What is STB Provider?

STB Provider is a financial derivatives trading platform established in 2023. Its headquarters are located at Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros Islet, Saint Lucia. The platform offers a variety of trading products, including:

- Forex: Trading in major and minor currency pairs.

- Precious Metals: Trading in gold and silver.

- Stock Indices: Trading in major global stock indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq.

- Energy: Trading in oil and natural gas.

The official website of STB Provider supports only English, meaning that investors must have a good command of the language to navigate the platform. STB Provider uses MetaTrader 5 (MT5) as its trading platform and offers three types of accounts:

- PRIME Account: Minimum deposit of $3,000.

- LP Account: Minimum deposit of $100,000.

- Custom Account: Minimum deposit of $500,000.

While STB Provider offers a range of products and account types, the platform’s overall trustworthiness and safety are still in question.

Is STB Provider safe and legitimate? Does STB Provider hold the appropriate regulatory licenses?

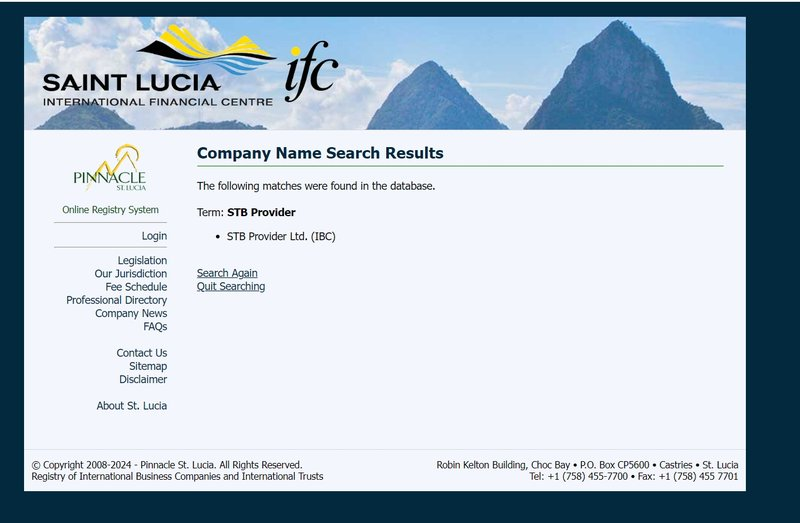

STB Provider’s domain was established on August 26, 2023, and STB Provider LTD claims to be registered in Saint Lucia under license number 2023-00478, purportedly regulated by the authorities there. According to its official website, the platform offers trading services in forex, precious metals, stock indices, and energy derivatives. However, investigations reveal that while a company named STB Provider Ltd is indeed registered with the Saint Lucia International Financial Centre (IFC), it is only registered as a standard international business company. Saint Lucia does not offer brokerage services for forex or other financial derivatives, meaning that STB Provider is likely not effectively regulated.

Given these uncertainties, the platform’s credibility is questionable, and its regulatory status remains unclear.

Funds Security at STB Provider:STB Provider claims, “At STB, the security of our client’s funds and personal information is our top priority. We utilize advanced encryption technology to safeguard sensitive data and implement strict security protocols to protect against unauthorized access. Additionally, client funds are held in segregated accounts with reputable financial institutions, providing an extra layer of protection.”

While these statements sound reassuring, it is crucial to consider them within the context of the platform’s regulatory ambiguity. Without transparent regulation and oversight, the effectiveness of these security measures cannot be fully verified. Segregated accounts and advanced encryption are standard practices among reputable brokers, but their efficacy is heavily dependent on the integrity and regulation of the institution itself.

Therefore, potential investors should be cautious, as claims of robust security measures may not be sufficient to ensure the safety of their funds in the absence of clear regulatory oversight.

STB Provider Trading Products

STB Provider offers a range of trading products, including:

