In recent times, the financial trading industry has seen a surge of new platforms promising high returns and seamless trading experiences. However, not all that glitters is gold. Among these new entrants is Profit Pulse Finance, a platform that has raised numerous red flags since its inception. This article delves into the reasons why Profit Pulse Finance might be a scam and why investors should be wary.

Corporate Background: Shrouded in Mystery

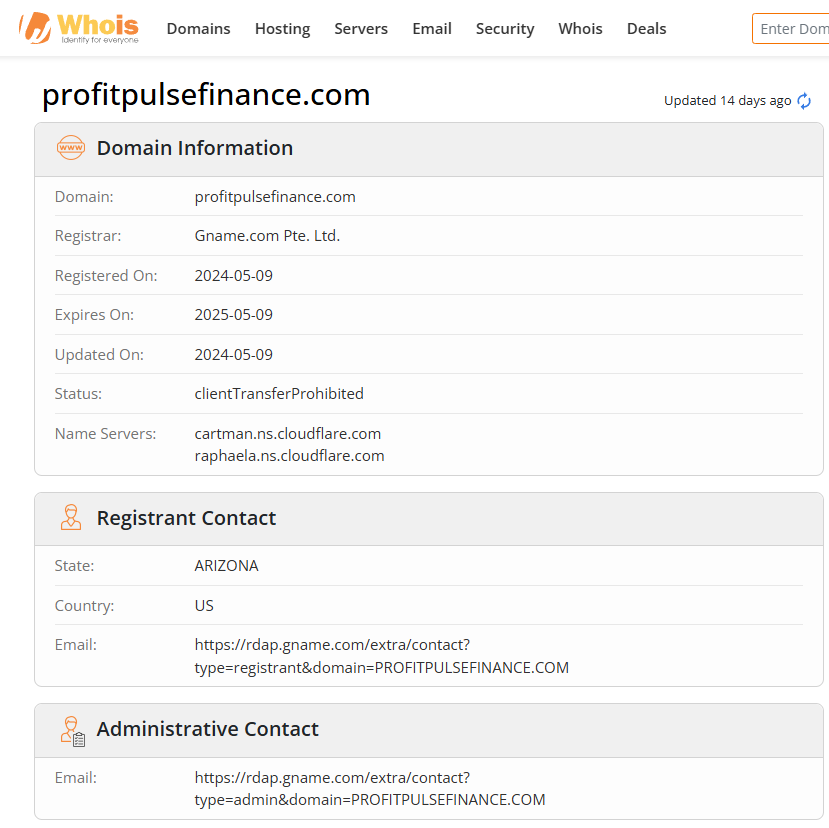

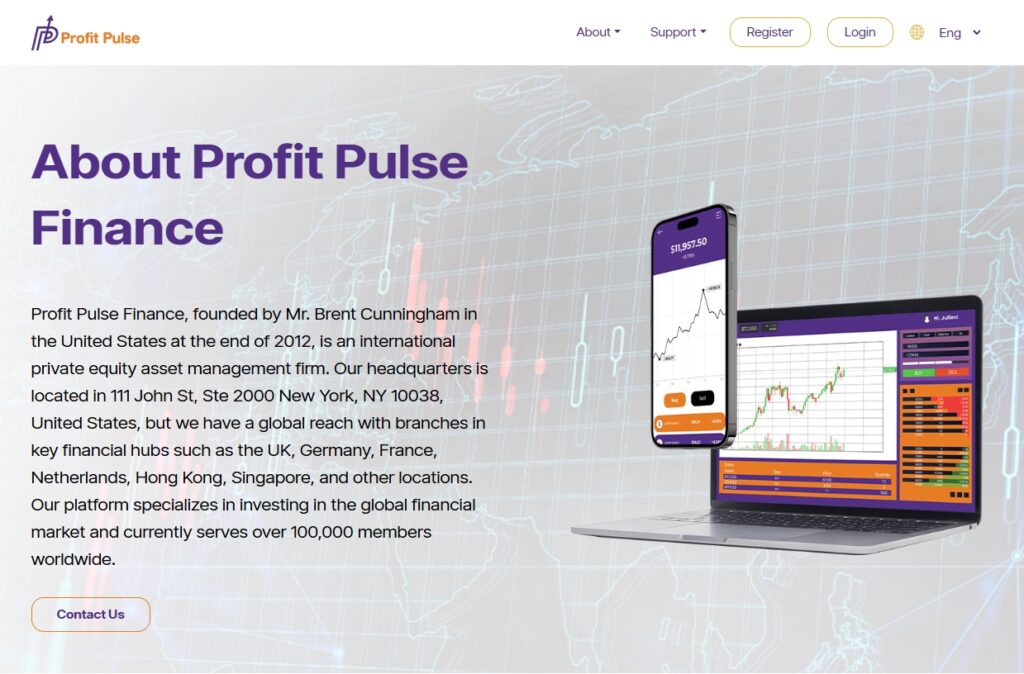

Profit Pulse Finance is an emerging financial trading platform, with its domain registered on May 9, 2024. Despite the claims on its official website that the company is headquartered in New York, USA, a thorough search reveals no registration information for the company in New York. This lack of transparency makes it difficult for investors to verify its legitimacy and credibility.

The absence of verifiable corporate information significantly increases the risk and uncertainty associated with Profit Pulse Finance. A legitimate financial trading platform should have clear and accessible information about its corporate registration and headquarters. This opacity is a glaring red flag that potential investors should not ignore.

Regulatory Information: The Crux of the Issue

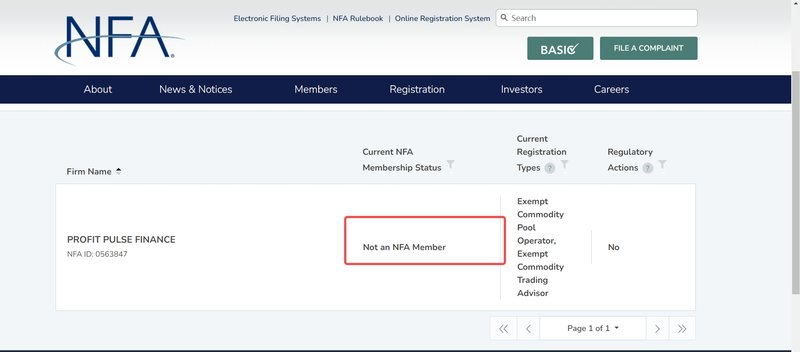

Profit Pulse Finance is currently not overseen by any financial regulatory authority, including the National Futures Association (NFA) in the United States. Regulatory oversight is crucial in the financial trading industry as it ensures that platforms adhere to strict laws and industry standards designed to protect investors. The absence of such regulation implies that Profit Pulse Finance operates without supervision from any authoritative body, leaving investors uncertain whether the platform complies with industry standards and regulations.

Without regulatory oversight, there is no assurance that Profit Pulse Finance adheres to fair trading practices or that investor funds are protected. This is a significant concern for any investor considering using this platform.

Lack of Transparency in Trading Conditions

Profit Pulse Finance has not disclosed specific information about spreads, leverage, and commissions on their official website. These are critical factors that traders consider when choosing a platform, as they directly impact trading costs and potential profitability. The lack of transparency in these areas is another red flag.

A reputable trading platform should provide detailed information about its trading conditions to help traders make informed decisions. The absence of such information on Profit Pulse Finance’s website suggests a deliberate attempt to obscure these details from potential investors.

Unclear Deposit and Withdrawal Methods

Profit Pulse Finance has not specified the methods for deposits and withdrawals on their official website. Typically, traders might be able to use various common payment methods, including bank transfers, credit cards, and e-wallets, for depositing and withdrawing funds. However, the lack of clarity regarding these methods further increases the platform’s uncertainty.

Investors need to know how they can deposit and withdraw their funds, as this is crucial for managing their investments. The absence of this information can be seen as an attempt to avoid scrutiny and accountability.

