In an increasingly digital world, the appeal of foreign exchange (Forex) trading has attracted a growing number of investors seeking lucrative opportunities. However, this surge in interest has also given rise to an alarming trend of fraudulent trading platforms preying on unsuspecting individuals. One such platform currently raising significant concerns is SSE FX, a company claiming to offer diverse Forex trading services through its website. This article will explore the risks associated with SSE FX and provide essential guidelines on how to protect yourself from potential fraud.

Understanding SSE FX: A Brief Overview

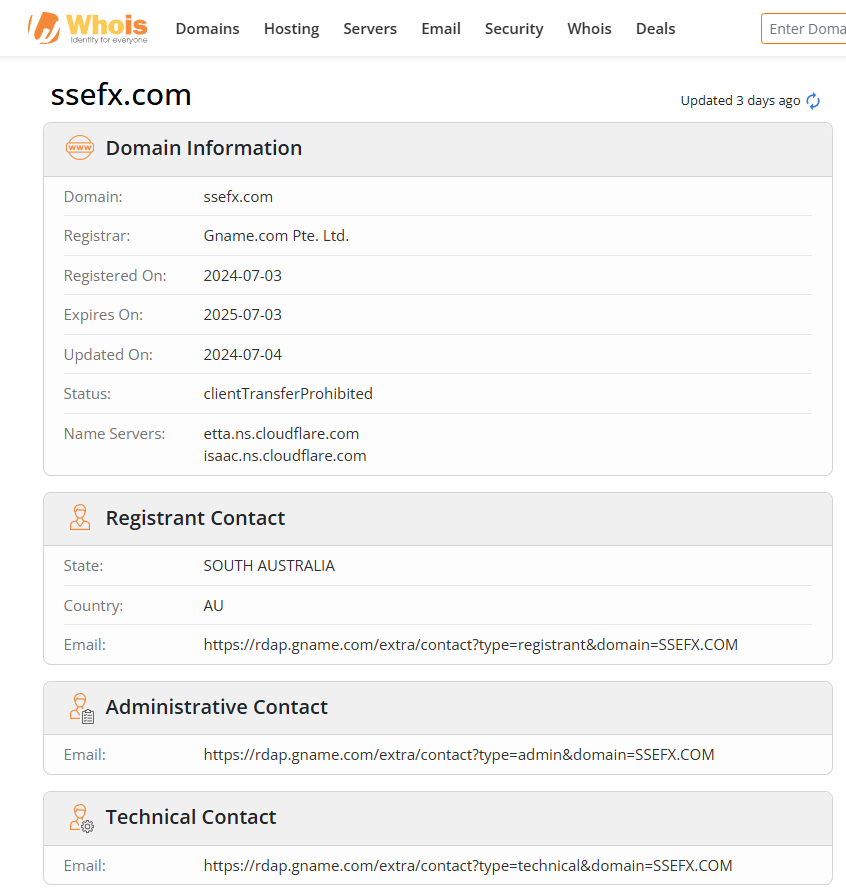

SSE FX is a recently launched platform that purports to offer foreign exchange trading services. Despite its professional-looking website, a deeper investigation reveals troubling gaps in its legitimacy. Launched on July 3, 2024, the platform claims to provide a variety of Forex trading services but fails to offer crucial details about its corporate background. The lack of transparent business registration information is a significant red flag for anyone considering using their services.

Lack of Company Registration Information

One of the most concerning aspects of SSE FX is its failure to disclose specific company registration details. Reliable trading platforms typically provide clear and verifiable information about their legal status, including company registration numbers, headquarters, and corporate governance. This transparency is crucial for establishing trust and credibility with potential clients. The absence of such information from SSE FX raises questions about its operational legitimacy.

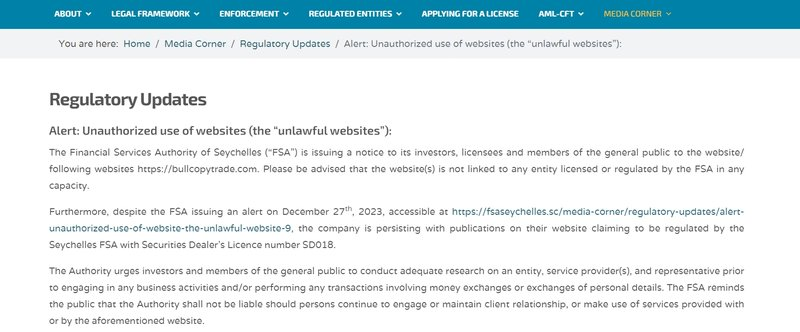

Questionable Regulatory Status

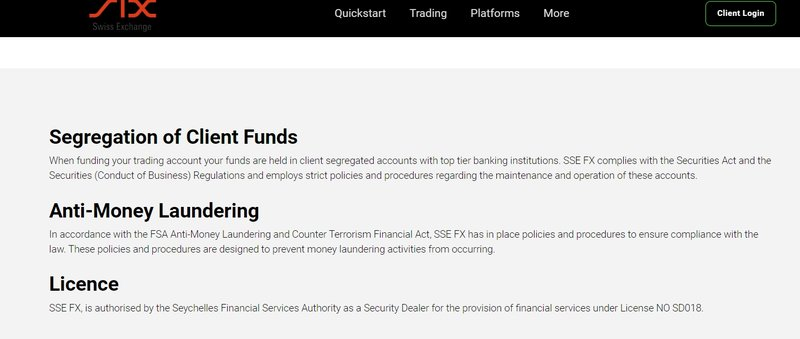

Adding to the skepticism surrounding SSE FX is its claim of being authorized by the Seychelles Financial Services Authority (FSA). The platform lists a license number, SD018, as evidence of its regulatory compliance. However, upon closer examination, it becomes evident that this claim is unfounded. The Seychelles FSA’s official registry contains no record of SSE FX under the specified license number. In fact, SD018 belongs to a different, well-known broker, suggesting that SSE FX may be deliberately misleading the public regarding its regulatory status.

