In today’s fast-paced financial markets, online trading has become more accessible than ever. With the rise of contract-for-difference (CFD) brokers, investors have the opportunity to trade a variety of assets, including forex, indices, metals, commodities, and cryptocurrencies. However, not all brokers operate with transparency and integrity. Make Capital, a relatively new CFD broker, has raised concerns among traders and regulators alike. This article provides a comprehensive overview of the potential risks associated with Make Capital and offers essential tips on how to protect your finances from potential scams.

Understanding Make Capital: A Brief Overview

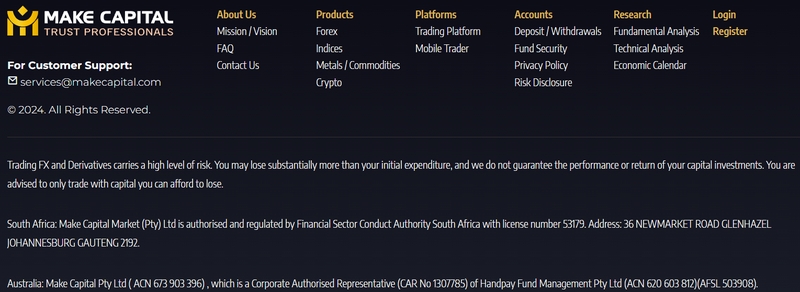

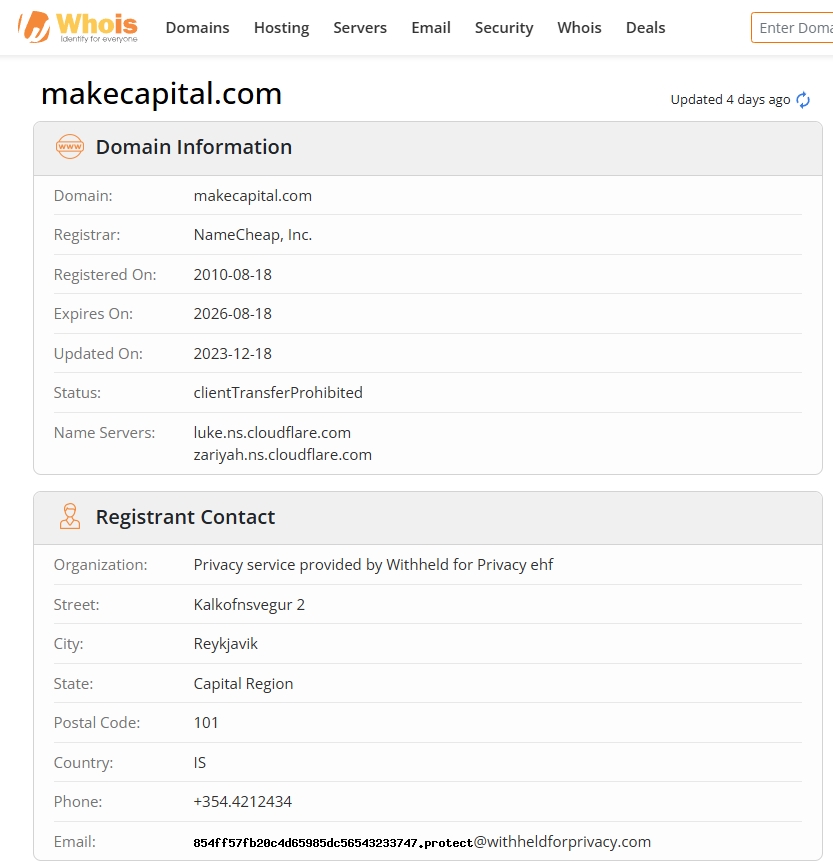

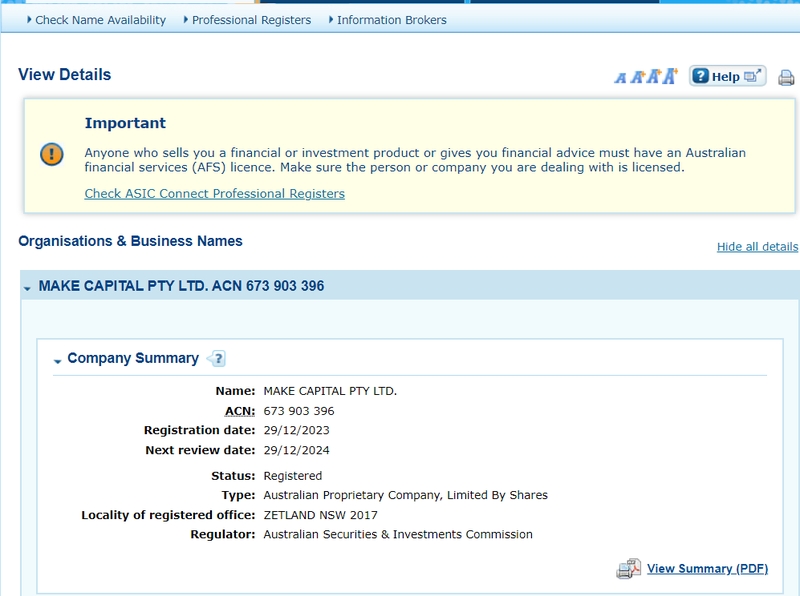

Make Capital, established in Australia on December 29, 2023, is a CFD broker offering investment services in a wide range of assets. Despite being registered in both Australia and South Africa, the company’s regulatory status and operational practices have come under scrutiny. While Make Capital is authorized by the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) of South Africa, these licenses may not provide the level of protection that traders expect.