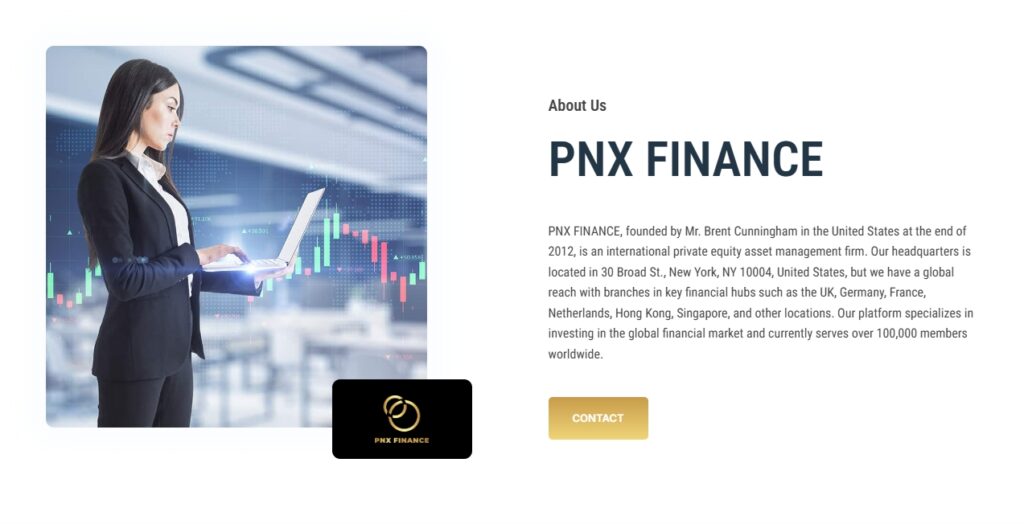

Identical Content to Other Suspect Platforms

A critical piece of evidence suggesting that Profit Pulse Finance is a scam is the content on its website. The content on Profit Pulse Finance’s website is almost identical to that of Gold Harbor Finance and PNX FINANCE. On their “About Us” pages, they all claim to have been founded by Mr. Brent Cunningham in the United States at the end of 2012. This repeated content across multiple platforms undoubtedly heightens the risk that Profit Pulse Finance is a scam.

Scam platforms often use identical or very similar content to create a facade of legitimacy. This tactic is designed to deceive potential investors into believing they are dealing with a reputable company when, in reality, they are not.

Potential Risks for Investors

Given the numerous red flags associated with Profit Pulse Finance, the potential risks for investors are significant. These include:

- Loss of Funds: Without regulatory oversight and clear trading conditions, investors are at a high risk of losing their funds.

- Lack of Recourse: In the event of a dispute or fraudulent activity, investors have limited options for recourse due to the lack of regulatory oversight.

- Data Security: The absence of clear information about the platform’s security measures raises concerns about the safety of investors’ personal and financial information.

Protecting Yourself from Scams

To protect yourself from potential scams like Profit Pulse Finance, consider the following steps:

- Research: Always research the platform thoroughly before investing. Look for verifiable corporate registration information and regulatory oversight.

- Regulation: Ensure that the platform is regulated by a reputable financial authority. Regulatory oversight provides an additional layer of protection for your investments.

- Transparency: Choose platforms that are transparent about their trading conditions, including spreads, leverage, and commissions.

- Deposit and Withdrawal Methods: Verify the available deposit and withdrawal methods to ensure you can easily manage your funds.

- Avoid Identical Content: Be cautious of platforms with identical content to other suspect websites. This is often a sign of a scam.

Profit Pulse Finance raises numerous red flags that suggest it may be a scam. The lack of clear corporate registration information, absence of regulatory oversight, and lack of transparency in trading conditions and deposit/withdrawal methods all point to significant risks for investors. Additionally, the identical content to other suspect platforms further heightens the suspicion.

Investors should exercise extreme caution when considering Profit Pulse Finance and thoroughly research any platform before investing. By taking the necessary precautions and being aware of the potential risks, you can protect yourself from falling victim to financial scams.

FAQs

What is Profit Pulse Finance?

Profit Pulse Finance is a newly established financial trading platform with a domain registered on May 9, 2024. However, it lacks clear corporate registration and regulatory oversight.

Is Profit Pulse Finance regulated?

No, Profit Pulse Finance is not overseen by any financial regulatory authority, including the National Futures Association (NFA) in the United States.

What are the risks of using Profit Pulse Finance?

The risks include the potential loss of funds, lack of recourse in case of disputes or fraud, and concerns about data security due to the absence of clear information about the platform’s security measures.

Why is the lack of regulatory oversight a concern?

Regulatory oversight ensures that financial trading platforms adhere to strict laws and industry standards designed to protect investors. Without it, there is no assurance that the platform follows fair trading practices or that investor funds are protected.

What should investors look for in a trading platform?

Investors should look for platforms with verifiable corporate registration information, regulatory oversight, transparency in trading conditions, and clear deposit and withdrawal methods.

Why is identical content a red flag?

Identical content across multiple suspect platforms suggests a coordinated effort to deceive potential investors by creating a facade of legitimacy. This is often a sign of a scam.