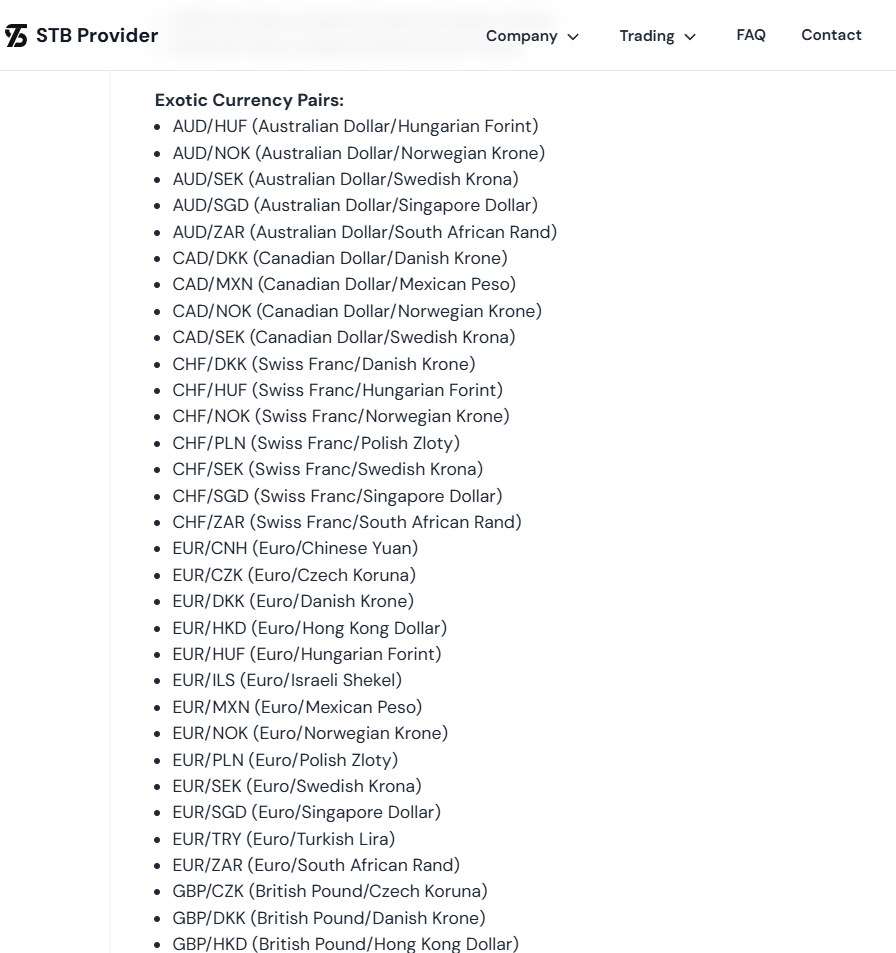

Forex:

STB Provider offers extensive forex trading services, covering both major and minor currency pairs. Investors can profit from currency exchange rate fluctuations.

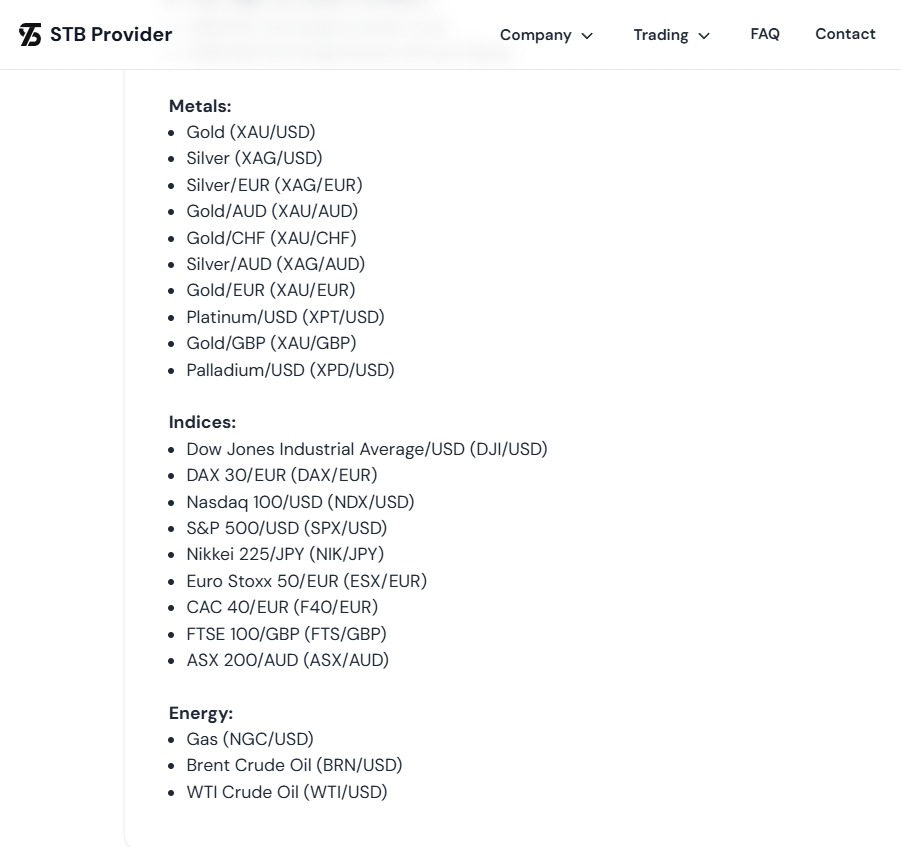

Precious Metals:

STB Provider’s precious metals trading includes gold and silver. Precious metals have long been considered safe-haven investments. By trading precious metals, investors can protect and grow their wealth during market volatility.

