legitimate broker must be registered with a national financial regulator and provide clear corporate information. Investors can verify this through official websites of regulatory bodies such as the U.S. Commodity Futures Trading Commission (CFTC) or the UK’s Financial Conduct Authority (FCA).

- Verify platform security: Reputable platforms should offer secure and fully functional trading systems. Users can test the platform’s stability, transaction speed, and fund management processes to assess its reliability.

- Assess company transparency: Trustworthy companies typically offer detailed background information, including their founding team, history, and client base. If the company’s information is vague or unverifiable, investors should proceed with caution.

- Be wary of high return promises: Any platform guaranteeing fast wealth or high returns should be approached cautiously. While legitimate investments can offer potential returns, they are always accompanied by reasonable risk disclosures.

- Evaluate reputation and reviews: Investors can check industry forums, social media, and third-party review sites for user feedback and platform reviews, offering additional insights into the platform’s credibility.

5. Strategies for Avoiding Financial Scams

To avoid falling victim to financial scams, investors should adopt the following strategies:

- Educate yourself: Stay informed about the financial markets and investment tools. Being knowledgeable can help you avoid being easily swayed by surface-level appeals.

- Conduct thorough verification: Before committing funds, verify all platform information. Use multiple sources to cross-check, including news outlets and financial regulator websites.

- Beware of unregulated platforms: Any platform that lacks financial regulation should be treated as highly risky. Regulatory oversight is essential in ensuring the safety of investor funds.

- Be cautious with unsolicited investment advice: Fraudulent platforms often contact investors via phone, email, or social media. Stay alert and never disclose personal information easily.

- Set stop-loss limits and diversify your investments: Investors should set clear stop-loss points and diversify their funds to avoid placing all assets in a single platform or project.

In a rapidly growing financial market, fraudulent platforms are not uncommon. Platforms like Bestcoin, which lack transparency and have weak technical support, undoubtedly increase the risk exposure of investors. By maintaining risk awareness, gaining an in-depth understanding of how the market works, and always opting for regulated platforms, investors can significantly reduce their chances of falling victim to scams. Remember, while legitimate financial trading can yield substantial returns, it is always accompanied by risks—there is no such thing as a “guaranteed win.”

Frequently Asked Questions (FAQ)

1.How can I determine if a trading platform is legitimate?

Legitimate platforms must provide complete corporate registration and regulatory information. Investors can verify the platform’s legitimacy by checking official databases of financial regulators, such as the U.S. CFTC or the UK FCA. If a platform fails to disclose such information or provides unclear details, be extremely cautious.

2.What should I do if I’ve already invested in a platform like Bestcoin?

If you suspect you have invested in a fraudulent platform, immediately cease all transactions and save any related communication or transaction records. Contact your country’s financial regulator or a consumer protection agency for professional assistance in recovering your funds.

3.Why are unregulated platforms particularly dangerous?

Unregulated platforms lack third-party oversight, leaving your funds unprotected. These platforms can change trading rules at will or restrict fund withdrawals, and may even disappear with your money. Regulatory oversight is key to ensuring platform transparency and safety.

4.Are there any investment products with guaranteed returns?

Legitimate investments always involve market risks, and any promise of “guaranteed returns” is untrustworthy. Investors should be wary of such enticing offers and approach investment opportunities with caution.

5.How can I avoid falling into a scam like Bestcoin?

Choose well-regulated platforms with a good reputation, and ensure the platform provides complete corporate background information. Verify all information through official channels and be cautious with any investment opportunities that promise high returns.