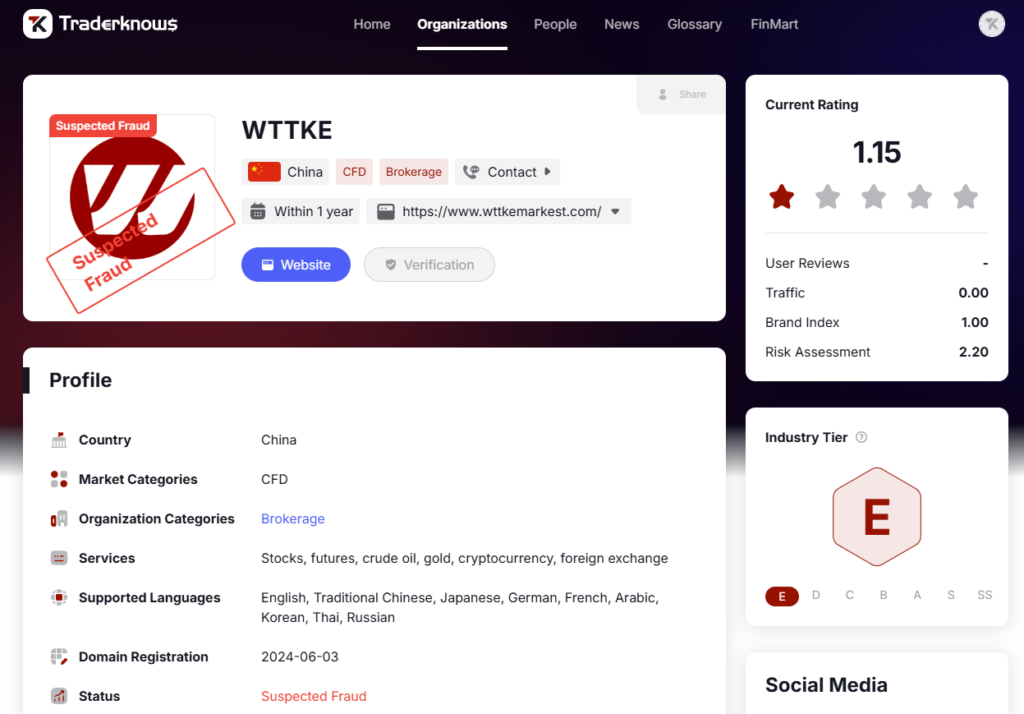

In today’s rapidly evolving financial markets, the promise of high returns and easy trading platforms can be enticing. Unfortunately, this environment also attracts fraudulent entities preying on unsuspecting investors. One such entity is WTTKE, a CFD broker that has recently come under scrutiny for potentially being a scam. This article aims to provide a comprehensive overview of the WTTKE scam, highlighting the red flags, the misleading information they provide, and essential tips on how to avoid falling victim to such scams.

What is WTTKE?

