Introduction to OTA Markets

OTA Markets is a forex brokerage established in 2024, headquartered in the United States. The company claims to offer a wide range of financial products for trading, including forex, precious metals, crude oil, and indices. Despite these offerings, OTA Markets has quickly garnered attention not for its services but for the lack of transparency and regulatory oversight, which poses significant risks to potential investors.

Company Background and Operations

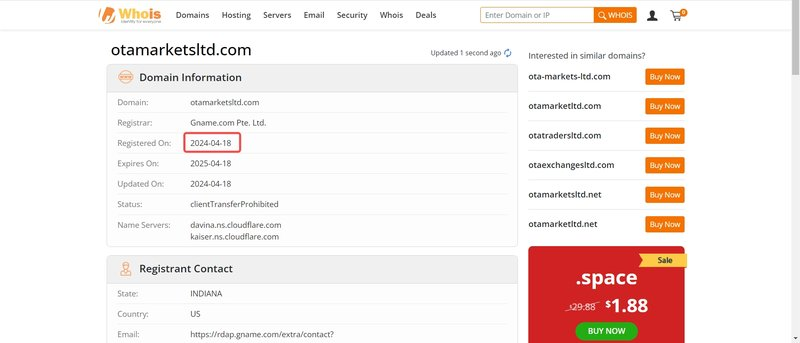

OTA Markets, officially registered as OTA Markets Co. Ltd., is based in Jersey City, New Jersey. The company’s website domain was registered on April 18, 2024, indicating a very recent entry into the financial services market. Such a short operational history suggests that OTA Markets may lack the experience and stability necessary to establish trust among investors.

Company Registration and Address

OTA Markets is registered in the U.S., with its corporate address listed at 30 Hudson St, Jersey City, NJ 07302. This address situates the company in a well-known commercial area; however, being registered does not equate to being regulated or trustworthy. The company’s short time in the market, having operated for less than a year, further raises concerns about its longevity and credibility.

Founding and Development Timeline

The company’s rapid establishment and operation, from its registration in April 2024 to its active marketing as a forex broker, imply a strategy focused on quick market penetration. This haste may reflect a lack of thorough preparation, regulatory compliance, or intent for long-term operations.

Regulatory Status of OTA Markets

The regulatory status of a forex broker is crucial in determining its legitimacy and reliability. OTA Markets claims to operate within the U.S., a jurisdiction known for its stringent financial regulations. However, the reality of OTA Markets’ regulatory standing is far from clear.

NFA Non-Member Status

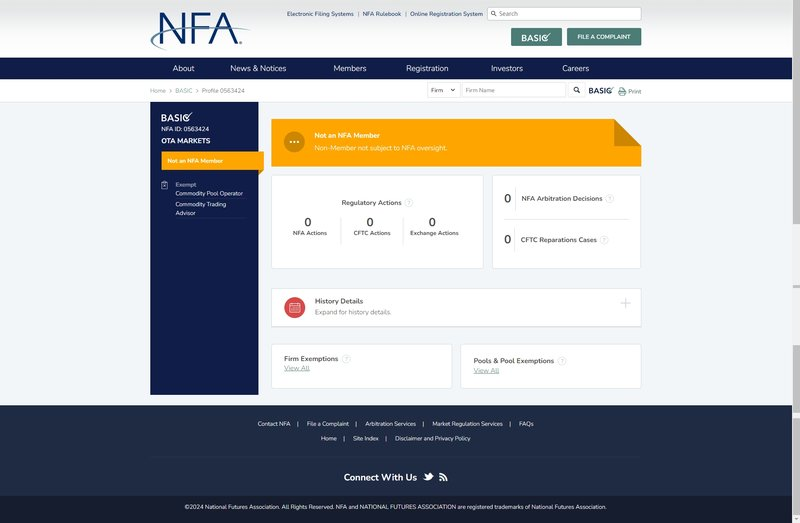

OTA Markets is not a member of the National Futures Association (NFA), the primary regulatory body overseeing forex brokers in the U.S. Instead, it is registered as a non-member unit with the NFA, which means it is not subject to the full spectrum of regulations and oversight that NFA member firms must adhere to. This status severely limits the protection offered to investors and raises red flags regarding the firm’s commitment to maintaining industry standards.

