In the fast-paced world of forex trading, choosing a reliable broker is crucial to your financial success. However, with the rise of fraudulent platforms, the risk of falling victim to scams has never been higher. One such platform that has recently come under scrutiny is CMOTC. This article exposes the deceptive practices of CMOTC, highlighting the red flags that signal this broker is not what it claims to be. We will delve into the company’s dubious regulatory claims, its questionable business practices, and why you should steer clear of this fraudulent platform.

Understanding CMOTC: What They Claim to Offer

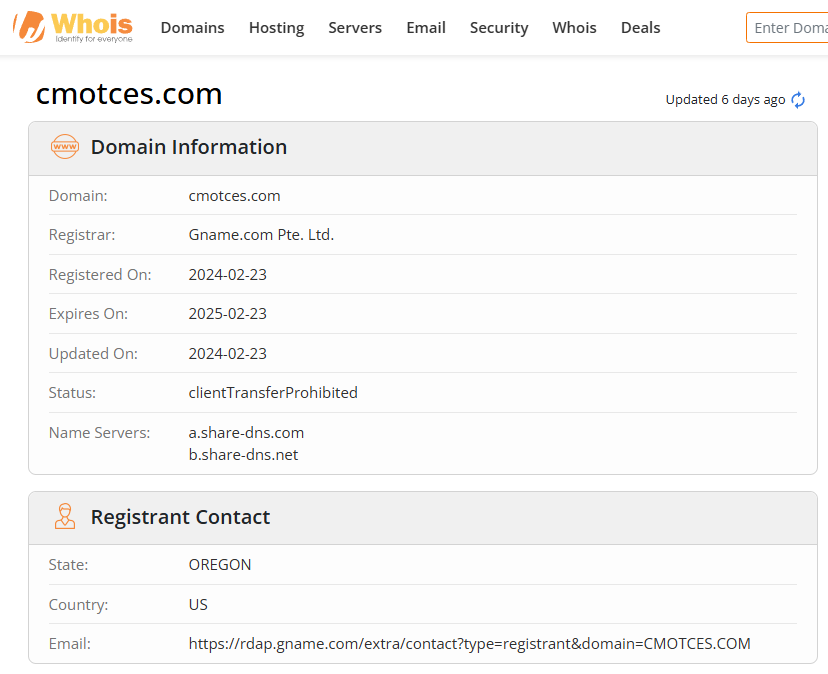

CMOTC, a forex broker that officially registered its website on February 23, 2024, presents itself as a robust trading platform offering a variety of markets. According to its official site, CMOTC allows users to trade forex, metals, commodities, and indices. The broker asserts that it is regulated by two prominent financial authorities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). Additionally, it claims membership in THE FINANCIAL COMMISSION, a self-regulatory organization and external dispute resolution body for financial markets.

At first glance, these credentials may seem impressive, potentially luring in unsuspecting investors. However, a closer examination reveals that these claims do not hold up under scrutiny.

Corporate Registration and Regulatory Status: The Red Flags

CMOTC asserts that it operates under the corporate entity CMOTC Limited and boasts regulatory oversight from ASIC and VFSC. However, upon verification, it becomes evident that these claims are part of a well-crafted deception.