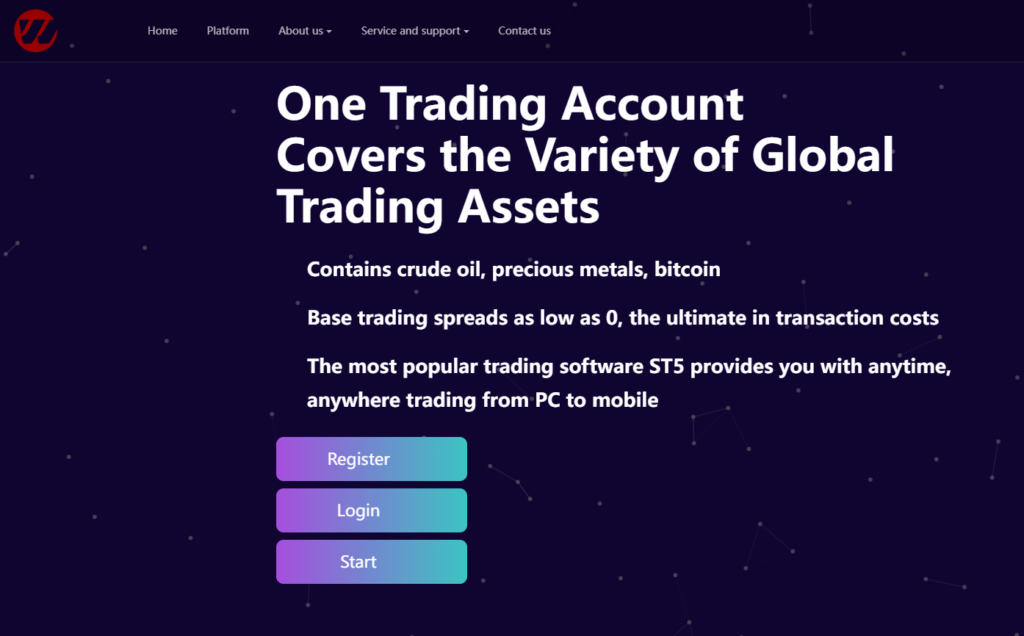

WTTKE is a CFD (Contract for Difference) broker that offers trading services in a variety of financial derivatives, including stocks, futures, crude oil, gold, cryptocurrencies, and forex. The company claims to cater to both retail and institutional clients, providing a platform for traders to engage in speculative activities across different financial markets.

WTTKE’s Website and Services Overview

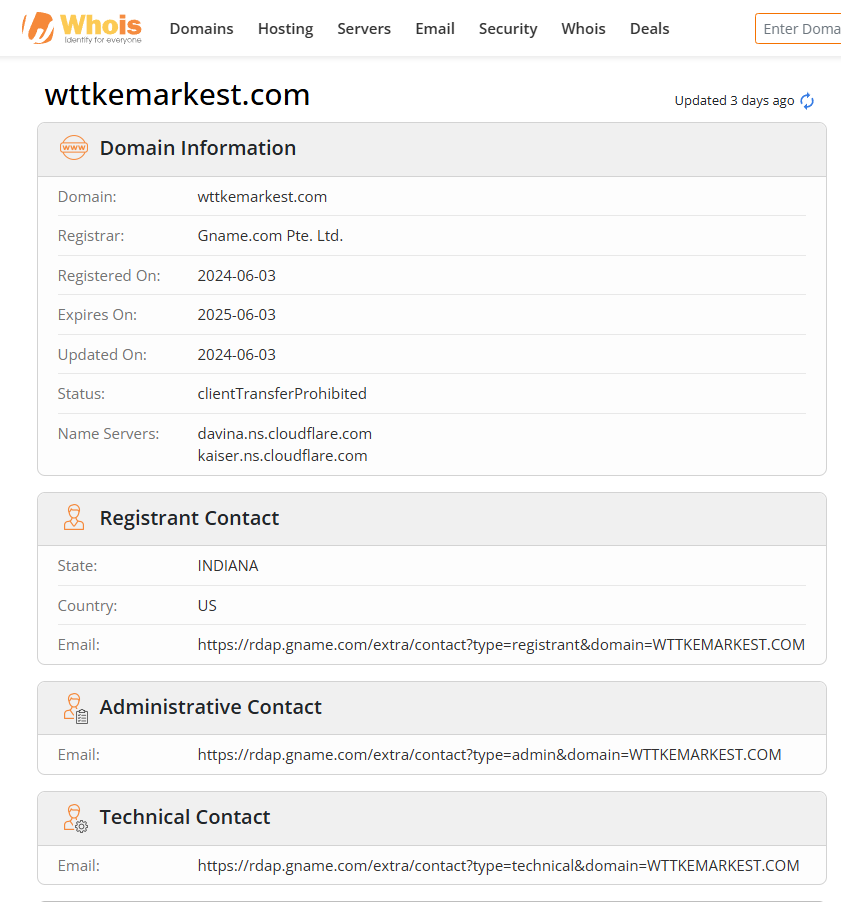

WTTKE’s official website, registered on June 3, 2024, presents itself as a professional trading platform. It claims to provide a range of trading services for financial derivatives and positions itself as a global player in the trading industry. The site features sleek design elements and extensive information on various trading instruments, aiming to instill confidence in potential investors.