The Regulatory Landscape: What You Need to Know

ASIC and FSCA: The Regulatory Authorities Behind Make Capital

Make Capital operates under two primary regulatory bodies: the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) of South Africa. Understanding the roles and limitations of these regulators is crucial for any potential investor.

- ASIC (Australian Securities and Investments Commission):

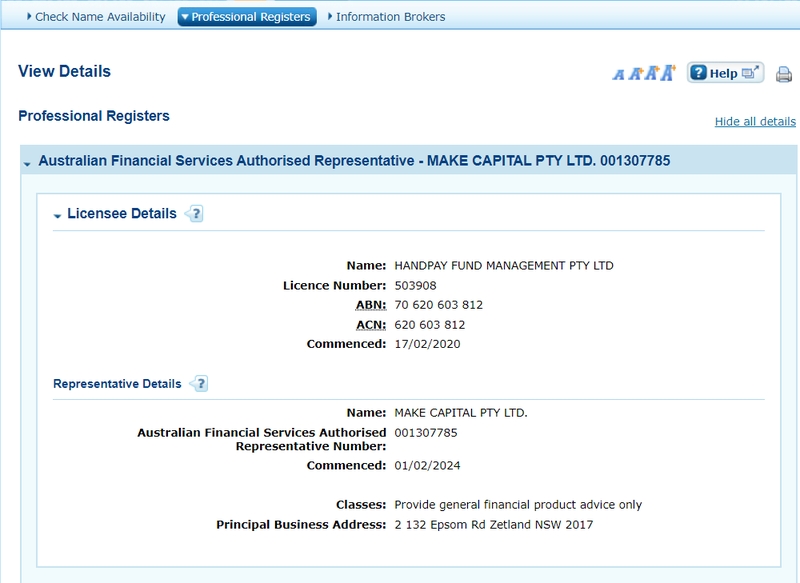

- Make Capital holds an ASIC authorized representative license (number 001307785) through HANDPAY FUND MANAGEMENT PTY LTD.

- ASIC is known for its rigorous oversight, but the effectiveness of this oversight can be compromised if companies engage in practices such as outsourcing or renting licenses, which can lead to reduced investor protection.

- FSCA (Financial Sector Conduct Authority of South Africa):

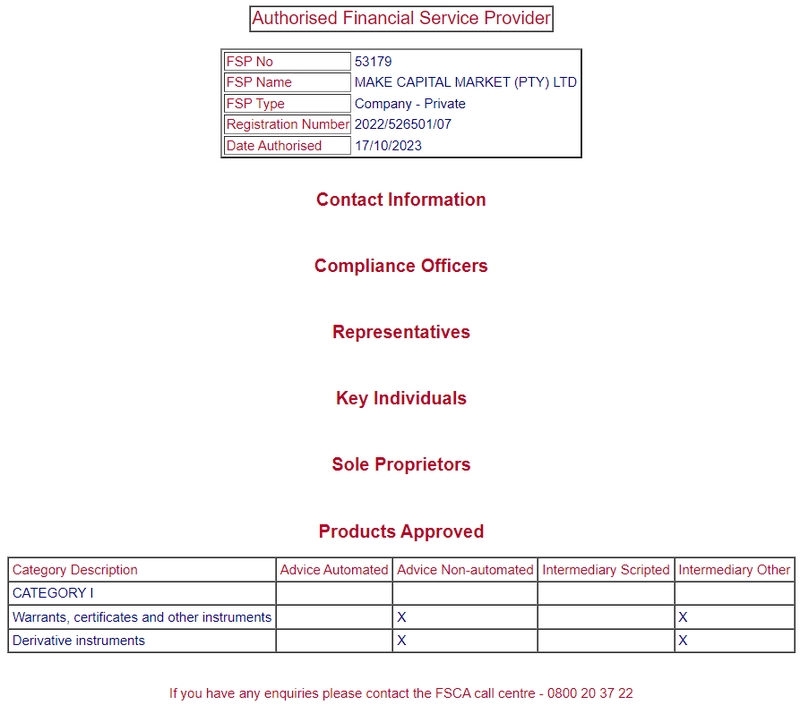

- The South African entity, MAKE CAPITAL MARKET (PTY) LTD, is licensed under the FSCA with FSP license number 53179.

- South Africa’s regulatory environment is considered less stringent, with lower application thresholds and a history of regulatory challenges, including being placed on the Financial Action Task Force (FATF) grey list in 2023.