Stock Indices:

STB Provider provides trading services for major global stock indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Index.

Energy:

STB Provider’s energy trading products include oil and natural gas. The energy market’s price fluctuations are influenced by various factors such as the global economy, geopolitical events, and supply and demand.

While these trading products offer diversity and investment opportunities, the unclear regulatory status of STB Provider remains a significant concern.

STB Provider Trading Platform

STB Provider offers the MetaTrader 5 (MT5) trading platform, known for its powerful features and flexibility. MT5 caters to a wide range of investors’ needs and preferences, offering extensive analytical tools, charts, and automated trading functions. These features enable traders to effectively implement various trading strategies.

However, no matter how advanced the platform may be, it poses significant risks if not backed by reliable regulation.

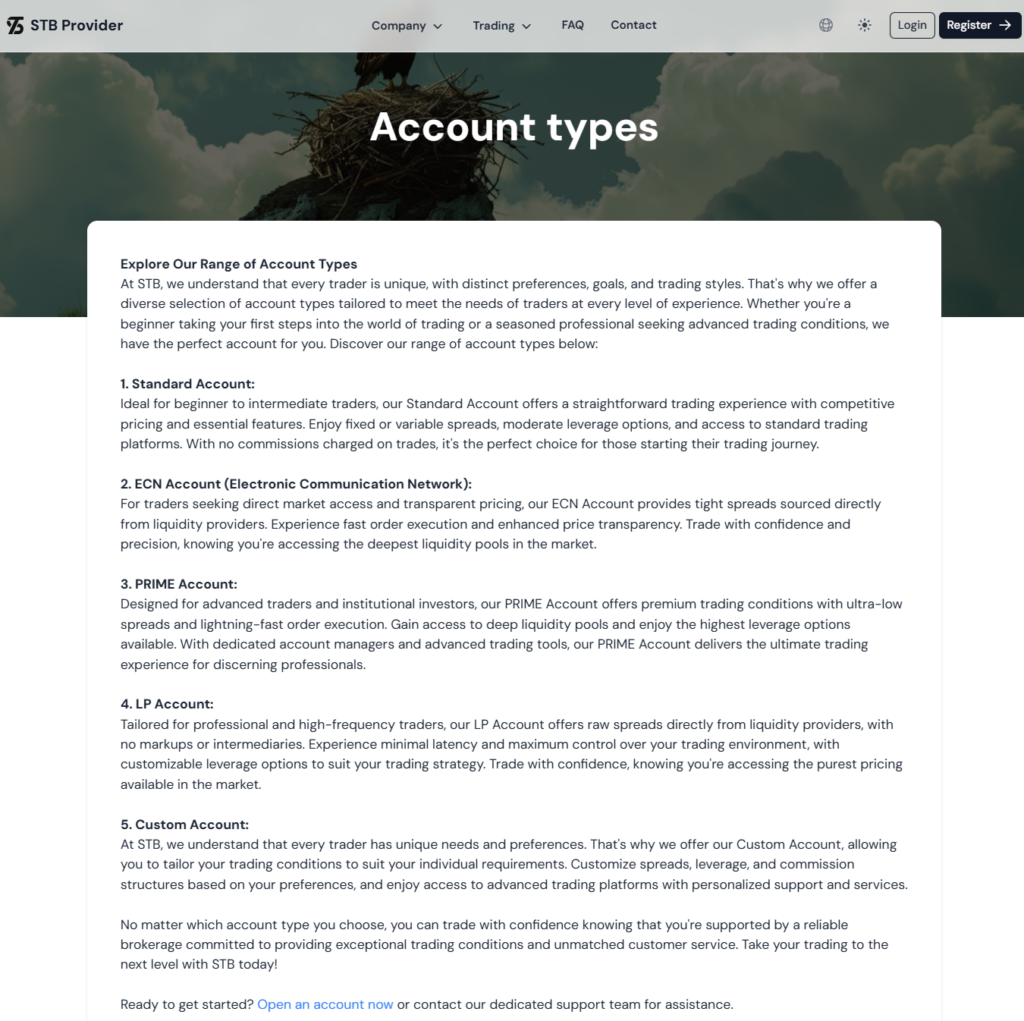

STB Provider Account Types

STB Provider offers three account types to cater to different levels of investors. Each account type comes with its own set of features and requirements:

PRIME Account:

- Minimum Deposit: $3,000

- Commission: Low commission rates to reduce trading costs.