However, despite the professional appearance, closer inspection reveals inconsistencies and red flags, particularly in the company’s registration details and regulatory claims.

Company Registration and Regulatory Status

Claims of U.S. and Australian Headquarters

WTTKE purports to be a subsidiary of Japan WTTKE, operating in the United States with headquarters in Tulsa, Oklahoma. The company also claims to provide retail and commercial banking services across the Midwestern and Southwestern United States. Additionally, it mentions being one of the top 50 financial services companies in the U.S. and the largest financial services company in Oklahoma.

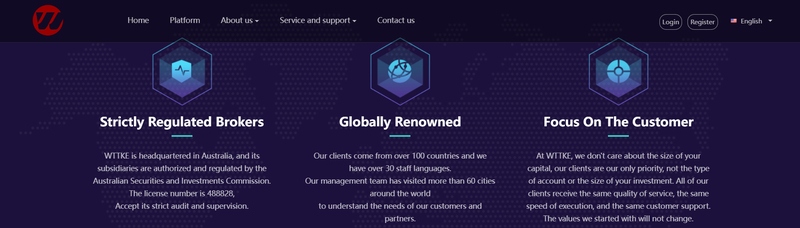

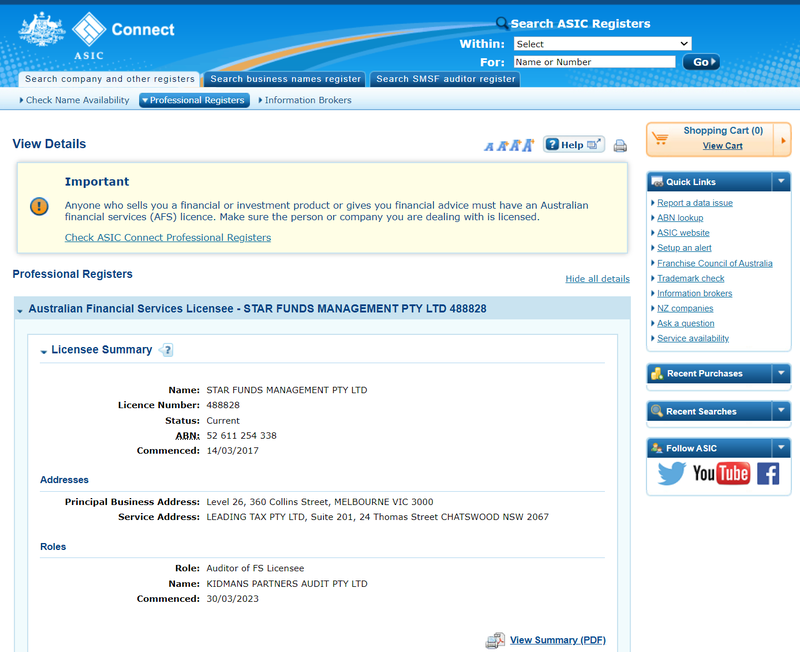

Confusingly, WTTKE’s homepage also states that its headquarters are in Australia, where its subsidiaries are allegedly authorized and regulated by the Australian Securities and Investments Commission (ASIC) under license number 488828.

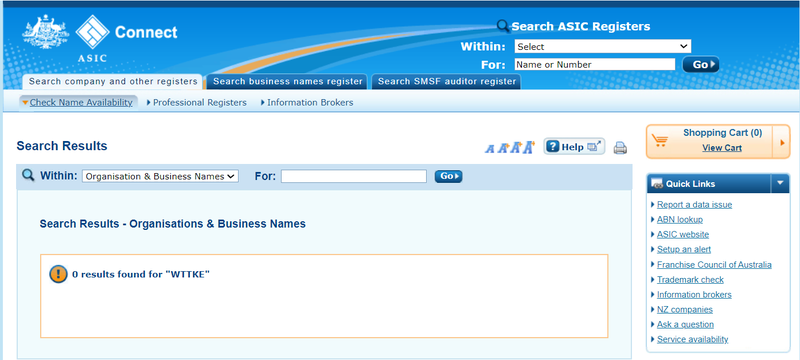

Verification of ASIC Registration

Upon verification with the ASIC, it becomes clear that WTTKE’s claims are false. The ASIC does not list any entity by the name of WTTKE. The license number 488828, which WTTKE claims to hold, actually belongs to another company, STAR FUNDS MANAGEMENT PTY LTD. This discrepancy strongly indicates that WTTKE is not a legitimate broker and is operating without proper regulatory oversight, making it a fraudulent entity.