Red Flags in Make Capital’s Operations

Lack of Transparency in Trading Accounts

One of the most significant concerns with Make Capital is the lack of detailed information about its trading accounts. The broker’s website does not disclose crucial details such as account types, spreads, trading leverage, margin call/stop-out levels, and trading commissions. This lack of transparency can lead to uncertainty and increased trading risks for investors.

The Risks of Operating with Insufficient Information

Without access to detailed account information, traders are at a disadvantage. The absence of clear terms and conditions can make it difficult to assess the true cost of trading, manage risk effectively, and develop sound trading strategies. This lack of transparency is a red flag that should not be ignored.

Potential Loopholes in Regulatory Compliance

Nominal Authorization vs. Actual Control

A concerning practice among some brokers, including Make Capital, is obtaining a nominal authorization from regulators like ASIC while actual operations are controlled by unregulated entities or individuals. This practice can lead to regulatory failure, leaving investors vulnerable to potential scams.

Outsourced or Rented Licenses

Another issue to be aware of is the outsourcing or renting of licenses. Some companies acquire licenses without having the necessary operational capabilities or expertise, resulting in a high-risk environment for traders. In such cases, the license holder may lack effective supervision over the outsourced entity, further increasing the potential for fraud.

Misleading Claims and Fake Licenses

Investors should be wary of brokers that exaggerate the scope or effectiveness of their regulatory licenses. Some companies may even forge or continue to operate with expired licenses, deceiving traders into believing they are dealing with a legitimate entity.

Compliance Issues and Investor Protection

Even when a broker holds legitimate licenses, compliance with regulations in practice is not always guaranteed. Issues such as failing to ensure the safety of client funds or providing inappropriate financial advice can lead to significant financial losses for investors.

The Risks of Trading with Make Capital

Limited Regulatory Oversight and Investor Protection:While Make Capital is registered with both ASIC and FSCA, the level of protection these licenses offer may be limited. The lenient regulatory environment in South Africa, combined with potential loopholes in Australia’s ASIC framework, means that traders may not be fully protected in the event of a dispute or financial loss.

High-Risk Warning for Potential Investors:Given the concerns surrounding Make Capital’s transparency, regulatory compliance, and operational practices, potential investors should approach this broker with caution. The risks associated with trading on an opaque platform far outweigh the potential benefits, particularly for those new to online trading.

How to Protect Your Finances from Scams

Research the Broker Thoroughly:Before committing to any broker, it is essential to conduct thorough research. Look for reviews from other traders, check the broker’s regulatory status, and verify the authenticity of their licenses. A lack of information or negative feedback should be a red flag.

Verify Regulatory Compliance:Ensure that the broker is fully compliant with the regulations of the country in which they are registered. This includes checking the validity of their licenses and ensuring that they are authorized to offer the specific financial services and products they claim.

Beware of Too-Good-to-Be-True Offers:Scammers often lure victims with promises of high returns and low risk. Be wary of any broker that makes unrealistic claims or pressures you into making quick decisions. Always remember that if something sounds too good to be true, it probably is.

Check for Transparency:A reputable broker will provide detailed information about their trading accounts, fees, and terms and conditions. If this information is not readily available, it could be a sign that the broker is trying to hide something.

Use Regulated Payment Methods:When funding your trading account, use payment methods that offer some level of protection, such as credit cards or reputable e-wallet services. Avoid sending money directly to a broker’s bank account, especially if the account is located in a different country.

Monitor Your Account Regularly:Once you start trading, keep a close eye on your account activity. Look out for any unauthorized transactions or changes to your account that you did not initiate. If you notice anything suspicious, contact your broker immediately and consider withdrawing your funds.

FAQs

What is Make Capital?

Make Capital is a CFD broker established in Australia in December 2023, offering investment services in various assets, including forex, indices, metals, commodities, and cryptocurrencies.

Is Make Capital a regulated broker?

Make Capital is registered and regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) of South Africa. However, concerns have been raised about the effectiveness of these regulatory licenses in protecting investors.

Why is Make Capital considered a high-risk broker?

Make Capital is considered high-risk due to its lack of transparency, potential regulatory loopholes, and limited information about trading accounts. The broker’s regulatory environment is also less stringent, raising concerns about investor protection.

How can I protect myself from potential scams?

To protect yourself from potential scams, research the broker thoroughly, verify their regulatory compliance, beware of too-good-to-be-true offers, and ensure transparency in their operations. Additionally, use regulated payment methods and monitor your account regularly.

What should I do if I suspect a scam?

If you suspect a scam, cease all trading activities immediately, withdraw your funds, and report the issue to the relevant regulatory authorities. It is also advisable to seek legal advice if necessary.

Are there safer alternatives to Make Capital?

Yes, there are many reputable CFD brokers that offer transparent operations, strong regulatory oversight, and positive customer reviews. Always choose a broker with a proven track record of protecting investor funds.