Exploring the realm of online trading can be overwhelming, particularly with the rise of fraudulent brokers. Open Eyes Limited is one broker that has sparked considerable concern. Although it markets itself as a trustworthy financial services provider, the reality seems to tell a different story. This article examines the reasons behind Open Eyes Limited’s reputation as a scam and provides tips on how to remain cautious when selecting a broker.

What is Open Eyes Limited?

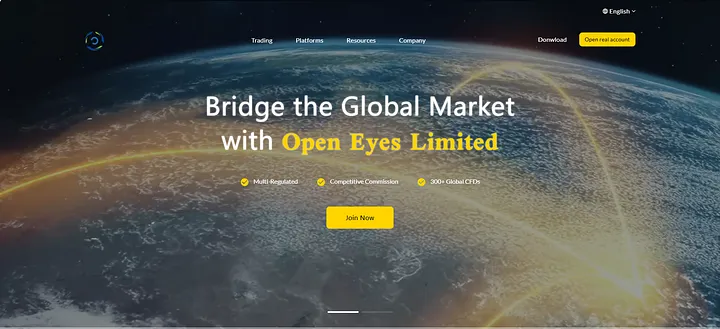

Open Eyes Limited positions itself as a Contract for Difference (CFD) broker, offering a variety of financial derivatives such as forex, metals, energy, indices, and stocks. Founded in 2008, the broker boasts of serving clients in over 70 countries and having offices in seven locations. However, despite these impressive claims, the broker’s legitimacy is highly suspect, raising concerns about why it is regarded as a scam.

Why Open Eyes Limited is Considered a Scam

Several compelling factors point to Open Eyes Limited being a scam. The most concerning issues relate to its questionable regulatory status, dubious business registration claims, misleading advertising tactics, and suspicious communication methods.