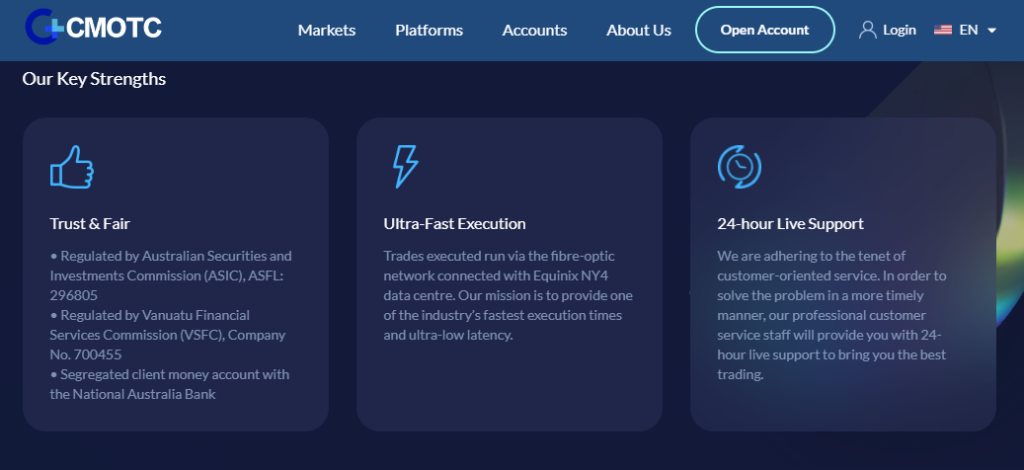

ASIC License Discrepancies: According to CMOTC’s website, the company holds ASIC license number 296805. However, a search on the official ASIC website reveals that this license is actually registered to DLS MARKETS (AUST) PTY LTD, not CMOTC Limited. This discrepancy is a significant red flag, indicating that CMOTC is falsely claiming another company’s license to appear legitimate.

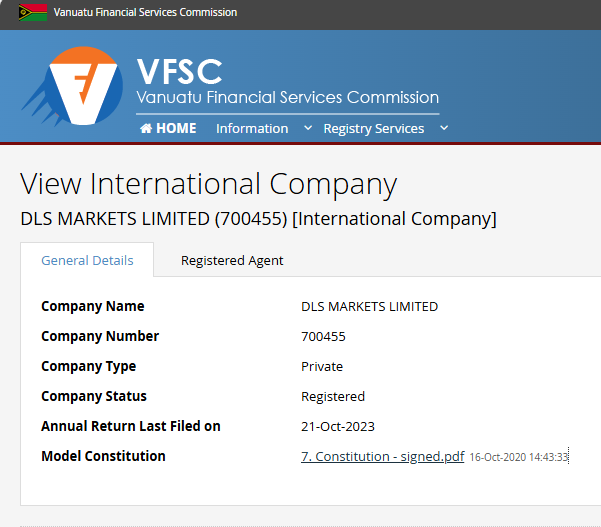

VFSC License Fraud: CMOTC also claims to be regulated by the VFSC under license number 700455. Similar to the ASIC case, this license is linked to DLS MARKETS LIMITED, not CMOTC. This pattern of using another company’s regulatory information suggests that CMOTC is a clone site—a fraudulent platform mimicking a legitimate entity to deceive traders.

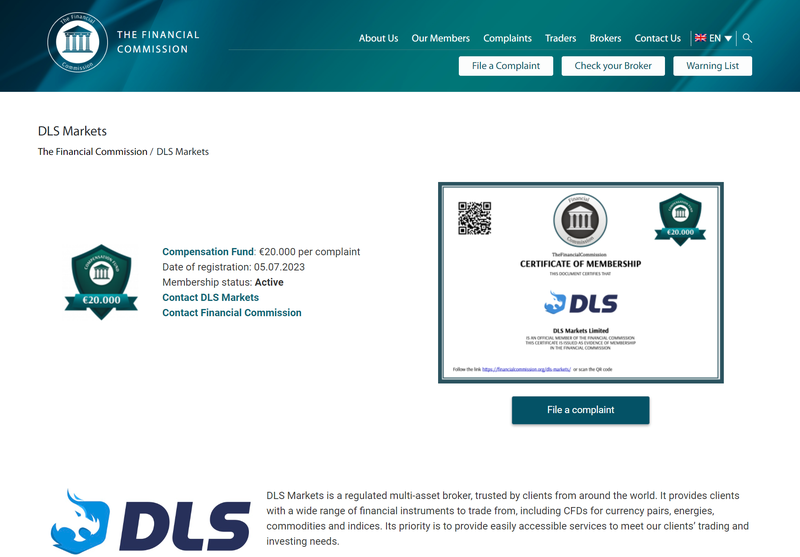

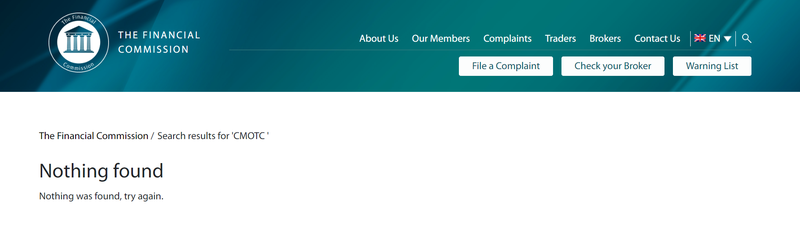

Misleading Membership with THE FINANCIAL COMMISSION: CMOTC’s claim of being a registered member of THE FINANCIAL COMMISSION is also misleading. A thorough check of the Commission’s membership directory shows no listing for CMOTC. Instead, DLS MARKETS is found in the directory, further confirming that CMOTC is a fraudulent clone of DLS MARKETS.

