Fintech advancements have introduced platforms like 90RICH, offering stock, futures, and forex services. However, its lack of transparency and regulation raises investor concerns. This article reviews 90RICH’s background, regulation, and transparency to help assess potential risks.

1. 90RICH’s Company Background: Lack of Transparency and Potential Risks

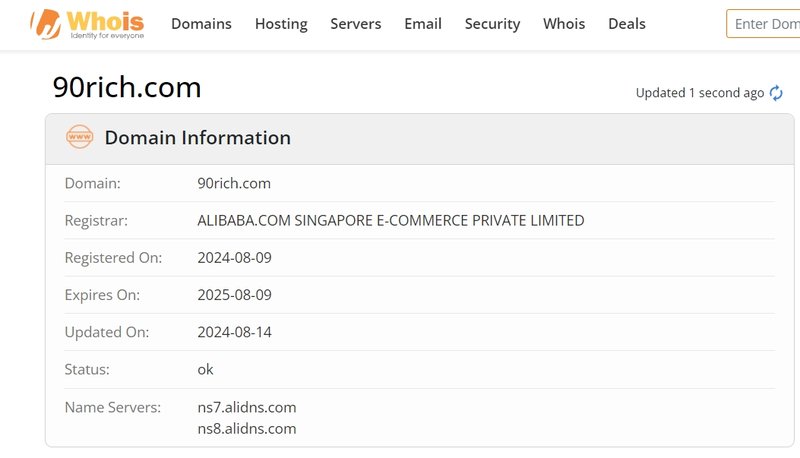

For any financial trading platform, the transparency of its company background is a key indicator of credibility. The official website of 90RICH states that the platform registered its domain on August 9, 2024, establishing it as a new platform that has yet to be tested over time. New platforms often come with higher risks as they lack a long-term track record, making it difficult to assess their reliability and operational stability.

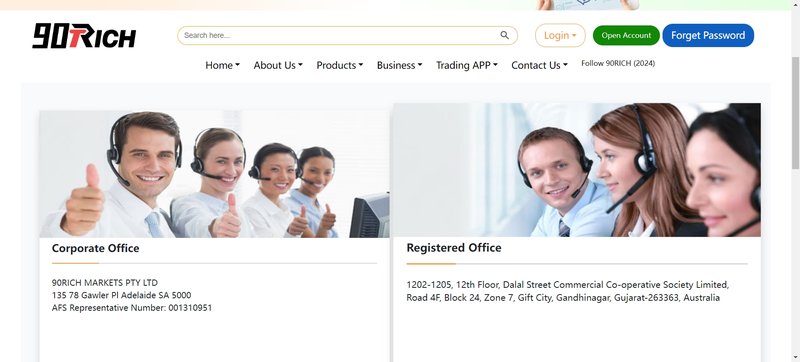

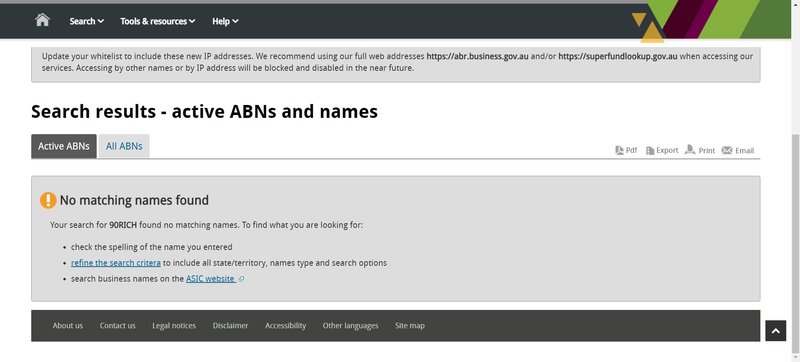

What’s more puzzling is that 90RICH claims its registered address is in Gift City, Australia. However, further investigation revealed no company registration information for this address. Fraudulent platforms or unregulated entities often use fake registration addresses to mislead potential investors. Such unclear company backgrounds undoubtedly make it more challenging for investors to verify the platform’s legitimacy, thus increasing the risk of potential financial loss.

Additionally, the 90RICH website does not provide detailed information about its management team or transparent operational details. This lack of information leaves investors with insufficient trust when choosing the platform. In financial investments, understanding the management team’s experience, the company’s strategy, and its operations is crucial. The absence of such information makes 90RICH appear even less transparent to potential investors.

2. Lack of Regulatory Oversight: A Risk to Investors’ Funds

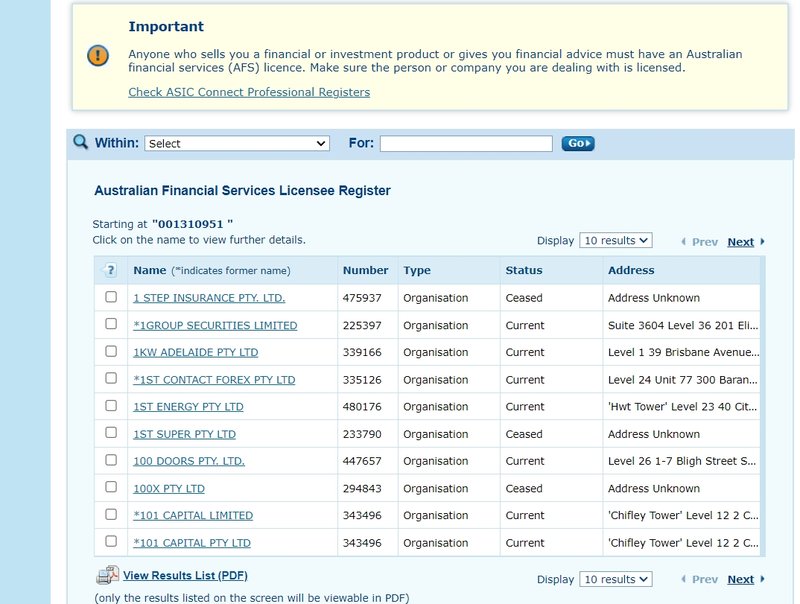

In addition to the vague company background, 90RICH presents significant issues in terms of regulatory oversight. The platform lists an AFS Representative Number: 001310951, but verification revealed no legitimate registration or regulatory records associated with this number. For a platform offering financial services, proper regulation is the foundation of fund security.

