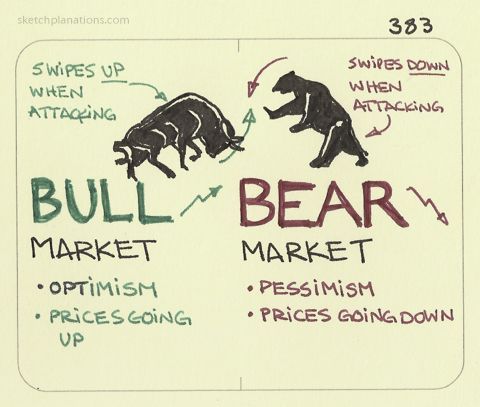

Navigating the financial markets can be daunting, especially when faced with the contrasting dynamics of bull and bear markets. These terms symbolize the market’s optimism and pessimism, respectively. In this article, we’ll delve into the intricacies of bull and bear markets, their causes, characteristics, and strategies to help investors make informed decisions.

What is a Bull Market?

A bull market signifies a period of rising asset prices, driven by investor optimism, robust economic growth, and increasing corporate profits. During this phase, market indices frequently reach new highs, and trading activity is vigorous.

Characteristics of a Bull Market

- Upward Trend: Continuous climb in stock or asset prices.

- High Trading Activity: Large buy orders and increased liquidity.

- Enhanced Investor Confidence: Positive market outlook and future growth expectations.

- Buyer’s Market: Predominance of buy orders.

- Increased Market Breadth: Most stocks or assets exhibit positive trends.

Causes of a Bull Market

- Economic Growth: Strong economic performance boosts corporate profitability and investor optimism.

- Low-Interest Environment: Low-interest rates stimulate investment and borrowing, driving market upward.

- Financial Policy Stimulus: Government and central bank policies provide liquidity and investment opportunities.

- Corporate Earnings Growth: Strong earnings performance enhances investor confidence and stock prices.

- Investor Sentiment: Positive sentiment and future growth expectations fuel buying activity.

- External Factors: Global economic conditions, political stability, and geopolitical events can impact market trends.

What is a Bear Market?

A bear market, conversely, is characterized by a prolonged decline in asset prices, driven by investor pessimism and economic downturns. This environment often results in reduced trading activity and a cautious investment approach.

Characteristics of a Bear Market

- Continuous Price Decline: Persistent drop in asset prices.

- Low Confidence: Pessimistic investor expectations.

- Increased Trading Volume: High volume due to risk reduction.

- Prevalence of Short-Selling: Common practice of profiting from declining prices.

- Economic Recession: Often accompanies economic downturns.

- High Volatility: Significant price fluctuations.

- Appeal of Safe-Haven Assets: Increased demand for stable assets like gold and bonds.

- Long Duration: Extended period of market decline.

Causes of a Bear Market

- Economic Recession: Economic downturns lead to pessimism and sell-offs.

- Inflation: Rising prices and tightened monetary policies increase investment risks.

- Wars or Crises: Negative economic outlook due to geopolitical tensions.

- Excessive Speculation: Burst of asset bubbles leads to panic selling.

- Negative News: Financial crises, scandals, and poor performance drive investor fear.

- Emotional Shifts: Investor sentiment shifts from optimism to pessimism.

Differences Between Bull and Bear Markets

- Price Trends: Bull markets see rising prices; bear markets experience falling prices.

- Market Sentiment: Optimism in bull markets, pessimism in bear markets.

- Trading Activity: High in bull markets, low in bear markets.

- Investment Strategies: Growth-focused in bull markets, risk-averse in bear markets.

Investment Strategies in a Bull Market

- Stock Investment: Focus on quality stocks with strong fundamentals.

- Asset Allocation: Diversify investments across different asset classes.

- Index Fund Investment: Participate in market growth through index funds.

- Short-Term Trading: Use technical analysis for short-term opportunities.

- Portfolio Rebalancing: Adjust asset weights to maintain balance.

Investment Strategies for a Bear Market

- Diversification: Spread investments to reduce risk.

- Invest in Safe-Haven Assets: Allocate funds to stable assets like gold and government bonds.

- Short Selling: Profit from declining prices through short-selling.

- Regular Fixed Investments: Buy high-quality assets at regular intervals to lower costs and achieve long-term gains.

FAQs

What triggers a bull market?

Economic growth, low-interest rates, financial policy stimulus, and positive investor sentiment typically trigger a bull market.

How long do bull markets last?

Bull markets can last several years, with durations varying based on economic conditions and investor behavior.

What are the risks of investing in a bull market?

Overvaluation and potential market corrections pose risks during a bull market.

What is the best strategy during a bear market?

Diversifying investments and focusing on safe-haven assets can mitigate risks during a bear market.

How do bear markets impact the economy?

Bear markets often coincide with economic downturns, reduced corporate earnings, and lower investor confidence.

Can bull and bear markets be predicted?

While indicators and trends can provide clues, predicting market movements with certainty is challenging due to numerous influencing factors.

Understanding bull and bear markets is crucial for investors aiming to navigate the financial landscape effectively. By recognizing their characteristics, causes, and appropriate investment strategies, one can make informed decisions to maximize returns and minimize risks. Whether riding the wave of a bull market or weathering the storm of a bear market, informed strategies are key to successful investing.