In the fast-paced world of online trading, platforms like GCL Global Limited often present themselves as gateways to financial prosperity. However, beneath their seemingly professional exterior lies a web of deceit designed to lure unsuspecting investors into a trap. This article aims to expose the fraudulent practices of GCL Global Limited and to share the story of one investor who fell victim to this scheme. By understanding the tactics used by such fraudulent platforms, investors can better protect themselves from falling prey to similar scams.

The Story of a Victim

One of the victims of GCL Global Limited’s scam is an individual who was initially contacted by a woman named Lucia Ricci through a social media platform. Lucia portrayed herself as a charming and knowledgeable investor, building a relationship with the victim over time. She eventually introduced the victim to GCL Global Limited, presenting it as a legitimate and profitable investment opportunity.

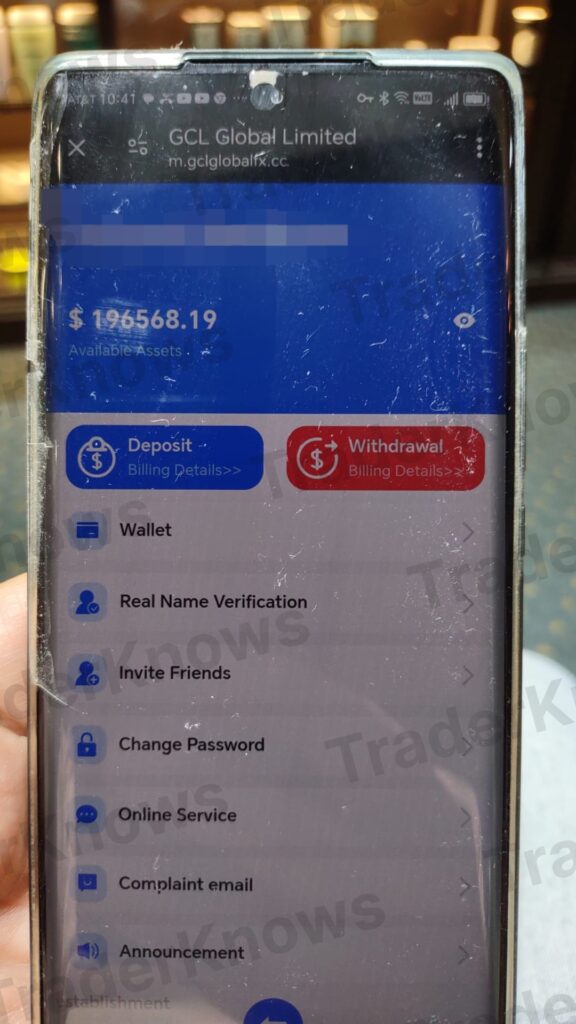

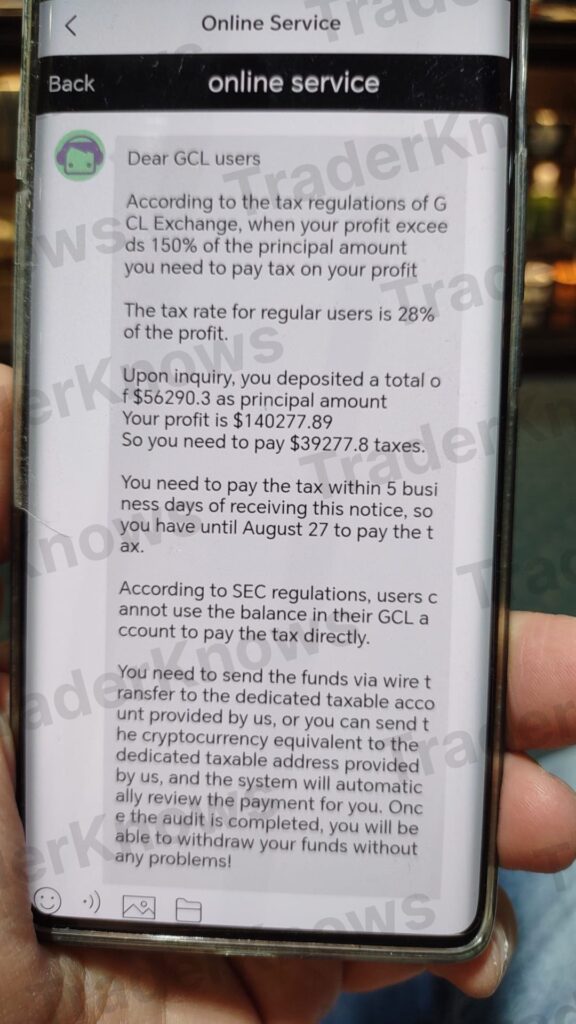

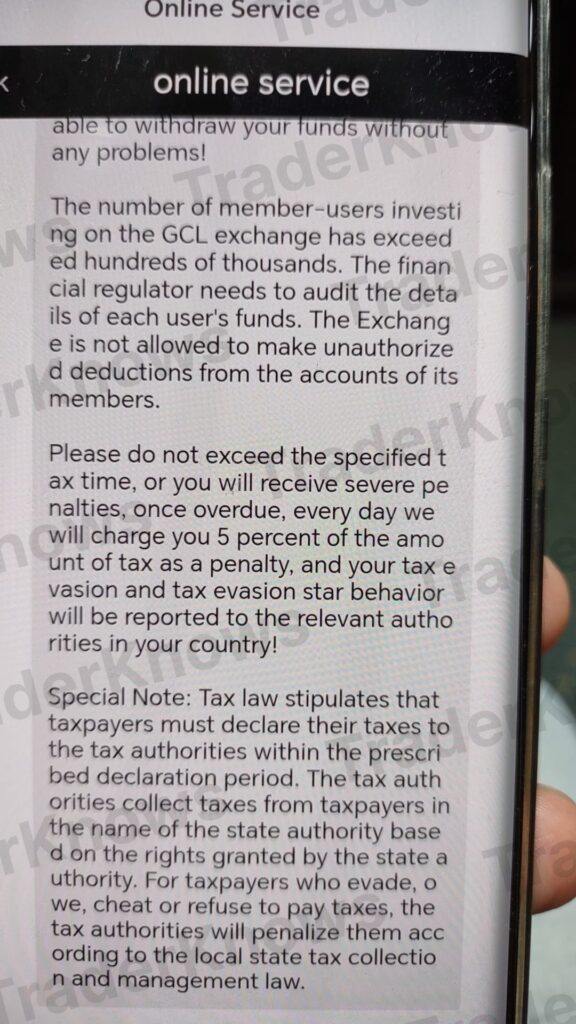

Encouraged by Lucia’s persuasion and the initial success he experienced on the platform, the victim invested a significant amount of money into GCL Global Limited. The platform seemed legitimate at first, with smooth transactions and apparent profits. However, when the victim attempted to withdraw his funds, the nightmare began. GCL Global Limited claimed that because his profits exceeded 150% of his initial