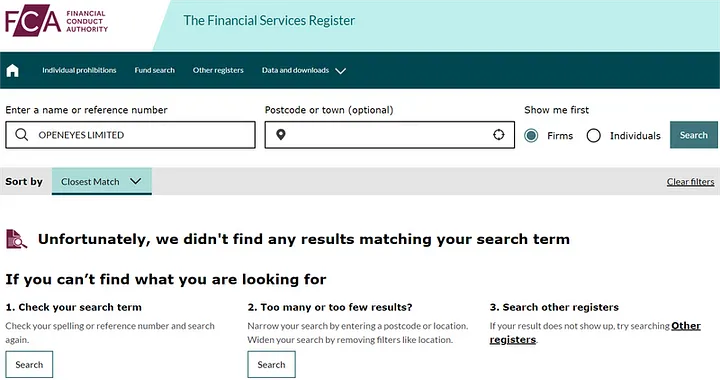

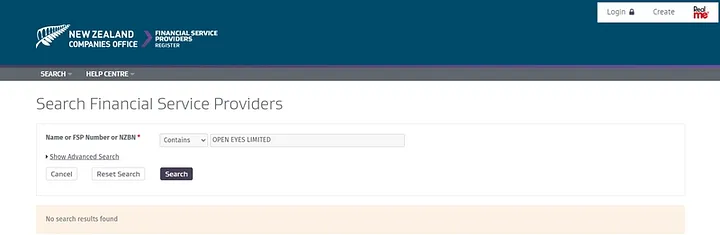

Absence of Regulatory Transparency

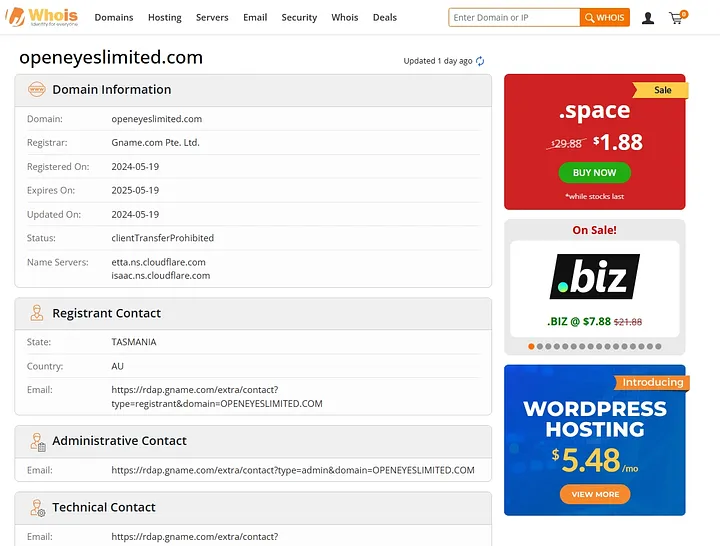

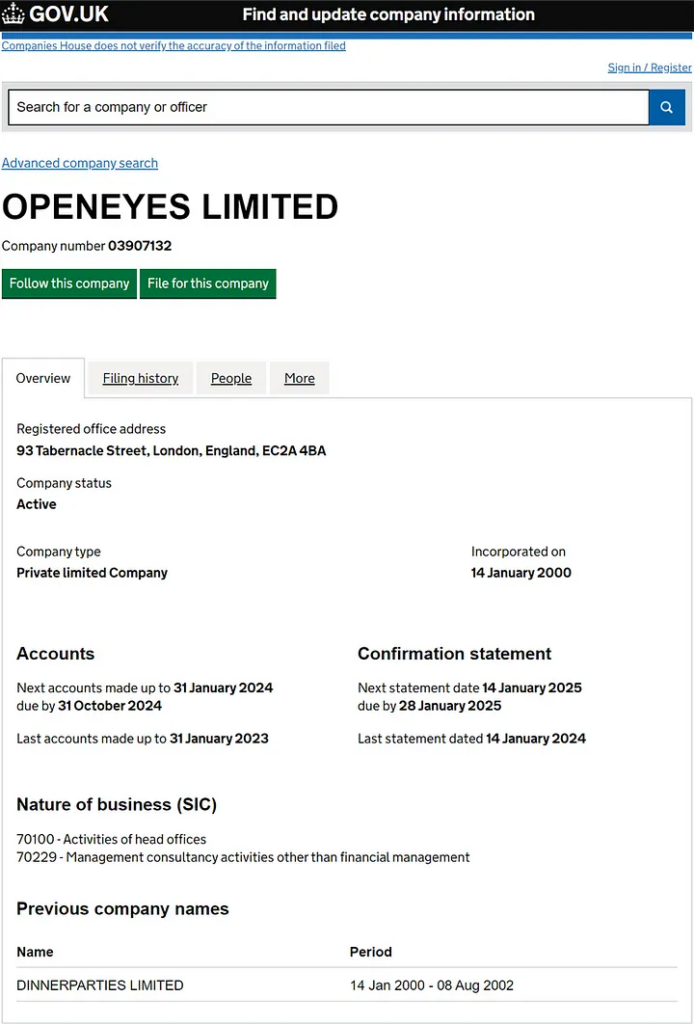

A broker’s regulatory status is a critical indicator of its legitimacy. However, Open Eyes Limited falls short in this area. Despite asserting that it is regulated by various financial authorities, the company fails to provide specific regulatory details on its website. Efforts to verify these claims reveal no registration with reputable bodies such as the UK Financial Conduct Authority (FCA) or the New Zealand Financial Service Providers Register, which raises significant red flags.

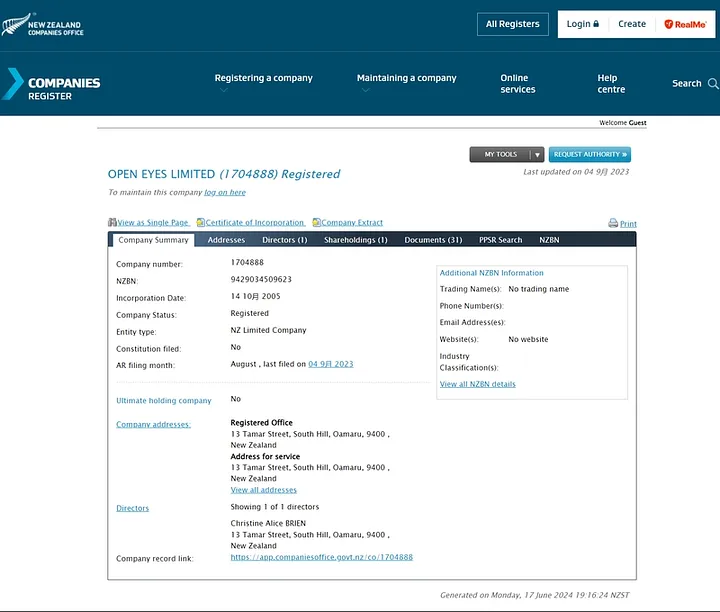

Misleading Business Registration Claims

The business registration details of Open Eyes Limited are equally questionable. While the company is listed in the UK Companies House and the New Zealand Companies Register, there is no corresponding regulatory information to support these registrations. This inconsistency suggests that the company may be leveraging these registrations to falsely present itself as a legitimate entity, without being subject to actual regulatory oversight.

Deceptive Advertising Practices

False advertising is a common tactic among fraudulent brokers, and Open Eyes Limited is no exception. The company promotes itself as a regulated and well-established entity, creating a misleading image that lures potential investors into a false sense of security. This deceptive marketing strategy increases the risk of financial loss for those who believe they are engaging with a trustworthy firm.

