Company Registration Information and Background

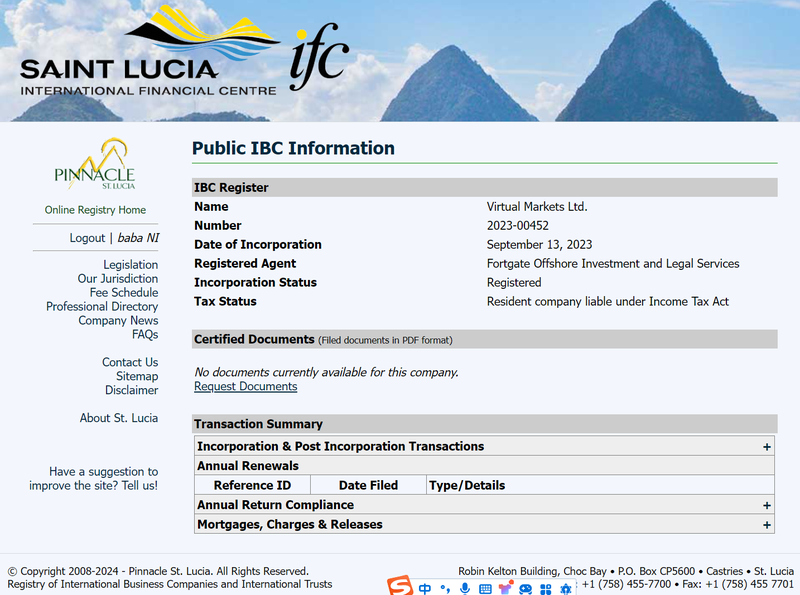

Virtual Markets Ltd is a newly established forex broker registered in Saint Lucia, with company registration number 2023-00452. According to its website, the company’s registered address is Ground Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia PO Box 838, Castries, Saint Lucia. While this information appears legitimate, further investigation reveals that the company has not disclosed its actual headquarters, raising concerns about its transparency.

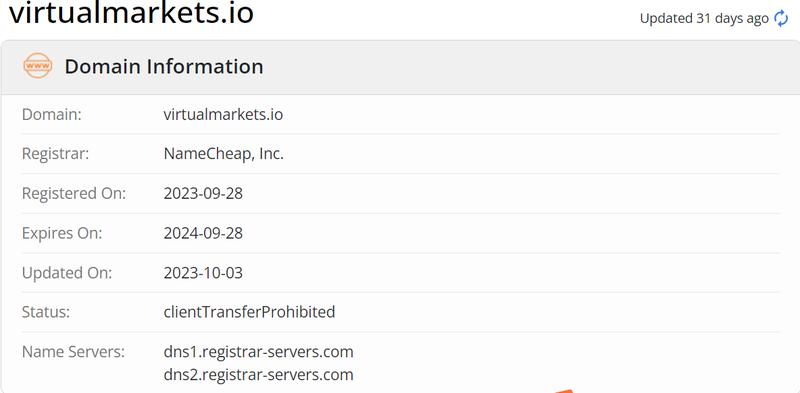

The registration data shows that Virtual Markets Ltd was founded on September 13, 2023, and its website domain was registered on September 28, 2023. Despite the company being less than six months old, it has already become active in the forex market, attracting the attention of investors. However, the risks associated with its rapid expansion are worth noting.

Lack of Effective Regulation and Financial Risks

For a forex broker, regulation by financial authorities is fundamental to ensuring its legitimacy and the safety of investors’ funds. However, Virtual Markets Ltd raises significant concerns in this regard. According to publicly available information, the company has not disclosed any regulatory status on its official website. Additionally, further investigation shows that Saint Lucia’s Financial Services Regulatory Authority (FSRA) does not have any registration records for Virtual Markets Ltd.

Operating without local financial regulation means that Virtual Markets is not subject to strict financial laws or compliance requirements. For investors, this likely means that their funds are not adequately protected. In the event of any financial issues with the company, investors may be unable to recover their losses, leading to severe financial consequences.

Moreover, Virtual Markets does not hold certification or licenses from other major regulatory authorities. Neither the U.S. Commodity Futures Trading Commission (CFTC) nor the UK Financial Conduct Authority (FCA) has any records of Virtual Markets’ registration. This only further intensifies doubts about the company’s legitimacy.

Offshore Registration to Avoid Legal Scrutiny

Virtual Markets has chosen to operate under Saint Lucia’s regulatory framework, raising serious questions about its legitimacy and transparency. Saint Lucia, a well-known offshore financial hub, offers lenient regulatory environments and low registration costs, which attract many companies to register there. Although this offshore registration model provides companies with greater operational freedom, it also facilitates potential financial fraud.

Many unscrupulous brokers choose to register in offshore financial centers like Saint Lucia to avoid stricter regulatory requirements in other countries. By setting up in this loosely regulated environment, Virtual Markets circumvents international financial oversight. In fact, many similar companies use this approach to gain investors’ trust while engaging in opaque financial practices, potentially even financial fraud.