investment, he was required to pay a 28% tax on his profits, amounting to $39,000, before any withdrawal could be processed. The victim was told that the tax had to be paid via wire transfer or cryptocurrency, and could not be deducted directly from his account balance.

Realizing something was wrong, the victim refused to pay the additional amount. As a result, GCL Global Limited locked his account, preventing him from accessing any of his funds. The victim was left with nothing but frustration and a significant financial loss, having been deceived by a platform that promised much but delivered only deceit.

The Deceptive Tactics of GCL Global Limited

GCL Global Limited employs several deceptive tactics to lure and trap investors:

- False Legitimacy: The platform claims to be based in Limassol, Cyprus, and even provides a supposed business address in New York City. However, investigations reveal that there is no record of GCL Global Limited in the official business registries of either location. This lack of verifiable information is a strong indicator of the platform’s fraudulent nature.

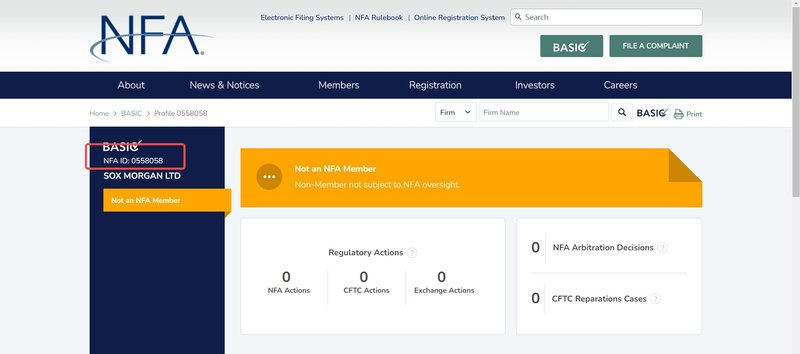

- Fake Regulation: GCL Global Limited falsely claims to be licensed by the National Futures Association (NFA) in the United States, with a specific license number. However, checks with the NFA reveal that the company is neither a member nor regulated by the organization. This false claim is intended to create a false sense of security among potential investors.