Red Flags of WTTKE

Misleading Information and False Advertising

WTTKE’s website is riddled with misleading information. The contradictory statements regarding its headquarters, coupled with the falsified ASIC license number, are clear indications of deceptive practices. Such inconsistencies are major red flags and should immediately alert potential investors to the possibility of fraud.

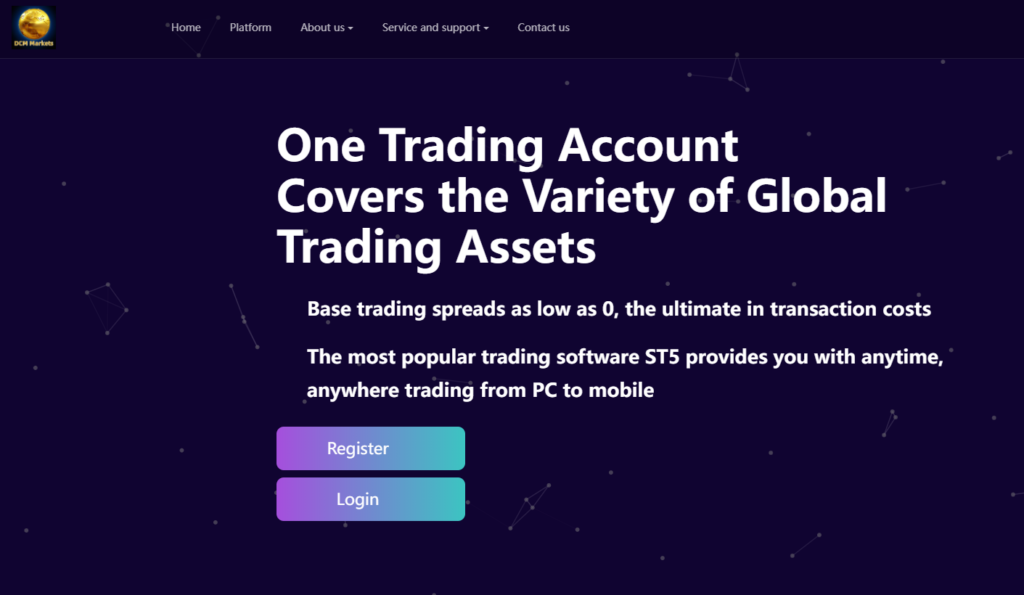

Similarities to Other Scam Broker Websites

One of the most concerning aspects of WTTKE is its website design and content, which are identical to several other known scam broker websites such as DML Markets, SXHJAS, TNFL FX, ABUSA, Hengtuo Finance, and VTPTRADE. The reuse of website templates and content across different scam platforms is a common tactic used by fraudulent brokers to create a veneer of legitimacy while operating multiple scams under different names.

Comparing WTTKE with Legitimate Brokers

Legitimate brokers are transparent about their regulatory status, often providing direct links to their registration details on regulatory body websites. They also offer multiple methods of communication, including phone numbers, live chat, and physical office addresses. In contrast, WTTKE only offers email as a contact method, which is a significant red flag. Moreover, the lack of any verifiable registration or regulation information further differentiates WTTKE from reputable brokers.

Potential Risks of Engaging with WTTKE

Engaging with WTTKE poses significant financial risks. Investors may find themselves unable to withdraw their funds, facing exorbitant fees, or receiving no returns on their investments. The lack of regulation means that there is no recourse for clients who fall victim to the scam, as the company is not accountable to any financial regulatory body.