Legitimate platforms in the financial markets are usually subject to strict regulations to ensure transparency in their operations and safeguard investors’ rights in case of disputes. In contrast, unregulated platforms come with significantly higher risks. 90RICH lacks proper regulation, leaving investors’ funds unprotected by any legal framework, posing a serious risk for those seeking safe investments.

For investors using an unregulated platform, if they suffer financial losses or if the platform suddenly ceases operations, it is often difficult to recover those funds through legal channels. This lack of regulation further heightens the risks investors face, especially in volatile market conditions or if problems arise with the platform.

3. Transparency and Operational Analysis of the 90RICH Platform

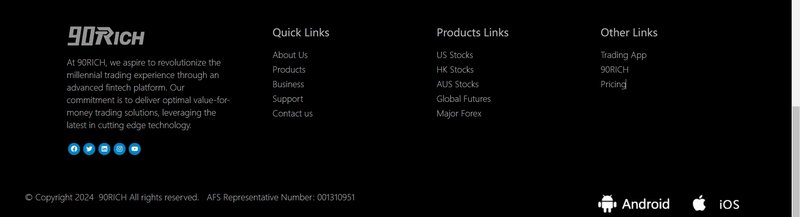

Beyond its company background and regulatory issues, 90RICH also exhibits shortcomings in terms of operational transparency. A legitimate and reliable financial platform typically provides clear details about its business model, transaction fees, and customer support. However, 90RICH’s website offers very limited information in these areas, lacking key details.

Firstly, the platform does not clearly specify its transaction fees, spreads, commissions, or other charges directly relevant to investors. This lack of transparency regarding fees can lead to unexpected high charges or unforeseen deductions when using the platform. A fair and transparent fee structure is an important indicator of whether a platform treats its clients equitably.

Secondly, there is no clear explanation of how customer funds are stored or protected. Regulated financial platforms usually separate client funds from operational funds and have them safeguarded by independent third-party custodians to protect against any potential financial collapse. However, 90RICH does not mention such safeguards, meaning investors’ funds could be at significant risk.

Finally, the lack of detailed contact information or support services on 90RICH further complicates the user experience. Investors often rely on customer support to resolve technical or financial issues, but 90RICH does not provide adequate contact details on its website, leaving users in a difficult position if problems arise.

4. Potential Risks and Signs of Fraud with 90RICH

In summary, 90RICH’s unclear company background, lack of regulatory information, and poor operational transparency all suggest that this platform carries significant risks. For novice investors or those unfamiliar with market dynamics, 90RICH may not be an ideal choice.

Fraudulent behavior in the financial markets is not uncommon, especially in unregulated environments where investors are often the primary victims. False advertising, fabricated company addresses, and unverifiable regulatory information are common traits of high-risk investment platforms. Investors should always remain cautious, especially when dealing with financial platforms that fail to provide clear, legitimate background information.

Additionally, the rapid establishment of 90RICH, combined with its lack of transparency, raises concerns about a potential “exit scam.” Many unregulated financial platforms initially attract investors with aggressive promotions, only to abruptly close down once they have accumulated a substantial amount of funds, leaving investors with heavy losses. Emerging unregulated platforms have repeatedly engaged in this kind of practice throughout history.

5. Investor Strategies and Recommendations

Given the high risks associated with platforms like 90RICH, what steps should investors take to protect their funds? First, conducting thorough background research is crucial. Before choosing any financial platform, investors should verify its regulatory status, company background, and user reviews. Legitimate regulatory authorities typically offer registration information for platforms, allowing users to check it on official regulatory websites.

Second, investors should opt for regulated platforms with established reputations. These platforms tend to have greater transparency, and investor interests are more easily protected in the event of disputes.

Finally, do not be swayed by promises of high returns or low barriers to entry. Many illegitimate platforms use exaggerated claims or false investment returns to lure unsuspecting investors. Investors must remain rational and skeptical when encountering such promises and resist the temptation of offers that seem too good to be true.

Although 90RICH claims to offer a variety of financial products and services, its lack of transparency, unregulated status, and absence of credible corporate information make it a high-risk investment platform. For investors looking to safeguard their funds, choosing a legitimate and regulated platform is a much wiser decision. In the financial markets, opportunities and risks coexist, and investors must always stay vigilant to avoid falling victim to fraudulent schemes.

FAQ

- What is 90RICH?

90RICH claims to be a platform offering trading in stocks, futures, forex, and other financial products, but its lack of transparency and regulatory oversight poses significant risks. - Is 90RICH regulated?

The regulatory number provided by 90RICH cannot be verified, indicating that the platform is not subject to oversight by any legitimate financial regulatory authority. - What risks are involved in investing with 90RICH?

90RICH’s lack of regulatory transparency and corporate background information means that investors’ funds are not secure, and there is a high risk of financial loss. - How can I protect my funds?

Investors should choose regulated financial platforms and avoid unregulated ones, while carefully researching the platform’s background and regulatory status. - How transparent is 90RICH?

90RICH provides very little information about its fee structure, management team, or fund protection, making it difficult for investors to assess the platform’s reliability. - Should I invest in 90RICH?

Given its lack of regulation and transparency, it is recommended that investors exercise caution and choose regulated trading platforms instead.