- Unclear Financial Processes: The platform does not provide clear information on deposit and withdrawal processes, leaving investors in the dark about how their funds are managed. The ambiguity surrounding financial operations adds another layer of risk, making it difficult for investors to retrieve their money once it is deposited.

- Manipulative Customer Support: While GCL Global Limited offers contact details for customer support, the actual effectiveness and responsiveness of this support are questionable. When issues arise, such as the need to withdraw funds, the platform’s support team becomes evasive, further trapping the victim in their scheme.

The Risks and Consequences of Falling for Such Scams

Falling victim to a scam like GCL Global Limited can have devastating consequences:

- Financial Loss: The most immediate impact is the loss of invested funds. Victims may lose their entire investment, as the platform is designed to extract as much money as possible before cutting off access to accounts.

- Emotional and Psychological Impact: The betrayal and loss can lead to significant emotional distress. Victims often experience feelings of guilt, shame, and anger, which can affect their mental health and overall well-being.

- Privacy and Security Risks: By providing personal information during the registration and investment process, victims may also be exposing themselves to identity theft and other forms of cybercrime.

How to Protect Yourself from Similar Scams

To avoid falling victim to scams like GCL Global Limited, it’s crucial to take the following precautions:

- Conduct Thorough Research: Always verify the legitimacy of an investment platform before depositing any money. Check for proper licensing and regulation through official channels, and look for independent reviews and testimonials from other users.

- Be Wary of Unsolicited Contacts: If someone contacts you out of the blue with an investment opportunity, be cautious. Scammers often use social media and other online platforms to initiate contact and build trust.

- Avoid Sharing Personal Information: Do not provide sensitive personal or financial information to platforms or individuals you do not fully trust. This includes bank account details, social security numbers, and other identifying information.

- Test Withdrawal Processes: Before making significant investments, test the platform’s withdrawal process with a small amount of money. If there are any delays or unusual requirements, it’s a red flag.

- Seek Professional Advice: If you’re unsure about an investment opportunity, consult with a financial advisor or other professional. They can help you assess the risks and determine whether the opportunity is legitimate.

GCL Global Limited is a prime example of how fraudulent platforms operate under the guise of legitimate businesses, preying on unsuspecting investors. By understanding the tactics used by such scammers and taking appropriate precautions, you can protect yourself from financial loss and emotional distress. Always conduct thorough research, remain vigilant, and never let your guard down when it comes to investing online.

How can we find out how to sue GCL?

Hi Derrick, If you want to take action against GCL Global Limited, it’s essential to determine the company’s actual location and legal status. Although GCL Global Limited claims to be based in Limassol, Cyprus and provides an address at 1585 Broadway, New York City, USA, investigations have revealed no official records of the company in these locations, indicating potential false representations. Given these circumstances, consider the following steps:

1. Consult a Legal Professional: Engage an attorney experienced in international fraud cases. They can assist in identifying the company’s true location and advise on the appropriate legal jurisdiction for filing a lawsuit.

2. Gather Evidence: Collect all relevant documentation, including communications, transaction records, and any promotional materials from GCL Global Limited. This evidence is crucial for building a strong case.

3. Report to Regulatory Authorities: File a complaint with financial regulatory bodies in your country. For instance, the U.S. Securities and Exchange Commission (SEC) handles such complaints in the United States.

4. Explore Alternative Dispute Resolution: If the company’s actual location is identified, consider mediation or arbitration as potential avenues for resolving the dispute.

5. Join Class-Action Lawsuits: Investigate whether other individuals have been similarly affected by GCL Global Limited. Participating in a class-action lawsuit can consolidate efforts and resources.

I hope my response can help you.( ̄▽ ̄)”

Good Morning. I have the exact same situation and finally decided to check (I know, pretty dumb of me). I got the exact message indicating that I need to pay $10049.20 before I can withdraw the money. I’ve asked for the “special account” to send the money and that is the point that I’m at. Any advise?

Hey there! I’m really sorry to hear you’re dealing with this. It must be incredibly frustrating. From what you’ve described, it sounds like you’re in the exact same situation many others have found themselves in. The request for you to pay more money before you can withdraw is definitely a red flag—it’s a common tactic scammers use.

My advice would be to stop all payments to them immediately and keep records of any messages or requests for money. You can also consider reporting them to the relevant authorities or consumer protection agencies.

I won’t always be checking this site, but if you need more advice or just want to talk through it, feel free to reach out to me via Telegram. You can contact me through the airplane icon at the top or bottom of the page. Just remember, while I can offer guidance, I can’t help with recovering any funds—but I’ll do what I can to support you!

Take care and stay safe!( •̀ ω •́ )