Red Flags in Trading Platforms

Operational issues and technical inconsistencies are telltale signs of a fraudulent broker. Users of Open Eyes Limited have reported a range of problems with its trading platforms, including delayed trade executions, hidden fees, and sudden account closures. These issues not only disrupt the trading experience but often result in significant financial losses for users.

Consequences of Trading with Fraudulent Brokers

The repercussions of trading with a fraudulent broker like Open Eyes Limited can be severe. Financial losses are the most immediate and obvious consequence, but the impact can extend further, leading to personal stress, wasted time, and even potential legal complications. Recognizing these risks highlights the critical importance of choosing a reputable and reliable broker.

How to Verify a Broker’s Legitimacy

To protect yourself from scams, it’s crucial to thoroughly verify a broker’s legitimacy. Essential steps include:

- Confirming the broker holds valid regulatory licenses.

- Cross-referencing business registration details with regulatory bodies.

- Reading user reviews and testimonials to gauge credibility.

- Ensuring the broker maintains transparent and open communication methods.

- Evaluating the quality, reliability, and transparency of their trading platforms.

Importance of Regulatory Oversight

Regulatory oversight is essential for ensuring brokers operate according to industry standards, safeguarding traders from fraudulent activities. Brokers under regulation are subject to rigorous scrutiny, which helps create a safer trading environment. Choosing a regulated broker reduces risks and promotes fair trading practices.

Recognizing Common Scam Tactics

Fraudulent brokers often use a set of common tactics to deceive traders, including:

- Promising unrealistically high returns with minimal risk.

- Employing high-pressure sales techniques to rush decisions.

- Offering enticing bonuses that come with hidden, unfavorable conditions.

- Providing misleading or incomplete information to obscure the truth.

Being aware of these tactics is crucial for avoiding scams.

What to Do if You’ve Been Scammed

If you suspect or confirm that you’ve been scammed, take the following actions:

- Immediately cease all communication with the broker.

- Report the incident to the appropriate financial authorities.

- Consult with legal professionals to explore potential recovery options.

- Share your experience publicly to help warn others.

Preventive Measures for Future Trading

To minimize the risk of falling victim to future scams, consider these practices:

- Conduct in-depth research before selecting a broker.

- Verify the broker’s regulatory status and business registration credentials.

- Use only trusted and well-reviewed trading platforms.

- Stay vigilant by educating yourself on common scam tactics and warnings.

The Role of Financial Regulatory Authorities

Financial regulatory authorities are pivotal in protecting traders. They establish and enforce regulations, perform regular audits, and take action against brokers who fail to comply. Opting for a broker regulated by a reputable authority adds an extra layer of security to your trading experience.

Educational Resources for Traders

Investing in your education about safe trading practices is key. Utilize resources such as trading courses, financial news websites, and publications from regulatory authorities to gain valuable insights. Staying informed empowers traders to make better decisions and avoid scams.

Staying Informed About Market Scams

Remaining up-to-date on the latest market scams is vital. Follow reputable financial news outlets, subscribe to alerts from regulatory bodies, and engage with trading communities to stay informed. Awareness is your best defense against scams.

Open Eyes Limited serves as a clear reminder of the importance of conducting thorough due diligence when choosing a broker. The absence of regulatory transparency, questionable registration claims, and numerous negative user experiences strongly suggest that this broker is a scam. By remaining informed and vigilant, traders can shield themselves from fraudulent brokers like this and ensure a more secure trading experience.

FAQs

What is Open Eyes Limited?

Open Eyes Limited is a CFD broker that offers trading services in financial derivatives. However, it is widely regarded as a scam due to its lack of regulatory oversight and deceptive business practices.

Why is Open Eyes Limited considered a scam?

Open Eyes Limited is labeled as a scam because it lacks verifiable regulatory information, makes misleading business registration claims, engages in false advertising, and provides limited contact options.

How can I verify a broker’s legitimacy?

To verify a broker’s legitimacy, check for valid regulatory licenses, review their business registration details, read user reviews, ensure they have transparent communication methods, and evaluate the reliability of their trading platforms.

What should I do if I’ve been scammed by a broker?

If you’ve been scammed by a broker, immediately stop all communication with them, report the scam to financial authorities, seek legal advice, and share your experience to help warn others.

Why is regulatory oversight important?

Regulatory oversight is crucial as it ensures brokers comply with industry standards, protecting traders from fraudulent activities and fostering a fair trading environment.

What are common scam tactics used by fraudulent brokers?

Fraudulent brokers commonly use tactics such as promising high returns with minimal risk, applying high-pressure sales techniques, offering bonuses with hidden conditions, and providing misleading or incomplete information.