As the financial markets evolve, unregulated brokers like BITTRA have emerged, despite claiming to offer a wide range of financial services. However, its registration and regulatory status raise concerns. This article delves into BITTRA’s background, registration details, and potential risks to help investors assess the platform’s safety.

Background of BITTRA

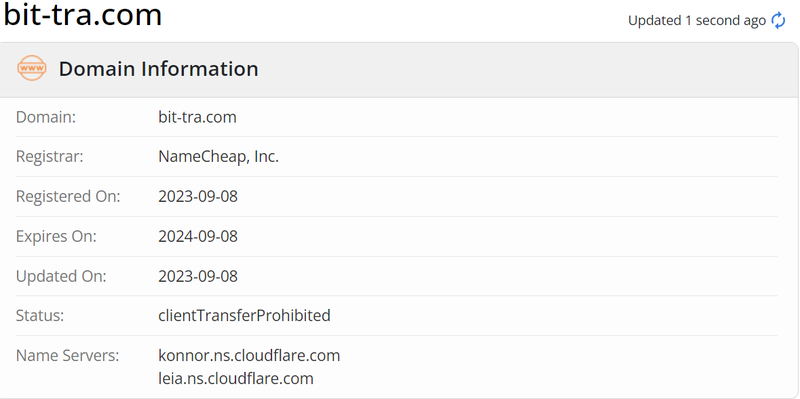

BITTRA was established on September 8, 2023, as a financial broker claiming to offer trading services in stocks, bonds, commodities, and cryptocurrencies. The company emphasizes providing real-time market data, advanced trading tools, and a secure trading environment. However, BITTRA has not disclosed its headquarters, raising concerns about its transparency.

Registration Information and Trading Services

According to its website, BITTRA’s registered entity is BITTRA LLC, with an address at 1099 18th Street, Denver, Colorado, USA. The company claims to have registered with the National Futures Association (NFA) under registration number 0560186 and says it was authorized on November 20, 2023.

BITTRA presents itself as offering a comprehensive range of financial asset trading services for individuals and institutions, including stocks, bonds, commodities, and cryptocurrencies. The company promises a secure trading interface and easy access to meet the needs of global users.

Regulatory Status: Misleading Investors?

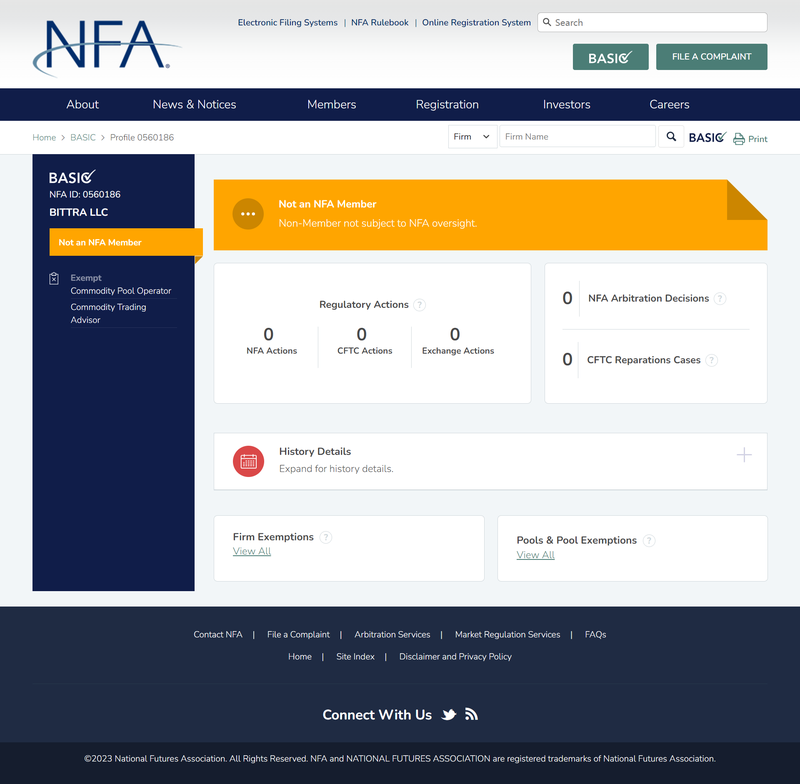

Although BITTRA claims on its website to be registered with the NFA and authorized, further investigation reveals that the company is not truly regulated by the NFA. This has raised serious doubts about the company’s legitimacy among investors.

NFA Registration Issues

The National Futures Association (NFA) is a self-regulatory organization in the U.S. responsible for overseeing futures brokers, ensuring their compliance and transparency. While BITTRA claims to be registered under NFA number 0560186, checks show that the company is listed as a non-member, meaning it is not regulated by the NFA.

This misleading regulatory information could be an attempt to deceive investors into believing BITTRA is subject to strict U.S. regulations, but in reality, it is not. This increases the risk to investors, as unregulated financial institutions are more prone to fraudulent or opaque practices.

Lack of Company Registration Transparency

In addition to regulatory concerns, BITTRA LLC’s registration information is also unclear. While the company lists an address at 1099 18th Street, Denver, Colorado, no valid registration information for BITTRA LLC can be found in public business databases. This lack of corporate transparency makes it difficult for investors to verify the company’s legitimacy, further exacerbating doubts about the platform.

Potential Risks of Using BITTRA

For investors, choosing a legitimate, compliant, and transparent broker is crucial. BITTRA’s lack of transparency and regulation suggests that the company may pose significant risks. Here are some key risks to consider when using BITTRA for trading.