Website Design Similarities and Questionable Practices

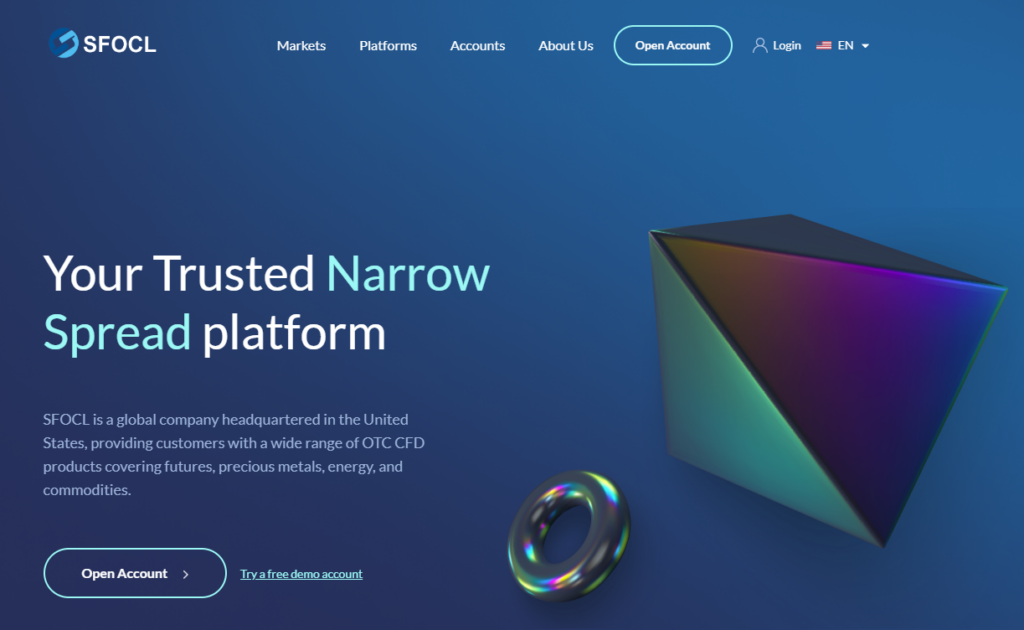

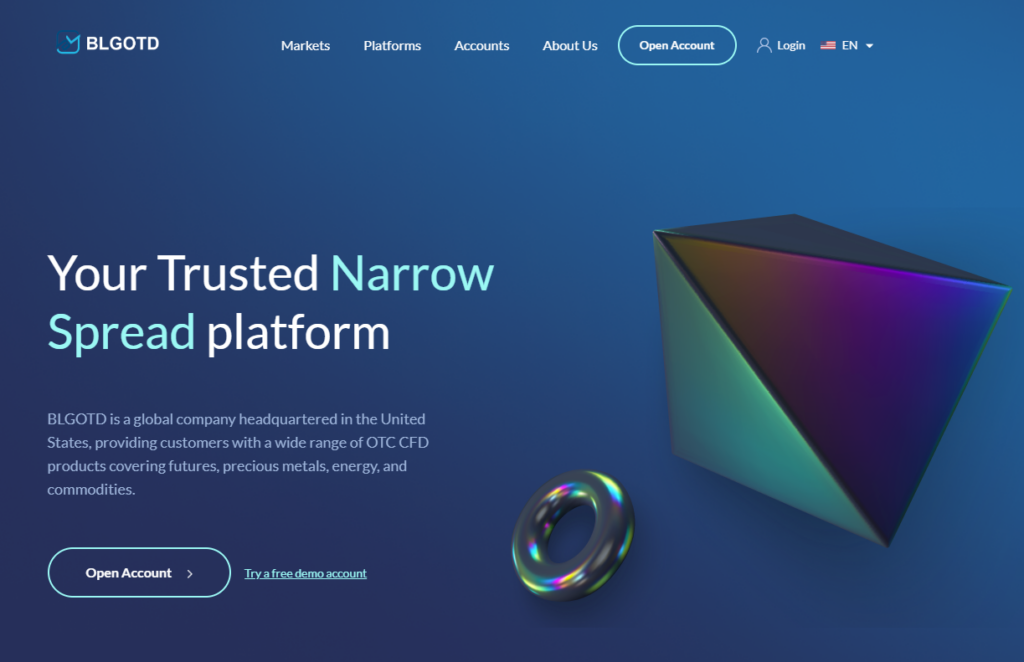

Another telltale sign of CMOTC’s fraudulent nature is its website design. The layout and features of the CMOTC website bear a striking resemblance to several other dubious broker websites, including NCXFX, BLGOTD, SFOCL, and WANDT. This similarity is not a coincidence but a common tactic used by scam brokers to create multiple fraudulent platforms under different names, making it harder for authorities to track them.

Moreover, CMOTC’s website contains several suspicious elements. For example, the “Terms and Conditions” section, which should provide critical legal information, only displays non-functional icons. In contrast, the legitimate DLS MARKETS website offers accessible and detailed legal documents. This difference underscores the fraudulent nature of CMOTC, as the inability to access essential documents is a clear sign that the broker is not operating transparently.

The Dangers of Investing with CMOTC

Investing with a fraudulent broker like CMOTC can have severe consequences. Given the evidence, it is clear that CMOTC is not a legitimate trading platform but a scam designed to exploit unsuspecting investors. Here are some of the potential dangers:

- Financial Loss: The most immediate risk is the loss of your investment. Once you deposit funds with CMOTC, retrieving them may prove impossible, as the platform is not regulated by any legitimate authority.

- Personal Information Theft: Fraudulent platforms often seek to obtain personal information that can be used for identity theft. By registering with CMOTC, you could unknowingly expose sensitive information to cybercriminals.

- No Legal Recourse: Since CMOTC is not genuinely regulated, victims have little to no recourse if they fall victim to this scam. Unlike with regulated brokers, where you can file a complaint with the regulatory body, fraudulent brokers operate outside the bounds of legal oversight, leaving investors unprotected.

How to Protect Yourself from Scam Brokers

To avoid falling victim to scam brokers like CMOTC, it’s essential to conduct thorough research before investing. Here are some tips to help you protect your investments:

- Verify Regulatory Claims: Always verify the regulatory claims made by a broker. Check the official websites of regulatory bodies to ensure that the broker is genuinely licensed.