How to Identify a Scam Broker

Checking Company Registration and Regulation

Always verify the registration and regulation status of any broker you intend to use. Legitimate brokers will be registered with relevant regulatory bodies such as the ASIC, FCA, or SEC, and their registration numbers can be verified directly on these bodies’ websites.

Evaluating Website Content and Design

Be wary of brokers whose websites have identical designs and content to known scam sites. Scammers often reuse website templates to save time and money, which can be a key indicator of fraud.

Assessing Communication Methods

Legitimate brokers provide multiple contact methods, including phone, email, live chat, and physical office locations. A lack of communication options is a red flag that the broker may not be legitimate.

What to Do If You’ve Been Scammed

If you believe you’ve fallen victim to WTTKE or a similar scam, it’s crucial to act quickly. Contact your bank or credit card company to dispute the transactions, and report the scam to your local financial regulatory authority. It may also be helpful to share your experience on online forums to warn others.

Preventive Measures Against Scam Brokers

To avoid falling victim to scam brokers, always conduct thorough research before investing. Verify the broker’s registration and regulation status, read user reviews, and be cautious of brokers that promise unusually high returns with minimal risk.

Legal Recourse for Victims

Victims of scam brokers like WTTKE may have limited legal recourse, especially if the broker operates in a jurisdiction with lax regulatory oversight. However, seeking legal advice and reporting the scam to financial authorities can sometimes lead to the recovery of lost funds.

The Importance of Choosing a Reputable Broker

Choosing a reputable broker is crucial for safeguarding your investments. Reputable brokers are transparent about their operations, regulated by recognized financial authorities, and have a track record of good customer service.

WTTKE presents itself as a legitimate CFD broker, but the evidence suggests otherwise. With falsified regulatory claims, misleading company information, and connections to other known scam brokers, WTTKE appears to be a fraudulent entity designed to exploit unsuspecting investors. By being vigilant and conducting thorough research, investors can protect themselves from falling victim to scams like WTTKE.

FAQs

What is WTTKE, and why is it considered a scam?

WTTKE is a CFD broker that claims to offer trading services in financial derivatives such as stocks, futures, crude oil, gold, cryptocurrencies, and forex. It is considered a scam because it provides false information about its regulatory status, falsely claims to be regulated by the Australian Securities and Investments Commission (ASIC), and has identical website content to other known scam brokers. These factors indicate that WTTKE is likely a fraudulent entity designed to deceive investors.

How can I verify if a broker is legitimate?

To verify if a broker is legitimate, check the broker’s registration and regulatory status with the relevant financial authorities, such as the ASIC, FCA, or SEC. Legitimate brokers will provide a valid license number, which can be cross-referenced on the regulatory body’s official website. Additionally, look for transparent company information, multiple communication methods, and positive user reviews from reliable sources.

What are the red flags that suggest WTTKE is a scam?

Several red flags suggest that WTTKE is a scam, including:

- False claims of regulation by ASIC with a fake license number.

- Contradictory information about the company’s headquarters.

- Identical website design and content to other known scam brokers.

- Limited communication options, with only an email address provided.

- Numerous online complaints from users unable to withdraw funds or experiencing sudden account closures.

What should I do if I have already invested money with WTTKE?

If you have already invested money with WTTKE, act quickly by contacting your bank or credit card company to dispute the transactions. Report the scam to your local financial regulatory authority, and consider seeking legal advice. Sharing your experience on online forums can also help warn others about the scam.

How can I protect myself from falling victim to similar scams?

To protect yourself from similar scams, follow these steps:

- Always verify the broker’s registration and regulatory status with recognized financial authorities.

- Conduct thorough research by reading user reviews and consulting with financial professionals.

- Be cautious of brokers that promise high returns with minimal risk, as these are common tactics used by scammers.

- Avoid brokers with limited communication methods or those that provide contradictory information about their operations.

Can I recover my funds if I have been scammed by WTTKE?

Recovering funds from a scam broker like WTTKE can be challenging, especially if the broker operates in a jurisdiction with weak regulatory oversight. However, you should report the scam to financial authorities and seek legal advice. In some cases, your bank or credit card company may be able to assist with chargebacks or disputes, depending on how the funds were transferred.