1. High Risk Due to Lack of Regulation

BITTRA’s misleading NFA registration information and lack of real regulation mean that investors’ funds are not protected. Legitimate brokers typically undergo strict scrutiny by regulatory bodies to ensure they comply with rules and protect client funds. BITTRA’s absence of regulatory oversight increases the risk to investors, particularly in the event of disputes or platform malfunctions, where legal protection may be limited.

2. Lack of Transparency

Transparency is a key factor in determining the trustworthiness of a financial institution. BITTRA has not disclosed its actual office location, and its registered address cannot be verified through legitimate channels. Furthermore, the company does not provide any information about its management team, making it impossible for investors to assess the qualifications and expertise of those managing their funds. This lack of information severely undermines investor trust.

3. False or Exaggerated Claims

BITTRA claims to offer a broad range of financial products, including stocks, bonds, commodities, and cryptocurrencies. While these products themselves are not unusual, the lack of proper regulation makes it difficult for investors to confirm the legitimacy of these services. Additionally, the security measures and trading tools BITTRA claims to provide have not been independently verified, raising concerns about possible exaggeration or false claims.

4. Questionable Customer Support

Legitimate financial institutions typically offer efficient customer support to resolve user issues and concerns. However, BITTRA has not provided clear details about its customer service methods or support channels. Without effective customer support, investors may find it challenging to resolve issues related to trading or fund disputes.

Key Steps to Avoid Financial Scams

While financial scams are increasingly common, investors can protect themselves by taking certain steps to reduce risk.

1. Verify Information Through Multiple Channels

Before choosing a platform, investors should verify its legitimacy through various sources, including the platform’s official website, regulatory body databases, and independent financial review sites. Relying solely on information provided by the platform itself is risky. Broad investigation helps investors better understand a platform’s background and legitimacy.

2. Consult Financial Experts

If uncertain about a platform’s legitimacy, investors can consult professional financial advisors or legal experts. These experts can help identify potential risks and provide objective opinions based on their knowledge and experience, ensuring investors make informed decisions and avoid common pitfalls.

3. Diversify Investment Risks

Diversification is a basic principle of investment. Concentrating all funds in a single platform or product is risky. In the event of fraud, all funds may be lost. By spreading funds across multiple reliable investment channels, investors can effectively reduce overall risk.

4. Be Wary of Unsolicited Investment Offers

Scammers often reach out to potential victims through phone calls, emails, or social media, offering what appear to be attractive investment opportunities. Investors should be highly cautious of investment advice from strangers, especially those urging immediate action or requesting fund transfers. These “urgent” investment suggestions are often red flags for scams, and investors should remain calm and conduct thorough research.

Common Financial Scam Case Studies

To better understand how financial scams operate, here are some common examples:

1. Fake Investment Platforms

A platform claims to offer trading services in stocks and cryptocurrencies, claiming to be regulated by multiple global financial authorities. However, further investigation reveals the platform uses fake regulatory information and certificates to attract investors. Once funds are deposited, the platform blocks withdrawals through technical means, eventually leading to total loss of funds.

2. Guaranteed High Returns Scam

An investor receives an offer promising fixed monthly returns of up to 20%. Enticed by the offer, they invest a significant sum, but after a few months, the platform claims “technical issues” prevent it from paying returns, then disappears. Investigation reveals the platform was unregulated, and its promised returns were a scam.

3. “Financial Guru” Scams on Social Media

Scammers posing as successful investors on social media showcase their “profits” and “luxurious lifestyles” to attract followers. Once victims invest in the platforms they recommend, the scammers disappear, taking the victims’ funds with them.

How to Protect Yourself from Financial Scams

Although the complexity and rapid growth of financial markets offer opportunities for scammers, investors can protect themselves with rational judgment and thorough research. Verifying registration information, regulatory status, and being cautious of high-return promises are effective ways to avoid scams. Consulting professionals, diversifying investments, and cross-verifying information also help minimize risk. By following these strategies, investors can avoid becoming victims of financial scams and keep their investments secure.

Is BITTRA Trustworthy?

In conclusion, BITTRA shows significant issues regarding regulation and transparency. Despite its claims of offering various financial products, its regulatory information has proven misleading, and its registration details cannot be verified. Furthermore, BITTRA lacks in key areas such as customer support and information transparency.

For investors, choosing a transparent and regulated broker is essential for ensuring the safety of their funds and smooth trading. BITTRA’s various problems suggest that investors should carefully consider the risks before engaging with the platform. Reputable, well-regulated brokers are undoubtedly a better choice in the market.

Frequently Asked Questions

1. Is BITTRA legally registered?

BITTRA LLC claims to be registered in Colorado, but no legal registration information can be found.

2. Is BITTRA regulated by the NFA?

BITTRA claims to be registered with the NFA, but it is listed as a non-member, meaning it is not under NFA regulation.

3. Is BITTRA’s registered address trustworthy?

The address BITTRA provides cannot be verified through legal channels, suggesting it may be using a false address.

4. Are BITTRA’s trading services reliable?

Due to BITTRA’s lack of regulation and transparency, it is difficult for investors to verify the reliability of its services.

5. How can I verify a broker’s compliance?

Investors can check a broker’s regulatory status, verify company registration, and assess transparency to determine its legitimacy.

6. Is BITTRA’s customer support reliable?

BITTRA does not clearly explain its customer support services, casting doubt on its effectiveness.