- Look for Transparency: A legitimate broker will provide easy access to its legal documents, terms, and conditions. If you encounter a website where these documents are inaccessible or incomplete, consider it a red flag.

- Research the Broker’s Reputation: Search for reviews and feedback from other traders. If a broker has a history of complaints or unresolved issues, it’s best to avoid them.

- Be Wary of Too-Good-To-Be-True Offers: Scam brokers often entice victims with promises of high returns with little risk. Remember, if it sounds too good to be true, it probably is.

CMOTC is a fraudulent platform posing as a legitimate forex broker. By falsely claiming regulatory oversight and mimicking the appearance of a legitimate company, it aims to deceive investors and steal their funds. It is crucial to remain vigilant and conduct thorough research before investing with any broker. Protect your hard-earned money by choosing only transparent, well-regulated brokers with a solid reputation in the financial industry.

FAQs

Is CMOTC a legitimate broker?

No, CMOTC is not a legitimate broker. It falsely claims regulatory oversight and mimics a legitimate company’s website and credentials.

What should I do if I have already invested with CMOTC?

If you have already invested with CMOTC, you should immediately contact your bank or payment provider to attempt to reverse the transaction. Additionally, report the scam to relevant authorities.

How can I verify if a broker is regulated?

To verify if a broker is regulated, visit the official website of the regulatory body and search for the broker’s license number.

Why is regulatory oversight important when choosing a broker?

Regulatory oversight ensures that brokers operate within legal boundaries, providing protection for investors and ensuring that the broker adheres to industry standards.

Can I recover my funds from a fraudulent broker?

Recovering funds from a fraudulent broker can be challenging and often requires legal assistance. It’s best to avoid fraudulent brokers altogether by conducting thorough research beforehand.

What are the signs of a scam broker?

Common signs of a scam broker include false regulatory claims, inaccessible legal documents, overly attractive offers, and a lack of transparency. Always be cautious and do your due diligence.