Potential for False Advertising and Market Manipulation

In addition to lacking regulatory oversight, Virtual Markets may also engage in false advertising or market manipulation through its website and platform. Unregulated forex brokers frequently exaggerate their profitability and promise high returns to lure investors into trading. However, without regulatory oversight, these brokers can often manipulate trading data, price movements, and other platform metrics, influencing investors’ decisions and, in some cases, deliberately causing them to lose money.

This kind of false advertising and market manipulation is not uncommon in the forex market. Especially on unregulated platforms, it can be difficult for investors to discern genuine price movements from manipulated data. Once false claims are exposed, investors may find themselves deeply trapped, and the recovery of lost funds becomes exceedingly difficult. Therefore, choosing a regulated and transparent broker is the best way to avoid falling victim to market manipulation.

Lack of Transparency in Fund Management and Associated Risks

For investors, ensuring the safety of their funds is of utmost importance. However, Virtual Markets’ fund management practices raise serious concerns about transparency. First, unregulated brokers often do not follow fund segregation rules, meaning investor funds may be used for the company’s operational expenses or other non-transparent purposes. This implies that if the company faces financial issues, recovering investors’ funds could be nearly impossible.

Furthermore, Virtual Markets has not disclosed whether its platform offers any form of insurance or an investor compensation scheme. For regulated brokers, fund segregation and compensation mechanisms are essential to protecting investor rights. In the event of bankruptcy or financial issues, these mechanisms enable investors to recover part of their losses. However, Virtual Markets has not provided any information on such protections, deepening concerns about the safety of investors’ funds.

Risks of Rapid Expansion in a Short Period

Virtual Markets’ website shows that the company has been operational for just four months, yet during this brief period, it has expanded its business rapidly and attracted a large number of investors. This rapid growth may be linked to promises of high returns, designed to lure investors. Emerging forex brokers often use exaggerated market claims and unrealistic profit promises to attract novice investors to the forex market. However, these brokers often lack the long-term operational capability and financial stability needed to ensure sustainable business.

The swift expansion in such a short time could indicate that the company lacks a solid, long-term business strategy. Many fraudulent financial companies use this model, attracting large sums of capital quickly, only to disappear in a short period, leaving investors with significant losses.

How to Avoid Financial Fraud Traps

When dealing with opaque forex brokers like Virtual Markets, investors must remain vigilant. Here are several effective methods to protect yourself:

- Verify Regulatory Information: When choosing a broker, first ensure they are regulated by a reputable financial authority. Prominent regulatory bodies like the UK’s FCA and the U.S. CFTC offer online tools that allow investors to verify the legitimacy of brokers.

- Beware of Promises of High Returns: Any broker promising quick and easy profits should raise red flags. The volatility of financial markets means that high returns often come with high risks. False promises of guaranteed returns are a common tactic in financial scams.

- Ensure Fund Security: Investors should choose brokers that follow fund segregation rules, ensuring personal funds are kept separate from the company’s operational funds. Unregulated brokers may misuse investor funds, leading to compromised fund safety.

- Check User Reviews: In addition to reviewing information on the broker’s website, use third-party platforms to read feedback and reviews from other users. Negative experiences and complaints often reveal underlying issues with the platform.

Based on the analysis, Virtual Markets, a forex broker with less than six months of operation, lacks transparent regulatory information, raises concerns about fund management, and operates under an offshore registration model. These factors suggest the company may be involved in financial fraud. Investors should prioritize regulated and transparent platforms when choosing a broker. The lack of transparency surrounding Virtual Markets casts doubt on its reliability, and investors should exercise caution to avoid potential scams.

FAQ (Frequently Asked Questions)

- Is Virtual Markets regulated?

Virtual Markets is not registered with any reputable financial regulatory authorities, such as the FSRA, FCA, or CFTC, meaning it is unregulated. This implies that investor funds are not protected by law. - Are funds safe with Virtual Markets?

Since the company does not offer fund segregation or compensation mechanisms, the safety of investor funds is not guaranteed. If the company faces financial difficulties, investors may not be able to recover their funds. - Is Virtual Markets’ registered address trustworthy?

Virtual Markets is registered in Saint Lucia, a known offshore financial hub with lenient regulations. The company may be using this location to avoid stricter financial regulations. - How can you tell if a forex broker is trustworthy?

First, ensure the broker is regulated by a reputable financial authority. Additionally, check if the company has fund segregation and investor compensation plans in place to safeguard your funds. - Why is Virtual Markets suspected of fraud?

The company lacks transparent regulatory information, uses offshore registration to avoid legal obligations, and its fund management practices and rapid expansion model indicate potential fraud. - How can you avoid forex investment scams?

Investors should prioritize brokers regulated by reputable financial authorities and be wary of promises of high returns. Ensuring fund security and avoiding opaque brokers is key to preventing scams.