Red Flags to Watch For in Financial Platforms

Fraudulent platforms like SSE FX often share common characteristics that can help you identify them before falling victim. Here are some critical warning signs to be aware of:

Lack of Transparency

A legitimate financial platform will always provide clear and accessible information about its operations, including company registration, regulatory oversight, and business practices. If a platform is vague or secretive about these details, it’s a strong indication of potential fraud.

Misleading Regulatory Claims

As seen with SSE FX, false claims of regulatory approval are a common tactic used by fraudulent platforms to create a false sense of security. Always verify any regulatory claims by cross-referencing with official regulatory bodies.

Unclear Trading Conditions

Another red flag is the absence of detailed information about account types, trading conditions, and fees. Reputable platforms are upfront about their services and the associated costs. If a platform is evasive or unclear about these details, it should be approached with caution.

How to Protect Yourself from Fraudulent Platforms

Given the risks associated with platforms like SSE FX, it’s crucial to take proactive steps to protect your investments. Here are some essential tips:

Conduct Thorough Research

Before investing in any platform, conduct extensive research. Look for user reviews, regulatory confirmations, and third-party analyses. A platform with little to no online presence, or one with negative reviews, is likely to be untrustworthy.

Verify Regulatory Information

Never take a platform’s regulatory claims at face value. Visit the official website of the claimed regulatory body and use their search tools to verify the platform’s credentials. If you find discrepancies, it’s best to avoid the platform altogether.

Seek Independent Advice

If you’re uncertain about a platform’s legitimacy, seek advice from a financial advisor or an independent expert. They can provide a more objective assessment and guide you on whether to proceed with caution or avoid the platform entirely.

Be Wary of Promises of High Returns

Fraudulent platforms often lure investors with promises of exceptionally high returns. Remember, if something sounds too good to be true, it probably is. Legitimate investments come with risks, and no platform can guarantee high profits without corresponding risks.

The Consequences of Falling for a Scam

The financial and emotional toll of falling victim to a fraudulent platform like SSE FX can be devastating. Beyond the immediate loss of funds, victims often face long-term financial difficulties, legal challenges, and significant stress. The ripple effects can impact not just the individual, but their families and communities as well.

Financial Losses

Victims of investment fraud often lose their entire investment, with little hope of recovery. Scammers typically operate from jurisdictions with weak regulatory oversight, making it difficult for authorities to take action.

Legal and Psychological Impact

In addition to financial loss, victims may find themselves entangled in legal battles to recover their funds. The psychological impact, including stress, anxiety, and loss of trust, can have long-lasting effects on the individual’s well-being.

What to Do If You’ve Been Scammed

If you believe you’ve fallen victim to a scam like SSE FX, it’s important to act quickly:

Report the Fraud

Report the fraud to your local authorities and financial regulatory body. The quicker you report, the better your chances of recovering your funds and preventing further loss.

Contact Your Bank or Credit Card Company

If you’ve made payments via bank transfer or credit card, contact your bank or card issuer immediately. They may be able to reverse the transaction or block further fraudulent activity.

Seek Legal Advice

Consult with a lawyer who specializes in financial fraud. They can advise you on your legal options and help you navigate the complexities of recovering lost funds.

Support Groups and Counseling

Consider joining a support group for victims of fraud. Sharing your experience with others can provide emotional relief and practical advice on how to move forward. Counseling services can also help in managing the psychological impact of the scam.

In the ever-evolving world of online financial services, staying informed and vigilant is your best defense against fraud. Platforms like SSE FX, with their questionable practices and lack of transparency, highlight the need for caution. By conducting thorough research, verifying regulatory claims, and seeking independent advice, you can protect yourself from falling prey to such scams.

FAQs

How can I verify the legitimacy of a financial platform like SSE FX?

A: Verify the platform’s regulatory status by checking with the relevant financial authority. Also, research the company’s registration details and read reviews from other users.

What should I do if I suspect a platform is a scam?

A: Report your suspicions to financial regulators and law enforcement. Avoid making any further transactions and consult a financial advisor for guidance.

Why is transparency important in financial services?

A: Transparency is crucial as it builds trust and ensures that the platform operates under legal and ethical standards. Lack of transparency often indicates potential fraud.

Can I recover my money if I fall victim to a scam like SSE FX?

A: Recovery is challenging but possible. Immediate reporting to authorities, contacting your bank, and seeking legal advice can increase your chances of recovery.

Are there any legitimate Forex trading platforms I can trust?

A: Yes, there are many reputable Forex trading platforms. Look for those with verified regulatory status, transparent business practices, and positive user reviews.

What are some common signs of a fraudulent trading platform?

A: Common signs include lack of clear company registration, false regulatory claims, promises of high returns with little risk, and unclear trading conditions.