MSB Registration Explained

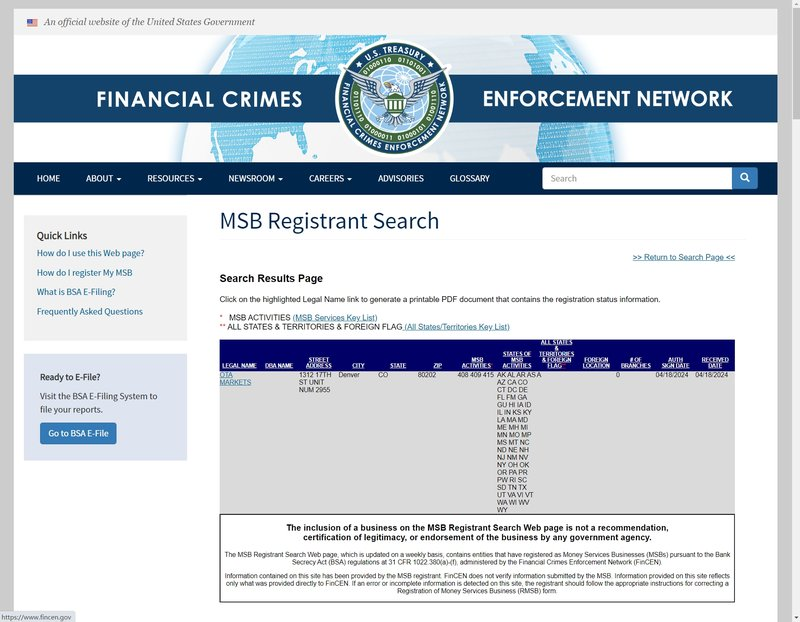

The company has obtained an MSB (Money Services Business) ID number, but this should not be confused with financial regulation. The MSB registration is more focused on preventing money laundering and financial crimes rather than ensuring the safety and fairness of financial trading services. Therefore, MSB registration does not equate to proper regulatory oversight for forex trading activities.

Potential Risks of Investing with OTA Markets

Investing with a broker that lacks stringent regulation and transparent operations is inherently risky. Here are some of the significant risks associated with OTA Markets:

Lack of Effective Regulation

Without effective regulatory oversight from a body like the NFA, OTA Markets operates without stringent checks on its trading practices, financial integrity, or customer protections. This lack of oversight could result in arbitrary actions, poor handling of customer funds, or even fraudulent activities.

Incomplete Information on Account Types

OTA Markets’ website provides limited information on the types of accounts available to traders. This lack of transparency can prevent potential clients from making informed decisions, understanding the full scope of fees or margins, and assessing whether the services meet their trading needs.

Limited Customer Support Options

Customer support is a crucial aspect of any financial service provider. OTA Markets offers only email support via [email protected]. The absence of more immediate communication methods like phone support or live chat can frustrate customers and complicate the resolution of urgent issues, further diminishing trust in the platform’s reliability.

Warning Signs and Red Flags

Several warning signs suggest that OTA Markets might not be a reliable trading platform:

Unverified Trading Platform “TradingWeb”

The trading platform offered by OTA Markets, named “TradingWeb,” has been reported to have several issues, including download links that do not work. The inability to access a functional trading platform raises severe concerns about the broker’s reliability and operational competence.

Inadequate Transparency and Communication

OTA Markets does not provide adequate communication channels or detailed information on their business practices. This lack of transparency could indicate potential misconduct or an attempt to obscure the company’s actual operations and financial status.

Investor Precautions and Safety Measures

To protect their finances, investors should exercise caution when considering unregulated brokers like OTA Markets. Here are some steps to take:

Researching Broker Credibility

Investors should thoroughly research any broker’s history, regulatory status, and customer reviews before committing any funds. Online forums, regulatory body databases, and financial watchdogs are excellent resources for verifying a broker’s credibility.

Importance of Regulatory Compliance

Choosing brokers regulated by well-known financial authorities (e.g., NFA, FCA, ASIC) ensures that the broker adheres to industry standards and provides a higher level of investor protection.

OTA Markets presents several red flags, from inadequate regulation to poor transparency and customer service. Investors should be cautious and consider more reputable, regulated alternatives to protect their financial interests and ensure a secure trading environment.

FAQs

What is OTA Markets?

OTA Markets is a recently established forex broker based in the U.S. offering various financial trading services.

Is OTA Markets regulated?

No, OTA Markets is not a member of the NFA, which means it lacks stringent regulatory oversight.

Why is regulatory compliance important for brokers?

Regulatory compliance ensures brokers adhere to standards that protect investors, such as transparent operations and secure handling of funds.

What are the risks of trading with OTA Markets?

Risks include lack of regulation, limited customer support, and inadequate platform transparency.

How can I verify a broker’s credibility?

Check the broker’s regulatory status with bodies like the NFA or FCA, read customer reviews, and consult financial watchdog websites.

What are safer alternatives to OTA Markets?

Reputable brokers like IG Group, Forex.com, and Interactive Brokers offer better regulatory compliance and investor protection.