- Spreads: Tight spreads that can help traders maximize potential profits.

- Leverage: Up to 1:300, allowing traders to control a large position with a relatively small amount of capital.

- Order Volume: Traders can place orders ranging from 0.01 to 100 lots, offering flexibility in trade sizing.

LP Account:

- Minimum Deposit: $100,000

- Commission: Low commission, suitable for high-volume traders.

- Spreads: Raw spreads, which are typically tighter than standard spreads, allowing for more precise entry and exit points.

- Leverage: Up to 1:100, which is lower than the PRIME account but still offers substantial leverage.

- Customization: Tailored for more experienced traders who require specific trading conditions.

Custom Account:

- Minimum Deposit: $500,000

- Customization: This account is designed for institutional or high-net-worth investors who require bespoke trading conditions and services. The terms of the Custom Account can be negotiated to fit the specific needs of the investor.

- Advanced Features: Custom accounts likely include premium features and services not available to other account types, such as dedicated account managers or exclusive market insights.

These account types reflect STB Provider’s attempt to cater to a broad range of investors, from retail traders to high-net-worth individuals. However, the high minimum deposit requirements, especially for the LP and Custom accounts, may limit accessibility to a select group of traders.missions and high leverage, it’s important to carefully evaluate these conditions.

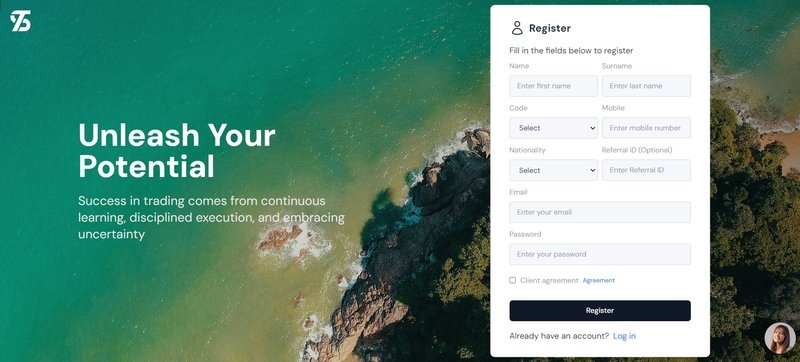

How do I open an account with STB Provider?

- Log in to the STB Provider website and click the register button

- Fill out the application form

- Submit identification/verification documents

- Deposit funds and start trading

Spreads, Leverage, and Commissions at STB Provider

STB Provider’s official website does not disclose specific details about spreads, trading leverage, commissions, minimum/maximum trade volume, maximum position/order size, margin call/stop-out levels, minimum price precision, or contract sizes. The lack of transparency around these key trading conditions presents a risk to investors. Without clear and transparent information, trading on this platform could be risky.

STB Provider Deposit and Withdrawal Methods

STB Provider’s official website does not provide specific details about its deposit and withdrawal methods. Typically, common payment methods such as bank transfers, credit cards, and e-wallets might be available, but the lack of official information raises concerns about the platform’s reliability.

FAQs

Is STB Provider a trustworthy platform?

STB Provider’s unclear regulatory status and lack of transparency raise doubts about its reliability. Investors should proceed with caution.

Where can I check STB Provider’s regulatory information?

Regulatory information can be found on STB Provider’s official website, but its credibility should be carefully evaluated.

Which trading platform does STB Provider use?

STB Provider uses MetaTrader 5 (MT5).

What is the minimum deposit required for STB Provider?

The minimum deposit is $3,000 for the PRIME Account, $100,000 for the LP Account, and $500,000 for the Custom Account.

What are the details on spreads and leverage at STB Provider?

Specific details on spreads and leverage are not disclosed on the official website.

What trading products does STB Provider offer?

STB Provider offers trading in forex, precious metals, stock indices, and energy products.

While STB Provider offers a variety of trading products and conditions, significant doubts remain about its reliability and safety. In particular, the lack of clear regulatory information and the possibility of inadequate oversight raise concerns about potential fraud. Next, let’s explore these issues in more depth.